Press release

Asia-Pacific Usage-Based Insurance Market Poised to Reach $64.29 Billion by 2030 | Anticipated Expansion

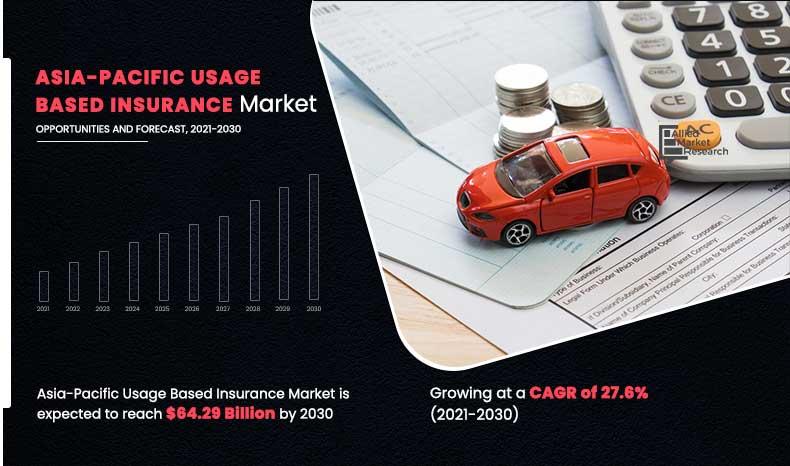

The Asia-Pacific usage-based insurance market size was valued at $5.64 billion in 2020, and is projected to reach $64.29 billion by 2030, growing at a CAGR of 27.6% from 2021 to 2030.𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/16258

Asia-Pacific Usage-Based Insurance Market by Type (Pay-As-You-Drive, Pay-How-You-Drive, and Manage-How-You-Drive), Technology (OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs), Vehicle Age (New Vehicles and Used Vehicles), Vehicle Type (Light-Duty Vehicle (LDV) and Heavy-Duty Vehicle (HDV)): Opportunity Analysis and Industry Forecast, 2021-2030

Usage-based insurance is a form of coverage in which the premium is directly proportional to the amount of time the vehicle is used. This sort of insurance is mostly offered in developed nations, the bulk of the market's top players are growing their operations in Asia-Pacific emerging countries. Furthermore, insurers use UBI plans to align driving habits of people with the premiums they charge. Telematics device, which is a system put in automobiles, monitors vehicle's speed, time, and distance travelled, which is then sent to insurance providers, which then charges insurance premiums appropriately.

Segment Review

The Asia-Pacific usage-based insurance market share is segmented based on type, technology, vehicle age, vehicle type, and country. In terms of type, the market is fragmented into pay-as-you-drive, pay-how-you-drive, and manage-how-you-drive.

Purchase Enquiry: https://www.alliedmarketresearch.com/purchase-enquiry/16258

Depending on technology, it is bifurcated into OBD-II-based UBI programs, smartphone-based UBI programs, hybrid-based UBI programs, and black-box-based UBI programs. As per vehicle age, it is bifurcated into new vehicles and used vehicles. In terms of vehicle type it is segmented into light-duty vehicle (LDV) and heavy-duty vehicle (HDV). Country wise, it is analyzed across China, Japan, Australia, Thailand, Singapore, Rest of Asia-Pacific.

Top Impacting Factors

Growth In Adoption Of Usage-based Insurance Among End Users

Higher Possibility Of Vehicles Being Recovered, When Stolen Or Low On Fuel

Key Findings Of The Study

• By policy type, the pay-as-you-drive segment accounted for the largest Asia-Pacific usage-based insurance market share in 2020.

• By technology, the OBD-II generated the highest revenue in 2020.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

https://www.alliedmarketresearch.com/request-for-customization/A15889

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Biometric Banking Market https://www.alliedmarketresearch.com/biometric-banking-market-A190645

Robo-advisory Market https://www.alliedmarketresearch.com/robo-advisory-market

Video Analytics in Banking Market https://www.alliedmarketresearch.com/video-analytics-in-banking-market-A110758

Decentralized Insurance Market https://www.alliedmarketresearch.com/decentralized-insurance-market-A74837

Gift Cards Market https://www.alliedmarketresearch.com/gift-cards-market

Hybrid Funds Market

https://www.alliedmarketresearch.com/hybrid-funds-market-A07395

Mortgage Funds Market https://www.alliedmarketresearch.com/mortgage-funds-market-A07399

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://steemit.com/@monikak

https://www.quora.com/profile/Monika-Kawade-2

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asia-Pacific Usage-Based Insurance Market Poised to Reach $64.29 Billion by 2030 | Anticipated Expansion here

News-ID: 3378205 • Views: …

More Releases from www.alliedmarketresearch.com

NFC Payments Market 2032: Trends, Competition, and Emerging Opportunities

Allied Market Research has recently published a report, titled, "NFC Payments Market by Device Type (Smartphones, Smartwatches, Tablets, EMV Cards, Others), by End User (Retail Stores, Hospitality, Healthcare Services, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global NFC payments market generated $25.8 billion in 2022, and is anticipated to generate $507.1 billion by 2032, witnessing a CAGR of 35.9% from 2023 to 2032.

Get a…

India E-Commerce Market Poised for Major Growth by 2032: In-Depth Analysis

According to a recent report published by Allied Market Research, titled, "India e-commerce Market by Model Type, and Offering: Opportunity Analysis and Industry Forecast, 2023-2032," The India e-commerce market was valued at $162.19 billion in 2022, and is projected to reach $1,355.59 billion by 2032, registering a CAGR of 23.7% from 2023-2032.

Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/A126917

As internet penetration continues to increase, more individuals have access to…

Singapore Remittance Market 2032: Growth Drivers, Competition, and Trends

Allied Market Research published a report, titled, "Singapore Remittance Market Type (Inward Remittance and Outward Remittance), Channel (Banks, Money Transfer Operators, and Others), Application (Consumption, Savings, and Investment), Mode (Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Business (C2B), and Customer-to-Customer (C2C)), and End User (Migrant Labor Workforce, Low-Income Households, Small Businesses, and Others): Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the Singapore Remittance industry generated $8.05 billion by Volume in…

Fuel Cards Market to Hit $2.8 Trillion Globally by 2032 at 14.4% CAGR, Europe Le …

Allied Market Research published a report, titled, "Fuel Cards Market by Card Type (Branded, Universal, and Merchant), and by Application (Fuel Refill, Parking, Vehicle Service, Toll Charge and Others): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global fuel cards industry generated $735 billion in 2022, and is anticipated to generate $2.8 trillion by 2032, witnessing a CAGR of 14.4% from 2023 to 2032.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭…

More Releases for UBI

Automotive Usage Based Insurance (UBI) Market Drivers, Trends And Restraints For …

Global Automotive Usage Based Insurance (UBI) report from Global Insight Services is the single authoritative source of intelligence on Automotive Usage Based Insurance (UBI) market. The report will provide you with analysis of impact of latest market disruptions such as Russia-Ukraine war and Covid-19 on the market. Report provides qualitative analysis of the market using various frameworks such as Porters' and PESTLE analysis. Report includes in-depth segmentation and…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…

Automotive UBI (Usage-based Insurance) Market 2022 | Detailed Report

ReportsnReports publishes the report titled Automotive UBI (Usage-based Insurance) that presents a 360-degree overview of the market under one roof. The report is developed with the meticulous efforts of an enthusiastic and experienced team of experts, analyts, and researchers that makes the report a valuable asset for stakeholders to make robust decisions. This report also provides an in-depth overview of product type, specification, technology, and production analysis considering vital factors…

Usage-Based Insurance Market Size, Share, Growth | UBI Industry Trends Analysis …

Allied Market Research has published a latest report titled, “Usage-Based Insurance Market by Policy Type [Pay-As-You-Drive Insurance (PAYD), Pay-How-You-Drive Insurance (PHYD), and Manage-How-You-Drive Insurance (MHYD)], Technology (OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs), Vehicle Age (New Vehicles and Used Vehicles), Vehicle Type (Light-Duty Vehicle (LDV) and Heavy-Duty Vehicle (HDV)): Global Opportunity Analysis and Industry Forecast, 2021–2027”, which says, the Usage-Based Insurance Market size is…

Global Electric Vehicle UBI Market Report Forecast to 2027

Electric Vehicle UBI Market

The expanding adoption of telematics and progressions in wellbeing innovation have decreased cases. The European Union has commanded e-help frameworks in the event of a mishap. The eCall framework, required for all new EU vehicles since March 2018, speeds up crisis reaction times by 40-half. Likewise, Russia commanded a comparable framework for new vehicles toward the finish of 2017, while Mexico has ordered radio-recurrence recognizable proof…

Automotive UBI (Usage-based Insurance) Market Outlook to 2026 - Allianz,AXA,Prog …

The Automotive UBI (Usage-based Insurance) Market report includes overview, which interprets value chain structure, industrial environment, regional analysis, applications, market size, and forecast. The report provides an overall analysis of the market based on types, applications, regions, and for the forecast period from 2020 to 2026. It also offers investment opportunities and probable threats in the market based on an intelligent analysis.

This report focuses on the Global Automotive UBI (Usage-based…