Press release

Usage-Based Insurance Market Size, Share, Growth | UBI Industry Trends Analysis 2027

Allied Market Research has published a latest report titled, “Usage-Based Insurance Market by Policy Type [Pay-As-You-Drive Insurance (PAYD), Pay-How-You-Drive Insurance (PHYD), and Manage-How-You-Drive Insurance (MHYD)], Technology (OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs), Vehicle Age (New Vehicles and Used Vehicles), Vehicle Type (Light-Duty Vehicle (LDV) and Heavy-Duty Vehicle (HDV)): Global Opportunity Analysis and Industry Forecast, 2021–2027”, which says, the Usage-Based Insurance Market size is expected to grow at alarming pace by 2027.The report focuses on the growth prospects, restraints, and trends of the global Usage-Based Insurance Market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global Usage-Based Insurance Market share.

Download Research Sample with Industry Insights (250+ Pages PDF Report) @ https://www.alliedmarketresearch.com/request-sample/1742

The key players profiled in the Usage-Based Insurance Market research report are Allianz SE, Allstate Corporation, Aviva, AXA, Insurethebox, Liberty Mutual Insurance, Mapfre S.A., Nationwide Mutual Insurance Company, Progressive Corporation and UNIPOLSAI ASSICURAZIONI S.P.A.

These players have adopted various strategies such as expansions, mergers & acquisitions, joint ventures, new product launches, and collaborations to gain a strong position in the industry.

Key Benefits for Stakeholders from this Research Report:

• This study comprises analytical depiction of the global Usage-Based Insurance Market outlook along with the current trends and future estimations to depict the imminent investment pockets.

• The overall Usage-Based Insurance Market analysis is determined to understand the profitable trends to gain a stronger foothold.

• The report presents information related to key drivers, restraints, and Usage-Based Insurance Market opportunities with a detailed impact analysis.

• The current Usage-Based Insurance Market forecast is quantitatively analyzed from 2020 to 2027 to benchmark the financial competency.

• Porter’s five forces analysis illustrates the potency of the buyers and the Usage-Based Insurance Market share of key vendors.

• The report includes the trends and the Usage-Based Insurance Market share of key vendors.

USAGE-BASED INSURANCE MARKET: Segment Analysis

The global Usage-Based Insurance Market share is segmented on the basis of type, technology, vehicle age, vehicle type and region.

Interested to Procure the Data? Inquire Here @ https://www.alliedmarketresearch.com/purchase-enquiry/1742

USAGE-BASED INSURANCE MARKET: Regional Scope and Demand Analysis for 2021-2027

Region wise, the Usage-Based Insurance Market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

North America is dominating the Usage-Based Insurance Market share, owing to growth of the high investment opportunities. However, Asia-Pacific is projected to register the significant growth rate during the forecast period. Furthermore, LAMEA holds the subsequent position, and is likely to increase its growth rate by the end of the forecast period, followed by Europe.

Covid-19 Impact on the Global Usage-Based Insurance Market:

Usage-Based Insurance Market Research Report provides an overview of the industry based on key parameters such as effect of COVID-19 on market size, sales, sales analysis and key drivers. The coronavirus pandemic (COVID-19) has affected all aspects of life around the world. This has changed some of the market situation. The main purpose of the research report is to provide users with a broad view of the market. Initial and future assessments of rapidly.

Get Detailed COVID-19 Impact Analysis on the Usage-Based Insurance Market @

Key Questions Answered in the Usage-Based Insurance Market Research Report: https://www.alliedmarketresearch.com/request-for-customization/1742?reqfor=covid

Q1. At what CAGR, the Global Usage-Based Insurance Market will expand from 2021 – 2027?

Q2. What will be the revenue of Global industry by the end of 2027?

Q3. Which are the factors that drives global industry Growth?

Q4. Who are the leading players in Usage-Based Insurance Market?

Q5. What are the segments of Usage-Based Insurance Market?

Q6. What are the key growth strategies of Usage-Based Insurance Market Players?

Q7. By Application, which segment is expected to exhibit the highest CAGR during 2021 – 2027?

Q8. By Region, which segment holds a dominant position in 2020 and would maintain the lead over the forecast period?

Key Market Segments

By Type

• Pay-as-you-drive (PAYD)

• Pay-how-you-drive (PHYD)

• Manage-how-you-drive (MHYD)

By Technology

• OBD-II-based UBI programs

• Smartphone-based UBI programs

• Hybrid-based UBI programs

• Black-box-based UBI programs

By Vehicle Age

• New Vehicles

• Used Vehicles

By Vehicle Type

• Light-Duty Vehicle (LDV)

• Heavy-Duty Vehicle (HDV)

By Region

• North America

o U.S.

o Canada

• Europe

o Germany

o France

o UK

o Italy

o Spain

o Belgium

o Rest of Europe

• Asia-Pacific

o China

o Japan

o Australia

o Singapore

o Thailand

o Rest of Asia-Pacific

• LAMEA

o Latin America

o Middle East

o Africa

Key Market Players

• Allianz SE

• Allstate Corporation

• Aviva

• AXA

• Insurethebox

• Liberty Mutual Insurance

• Mapfre S.A.

• Nationwide Mutual Insurance Company

• Progressive Corporation

• UNIPOLSAI ASSICURAZIONI S.P.A

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-Based Insurance Market Size, Share, Growth | UBI Industry Trends Analysis 2027 here

News-ID: 2379528 • Views: …

More Releases from Allied Market Research

Agritourism Market Update: Global Value Expected to Reach $111.1 Billion by 2032

The agritourism market size was valued at $33.8 billion in 2022, and is estimated to reach $111.1 billion by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

According to a new report published by Allied Market Research, titled, "Agritourism Market Size, Share, Competitive Landscape and Trend Analysis Report, by Sales Channel, by Activity: Global Opportunity Analysis and Industry Forecast, 2023-2032." The research provides a current evaluation of the…

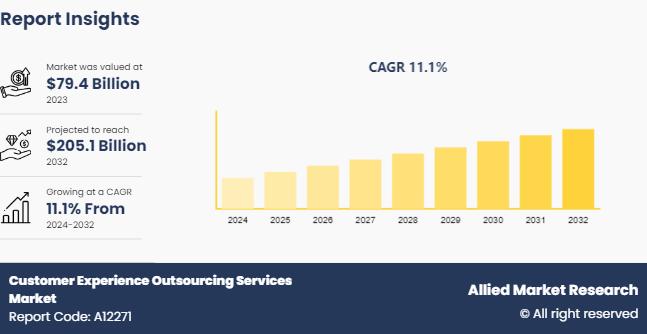

The Global Customer Experience Outsourcing Services Market Reach USD 205.1 Billi …

According to the report published by Allied Market Research, The Global Customer Experience Outsourcing Services Market Reach USD 205.1 Billion by 2032 Growing at 11.1% CAGR . The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge…

Steel Roofing Market Growth Trends Analysis 2032 | Hits at a CAGR of 4.2%

The steel roofing market size was valued at $10.7 billion in 2020, and is estimated to reach $17.5 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Increasing population and urbanization are the main elements driving demand for residential and non-residential buildings. This positively influences the steel roofing market.

Download Updated Sample PDF: https://www.alliedmarketresearch.com/request-sample/A125190

Driving Demands:

Commonly, the fastening types of metallic roofing including steel roofing are exposed and…

U.S. Interior Doors Market Outlook 2024-2033 Projected Growth to Reach $20,874.1 …

The U.S. interior doors market size was valued at $14,544.8 million in 2023 and is projected to reach $20,874.1 million by 2033, registering a CAGR of 3.6% from 2024 to 2033.

Commonly observed types of interior doors are panel door, bypass door, bifold door, pocket door, and others. Among these, the panel door segment accounted for the highest market share in 2023, owing to its space saving ability.

Further, the swinging…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…