Press release

Annuity Insurance Market: Studying the Evolving Dynamics and Latest Advancements in the Industry during 2024-2032

Annuity Insurance Market: Studying the Evolving Dynamics and Latest Advancements in the Industry during 2024-2032Allied Market Research recently published a report on the annuity insurance market which classifies the industry under the categories of type, application, and distribution channel. As per the report, the landscape, which accounted for $1.0 trillion in 2023, is set to reach $1.5 trillion by 2032, thus growing at a CAGR of 4.0% from 2024 to 2032. The study also provides regional analysis to help companies understand the true nature of the industry.

𝐂𝐥𝐚𝐢𝐦 𝐘𝐨𝐮𝐫 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂: https://www.alliedmarketresearch.com/request-sample/A323697

A Brief Overview of the Market Dynamics

The AMR report primarily focuses on the major growth drivers, investment opportunities, and restraints in the market to assist businesses in developing strategies for thriving in the sector. Annuity insurance refers to a long-term income protection plan wherein the life insurer provides a series of payments to the applicant in return for a lump-sum amount. Thus, this financial mechanism plays a huge role in retirement planning and security as it provides pension supplement and asset protection.

The growing awareness regarding the importance of different income strategies is expected to create numerous opportunities for growth in the industry. Furthermore, volatility in financial markets has led to many people opting for insurance schemes to provide security in the future. However, the high cost of annuities is anticipated to create hurdles in the full-fledged growth of the market. Nonetheless, a favorable regulatory environment and initiatives are predicted to augment the growth rate of the industry in the coming period.

To aid companies in understanding the performance of the market in different countries, the report also provides a comprehensive analysis of regions such as North America, LAMEA, Europe, and Asia-Pacific. The leading socioeconomic, cultural, political, legal, and demographic factors influencing the industry have been studied. The well-developed financial industry and planning culture in countries such as the U.S. have strengthened the position of the sector in North America.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐳𝐞𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 & 𝐓𝐎𝐂 𝐍𝐨𝐰! @ https://www.alliedmarketresearch.com/request-for-customization/A323697

Upcoming Trends in the Industry

The advent and integration of robotic process automation and AI has been one of the most important advancements in the market. Many insurance companies and businesses have launched AI-powered platforms and chatbots to provide better services to their customers. These solutions use natural language processing techniques to handle doubts and queries to provide real-time support to policyholders. Furthermore, these tools help in assessing medical history, processing claims, and detecting fraudulent cases quickly. The overall chances of errors are significantly reduced with the use of AI-based software applications. On the other hand, RPA is primarily used to perform repetitive tasks such as form filling and data entry, thus allowing the workforce to engage in decision-making-related tasks.

Major Companies Profiled in the Market Report

Zurich

Jackson National Life Insurance Company

New York Life Insurance Company

Allianz

MassMutual

American International Group, Inc.

MetLife Services and Solutions, LLC.

Lincoln Financial Group

Nationwide Mutual Insurance Company

Equitable Holdings, Inc.

Assicurazioni Generali S.p.A.

Munich Re

Pacific Life Insurance Company

Prudential Financial, Inc.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: 𝐈𝐧𝐬𝐢𝐝𝐞𝐫'𝐬 𝐆𝐮𝐢𝐝𝐞 𝐭𝐨 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞@ https://www.alliedmarketresearch.com/purchase-enquiry/A323697

To summarize, the AMR report on the annuity insurance market highlights the major investment drivers and provides actionable data and market intelligence to help companies establish their foothold in the industry. The report also offers first-hand research obtained from different stakeholders in the sector to aid companies in developing strategies to excel in the market.

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

U.S B2C Payment Market https://www.alliedmarketresearch.com/u-s-b2c-payment-market-A316932

Wedding Loans Market https://www.alliedmarketresearch.com/wedding-loans-market-A323339

Online Payday Loans Market https://www.alliedmarketresearch.com/online-payday-loans-market-A157231

Travel Insurance Market https://www.alliedmarketresearch.com/travel-insurance-market

Merchant Cash Advance Market https://www.alliedmarketresearch.com/merchant-cash-advance-market-A323338

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Annuity Insurance Market: Studying the Evolving Dynamics and Latest Advancements in the Industry during 2024-2032 here

News-ID: 3667739 • Views: …

More Releases from Allied Market Research

Analyzing the Growth Potential and Innovations in the AC MCB Market from 2023 to …

Allied Market Research has released a detailed report on the global AC MCB market. As per the study, the industry is predicted to accumulate a value of $3.8 billion by 2032, exhibiting a notable CAGR of 5.5% during the forecast period from 2023 to 2032. The market generated a value of $2.2 billion in 2022. The report provides details about the current trends, market segmentation, key investment areas, regional analysis,…

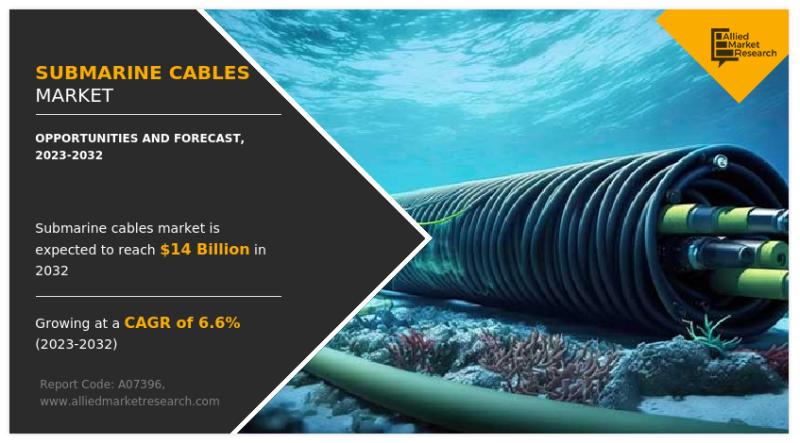

A Look into the Emerging Trends in the Submarine Cables Market from 2023 to 2032

The report presents a comprehensive analysis of the submarine cables market, highlighting key aspects such as sales projections, industry size, market share, and primary growth drivers. It forecasts significant expansion throughout the upcoming period. The report also provides detailed insights into the market's drivers, restraints, and opportunities that shape the industry. Additionally, the analysis covers the performance of the landscape across four key regions such as Asia-Pacific, Europe, North America,…

Latin America Field Service Management Market Targets $2,234.22 Million by 2032

According to a new report published by Allied Market Research, the Latin America field service management market was valued at $326.91 million in 2022, and is projected to reach $2,234.22 million by 2032, growing at a CAGR of 21.3% from 2023 to 2032.

There is an expansion and noticeable change in the field service market in Latin America. Businesses from a variety of industries have become more and more aware of…

Data Fabric Market Growing at 23.8% CAGR to Hit USD 4,546.9 Million | Growth, Sh …

According to the report, the global data fabric industry was estimated at $812.6 million in 2018 and is expected to hit $4.54 billion by 2026, growing at a CAGR of 23.8% from 2019 to 2026.

Rise in volume & variety of business data, increase in need for business agility & data accessibility, and growing demand for real-time streaming analytics drive the growth of the global data fabric market. On the other…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…