Press release

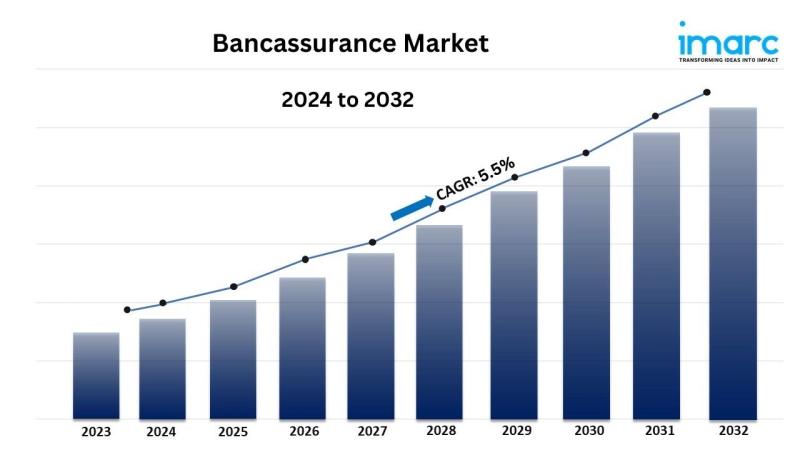

Bancassurance Market Size Projected to Reach USD 2,255 Billion by 2032, Growing at a 5.5% CAGR

Bancassurance IndustrySummary:

* The global [https://www.imarcgroup.com/bancassurance-market] size reached USD 1,428 Billion in2023.

* The market is expected to reach USD 2,255 Billion by 2032, exhibiting a growth rate (CAGR) of 5.5% during 2024-2032.

* Asia Pacific leads the market, accounting for the largest bancassurance market share.

* Life bancassurance accounts for the majority of the market share in the product type segment due to the increasing demand for life insurance products among consumers seeking long-term financial security and protection, which bancassurance models effectively deliver through existing banking relationships.

* Pure distributor holds the largest share in the bancassurance industry.

* The changing consumer preferences are a primary driver of the bancassurance market.

* Technological advancements and the growing digital transformation are reshaping the bancassurance market.

Industry Trends and Drivers:

* Changing Consumer Preferences:

As consumers become more accustomed to streamlined and integrated services, they increasingly favor solutions that simplify their financial lives. Additionally, bancassurance, the collaboration between banks and insurance providers, taps into this demand by allowing customers to purchase insurance products through their trusted bank. This seamless integration provides a one-stop-shop experience where customers can manage their banking and insurance needs within a familiar environment. It saves time, reduces the complexity of dealing with multiple providers, and leads to more tailored insurance offerings, as banks have a deeper understanding of their clients' financial behavior. Moreover, customers experience increased convenience, which enhances their overall satisfaction by bundling insurance products with banking services. The trend toward simplicity and comprehensive service offerings continues to drive the demand for bancassurance, especially as more consumers seek out services that align with their desire for efficiency and ease.

* Technological Advancements:

The rise of cutting-edge technologies, including artificial intelligence (AI) and big data analytics, has transformed the bancassurance market. These technologies are transforming how banks assess risk, underwrite policies, and deliver insurance products. Additionally, AI enables more precise risk evaluation by analyzing vast amounts of data, allowing banks to provide personalized insurance solutions tailored to individual customer needs and profiles. Moreover, with better data insights, insurers can create more accurate pricing models, improving the customer experience and profitability. Besides, AI-driven chatbots and digital assistants offer round-the-clock customer service, handling inquiries and guiding customers through their insurance options seamlessly. These technological advancements enable banks to offer innovative insurance products that are more personalized, efficient, and accessible, fostering greater customer satisfaction and loyalty. As banks continue to adopt these technologies, the bancassurance model is becoming more agile and responsive to consumer demands.

* Increasing Digital Transformation:

The digital transformation of the banking sector has opened new avenues for offering insurance products through online channels. Additionally, the rise of digital banking platforms allows consumers to explore, compare, and purchase insurance products directly from their smartphones or computers, offering a hassle-free experience. This shift to online services means that insurance solutions are more accessible to a broader audience, particularly younger consumers who prioritize convenience and speed. Moreover, enhanced digital interfaces streamline the entire insurance purchasing process, from providing quotes to completing transactions and managing policies online. Furthermore, digital transformation enables personalized marketing, where customers receive tailored insurance offers based on their financial history and preferences. This improves the purchasing experience and increases customer engagement and trust in the bank's ability to meet its financial and insurance needs.

For an in-depth analysis, you can request a sample copy of the report: [https://www.imarcgroup.com/bancassurance-market/requestsample]

Bancassurance Market Report Segmentation:

Breakup By Product Type:

* Life Bancassurance

* Non-Life Bancassurance

Life bancassurance represents the largest segment due to the increasing demand for life insurance products among consumers seeking long-term financial security and protection, which bancassurance models effectively deliver through existing banking relationships.

Breakup By Model Type:

* Pure Distributor

* Exclusive Partnership

* Financial Holding

* Joint Venture

Pure distributor accounts for the largest market share as it allows banks to focus on their core competencies while leveraging their extensive customer base to promote insurance products without the complexities of underwriting or claims management.

Breakup By Region:

* North America (United States, Canada)

* Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

* Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

* Latin America (Brazil, Mexico, Others)

* Middle East and Africa

Asia Pacific holds the leading position owing to a large market for bancassurance driven by rapid economic growth, increasing insurance penetration, and a growing middle class across the region.

Top Bancassurance Market Leaders:

* ABN AMRO Bank N.V.

* The Australia and New Zealand Banking Group Limited

* Banco Bradesco SA

* The American Express Company

* Banco Santander, S.A.

* BNP Paribas S.A.

* The ING Group

* Wells Fargo & Company

* Barclays plc

* Intesa Sanpaolo S.p.A.

* Lloyds Banking Group plc

* Citigroup Inc.

* Credit Agricole S.A.

* HSBC Holdings plc

* NongHyup Financial Group

* Societe Generale

* Nordea Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Browser Other Report

* Air Freight Market [https://www.imarcgroup.com/air-freight-market] Size, Share and Industry Analysis, Report 2024-2032

* Ginger Market [https://www.imarcgroup.com/ginger-market] Size, Share, Growth and forecast Report 2024-2032

* E-Bike Market [https://www.imarcgroup.com/e-bike-market] Size, Share and Market Analysis, Report 2024-2032

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Media Contact

Company Name: IMARC Group

Contact Person: Elena Anderson

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=bancassurance-market-size-projected-to-reach-usd-2255-billion-by-2032-growing-at-a-55-cagr]

Phone: +1-631-791-1145

Address:134 N 4th St.

City: Brooklyn

State: NY

Country: United States

Website: https://www.imarcgroup.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bancassurance Market Size Projected to Reach USD 2,255 Billion by 2032, Growing at a 5.5% CAGR here

News-ID: 3694656 • Views: …

More Releases from ABNewswire

Shipping Container Market Size, Industry Share, Latest Trends, Top Key Players, …

The shipping container market is growing due to global trade expansion, e-commerce, and supply chain demands.

Attributes and Key Statistics of the Shipping Container Market Report by IMARC Group:

Base Year: 2023

Forecast Years: 2024-2032

Historical Years: 2018-2023

Units: USD Billion

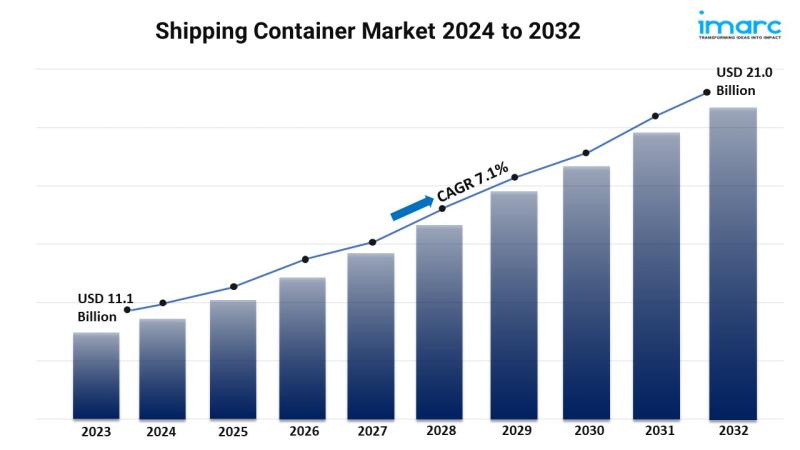

Market Size in 2023: USD 11.1 Billion

Market Forecast in 2032: USD 21.0 Billion

Market Compound Annual Growth Rate 2024-2032: 7.1%

The latest report published by IMARC Group, titled "Shipping Container Market Report by Product (Dry Storage Containers,…

Bioenergy Market Size to Surpass 289.2 GW by 2032, Rising At A CAGR Of 7%

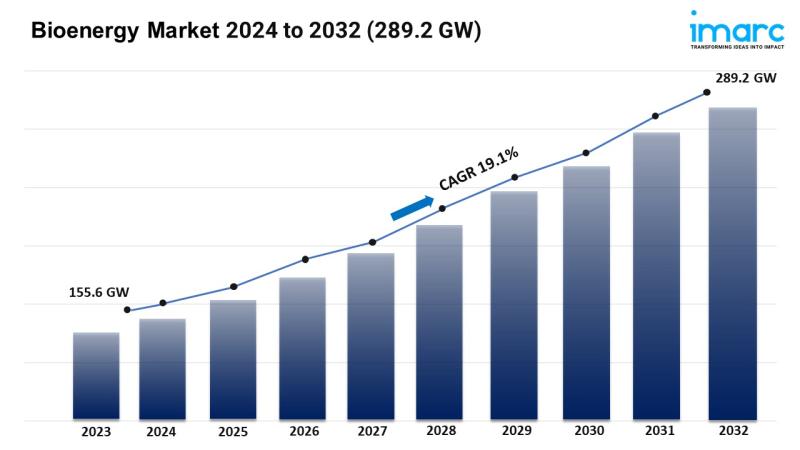

The global bioenergy market size reached 155.6 GW in 2023. Looking forward, IMARC Group expects the market to reach 289.2 GW by 2032, exhibiting a growth rate (CAGR) of 7% during 2024-2032.

Global Bioenergy Industry: Key Statistics and Insights in 2024-2032

Summary:

* The global bioenergy market size reached 155.6 GW [https://www.imarcgroup.com/bioenergy-market] in 2023.

* The market is expected to reach 289.2 GW by 2032, exhibiting a growth rate (CAGR) of 7%…

Facility Management Market Size, Industry Share, Growth, Leading Key Drivers, & …

Global Facility Management Market: Growth driven by rising demand for integrated services and smart solutions.

Attributes and Key Statistics of the Facility Management Market Report by IMARC Group:

Base Year: 2023

Forecast Years: 2024-2032

Historical Years: 2018-2023

Units: USD Billion

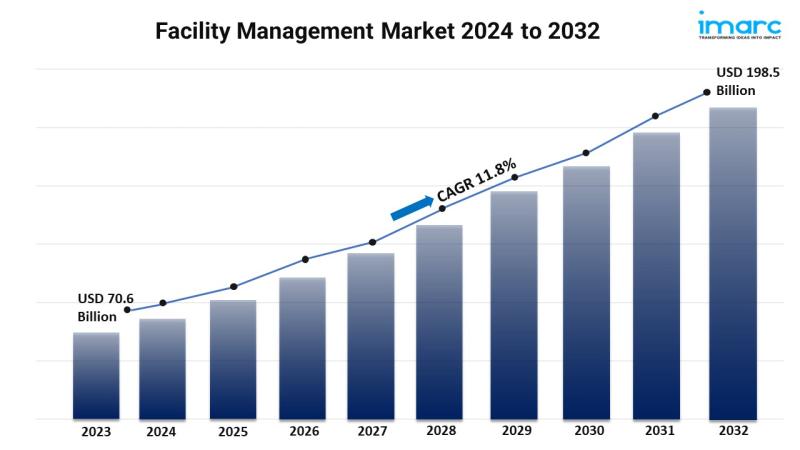

Market Size in 2023: USD 70.6 Billion

Market Forecast in 2032: USD 198.5 Billion

Market Compound Annual Growth Rate 2024-2032: 11.8%

IMARC Group's latest research report, titled "Facility Management Market Report by Solution (Facility Property Management, Building Information Modeling,…

Honey Market Size to Surpass USD 14.8 Billion by 2032, Exhibiting a CAGR of 4.4%

The honey market is experiencing steady growth driven by the increasing demand for natural sweeteners, rising popularity of organic and specialty honey, considerable growth in the functional foods sector, higher uptake of natural cosmetics and personal care products.

Attributes and Key Statistics of the Honey Market Report by IMARC Group:

Base Year: 2023

Forecast Years: 2024-2032

Historical Years: 2018-2023

Units: USD Billion

Market Size in 2023: USD 9.3 Billion

Market Forecast in 2032: USD 14.8 Billion

Market Compound…

More Releases for Bancassurance

Bancassurance Market Share, Growth Forecast- Global Industry Outlook 2021 - 2031

Bancassurance Market: Overview

The bancassurance market is expected to witness substantial growth owing to the increasing economic growth in several countries across the globe. The implementation of the bancassurance concept for upselling insurance plans by various banks across the world may create immense growth opportunities for the bancassurance market during the forecast period of 2021-2031.

Get A Brochure Of The Report @ https://www.tmrresearch.com/sample/sample?flag=B&rep_id=8177

Bancassurance is a financial agreement between insurance companies and banks…

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…

Bancassurance Technology Market To Incur Rapid Extension During 2020-2025

Global Bancassurance Technology Market essentials: an introduction of the market, characterizations, types, applications and supply chain scenario; Bancassurance Technology industry approaches and designs; type details; producing forms; cost structures. It also informs global fundamental regions economic situations, including the Bancassurance Technology product value, benefit, restraints, generation, demand and supply, and Bancassurance Technology industry development rate and so on. The report presents SWOT and Bancassurance Technology PESTEL analysis, speculation plausibility, and…

Global Bancassurance Market to Witness a Pronounce Growth During 2025

Market Research Report Store offers a latest published report on Bancassurance Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

Bancassurance is a relationship between a bank and an insurance company that is aimed at offering insurance products or insurance benefits to the bank's customers.

Europe market took up about 39% the global market in 2018, while North America and China were…

Strategic Overview of Bancassurance Technology Market Size, Status

HTF MI recently broadcasted a new study in its database that highlights the in-depth market analysis with future prospects of Bancassurance Technology market. The study covers significant data which makes the research document a handy resource for managers, industry executives and other key people get ready-to-access and self analyzed study along with graphs and tables to help understand market trends, drivers and market challenges. Some of the key players mentioned…

Global Bancassurance Technology Market Report, History and Forecast 2013-2025

This report studies the Bancassurance Technology market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2018-2025; This report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

Bancassurance refers to a distribution channel for insurance products. It is a means for insurance companies to sell their products…