Press release

Crypto Tax Software Market to Set an Explosive Growth in Near Future

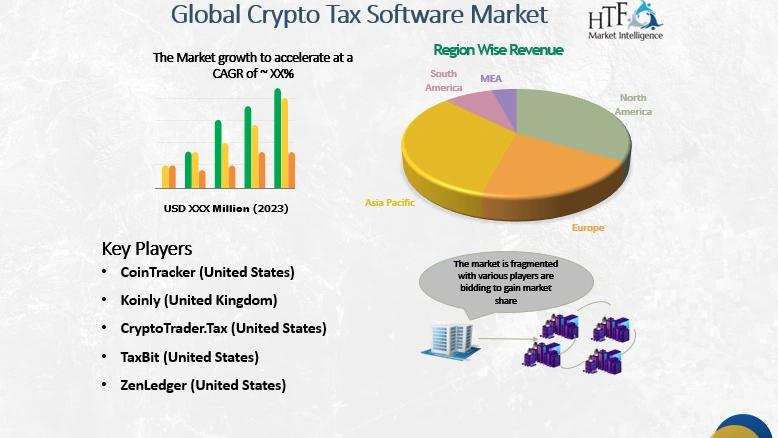

The Latest Market Research Study on "Global Crypto Tax Software Market" is now released to provide a detailed overview of hidden gems performance analysis in recent years. The study covers an in-depth overview of market dynamics, segmentation, product portfolio, business plans, and the latest developments in the industry. Staying on top of market trends & drivers always remains crucial for decision-makers and marketers to keep a hold of developing opportunities.Some of the major players such as CoinTracker (United States), Koinly (United Kingdom), CryptoTrader.Tax (United States), TaxBit (United States), ZenLedger (United States), BearTax (United States), Accointing (Switzerland), TokenTax (United States), TaxDown (Spain), Ledgible (United States)

According to HTF Market Intelligence, the global Crypto Tax Software market is valued at USD 1.5 Billion in 2023 and is estimated to reach a revenue of USD 6.5 Billion by 2030, with a CAGR of 32.5% from 2023 to 2030.

Request Customized Sample Now @ https://www.htfmarketintelligence.com/sample-report/global-crypto-tax-software-market?utm_source=Krati_OpenPR&utm_id=Krati

Crypto Tax Software Market Overview

Crypto tax software is a specialized tool designed to help individuals and businesses manage and report their cryptocurrency transactions for tax purposes. This software automates the process of tracking, calculating, and reporting gains and losses associated with cryptocurrency investments, ensuring compliance with tax regulations.

Crypto Tax Software Market Competitive Landscape & Company Profiles

The Company's Coverage aims to innovate to increase efficiency and product life. The long-term growth opportunities available in the sector are captured by ensuring constant process improvements and economic flexibility to spend in the optimal schemes. Company profile section of players such as CoinTracker (United States), Koinly (United Kingdom), CryptoTrader.Tax (United States), TaxBit (United States), ZenLedger (United States), BearTax (United States), Accointing (Switzerland), TokenTax (United States), TaxDown (Spain), Ledgible (United States) includes its basic information like company legal name, website, headquarters, subsidiaries, market position, history, and 5 closest competitors by Market capitalization/revenue along with contact information.

Market Drivers:

Increasing adoption of cryptocurrencies and blockchain technology

Growing regulatory focus on cryptocurrency transactions and taxation

Market Opportunities:

Expansion into global markets with evolving crypto tax regulations

Development of user-friendly and secure software solutions

Market Leaders & Development Strategies

In July 2024, Intuit's TurboTax launched the TurboTax Investor Center, a free year-round crypto tax software solution. It allows users to track their crypto investments, monitor tax implications, and import transactions from various exchanges and wallets automatically.

Geographical Analysis: Europe, North America have shown robust growth in Crypto Tax Software market and Crypto Tax Software region is growing at fastest pace.

Get Complete Scope of Work @ https://www.htfmarketintelligence.com/report/global-crypto-tax-software-market

Crypto Tax Software Market: Segmentation

The Crypto Tax Software Market is Segmented by Deployment Mode (Cloud-based, On-premise) by End-User (Personal, Business, SMEs, Large Enterprises) and by Geography (North America, South America, Europe, Asia Pacific, MEA).

Crypto Tax Software Market - Geographical Outlook

The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

North America (United States, Mexico & Canada)

South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Have Any Query? Ask Our Expert @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-crypto-tax-software-market?utm_source=Krati_OpenPR&utm_id=Krati

Key Questions Answered with this Study

1) What makes Global Crypto Tax Software Market feasible for long-term investment?

2) Know value chain areas where players can create value?

3) Teritorry that may see a steep rise in CAGR & Y-O-Y growth?

4) What geographic region would have better demand for products/services?

5) What opportunity emerging territory would offer to established and new entrants in Global Crypto Tax Software market?

6) Risk side analysis connected with service providers?

7) How influencing are factors driving the demand of Global Crypto Tax Software in the next few years?

8) What is the impact analysis of various factors in the Global Crypto Tax Software market growth?

9) What strategies of big players help them acquire a share in a mature market?

10) How Technology and Customer-Centric Innovation is bringing big Change in Global Crypto Tax Software Market?

Buy Latest Edition of Market Study Now @ https://www.htfmarketintelligence.com/buy-now?format=1&report=11635?utm_source=Krati_OpenPR&utm_id=Krati

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like Complete America, LATAM, Europe, Nordic regions, Oceania or Southeast Asia, or Just Eastern Asia.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Tax Software Market to Set an Explosive Growth in Near Future here

News-ID: 3657017 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Revenue Cycle Management Software Market Set for Rapid Growth with Quest Diagnos …

The Latest Market Research Study on "Global Revenue Cycle Management Software Market" is now released to provide a detailed overview of hidden gems performance analysis in recent years. The study covers an in-depth overview of market dynamics, segmentation, product portfolio, business plans, and the latest developments in the industry. Staying on top of market trends & drivers always remains crucial for decision-makers and marketers to keep a hold of developing…

Video Surveillance As A Service Market to Witness Impressive Growth by 2030: Gen …

The Latest Market Research Study on "Global Video Surveillance As A Service Market" is now released to provide a detailed overview of hidden gems performance analysis in recent years. The study covers an in-depth overview of market dynamics, segmentation, product portfolio, business plans, and the latest developments in the industry. Staying on top of market trends & drivers always remains crucial for decision-makers and marketers to keep a hold of…

AI Email Writer Market Likely to Enjoy Promising Growth with Crystal, Phrasee, T …

The Latest Market Research Study on "Global AI Email Writer Market" is now released to provide a detailed overview of hidden gems performance analysis in recent years. The study covers an in-depth overview of market dynamics, segmentation, product portfolio, business plans, and the latest developments in the industry. Staying on top of market trends & drivers always remains crucial for decision-makers and marketers to keep a hold of developing opportunities.

Some…

Decision Intelligence Market to Witness Huge Growth by 2030: Google, TIBCO Softw …

The Latest Market Research Study on "Global Decision Intelligence Market" is now released to provide a detailed overview of hidden gems performance analysis in recent years. The study covers an in-depth overview of market dynamics, segmentation, product portfolio, business plans, and the latest developments in the industry. Staying on top of market trends & drivers always remains crucial for decision-makers and marketers to keep a hold of developing opportunities.

Some of…

More Releases for Tax

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…

Industry Leading Tax Software Market For High-Volume Tax Businesses with Online …

Market Highlights

Tax software is software that ensures tax compliance for income tax, corporate tax, VAT, service tax, customs, sales tax, use tax, or other taxes its users may be required to pay. The software automatically calculates a user's tax liabilities to the government, keeps track of all transactions, keeps track of eligible tax credits, etc. The software can also generate forms or filings needed for tax. The software will have…

Kreston Reeves Tax Director achieves leading international tax qualification

Kreston Reeves, one of the leading accountancy and financial services firms located across London, Kent and Sussex, is proud to announce that Matthew Creevy, Corporation Tax Technical Director, has achieved the Advanced Diploma in International Taxation (ADIT), placing him in the highest echelons of international tax professionals.

ADIT is an advanced level designation in international cross-border tax. The credential is designed by a board of world-leading experts and has been created…

SMP Accounting & Tax appoints Rachael Hooper as Tax Manager

Russell Bedford member SMP Accounting & Tax Limited, one of the Isle of Man’s largest accounting and tax firms, has appointed Rachael Hooper as a manager in its Tax Department.

Rachael will be working in all areas of UK, Isle of Man and International taxation, with a particular focus on UK resident non-UK domiciled individuals, Trusts and Inheritance Tax.

After qualifying as a Chartered Accountant with a Big Four accountancy firm, Rachael…

United Tax Group Announces Effective Tax Negotiators

United States (June 2011) – United Tax Group announces effective tax negotiators for clients. Tax negotiators work directly with the IRS so tax payers do not. The expertise of tax negotiators helps save clients thousands.

Tax negotiators from United Tax Group are assigned individual clients. This means tax negotiators are working on particular cases assigned. Therefore, clients receive individualized attention for their case.

This individualized attention by United Tax Group gets results.…