Press release

Online Lending Market set for 13.8% CAGR by 2030 | Zopa, Daric, Pave

The Latest published market study on Global Online Lending Market provides an overview of the current market dynamics in the Online Lending space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players that are in coverage of the study are Zopa,Daric,Pave,Mintos,Lendix,Ratesetter,Canstar,Faircent,Upstart,Funding Circle,Prosper,CircleBack Lending,Peerform,Lending Club.Get ready to identify the pros and cons of the regulatory framework, local reforms, and its impact on the Industry. Know how Leaders in Online Lending are keeping themselves one step forward with our latest survey analysis

Click to get Global Online Lending Market Research Sample PDF Copy Here @: https://www.htfmarketreport.com/sample-report/1980405-global-online-lending-market-size-study-by-type

Major highlights from the Study along with most frequently asked questions:

1) What so unique about this Global Online Lending Assessment?

Market Factor Analysis: In this economic slowdown, the impact on various industries is huge. Moreover, the increase in demand & supply gap as a result of the sluggish supply chain and the production line has made the market worth observing. It also discusses technological, regulatory, and economic trends that are affecting the market. It also explains the major drivers and regional dynamics of the global market and current trends within the industry.

Market Concentration: Includes C4 Index, HHI, Comparative Online Lending Market Share Analysis (Y-o-Y), Major Companies, Emerging Players with Heat Map Analysis

Market Entropy: Randomness of the market highlighting aggressive steps that players are taking to overcome the current scenario. Development activity and steps like expansions, technological advancement, M&A, joint ventures, and launches are highlighted here.

Patent Analysis: Comparison of patents issued by each player per year.

Peer Analysis: An evaluation of players by financial metrics such as EBITDA, Net Profit, Gross Margin, Total Revenue, Segmented Market Share, Assets, etc to understand management effectiveness, operation, and liquidity status.

2)Why only a few Companies are profiled in the report?

Industry standards like NAICS, ICB, etc are considered to derive the most important manufacturers. More emphasis is given to SMEs that are emerging and evolving in the market with their product presence and technologically upgraded modes, current version includes players like "Zopa,Daric,Pave,Mintos,Lendix,Ratesetter,Canstar,Faircent,Upstart,Funding Circle,Prosper,CircleBack Lending,Peerform,Lending Club" etc and many more.

** Companies reported may vary subject to Name Change / Merger etc.

Complete Purchase of Latest Edition of Global Online Lending Report @ https://www.htfmarketreport.com/buy-now?format=1&report=1980405

3) What details will the competitive landscape provide?

A value proposition chapter to gauge Online Lending market. 2-Page profiles of all listed companies with 3 to 5 years of financial data to track and comparison of business overview, product specification, etc.

4) What is all regional segmentation covered? Can specific countries of interest be added?

A country that is included in the analysis is North America, Europe, Asia-Pacific etc

** Countries of primary interest can be added if missing.

5) Is it possible to limit/customize the scope of study to applications of our interest?

Yes, the general version of the study is broad, however, if you have limited application in your scope & target, then the study can also be customized to only those applications. As of now, it covers applications Individuals,Businesses.

** Depending upon the requirement the deliverable time may vary.

To comprehend Global Online Lending market dynamics in the world mainly, the worldwide Online Lending market is analyzed across major global regions. A customized study by a specific region or country can be provided, usually, the client prefers below

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc) & Rest

• Oceania: Australia & New Zealand

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1980405-global-online-lending-market-size-study-by-type

Basic Segmentation Details

Global Online Lending Product Types In-Depth: On-Premises,Cloud-based

Global Online Lending Major Applications/End users: Individuals,Businesses

Geographical Analysis: North America, Europe, Asia-Pacific etc & Rest of World

For deep analysis of Online Lending Market Size, Competition Analysis is provided which includes Revenue (M USD) by Players (2020-2022E) & Market Share (%) by Players (2020-2022E) complemented with concentration rate.

Browse for Full Report at @: https://www.htfmarketreport.com/reports/1980405-global-online-lending-market-size-study-by-type

Actual Numbers & In-Depth Analysis of Global Online Lending Market Size Estimation and Trends Available in Full Version of the Report.

Thanks for reading this article, you can also make sectional purchases or opt-in for a regional report by limiting the scope to only North America, ANZ, Europe or MENA Countries, Eastern Europe, or European Union.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Lending Market set for 13.8% CAGR by 2030 | Zopa, Daric, Pave here

News-ID: 3652996 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

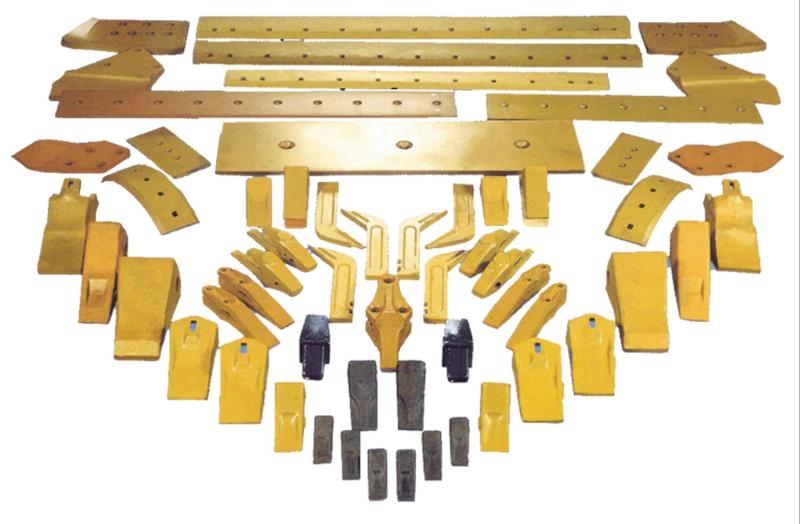

Ground Engaging Tool Market Players Gaining Attractive Investments: Atlas Copco, …

HTF Market Intelligence published a new research document of 150+pages on "Ground Engaging Tool Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Ground Engaging Tool market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic…

Art & Craft Material Market to Witness Phenomenal Growth: Crayola, Faber-Castell …

HTF Market Intelligence published a new research document of 150+pages on "Art & Craft Material Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Art & Craft Material market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario…

Family Floater Health Insurance Market SWOT Analysis & Key Business Strategies | …

HTF Market Intelligence recently released a survey document on Family Floater Health Insurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints…

Real Estate & Property Management Services Market Sets the Table for Continued G …

HTF Market Intelligence recently released a survey document on Real Estate & Property Management Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities,…

More Releases for Lending

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

P2P Lending 2018 Global Market Key Players – CircleBack Lending, Lending Club, …

P2P Lending Market 2018

Wiseguyreports.Com Adds “P2P Lending – Global Market Demand, Growth, Opportunities, Manufacturers, Analysis of Top Key Players and Forecast to 2025” To Its Research Database.

Description:

This report studies the global P2P Lending market, analyzes and researches the P2P Lending development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

CircleBack Lending

Lending Club

Peerform

Prosper

Upstart

Funding Circle

PwC

SoFi

LendingTree

GuidetoLenders

EvenFinacial

Creditease

Request for Sample Report@ https://www.wiseguyreports.com/sample-request/2842620-global-p2p-lending-market-size-status-and-forecast-2025

Market segment by Regions/Countries,…

Global Peer-to-peer Lending Market 2018: Key Players – CircleBack Lending, Len …

Summary

WiseGuyReports.com adds “Peer-to-peer Lending Market 2018 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting to 2023” reports to its database.

This report provides in depth study of “Peer-to-peer Lending Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Peer-to-peer Lending Market report also provides an in-depth survey of key players in the market which is based on the various objectives of an organization such as…

P2P Lending 2018 Global Market Key Players – CircleBack Lending, Lending Club, …

P2P Lending Market 2018

Wiseguyreports.Com Adds “P2P Lending – Global Market Demand, Growth, Opportunities, Manufacturers, Analysis of Top Key Players and Forecast to 2025” To Its Research Database.

Description:

This report studies the global P2P Lending market, analyzes and researches the P2P Lending development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

CircleBack Lending

Lending Club

Peerform

Prosper

Upstart

Funding Circle

PwC

SoFi

LendingTree

GuidetoLenders

EvenFinacial

Creditease

Request for Sample Report@ https://www.wiseguyreports.com/sample-request/2842620-global-p2p-lending-market-size-status-and-forecast-2025

Market segment by Regions/Countries,…