Press release

BFSI BPO Services Providers Market Size, Share, Trends and Forecast by Service Type For 2025 - 2033

The global BFSI BPO services market is experiencing robust expansion, valued at USD 124.86 billion in 2024 and projected to reach USD 230.08 billion by 2033, growing at a CAGR of 6.68%. This impressive growth is fueled by rising demand for cost-efficient operations, stringent regulatory compliance needs, and rapid digital transformation across banking, financial services, and insurance sectors. The integration of advanced technologies like AI, automation, and cloud-based solutions is further accelerating outsourcing adoption, enabling institutions to enhance customer experience, streamline back-office functions, and strengthen cybersecurity.Request for a sample copy of this report:

https://www.imarcgroup.com/bfsi-bpo-services-market/requestsample

Study Assumption Years

• Base Year: 2024

• Historical Year: 2019-2024

• Forecast Year: 2025-2033

BFSI BPO Services Market Key Takeaways

• The market is projected to grow from USD 124.86 billion in 2024 to USD 230.08 billion by 2033 at a CAGR of 6.68%.

• North America dominates the market with a 36.0% share in 2024, led by the United States.

• Customer services is the largest service type segment, accounting for 23.8% of the market.

• Large enterprises hold the majority share (59.98%) due to their global scale and complex compliance needs.

• Banks are the leading end users, representing 40.2% of total demand.

• Key growth drivers include fintech disruption, cybersecurity threats, and regulatory complexity.

• Strategic investments in AI, blockchain, and cloud technologies are shaping competitive differentiation.

Market Growth Factors

1 - Cost Efficiency and Operational Scalability

Financial institutions face ongoing pressure to trim costs while still delivering high-quality service. With a staggering 30,000 fintech startups raising the stakes, many banks and financial services are opting to outsource non-core functions - like data entry, claims processing, and customer support - to specialized BPO providers. This shift not only leads to significant savings by cutting out expenses related to hiring, training, and infrastructure but also allows for further reductions in labor costs through offshore outsourcing. Scalable BPO models enable firms to adjust their resources based on demand fluctuations. Additionally, advanced automation and AI solutions help minimize manual errors and speed up processes like loan approvals and fraud detection. These efficiencies free up capital for innovation and digital transformation, making cost-effective outsourcing a strategic necessity in today's dynamic financial environment.

2 - Stringent Regulatory Compliance Requirements

The BFSI sector is dealing with a complex mix of global and regional regulations, including KYC, AML, GLBA, FFIEC, and PCI DSS. Maintaining in-house compliance teams can be quite costly and challenging, especially given the rapid changes in regulations. That's where BPO providers step in, offering their specialized expertise to help navigate this tricky landscape. They provide real-time monitoring, automated reporting, and risk management frameworks that adapt to changing standards. By outsourcing compliance, financial institutions can minimize their exposure to penalties, legal risks, and operational disruptions. BPO firms also improve transaction monitoring and fraud prevention, ensuring compliance while still delivering top-notch service. This kind of regulatory agility is particularly important for large, multinational banks and insurers operating across different jurisdictions, highlighting the vital role of BPO in governance and risk mitigation.

3 - Technological Advancements and Fintech Integration

AI, machine learning, robotic process automation (RPA), and blockchain are shaking up the BFSI landscape, with BPO providers leading the charge in this exciting transformation. Just think about it - generative AI is projected to boost productivity by 5% and slash global costs by a whopping $300 billion. BPO firms are tapping into these technologies to streamline back-office operations, improve fraud detection, and provide real-time analytics for assessing credit risk. Thanks to cloud-based platforms, secure data sharing and smooth integration with core banking systems through APIs have never been easier. Plus, partnerships with fintech companies are supercharging capabilities, allowing BPOs to support digital lending, payment processing, and engaging customers across multiple channels. With biometric authentication and AI-driven chatbots, security and personalization are on the rise, while predictive analytics help make smarter investment choices. This tech-driven evolution is redefining BFSI BPO, transforming it from a mere support function into a true innovation powerhouse.

Market Segmentation

The BFSI BPO services market is segmented as follows:

By Service Type:

• Customer Services: Largest segment (23.8% in 2024), driven by demand for 24/7 multichannel support and personalized engagement.

• Finance and Accounting: Includes transaction processing, bookkeeping, and financial reporting.

• Human Resources: Covers payroll, recruitment, and employee lifecycle management.

• KPO (Knowledge Process Outsourcing): Involves research, analytics, and decision support services.

• Procurement and Supply Chain: Manages vendor selection, contract administration, and logistics coordination.

• Others: Encompasses miscellaneous specialized BPO functions.

By Enterprise Size:

• Large Enterprises: Dominant segment (59.98% in 2024), leveraging BPO for global scalability and complex compliance.

• Small and Medium-sized Enterprises (SMEs): Increasingly adopting BPO for cost-effective access to advanced capabilities.

By End User:

• Banks: Leading end user (40.2% in 2024), outsourcing customer service, compliance, and digital transformation.

• Capital Markets: Includes investment banks, brokerages, and trading firms requiring risk and data analytics.

• Insurance Companies: Rely on BPO for claims processing, policy administration, and customer support.

By Region:

o North America (United States, Canada)

o Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

o Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

o Latin America (Brazil, Mexico, Others)

o Middle East and Africa

Regional Insights

North America leads the BFSI BPO services market with a 36.0% share in 2024, primarily driven by the United States, which accounts for 87.5% of the regional market. The region's mature financial ecosystem, home to global banking and insurance giants, demands sophisticated, technology-driven outsourcing solutions. Stringent cybersecurity and compliance regulations, coupled with rapid fintech adoption - over 13,100 U.S. fintech startups - fuel BPO demand. Proximity to European markets and English-language proficiency further enhance North America's appeal as a strategic outsourcing hub for global financial institutions.

Recent Developments & News

The BFSI BPO landscape is evolving rapidly through strategic tech acquisitions and fintech collaborations. A notable development includes a digital twin technology platform from Percipient, a Singapore-based fintech firm, in January 2025. This move enhances ability to accelerate core banking system transformations for clients across Asia Pacific. Beyond M&A activity, leading BPO providers are embedding AI, blockchain, and cloud-native solutions into their service portfolios. These innovations enable end-to-end process automation, real-time fraud detection, and omnichannel customer experiences. Additionally, partnerships between legacy banks and BPO firms are deepening to support scalable digital banking, payment processing, and regulatory tech (RegTech) initiatives.

Key Players

Cognizant, Concentrix Corporation, Genpact, IBM Corporation, Infosys Limited, Mphasis Limited, NTT Data Corporation, Tata Consultancy Services Limited, Wipro Limited, etc.

Ask Analyst for Customization:

https://www.imarcgroup.com/request?type=report&id=7203&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release BFSI BPO Services Providers Market Size, Share, Trends and Forecast by Service Type For 2025 - 2033 here

News-ID: 4222462 • Views: …

More Releases from IMARC Group

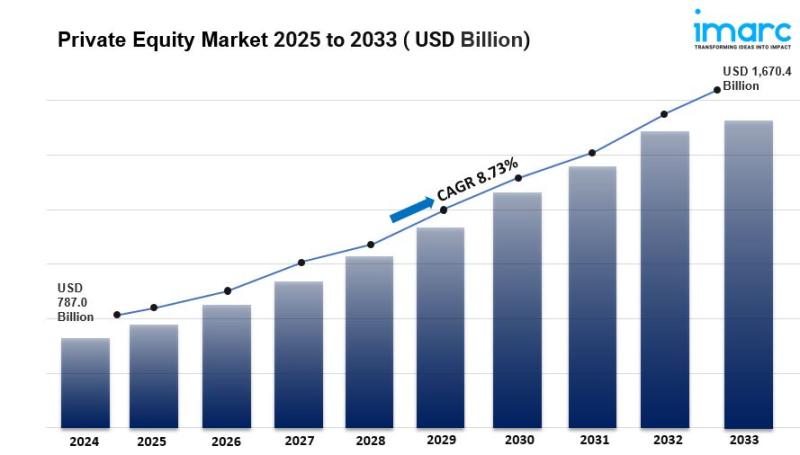

Private Equity Market is Expected to Grow USD 1,670.43 Billion by 2033 | At CAGR …

Overview Private Equity Market Outlook:

The private equity market plays a crucial role in the global financial ecosystem, providing capital to privately held companies or acquiring public companies to restructure them for long-term value creation. Unlike public markets, private equity investments are typically illiquid and made by institutional investors, high-net-worth individuals, and private equity (PE) firms seeking higher returns. The market's growth is driven by increasing corporate restructuring activities, demand for…

Technical Textiles Business Plan 2025: Setup Costs, Revenue & Profitability

Overview:

IMARC Group's "Technical textiles Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful Technical textiles business. This in-depth report covers critical aspects such as market trends, investment opportunities, revenue models, and financial forecasts, making it an essential tool for entrepreneurs, consultants, and investors. Whether assessing a new venture's feasibility or optimizing an existing business, the report provides a deep dive into all components necessary for…

Setting Up GaN Power Devices Plant in Saudi Arabia: A Comprehensive Guide for En …

IMARC Group's "GaN Power Devices Production Cost Analysis Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a detailed roadmap for establishing a GaN power devices manufacturing plant in Saudi Arabia. The report offers every critical aspect of the setup process, such as unit operations, raw material requirements, utility supply, infrastructural needs, machinery models, labour necessities, transportation timelines, packaging costs, etc.

In addition to the…

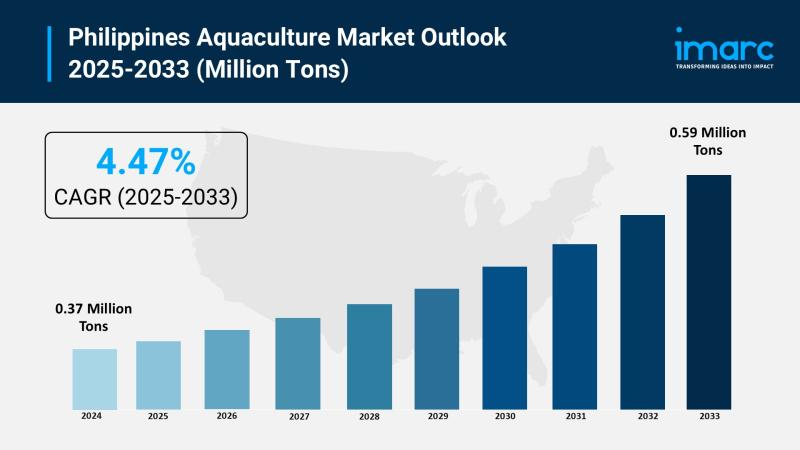

Philippines Aquaculture Market 2025 | Expected to Reach 0.59 Million Tons by 203 …

The latest report by IMARC Group, "Philippines Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033," provides an in-depth analysis of the Philippines aquaculture market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines aquaculture market size reached 0.37 million tons in 2024 and is projected to grow to 0.59 million tons by…

More Releases for BPO

Times BPO Sets New Benchmark for Affordable, Scalable BPO Services

New Delhi, India - [26th June 2025] - In an industry often plagued by overpromises and high entry barriers, Times BPO, a rapidly growing business process outsourcing company, is setting a new standard by offering affordable, scalable, and transparent BPO solutions for startups, small businesses, and first-time entrepreneurs. With an unwavering commitment to client success and operational excellence, Times BPO has positioned itself as a game-changer in the outsourcing landscape.

At…

Ascent BPO presents top-notch BPO services for every sector!

Outsourcing business processes is a convenient method to access high-quality customer engagement services. And, you must be delighted to learn that Ascent BPO, a popular Noida-based BPO company, is there to provide the right BPO services solution for you. They are equipped with expert and well-qualified professionals who deliver 100% customer satisfaction with their services. If you want to learn about the services offered by this popular outsourcing company, then…

TIMES BPO: Transforming the BPO Industry with Startup-Friendly Business Solution …

The outsourcing industry is evolving, and TIMES BPO is at the forefront, creating sustainable and profitable business opportunities for startups and entrepreneurs. With over 13 years of expertise, TIMES BPO offers a comprehensive ecosystem that empowers business seekers to establish successful call center ventures without the usual hurdles of market entry and client acquisition.

Revolutionizing BPO for New Business Owners: The journey of starting a business is filled with challenges, but…

Open Access BPO named top BPO company

WASHINGTON DC, March 1, 2021 – Open Access BPO has been recognized as one of the best business process outsourcing (BPO) companies and a top voice service provider in the recent Clutch 2021 Awards.

Market research and B2B review agency Clutch named Open Access BPO in its Top BPO Companies list, having bagged recognitions in multiple categories:

Best Back Office

Best Data Entry

Best Writing & Content Creation

As a Top Voice Services…

BPO Service Market:cheesy, Wipro, ServiceBPO, Accenture, Infosys BPO, Capri

BPO Service Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global BPO Service market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Rqnlu4

The Global BPO Service market Report provides a detailed analysis of the current dynamics of the market with an extensive focus on the secondary research. It also studies current situation of the market…

BPO Service Market- cheesy, Wipro, ServiceBPO, Accenture, Infosys BPO, Capri

Global BPO Service Market Size, Status and Forecast 2022 provides Market information about Manufacturers, Countries, Type and Application.This BPO Service Industry report also states Company Profile, sales, BPO Service Market revenue and price, market share, market growth and gross margin by regions.The following summary will give an overview of the causes, processes, and possible effects of the market research proposal.

Request for sample copy of report @ https://goo.gl/xUqpPT

Top Manufacturers/Key Players:-

cheesy

Wipro

ServiceBPO

Accenture

Infosys BPO

Capri

The…