Press release

Parametric Insurance Market Still Has Room to Grow | Munich Re, AXA, Aon

The latest study released on the Global Parametric Insurance Market by USD Analytics Market evaluates market size, trend, and forecast to 2030. The Parametric Insurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.Key Players in This Report Include:

Swiss Re (Switzerland), Munich Re (Germany), Lloyd's of London (United Kingdom), AXA (France), Allianz (Germany), Chubb (Switzerland), Hannover Re (Germany), Travelers (United States), Berkshire Hathaway Specialty Insurance (United States), Zurich Insurance Group (Switzerland), Aon (United Kingdom)

Download Free Sample Report PDF @ https://www.usdanalytics.com/sample-request/31500

Global Parametric Insurance Market Size is valued at $16.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 10.6% to reach $36.9 Billion by 2032.

Definition:

The Parametric Insurance Market refers to a type of insurance that pays out benefits based on predetermined parameters or triggers, rather than the traditional indemnity model, which requires assessing actual losses incurred. This innovative insurance model is gaining traction across various sectors, especially in areas prone to natural disasters and climate-related risks.

Market Drivers:

• Increasing Frequency of Natural Disasters: The rising occurrence of climate-related events is driving demand for parametric insurance solutions to manage risks effectively.

• Speed of Payouts: The quick claims settlement process of parametric insurance appeals to businesses and individuals who need immediate financial support after a triggering event.

• Lack of Traditional Coverage: In regions where traditional insurance may be insufficient or unavailable, parametric insurance offers an alternative to manage risks.

Market Trends:

• Technological Advancements: The use of big data, IoT, and machine learning is enhancing the accuracy and efficiency of parametric insurance products.

• Integration with Traditional Insurance: Some insurers are incorporating parametric solutions into their traditional offerings to provide comprehensive coverage.

Challenges:

• Data Reliability: The effectiveness of parametric insurance relies on accurate and reliable data sources. Issues with data quality can lead to disputes over payouts.

• Market Education: Increasing awareness and understanding of parametric insurance among potential clients remains a challenge, as it is still a relatively new concept.

• Regulatory Compliance: Navigating regulatory requirements for parametric insurance products can be complex and varies by region.

Major Highlights of the Parametric Insurance Market report released by USD Analytics

By Type (Weather Parametric Insurance, Natural Catastrophe Parametric Insurance, Pandemic Parametric Insurance, Cyber Parametric Insurance, Agricultural Parametric Insurance, Others), By Distribution Channel (Insurance Companies and Reinsurers, Brokers and Intermediaries, Online Platforms, Governments and International Organizations, Others).

Global Parametric Insurance market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to helps the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Buy Complete Assessment of Parametric Insurance Market Now @ https://www.usdanalytics.com/payment/report-31500

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• -To carefully analyze and forecast the size of the Parametric Insurance market by value and volume.

• -To estimate the market shares of major segments of the Parametric Insurance market.

• -To showcase the development of the Parametric Insurance market in different parts of the world.

• -To analyze and study micro-markets in terms of their contributions to the Parametric Insurance market, their prospects, and individual growth trends.

• -To offer precise and useful details about factors affecting the growth of the Parametric Insurance market.

• -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Parametric Insurance market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Get (10-30%) Discount on Immediate Purchase: https://www.usdanalytics.com/discount-request/31500

Major highlights from Table of Contents:

Parametric Insurance Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Parametric Insurance market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Parametric Insurance Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Parametric Insurance Market Production by Region Parametric Insurance Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

Key Points Covered in Parametric Insurance Market Report:

• Parametric Insurance Overview, Definition and Classification Market drivers and barriers

• Parametric Insurance Market Competition by Manufacturers

• Parametric Insurance Capacity, Production, Revenue (Value) by Region (2024-2030)

• Parametric Insurance Supply (Production), Consumption, Export, Import by Region (2024-2030)

• Parametric Insurance Production, Revenue (Value), Price Trend by Type { Weather Parametric Insurance, Natural Catastrophe Parametric Insurance, Pandemic Parametric Insurance, Cyber Parametric Insurance, Agricultural Parametric Insurance, Others }

• Parametric Insurance Market Analysis by Application { Insurance Companies and Reinsurers, Brokers and Intermediaries, Online Platforms, Governments and International Organizations, Others}

• Parametric Insurance Manufacturers Profiles/Analysis Parametric Insurance Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Browse Complete Summary and Table of Content @: https://www.usdanalytics.com/industry-reports/parametric-insurance-market

Key questions answered

• How feasible is Parametric Insurance market for long-term investment?

• What are influencing factors driving the demand for Parametric Insurance near future?

• What is the impact analysis of various factors in the Global Parametric Insurance market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, or Southeast Asia.

Contact Us:

Harry (Business Consultant)

USD Analytics Market

Phone: +1 213-510-3499

sales@usdanalytics.com

About Author:

USD Analytics Market is a leading information and analytics provider for customers across industries worldwide. Our high-quality research publications are connected market. Intelligence databases and consulting services support end-to-end support our customer research needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Parametric Insurance Market Still Has Room to Grow | Munich Re, AXA, Aon here

News-ID: 3678592 • Views: …

More Releases from USD Analytics

Contract Laboratory Organization Market Is Booming So Rapidly | Solvias, Selvita …

The latest study released on the Global Contract Laboratory Organization Market by USD Analytics Market evaluates market size, trend, and forecast to 2030. The Contract Laboratory Organization market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the…

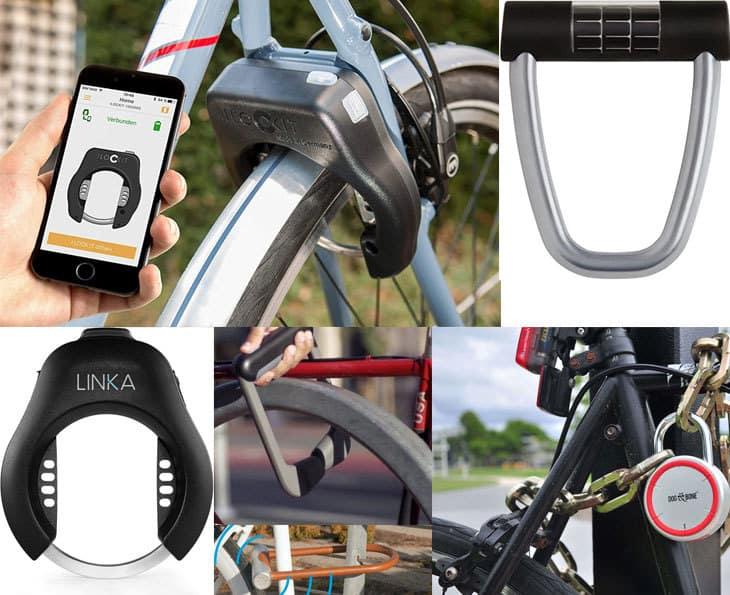

Smart Bike Lock Market Is Booming So Rapidly | Lattis, LINKA, Mobilock

The latest study released on the Global Smart Bike Lock Market by USD Analytics Market evaluates market size, trend, and forecast to 2030. The Smart Bike Lock market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the…

Proptech Market Is Booming So Rapidly | Zumper, Zillow, Qualia

The latest study released on the Global Proptech Market by USD Analytics Market evaluates market size, trend, and forecast to 2030. The Proptech market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in This…

Insomnia Drug Market to Witness Huge Growth by 2024 | Sanofi, Lundbeck, Viatris

The latest study released on the Global Insomnia Drug Market by USD Analytics Market evaluates market size, trend, and forecast to 2030. The Insomnia Drug market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…