Press release

A Growing Sector: Cancer Insurance Market Forecasted at $159.9 Billion by 2032 | At a CAGR of 10.2%

Cancer insurance is a kind of critical illness insurance that will deliver predetermined sum of money to the policyholder in case of cancer diagnosis. The purpose of cancer insurance is to offer financial assistance to individuals that are facing high costs associated with cancer treatment, including medical expenses, medications, surgeries and other related costs. The cancer insurance market policy also acts a life insurance for cancer patients The lump sum payment will be used at the discretion of the policyholder to address different financial requirements during the cancer journey.The main advantage of having cancer insurance is to ensure that the person is financially protected. When a cancer diagnosis is implemented the cancer insurance helps in paying for the lump sum benefit thus providing a safety net of funds to cover variety of costs in relation to treatment, recuperation and everyday life. Furthermore, out of the pocket costs that are expensive in nature are associated with the health insurance. The expenditure of medical procedures, surgeries, prescription drugs and therapies are not entirely covered by the standard health insurance. In addition, cancer fund is flexible in nature and can be utilized in any way the user wants to utilize it.

𝐂𝐥𝐚𝐢𝐦 𝐘𝐨𝐮𝐫 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂: https://www.alliedmarketresearch.com/request-sample/A264275

According to the report published by Allied Market Research, the global cancer insurance market garnered $61.7 billion in 2022 and is expected to generate a revenue of $159.9 billion by 2032, growing at a noteworthy CAGR of 10.2% from 2023 to 2032. The comprehensive study analyzes the actionable insights, drivers, competitive scenario, market dynamics, size, and promising investment regions.

Highlights:

The insurance plan segment of the global cancer insurance market is further divided into individual plan, supplement plan, and critical illness plan.

The individual plan segment held the maximum market share in 2022.

Based on region, the Europe region is predicted to grow with the fastest CAGR during the forecast period.

Cancer Insurance Market

Futuristics Trends in Cancer Insurance:

Customized Policies: Nowadays, several insurance companies are offering more customizable cancer insurance policies to meet the diverse needs of consumers. These policies would allow individuals to choose coverage amounts, benefit periods, and specific types of cancer coverage based on their preferences and budget.

Comprehensive Coverage: With the changing consumer demands, many insurers are expanding the scope of coverage provided by cancer insurance policies, including a broader range of services and expenses. These coverage plans include diagnostic tests, alternative therapies, genetic counselling, and rehabilitation services to support individuals throughout their cancer journey.

Integration with Critical Illness Insurance: Some insurers are integrating cancer insurance with critical illness insurance to provide comprehensive coverage for a wide range of serious medical conditions. Such approaches are expected to offer policyholders greater flexibility and peace of mind by addressing multiple health risks under a single insurance policy.

Segments of the Cancer Insurance Market:

Insurance Plan:

Individual Plan: An individual plan in cancer insurance is a policy purchased directly by an individual to cover personal cancer-related expenses. It typically offers a lump-sum payment upon diagnosis, coverage for treatment expenses such as surgery and chemotherapy. It also includes additional benefits such as home healthcare and counseling services.

Supplement Plan: This insurance plan complements existing health insurance by providing additional coverage for cancer-related expenses not fully covered by primary insurance. Such plans offer benefits such as coverage for treatment costs, broader coverage amounts, and assistance with non-medical expenses, helping alleviate financial burdens associated with cancer diagnosis and treatment.

Critical Illness Plan: This type of policy also provides coverage for other serious illnesses along with cancer, such as cardiovascular diseases, neurological disorders, etc. With this plan, patients can avail coverage for the diagnosis of critical health conditions, medical expenses, and other financial obligations associated with the illness, including cancer treatment costs.

Gender:

Male: In 2022, the male segment of the cancer insurance market held the highest share due to the increased smoking and alcohol consumption in males.

Female: The female segment is predicted to exhibit the highest CAGR during the estimated timeframe due to the increasing prevalence of breast cancer among females globally.

𝐁𝐮𝐲 𝐓𝐡𝐢𝐬 𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 (𝐏𝐃𝐅 𝐰𝐢𝐭𝐡 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐂𝐡𝐚𝐫𝐭𝐬, 𝐓𝐚𝐛𝐥𝐞𝐬, 𝐚𝐧𝐝 𝐅𝐢𝐠𝐮𝐫𝐞𝐬) @ https://bit.ly/3V2iHpN

The individual plan segment to maintain its leadership status throughout the forecast period

Based on insurance plan segment, the individual plan segment attained more than half of the market-share and will continue to dominate the market for the forecast period as the plan is affordable for middle- and lower-class income earning groups. However, from 2023 to 2032, the critical illness plan is expected to grow at the fastest rate of 12.3%. This is due to the lump sum benefit provided by the plan.

The male segment to maintain its leadership status throughout the forecast period

Based on gender, the male segment held the highest market share in 2022, accounting for more than three-fifths of the cancer insurance market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is because of increasing smoking and alcohol intake among the males. However, from 2023 to 2032, the female segment is expected to grow at the fastest rate of 11.7%. This is because of increasing lack of proper diet among the young females.

The North America segment to maintain its leadership status throughout the forecast period

Based on region, North America held the highest market share in 2022, accounting for around one-third of the cancer insurance market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is because of increasing cancer cases in the region. However, from 2023 to 2032, the Asia-Pacific segment is expected to grow at the fastest rate of 12.9%. This is because of increasing population, pollution and health problems in the region.

The Growing Landscape of Different Regions:

The global cancer insurance market is evaluated across various regions including North America, Asia-Pacific, Europe, and LAMEA. The North America region dominated the market in 2022 because of the increased number of cancer cases across the region. However, the Europe region is expected to grow at a healthy CAGR due to the rising cases of different types of cancers among middle-aged individuals throughout the region.

Key Determinants Boosting the Growth of the Cancer Insurance Market:

The global cancer insurance market has experienced significant growth due to the rapid technological advancements in cancer treatment. For instance, gene editing tools have become one of the latest technologies that have helped specialists to modify genes used for cancer development. Furthermore, the increasing risk of cancer among adults is expected to increase the demand for cancer insurance in the forthcoming years. On the other hand, unlike traditional health insurance, advanced cancer insurance policies cover experimental and cutting-edge therapies which are expected to drive the growth of the market exponentially during the estimated period.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: 𝐈𝐧𝐬𝐢𝐝𝐞𝐫'𝐬 𝐆𝐮𝐢𝐝𝐞 𝐭𝐨 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞@ https://www.alliedmarketresearch.com/purchase-enquiry/A264275

Prominent Market Players:

CVS Health

Prudential Plc

United Health

UNUM Group

Aviva Plc

Mutual of Omaha

China Life

Aflac

AXA

Cigna Group

Some Other Important Questions Covered in the Comprehensive Study:

What are the potential investment options across different regions?

What are the new strategies of key companies in the market?

Which company accounted for the highest market share?

What are the key opportunities in the market?

Which region or sub-segment is expected to drive the market in the forecast period?

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Purchase Order Financing Market https://www.alliedmarketresearch.com/purchase-order-financing-market-A323695

Auto Insurance Market https://www.alliedmarketresearch.com/auto-insurance-market

Corporate Secretarial Services Market https://www.alliedmarketresearch.com/corporate-secretarial-services-market-A121486

Aviation Consulting Market https://www.alliedmarketresearch.com/aviation-consulting-market-A324243

Capital Exchange Ecosystem Market https://www.alliedmarketresearch.com/capital-exchange-ecosystem-market-A324213

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release A Growing Sector: Cancer Insurance Market Forecasted at $159.9 Billion by 2032 | At a CAGR of 10.2% here

News-ID: 3679559 • Views: …

More Releases from Allied Market Research

NFC Payment Devices Market, Valued at $67.71 Billion, Projected to Grow at a CAG …

As per the report published by Allied Market Research, the global NFC payment devices market generated $16.35 billion in 2020, and is expected to reach $67.71 billion by 2028, growing at a CAGR of 19.5% from 2021 to 2028. Increase in adoption of smart wearables and rise in penetration of digital payments have led to the growth of the NFC payments market in recent years.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂…

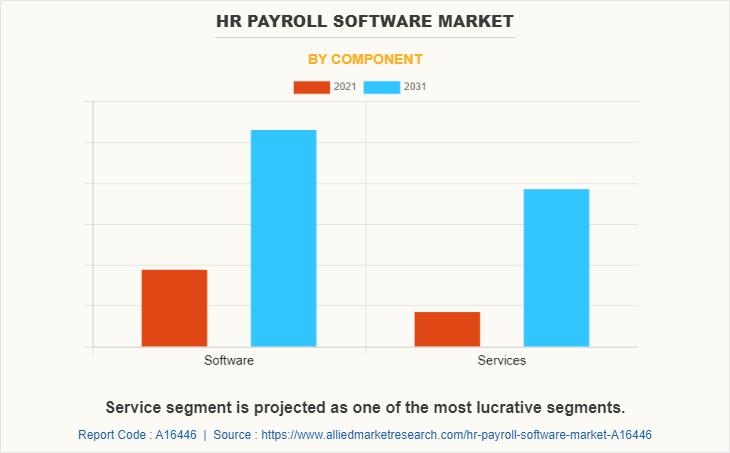

HR Payroll Software Market Size is Growing at a CAGR of 9.2% and Reach $55.69 Bi …

According to the report, the global HR payroll software industry generated $23.55 billion in 2021, and is estimated to reach $55.69 billion by 2031, witnessing a CAGR of 9.2% from 2022 to 2031.

Rise in usage of social media and surge in need for cost-effective HR payroll system drive the growth of the global HR payroll software market. In addition, the shift toward digitalization and rise in implementation of the Industry…

Portable Generators Market Comprehensive Analysis by 2032 | Hits at a CAGR of 4. …

Prime determinants of growth

The growing popularity of outdoor recreational activities such as camping, RVing, and tailgating has boosted the demand for portable generators. These generators provide a convenient power source for outdoor enthusiasts to power appliances and electronic devices. Rapid urbanization and infrastructure development in emerging economies are driving the demand for portable generators. Construction sites, in particular, rely on portable generators to power tools and equipment in areas without…

Rebar Robotics Market Demand Analysis 2024 to 2033 |Top Companies To Reach $116. …

Prime determinants of growth

Increase in construction activities and urbanization globally, lack of skilled cheap labor, and surge in emphasis on sustainable and eco-friendly construction practices drives the market growth. However, high initial investment costs associated with Rebar robotics production restrain the market growth. On the other hand, technological advancements and innovations are anticipated to positively affect the market.

According to the report, the rebar robotics market was valued at…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…