Press release

Micro Venture Capital (VC) Funds Market Gaining Momentum with Positive External Factors

HTF MI published a new business research study with the title Micro Venture Capital (VC) Funds Market Study Forecast till 2030. This Micro Venture Capital (VC) Funds market report brings data for the estimated year 2024 and forecasted till 2030 in terms of both, value (USD MN) and volume (MT). The report also consists of a detailed assessment of macroeconomic factors and a market outlook of the Micro Venture Capital (VC) Funds market. The study is conducted by applying both top-down and bottom-up approaches and further iterative methods used to validate and size market estimation and trends of the Micro Venture Capital (VC) Funds market. Additionally, to complement insights EXIM data, consumption, supply and demand Figures, raw price analysis, market revenue, and gross margins. Some of the companies listed in the research study are Sequoia Capital, Accel, Andreessen Horowitz, Benchmark Capital, Greylock Partners, Union Square Ventures, Lightspeed Venture Partners, Bessemer Venture Partners, Kleiner Perkins, Foundry Group, General Catalyst, First Round Capital, SoftBank Vision Fund, Y Combinator, 500 Startups etc.The Micro Venture Capital (VC) Funds Market have seen a market size of USD 14.5 in 2023 and is estimated to reach USD 28 by 2030, growth at a CAGR of 9 %. Pre Covid, back in 2019 it was ranging ~ USD 12.5 and since then market have recovered completely and showing robust growth.

Acquire Sample Report + All Related Tables & Graphs of Micro Venture Capital (VC) Funds Market Study Now 👉https://www.htfmarketreport.com/sample-report/3204764-global-micro-venture-capital?utm_source=Krati_OpenPR&utm_id=Krati

Definition:

The Global Micro Venture Capital (VC) Funds Market involves investments in early-stage companies with high growth potential, typically startups. These investments are crucial for technology, healthcare, and consumer goods sectors, providing seed funding and subsequent investment rounds to support business growth and innovation. Venture capitalists play a key role in fostering new ideas and technologies through financial support and strategic guidance.

Market Trends:

Growth in digital and tech startups, focus on disruptive innovations

Market Drivers:

Increase in entrepreneurial activity, rise in technology and healthcare innovations

Market Challenges:

High risk of investments, market volatility, competition among VCs

Fastest-Growing Region:

Asia-Pacific, Latin America

Dominating Region:

North America, Europe

To Review Full Table of Content Click Here 👉https://www.htfmarketreport.com/reports/3204764-global-micro-venture-capital

What to Expect from this Report On Micro Venture Capital (VC) Funds Market:

1. A comprehensive summary of several area distributions and the summary types of popular products in the Micro Venture Capital (VC) Funds Market.

2. You can fix up the growing databases for your industry when you have info on the cost of the production, cost of the products, and cost of the production for the next years.

3. Thorough Evaluation of the break-in for new companies who want to enter the Micro Venture Capital (VC) Funds Market.

4. Exactly how do the most important companies and mid-level companies make income within the Market?

5. Complete research on the overall development within the Micro Venture Capital (VC) Funds Market that helps you select the product launch and overhaul growths.

Focus on segments and sub-sections of the Market are illuminated below:

Based on Product Types of Micro Venture Capital (VC) Funds Market: Seed Funding, Early-Stage VC, Series A/B Funding, Growth Capital, Angel Investments

The Study Explores the Key Applications/End-Users of Micro Venture Capital (VC) Funds Market: Technology Startups, Healthcare Startups, Consumer Goods, Fintech, SaaS

Regional Analysis for Micro Venture Capital (VC) Funds Market:

• APAC (Japan, China, South Korea, Australia, India, and the Rest of APAC; the Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

Procure research study Micro Venture Capital (VC) Funds at Discounted Pricing👉 https://www.htfmarketreport.com/buy-now?format=1&report=3204764-global-micro-venture-capital?utm_source=Krati_OpenPR&utm_id=Krati

Resource and Consumption - In extension with sales, this segment studies Resources and consumption for the Micro Venture Capital (VC) Funds Market. Import-export data is also provided by region if applicable.

Free Customization based on client requirements on Immediate purchase:

1- Free country-level breakdown of any 5 countries of your interest.

2- Competitive breakdown of segment revenue by market players.

3 - Additional company profiles and Qualitative analysis subject to feasibility check.

Enquire for customization in Micro Venture Capital (VC) Funds Market Report 👉 https://www.htfmarketreport.com/enquiry-before-buy/3204764-global-micro-venture-capital?utm_source=Krati_OpenPR&utm_id=Krati

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like APAC, LATAM, North America, Europe, or Southeast Asia.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro Venture Capital (VC) Funds Market Gaining Momentum with Positive External Factors here

News-ID: 3655123 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Robotic Pet Cats Market Next Big Thing: Major Giants- CleverPet, Honda, Sony

HTF MI published a new business research study with the title Robotic Pet Cats Market Study Forecast till 2030. This Robotic Pet Cats market report brings data for the estimated year 2024 and forecasted till 2030 in terms of both, value (USD MN) and volume (MT). The report also consists of a detailed assessment of macroeconomic factors and a market outlook of the Robotic Pet Cats market. The study is…

B2B Mobile Commerce Market looks to expand its size in Overseas Marketplace

HTF MI published a new business research study with the title B2B Mobile Commerce Market Study Forecast till 2030. This B2B Mobile Commerce market report brings data for the estimated year 2024 and forecasted till 2030 in terms of both, value (USD MN) and volume (MT). The report also consists of a detailed assessment of macroeconomic factors and a market outlook of the B2B Mobile Commerce market. The study is…

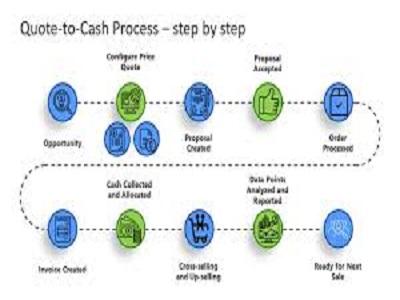

Quote-to-Cash Consulting Service Market is Set To Fly High in Years to Come

HTF MI published a new business research study with the title Quote-to-Cash Consulting Service Market Study Forecast till 2030. This Quote-to-Cash Consulting Service market report brings data for the estimated year 2024 and forecasted till 2030 in terms of both, value (USD MN) and volume (MT). The report also consists of a detailed assessment of macroeconomic factors and a market outlook of the Quote-to-Cash Consulting Service market. The study is…

Quick Service Restaurant (QSR) IT Market to Witness Huge Growth by 2030: Panason …

HTF MI published a new business research study with the title Quick Service Restaurant (QSR) IT Market Study Forecast till 2030. This Quick Service Restaurant (QSR) IT market report brings data for the estimated year 2024 and forecasted till 2030 in terms of both, value (USD MN) and volume (MT). The report also consists of a detailed assessment of macroeconomic factors and a market outlook of the Quick Service Restaurant…

More Releases for Venture

S Venture Capital Advisors: Investment Intelligence

S Venture Capital Advisors invests across a diverse field of market places and industry sectors within a global forum. The specific type and / or location of each investment opportunity is of no relevance to our in house experts. Our main objective is simple and based on risk verses reward ratios, any move or recommendation made by ourselves to our clients on this basis ensures them consistent returns and, in…

SEMIKRON and drivetek form joint venture

SKAI power electronic system matched with motor control software for vehicles

Nuremberg, 28 February 2011 – Semikron further strengthens its presence in and dedication to the electric and hybrid vehicle market by forming a 50/50 joint venture with drivetek, a development specialist for innovative electrical drives and control technology. The joint venture, SKAItek GmbH, will provide innovative motor control software optimized for the newest generation of SKAI 2 IGBT and MOSFET…

Hypo Venture Capital - Socially Responsible Investing

Do good while making money: A guide to socially responsible investing

Here at Hypo Venture Capital we are committed to offering our clients access to the latest and broadest range of financial services and products on the market. We know that choosing the right strategy, the right investment and the right product is no easy task in this day and age! Whether its advice, investments or financial planning we are…

CleanTech Venture Capital Interest

Keynote speaker to share the vision for CleanTech and Venture Capital Funding at EngEx 2010

SAN DIEGO – CleanTech start-ups are grabbing increased interest and investments from venture capital groups that placed almost $2 billion into eco-friendly companies last year and increased the funding pace with another $773 million during the first quarter of 2010. Clean energy business owners and industry professionals attending EngEx 2010 will hear more about the…

Sep. 5th Venture Capital Event

(EMAILWIRE.COM, July 31, 2007)- New York - Argyle Executive Forum is pleased to present its 2007 Leadership in Venture Capital Forum. The event, to take place in Manhattan, will bring together 135–150 CEOs & Board members of public and private large cap and mid cap corporations, complementary areas of executive leadership (CFOs & COOs), members of the endowment, foundation, and family office community, select advisory firms, and select founders /…

European Venture Market ICT 2006

European Venture Market ICT 2006

4th – 6th October 2006

Potsdam, Germany

www.europeanventuremarket.com

The European Venture Market is a platform to facilitate the meeting of entrepreneurs and investors. It is a platform for any kind of financing with focus to equity. Giving the wide variety of investors joining the platform the Market is suitable for any sectors especially for ICT & related as the platform will be organise by Hasso Plattner Ventures.

The European…