Press release

What is the eligibility of Employee Retention Tax Credit for business in USA

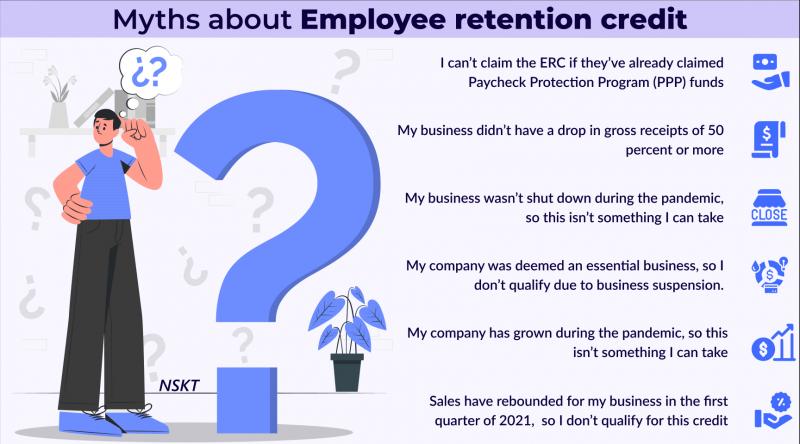

Employee Retention Tax credit (ERC) is a refundable tax credit for the employees against certain employment taxes which is equal to 50% of the qualified wages an eligible employer pays to employees after March 12, 2020, and before January 1, 2021. The eligible employers can get immediate access to the credit by reducing employment tax deposits they are otherwise required to make. Also, if the employer's employment tax deposits are not sufficient to cover the credit, the employer may get an advance payment from the IRS. The Employee retention tax credit, also referred to as the ERTC, was created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which came into effect in March 2020. This law was formulated to encourage businesses to keep employees on their payroll. The Consolidated Appropriations Act, 2021 (CAA), enacted in December 2020, and the American Rescue Plan Act (ARPA), enacted in March 2021, amended and extended the credit and the availability of certain advance payments of the credits through the end of 2021. The ARPA, for instance, allows small employers that received a Paycheck Protection Program (PPP) loan to also claim the ERTC.Read the complete Blog here:-

https://www.nsktglobal.com/employee-retention-tax-credit-once-in-a-lifetime-tax-incentive-for-business-in-usa

Eligibility Criteria

There are no such limits or eligibility criteria for Employee Retention Tax Credit. However different kinds of businesses are treated differently.

For businesses with 100 full-time employees or less- In this case, all the wages of the employee qualify for the credit. Irrespective of whether the business is in running state or has been subjected to shut down.

For businesses with more than 100 full-time employees- In this case, the credits are qualified for the employees when an employee was not able to render services due to covid-19 related circumstances.

Private-sector businesses and tax-exempt organizations are also eligible for Employee Retention tax credit. But there are certain clauses to it:

Businesses that faced full or partial shutdown of operations as a result of a government order limiting commerce due to COVID-19 during 2020 or 2021.

Gross receipts decline by more than 50 percent during a 2020 or 2021 calendar quarter when compared to the same quarter in the prior year.

A "recovery startup" business that was launched after Feb. 15, 2020, for which the average annual gross receipts do not exceed $1 million, subject to a quarterly ERTC cap of $50,000.

Contact us to check your business eligibility

https://www.nsktglobal.com/usa/contact-us.php

or mail us at

usoffice@nsktglobal.com

NSKT Global (USA Office)

1564 Market Place Blvd Suite 400 PMB 328

Ocean Isle Beach, NC 28469

Email:- usoffice@nsktglobal.com

Phn:- 888 701 675

888 701 NSKT

https://www.nsktglobal.com/usa

NSKT Global (UAE Office)

Level 14, Boulevard Plaza Tower 1,

Downtown, Dubai, UAE PO 334155

Phn +971 44 394 263

Whatsapp +971 55 171 2487

Email:- uae@nsktglobal.com

https://nsktglobal.com/uae

At NSKT Global we provides the complete range of advisory services to the SMEs as well as to the established businesses. Dealing in the industry for over 10 years. In countries across globe Namely UAE, USA and India.

contact us

https://www.nsktglobal.com/usa/contact-us.php

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What is the eligibility of Employee Retention Tax Credit for business in USA here

News-ID: 2370179 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

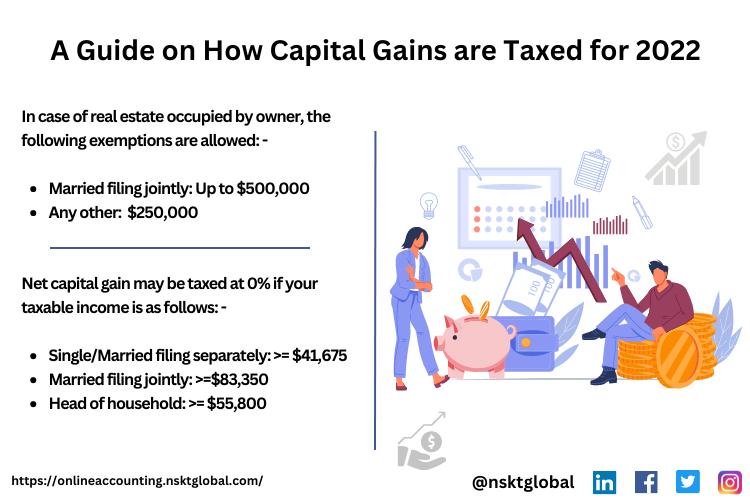

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

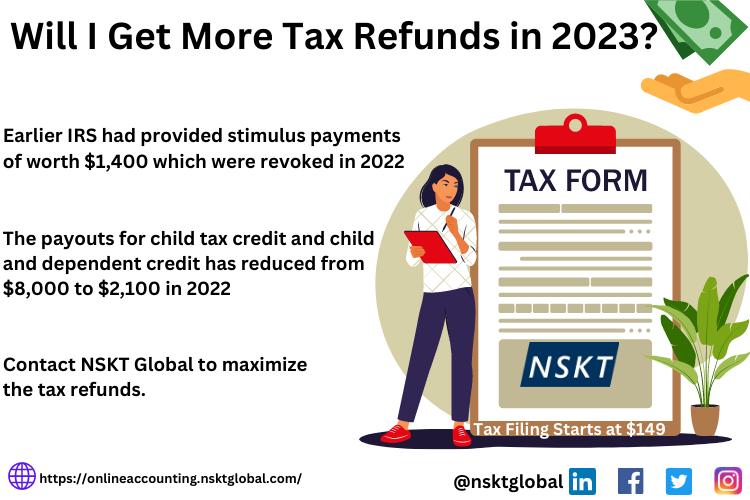

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for Tax

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…

Industry Leading Tax Software Market For High-Volume Tax Businesses with Online …

Market Highlights

Tax software is software that ensures tax compliance for income tax, corporate tax, VAT, service tax, customs, sales tax, use tax, or other taxes its users may be required to pay. The software automatically calculates a user's tax liabilities to the government, keeps track of all transactions, keeps track of eligible tax credits, etc. The software can also generate forms or filings needed for tax. The software will have…

Kreston Reeves Tax Director achieves leading international tax qualification

Kreston Reeves, one of the leading accountancy and financial services firms located across London, Kent and Sussex, is proud to announce that Matthew Creevy, Corporation Tax Technical Director, has achieved the Advanced Diploma in International Taxation (ADIT), placing him in the highest echelons of international tax professionals.

ADIT is an advanced level designation in international cross-border tax. The credential is designed by a board of world-leading experts and has been created…

SMP Accounting & Tax appoints Rachael Hooper as Tax Manager

Russell Bedford member SMP Accounting & Tax Limited, one of the Isle of Man’s largest accounting and tax firms, has appointed Rachael Hooper as a manager in its Tax Department.

Rachael will be working in all areas of UK, Isle of Man and International taxation, with a particular focus on UK resident non-UK domiciled individuals, Trusts and Inheritance Tax.

After qualifying as a Chartered Accountant with a Big Four accountancy firm, Rachael…

United Tax Group Announces Effective Tax Negotiators

United States (June 2011) – United Tax Group announces effective tax negotiators for clients. Tax negotiators work directly with the IRS so tax payers do not. The expertise of tax negotiators helps save clients thousands.

Tax negotiators from United Tax Group are assigned individual clients. This means tax negotiators are working on particular cases assigned. Therefore, clients receive individualized attention for their case.

This individualized attention by United Tax Group gets results.…