Press release

Bancassurance Market Share, Growth Forecast- Global Industry Outlook 2021 - 2031

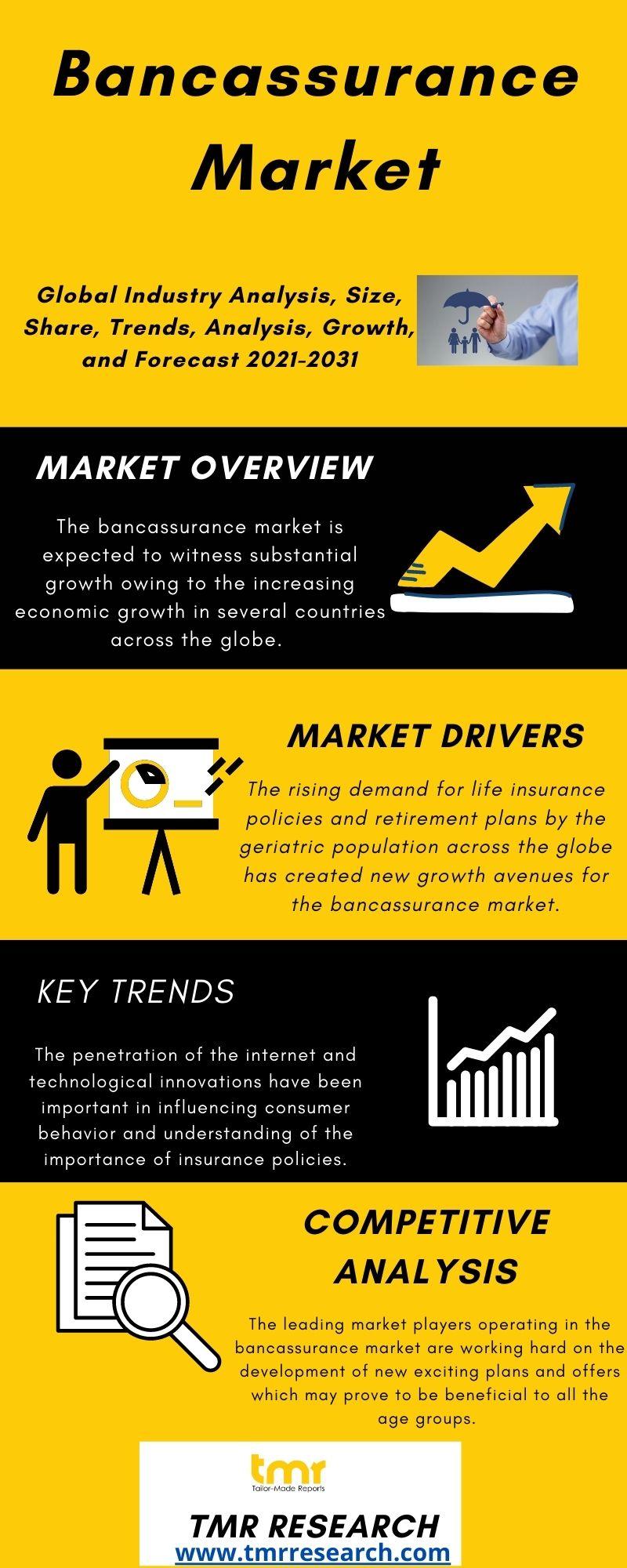

Bancassurance Market: OverviewThe bancassurance market is expected to witness substantial growth owing to the increasing economic growth in several countries across the globe. The implementation of the bancassurance concept for upselling insurance plans by various banks across the world may create immense growth opportunities for the bancassurance market during the forecast period of 2021-2031.

Get A Brochure Of The Report @ https://www.tmrresearch.com/sample/sample?flag=B&rep_id=8177

Bancassurance is a financial agreement between insurance companies and banks to add value to the revenue generation aspect through the sale of insurance policies. This arrangement helps in increasing the turnover of the bank and offers high returns on equity. The insurance companies are gaining huge profits and have increased their sales due to the expansion of their customer base worldwide.

The bancassurance market can be segmented into life bancassurance and non-life bancassurance based on the product type. By model type, the market can be classified into the joint venture, exclusive partnership, financial holding, and pure distributorship. The life bancassurance segment may show promising growth owing to the rising awareness regarding insurance policies across the world. Furthermore, the pure distribution segment may show excellent growth on account of the sales opportunities provided to the banks and insurance firms.

The research team at TMR Research analyses the market scenario and prepares an all-important report on the growth trajectory of the bancassurance market. The various aspects such as current trends, latest developments, competitive landscape, segmentation, and regional dynamics are studied thoroughly. A clear understanding of the market operations and revenue generation is possible due to the deep insights into the market. The stakeholders can make proper decisions regarding investments and plan strategies accordingly. The impact of the COVID-19 pandemic on market growth will also be included in this report.

Bancassurance Market: Key Drivers and Opportunities

The rising demand for life insurance policies and retirement plans by the geriatric population across the globe has created new growth avenues for the bancassurance market. The rising economy of developing countries has proved to be a revenue generator for the growth of the bancassurance market. The penetration of the internet and technological innovations have been important in influencing consumer behavior and understanding of the importance of insurance policies. All these aspects may bring substantial growth to the bancassurance market during the forecast period.

Get The Table Of Content Of The Report @ https://www.tmrresearch.com/sample/sample?flag=T&rep_id=8177

Bancassurance Market: Competitive Analysis

The leading market players operating in the bancassurance market are working hard on the development of new exciting plans and offers which may prove to be beneficial to all the age groups. The special plans developed for the senior population with retirement benefits are lucrative and may bring immense growth to the bancassurance market.

The promotional activities and advertisement campaigns are creating awareness about various insurance plans available in the market. Furthermore, the new offerings by various insurance companies and banks may act as a growth booster for the bancassurance market. Strategic collaborations with various organizations may generate good revenue for the market.

The key players functional in the bancassurance market are Credit Agricole Group, Citigroup Inc, Intesa Sanpaolo S.p.A, HSBC Holdings Plc., Banco Santander, S.A, BNP Paribas S.A, and The American Express Company.

Bancassurance Market: Regional Dynamics

The global market can be segmented into Europe, North America, Latin America, and the Middle East and Africa based on the regions. Asia Pacific is anticipated to be at the forefront on account of favorable norms related to financial planning and insurance. Furthermore, the increase in disposable income of individuals in developing countries such as Japan, China, and India has led to increase in investments in the insurance policies in this region.

All these acts act as growth propellers for the bancassurance market. North America may follow Asia Pacific in the growth trajectory owing to the rising awareness regarding benefits provided by insurance policies and the advantages of covers provided by the companies.

Get A Discount On The Report @ https://www.tmrresearch.com/sample/sample?flag=D&rep_id=8177

About Us:

TMR Research is a premier provider of customized market research and consulting services to business entities keen on succeeding in today's supercharged economic climate. Armed with an experienced, dedicated, and dynamic team of analysts, we are redefining the way our clients' conduct business by providing them with authoritative and trusted research studies in tune with the latest methodologies and market trends.

Contact:

Rohit Bhisey

TMR Research,

3739 Balboa St # 1097,

San Francisco, CA 94121

United States

Tel: +1-415-520-1050

Visit Site: https://www.tmrresearch.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bancassurance Market Share, Growth Forecast- Global Industry Outlook 2021 - 2031 here

News-ID: 2690871 • Views: …

More Releases from TMR Research

Automotive Vision System Market Share and Growth Factors Impact Analysis 2021 - …

Automotive Vision System Market: Introduction

A system that increases the vehicle driver's perception during night or bad weather conditions is termed as Automotive night vision system (ANVS). The system is otherwise beyond the reach of the vehicle's headlights, thereby prevents accidents at night. It can also be defined as a system which assists the driver by increasing visibility during bad whether while providing safety. Vehicle which have automotive vision system integrated are…

Waste Heat Recovery Market Competitive Landscape Analysis with Forecast by 2031

Waste Heat Recovery Market: Snapshot

The waste heat recovery market has been expected to reach a valuation of US$ 65.87 Bn and expand at a CAGR of 6.90% in the foreseeable years from 2020 to 2030.

The growth opportunities in the waste heat recovery market are attributed to the increasing prices of electricity and energy in the emerging economies. In addition to this, government regulations and incentives are also estimated to contribute…

Physical Fitness Equipment Market Current Trends and Future Aspect Analysis | Ma …

Global Physical Fitness Equipment Market: Snapshot

The physical fitness equipment market has been expected to reach a valuation of US$ 14.8 Bn and expand at a CAGR of 3.3% in the foreseeable years from 2020 to 2030.

The revenue generation opportunities in the physical fitness equipment market are attributed to the increasing enthusiasm among people toward fitness. In recent years, the fitness industry has been growing at a noticeable speed owing to…

Molecular Spectrometry Market Competitive Analysis and Forecast 2021-2031 | Grow …

Global Molecular Spectrometry Market: Snapshot

Molecular spectrometry examines and quantifies the response of molecules on interaction with known amounts of energy. Molecules have some energy levels that can be studied by determining the molecule's energy exchange through emission or absorbance. Molecular spectrometry involves studying emission, absorption, or scattering of electromagnetic waves by atoms or molecules to quantitatively and qualitatively study atoms, molecules or physical processes. The interaction of matter with radiation…

More Releases for Bancassurance

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…

Bancassurance Technology Market To Incur Rapid Extension During 2020-2025

Global Bancassurance Technology Market essentials: an introduction of the market, characterizations, types, applications and supply chain scenario; Bancassurance Technology industry approaches and designs; type details; producing forms; cost structures. It also informs global fundamental regions economic situations, including the Bancassurance Technology product value, benefit, restraints, generation, demand and supply, and Bancassurance Technology industry development rate and so on. The report presents SWOT and Bancassurance Technology PESTEL analysis, speculation plausibility, and…

Global Bancassurance Market to Witness a Pronounce Growth During 2025

Market Research Report Store offers a latest published report on Bancassurance Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

Bancassurance is a relationship between a bank and an insurance company that is aimed at offering insurance products or insurance benefits to the bank's customers.

Europe market took up about 39% the global market in 2018, while North America and China were…

Strategic Overview of Bancassurance Technology Market Size, Status

HTF MI recently broadcasted a new study in its database that highlights the in-depth market analysis with future prospects of Bancassurance Technology market. The study covers significant data which makes the research document a handy resource for managers, industry executives and other key people get ready-to-access and self analyzed study along with graphs and tables to help understand market trends, drivers and market challenges. Some of the key players mentioned…

Global Bancassurance Technology Market Report, History and Forecast 2013-2025

This report studies the Bancassurance Technology market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2018-2025; This report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

Bancassurance refers to a distribution channel for insurance products. It is a means for insurance companies to sell their products…

Bancassurance Boost Non Life Insurance in Denmark: Ken Research

The growth in Denmark’s insurance industry has gained pace in recent times owing to economic recovery by the country, better deals offered by insurance companies, and encouragement of foreign direct investment in the insurance sector.

Ken Research in its recently published report on “Non-Life Insurance in Denmark, Key Trends and Opportunities to 2020” forecasts bright growth prospects in the non-life insurance segment which is the second largest segment in the Danish…