Press release

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors such as the stimulus check. Let us understand how this aid has helped taxpayers receive more significant tax refunds in 2020 and 2021 and how the tax refunds of 2022 will be affected.Lower tax refunds in 2023 because of the revoked stimulus payment and over-the-line charitable donation credit.

IRS has stated that the tax refunds for 2023 are going to be lower than the previous years because the IRS will not provide taxpayers with Stimulus payments to taxpayers. The stimulus payment has been revoked due to the lack of economic impact payments in 2022. The last round of stimulus payments was received in 2021, worth $1,400. The government provides stimulus checks to taxpayers to boost their spending capacity. In addition, the IRS has also revoked the charitable deductions for the tax year of 2022. The incentives provided by the IRS Refunds to enhance the overall spending capacity of taxpayers through 2020 and 2021 are now being revoked. This means the tax credits and deductions will be lower in 2023, similar to what they were in 2019.

Lower child and dependent care credit, as well as child tax credit

The tax returns for the year 2021 had higher dependent care credits, as the payout for a single-child/dependent went as high as $4,000, while that for two or more dependents was $8,000. These payouts were staggeringly high compared to those received in the previous year, which stood at $1,050 and $2100, respectively. For 2021, the maximum child tax credit was also increased to $3,600 for kids under six and $3,000 until they turn 17, compared to a maximum payout of $2,000 for kids under 16. However, these credits have gone down to their original level for the tax returns to be obtained in 2023. This considerable tax credit trim-off is predicted to bring down the 2023 tax refunds to a huge extent!

Lower EITC

In 2021, the maximum income tax credit for childless workers came to $1500 from $500 in 2019. The minimum age limit was also changed from 25 to 19. The government did this to help taxpayers get through 2021, which was the most impacted by the Covid-19 outbreak. For the tax returns of 2022, this amount went back to its original value, further bringing down the Tax Credits for 2023.

How to get your tax refunds faster

To receive tax refunds faster, you should file taxes online. Taxpayers that choose to file their taxes through mail face delayed tax returns, as the tax documentation, including Form 1040 and supporting documents, take a few weeks to reach the IRS Refunds, which is then predicted to be processed in the next 21 days. Most of the tax filings done by American Taxpayers have been historically recorded to be processed within 21 days. However, it has been noticed that the payment procedure also affects the time taken by the IRS to provide taxpayers with tax returns. The taxpayers choose the mode of payment, and they can receive their tax refunds either by mail or by direct deposit to the taxpayer's bank.

However, specific errors made while filing for taxes lead to delayed tax returns. Taxpayers should pay particular attention while filling up these details to avoid these errors while filing taxes online. Math errors are one of them. They are simple calculation errors, which, if not done correctly, must be rectified by the IRS. This takes a lot of time, which should be avoided at all times to ensure the reception of tax refunds on time. Therefore, the IRS suggests taxpayers have all their bills and income statements handy before they file taxes online.

Why should you get a good tax preparer to handle your tax affairs?

If a taxpayer files taxes online by themselves, there's a good chance that they might make mistakes or overlook certain transactions that might cost them time and/or money. Making these mistakes might lead to even lower tax refunds in 2023. If you are dealing with the same issue and require assistance with your tax returns, visit the official website of NSKT Global. They employ a trained and qualified team of tax professionals ready to help clients lower their tax bills as much as possible. The tax professionals working with NSKT Global have access to your bank transactions once a taxpayer has connected their bank account with the infrastructure of NSKT Global, which helps them track cash flow. Save yourself a lot of time, and make the tax filing process more pleasant. Click here for more information regarding the services offered by NSKT Global and how you can benefit from their tax services!

Schedule a Free Consultation

Charlotte City Center 25 North Tryon Street Suite 1600, Charlotte North Carolina, 28202

NSKT Global, is a Global consulting firm with a team of certified public accountants, certified fraud examiners (CFE), certified sarbanes-oxley experts (CSOE), Business Advisers, Internal Auditors, Data Scientist and IT experts. We extend all kinds of help to our clients and assist them at all possible junctures of their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Will I Get More Tax Refunds in 2023? here

News-ID: 2878575 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

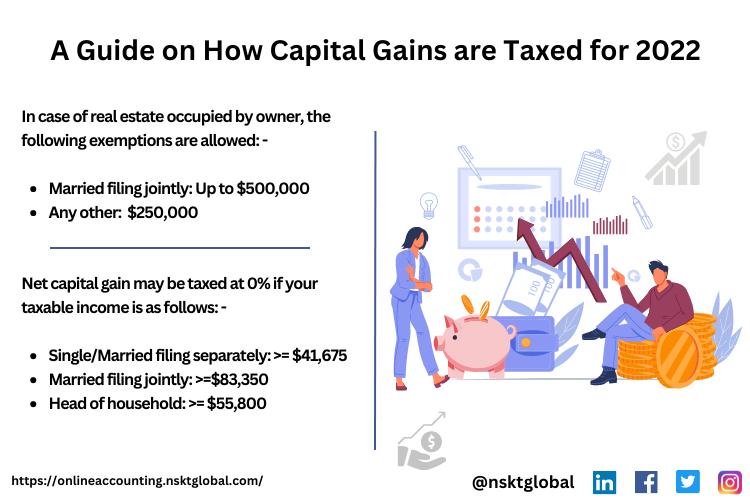

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

How do I file a 1040 tax return?

At the end of every year, the tax filing season is a significant event to be taken seriously by taxpayers. Taxpayers attempt to file their taxes accurately, so their tax bills can be minimized. Tax filing can be done online by utilizing the official IRS website. The individual income taxes are to be filled by every taxpayer in the United States before the prescribed deadline. At the end of every…

More Releases for IRS

STAY ONE STEP AHEAD OF THE IRS WITH NATIONWIDE TAX EXPERTS

Huntington Beach, CA – March 21, 2019 - Have you been thumped with a tax demand from the IRS and not sure what to do? Nationwide Tax Experts are on hand to offer you the best solution to save money and minimize that tax debt.

Millions of Americans find themselves in the same position, not knowing which way to turn, under pressure and stress, and facing a crisis with their impending…

Global Intelligent Road System (IRS) Market Size, Status, Key player:- Software, …

Market Research Hub (MRH) has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Intelligent Road System (IRS) Market Size, Status and Forecast 2018-2025” provides an in-depth analysis of the Intelligent Road System (IRS) Market with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house).The research study…

New Tool Quickly Calculates IRS Settlements

Old Hickory, Tenn. - TaxProEZ, a professional tax resolution and preparation company, announces the release of a new tool that helps enrolled agents quickly by calculating settlements. Tax resolution expert Gary LaRoy is offering the tool to enrolled agents, so they can support their clients’ tax management needs.

The Internal Revenue Service (IRS) is sure to come calling when back taxes are owed. The average accountant or tax professional company may…

Edupliance Announces Webinar To Cover How to Correct IRS Forms

Edupliance announces webinar titled, “Complete Guide to Correcting IRS Forms” that aims to advise attendees on the correct way to fill Form 941, use Form W-2c to correct the employee’s year-end information as well as how to file amended return for Form 940. The webinar goes LIVE on Wednesday, May 31, from 01:00 PM to 02:30 PM, Eastern Time.

Mistakes can occur in even the most efficient and knowledgeable payroll departments!…

Global IRS Mode Selector Module Assemblys Market Research Report 2017

Summary

This report studies IRS Mode Selector Module Assemblys in Global market, especially in North America, Europe, China, Japan, Southeast Asia and India, focuses on top manufacturers in global market, with capacity, production, price, revenue and market share for each manufacturer, covering

Company One

Company Two

Company Three

Company Four

Company Five

Company Six

Company Seven

Company Eight

Company Nine

Company Ten

Company 11

Company 12

Company 13

Company 14

Company 15

Company 16

Company 17

Company 18

Company 19

Company 20

Get Sample Report @ http://www.reportbazzar.com/request-sample/?pid=810017&ptitle=Global+IRS+Mode+Selector+Module+Assemblys+Market+Research+Report+2017&req=Sample

Market Segment by Regions, this report…

CW Associates CPA's Hawaii: Modernizing Fax Filings with the IRS

Federal and state agencies, including the court systems, are modernizing by allowing the electronic filing of petitions and other court documents. For example, Alabama, Texas, Illinois and Missouri have e-filing systems for court petitions. In 2014, two federal courts (2nd and 9th Circuit Courts of Appeals) piloted an e-filing program for all courts in which the user is authorized to file electronically. The program is expected to become national in…