Press release

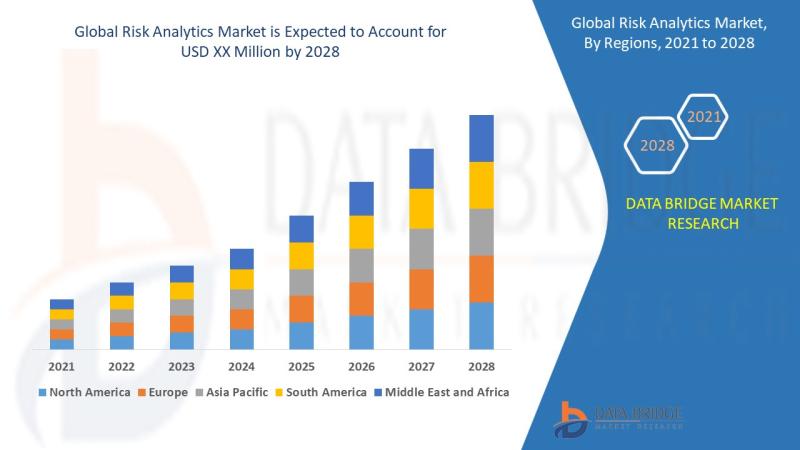

The risk analytics market is expected to witness market growth at a rate of 16.05% in the forecast period of 2021 to 2028.

Risk Analytics Market Size And Forecast by 2031The risk analytics market is expected to witness market growth at a rate of 16.05% in the forecast period of 2021 to 2028.. Risk Analytics Market report provides a holistic evaluation of the market. The report offers comprehensive analysis of Size, Share, Scope, Demand, Growth, Value, Opportunities, Industry Statistics, Industry Trends, Industry Share, Revenue Analysis, Revenue Forecast, Future Scope, Challenges, Growth Drivers, leaders, graph, insights, Research Report, companies, overview, outlook and factors that are playing a substantial role in the market.

Global Risk Analytics Market Segmentation Analysis

Global Risk Analytics Market, By Component (Software, Solution and Services), Deployment Mode (Cloud and On-Premises), Organization Size (Large Enterprises and SMEs), Risk Type (Portfolio Risk, Strategic Risk, Operational Risk, Financial Risk and Others), Vertical (Banking and Financial Services, Insurance, Manufacturing, Transportation and Logistics, Retail and Consumer Goods, IT and Telecom, Government and Defense, Healthcare and Life Sciences, Energy and Utilities and Others), and Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa) Industry Trends and Forecast to 2028.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-risk-analytics-market

Which are the top companies operating in the Risk Analytics Market?

The "Global Risk Analytics Market "study report will provide a valuable insight with an emphasis on the global market. The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the Risk Analytics Market extension. This Risk Analytics Market report provides the information of the Top 10 Companies in Risk Analytics Market in the market their business strategy, financial situation etc.

**Segments**

- **By Component**: The risk analytics market can be segmented into software and services. In 2020, the services segment held a significant market share owing to the increasing demand for consulting, support, and maintenance services. However, as the focus on software solutions for risk analytics grows, the software segment is expected to witness substantial growth by 2028.

- **By Deployment Mode**: The market is also categorized by deployment mode as on-premises and cloud. In 2020, on-premises deployment was dominant due to data security concerns and regulatory compliance requirements. Nevertheless, the shift towards cloud-based solutions is anticipated to accelerate, providing flexibility, scalability, and cost-efficiency benefits by 2028.

- **By Organization Size**: Small & Medium Enterprises (SMEs) and Large Enterprises are the segments based on organization size. In 2020, large enterprises accounted for a major market share due to their higher adoption rate of advanced analytics tools. The SMEs segment is likely to grow rapidly as these organizations recognize the importance of risk analytics for sustainable growth and operational efficiency.

- **By Application**: Risk analytics finds applications in fraud detection & prevention, governance, risk, and compliance management, asset management, and others. Each application segment plays a crucial role in various industries such as banking, financial services, insurance, healthcare, and more. Over the forecast period, the demand for risk analytics across diverse applications is expected to surge significantly.

**Market Players**

- **IBM Corporation**: A key player in the risk analytics market, IBM offers advanced risk management solutions leveraging AI and machine learning capabilities to help businesses identify, assess, and mitigate risks effectively.

- **SAS Institute**: Known for its comprehensive suite of risk analytics software, SAS Institute provides innovative tools for risk modeling, stress testing, and regulatory compliance, catering to the evolving needs of organizations.

- **Oracle Corporation**: Oracle offers a range of risk analytics solutions that empower businesses to make data-driven decisionsIBM Corporation, SAS Institute, and Oracle Corporation are key players in the risk analytics market, each offering unique solutions to meet the evolving needs of organizations across various industries. IBM is renowned for its advanced risk management solutions that leverage artificial intelligence and machine learning capabilities to help businesses identify, assess, and mitigate risks effectively. With a focus on software solutions, IBM is well-positioned to capitalize on the growing demand for risk analytics tools.

SAS Institute, on the other hand, is known for its comprehensive suite of risk analytics software that includes tools for risk modeling, stress testing, and regulatory compliance. The company's innovative approach to risk analytics has garnered a strong reputation in the market, attracting a diverse range of clients seeking advanced solutions for managing and mitigating risks effectively.

Oracle Corporation stands out in the risk analytics market with its range of solutions that empower businesses to make data-driven decisions and gain new insights into market trends. Oracle's offerings in risk analytics cater to the increasing demand for sophisticated tools that provide actionable insights to help businesses navigate complex risk landscapes.

The market positioning of these key players reflects the shifting dynamics within the risk analytics industry, where organizations are increasingly turning to advanced technology solutions to enhance their risk management practices. As businesses across sectors recognize the importance of leveraging data analytics to mitigate risks and drive operational efficiency, companies like IBM, SAS Institute, and Oracle are well-positioned to meet this growing demand with their innovative risk analytics solutions.

Overall, the risk analytics market is poised for significant growth as organizations seek to enhance their risk management capabilities in an increasingly complex and uncertain business environment. With the proliferation of data and the rise of advanced analytics technologies, the demand for robust risk analytics solutions is expected to continue increasing, presenting lucrative opportunities for market players to innovate and expand their offerings to meet the evolving needs of businesses worldwide.**Market Players**

The major players covered in the risk analytics market report are IBM, Oracle, SAP SE, SAS Institute Inc., FIS, Moody's Analytics, Inc., Verisk Analytics, Inc., AXIOMSL, Inc., GURUCUL; PROVENIR, BRIDGEi2i Analytics Solutions, DataFactZ; RECORDED FUTURE, INC., Digital Fineprint, Finastra, Tata Consultancy Services Limited, Genpact, and ACL Services Ltd. dba Galvanize among other domestic and global players. These market players bring a diverse range of solutions to the risk analytics industry, catering to the evolving needs of organizations across various sectors.

In the competitive landscape of the risk analytics market, these players showcase their unique strengths and capabilities to address the increasing demand for advanced risk management solutions. Each competitor, including IBM, Oracle, and SAS Institute, among others, focuses on leveraging technology and data analytics to empower businesses with actionable insights for effective risk mitigation strategies.

IBM stands out for its AI and machine learning-driven risk management solutions, which enable businesses to identify, assess, and mitigate risks efficiently. Oracle offers a comprehensive suite of risk analytics solutions that support data-driven decision-making, while SAS Institute is known for its innovative tools for risk modeling and regulatory compliance.

As the market for risk analytics continues to expand globally, these key players are strategically positioned to capitalize on the growing demand for sophisticated risk management solutions. By providing a combination of advanced technologies,

Explore Further Details about This Research Risk Analytics Market Report https://www.databridgemarketresearch.com/reports/global-risk-analytics-market

Browse More Reports:

https://dbmrnews928732.blogspot.com/2024/09/nucleic-acid-based-drugs-market-size.html

https://dbmrnews928732.blogspot.com/2024/09/paper-core-market-value.html

https://dbmrnews928732.blogspot.com/2024/09/atrial-fibrillation-market-global.html

https://dbmrnews928732.blogspot.com/2024/09/premium-wine-market-size-trends-growth.html

Contact Us: -

Data Bridge Market Research

US: +1 888 387 2818

United Kingdom: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: - sopan.gedam@databridgemarketresearch.com

About Data Bridge Market Research:

An absolute way to predict what the future holds is to understand the current trend! Data Bridge Market Research presented itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are committed to uncovering the best market opportunities and nurturing effective information for your business to thrive in the marketplace. Data Bridge strives to provide appropriate solutions to complex business challenges and initiates an effortless decision-making process. Data Bridge is a set of pure wisdom and experience that was formulated and framed in 2015 in Pune.

Data Bridge Market Research has more than 500 analysts working in different industries. We have served more than 40% of the Fortune 500 companies globally and have a network of more than 5,000 clients worldwide. Data Bridge is an expert in creating satisfied customers who trust our services and trust our hard work with certainty. We are pleased with our glorious 99.9% customer satisfaction rating.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The risk analytics market is expected to witness market growth at a rate of 16.05% in the forecast period of 2021 to 2028. here

News-ID: 3666851 • Views: …

More Releases from Data Bridge Market Research

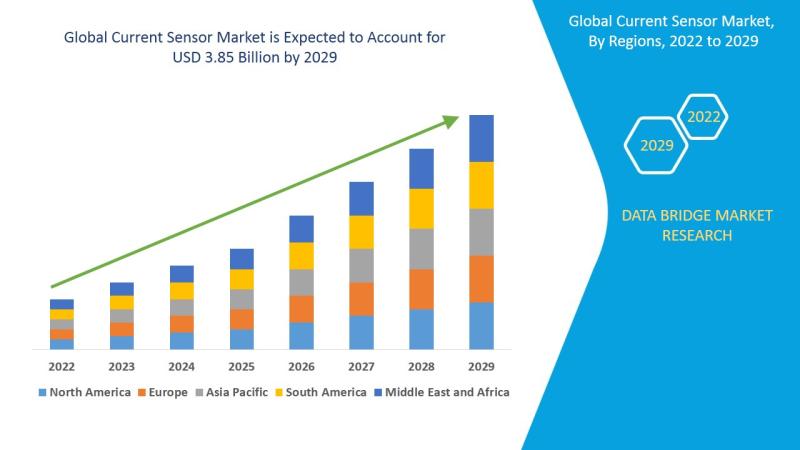

The Global Current Sensor Market is expected to undergo a CAGR of 6.65%

Current Sensor Market Size And Forecast by 2031

Data Bridge Market Research analyses that the Global Current Sensor Market which was USD 2.3 Million in 2021 is expected to reach USD 3.85 Billion by 2029 and is expected to undergo a CAGR of 6.65% during the forecast period of 2021 to 2029. Current Sensor Market report provides a holistic evaluation of the market. The report offers comprehensive analysis of Size, Share,…

The Global Molded Fiber Packaging Market is expected to reach USD 6.17 Billion b …

Molded Fiber Packaging Market Size And Forecast by 2031

Data Bridge Market Research analyses that the Global Molded Fiber Packaging Market which was USD 4.23 Million in 2023 is expected to reach USD 6.17 Billion by 2031 and is expected to undergo a CAGR of 4.82% during the forecast period of 2023 to 2031. Molded Fiber Packaging Market report provides a holistic evaluation of the market. The report offers comprehensive analysis…

The Global Rolling Stock Market is expected to reach USD 84087.51 Million by 202 …

Rolling Stock Market Size And Forecast by 2031

Data Bridge Market Research analyses that the Global Rolling Stock Market which was USD 59583.7 Million in 2021 is expected to reach USD 84087.51 Million by 2029 and is expected to undergo a CAGR of 4.40% during the forecast period of 2021 to 2029. Rolling Stock Market report provides a holistic evaluation of the market. The report offers comprehensive analysis of Size, Share,…

Spine Biologics Market to Exhibit a Remarkable CAGR of 4.03% by 2028, Size, Shar …

The spine biologics market is expected to witness market growth at a rate of 4.03% in the forecast period of 2021 to 2028. Data Bridge Market Research report on spine biologics market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The increase in the prevalence of spine disorders globally is escalating the growth of…

More Releases for Risk

Enterprise Governance, Risk and Compliance (EGRC) Market | Demand for Better Ris …

The enterprise governance, risk, and compliance market is relied upon to enlist an enormous development, during the gauge time of 2018 to 2028. The associations work in a complex and exceptionally powerful worldwide condition. Thus, overseeing danger and consistence because of the effect of the progressions around is probably the greatest test that an association faces. Also, the rising dangers among the associations inferable from digitalization and sharing of immense…

Financial Risk Management Software Market Overview by Operational Risk, Credit R …

Download Free PDF Brochure of Financial Risk Management Software Market at http://www.rnrmarketresearch.com/contacts/request-sample?rname=1936951 .

Financial Risk Management Software Market are increasingly being deployed along with embedded communications technology to provide critical services that allow a building to meet the functional and operational needs of building occupants. Financial risk management software Market helps in making dividend announcements and financial statements relevant and reliable.

Key Content of Chapters (Including and can be customized)

Key Content…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analytics Market by Software (ETL, Risk Calculation Engines, Scorecard and …

Introduction:

Risk analytics is a technique which helps in assisting various organizations in knowing the risks associated with their businesses. Risk analytics are a set of tools which helps organizations in deriving and concluding decisions associated with risks involved and thus helps in improving their overall business performance. Moreover, apart from this, the risk analytics tools aids in improving return on invested capital as well as reduces the total cost involved…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…