Press release

Digital Banking Market Insights to 2031: Key Players & Analysis

The recently released Digital Banking Market Report 2024, delivers an in-depth analysis of the market. This comprehensive evaluation includes size, product specifications, cost structures, industry connections, and an overview of the market landscape. Additionally, the report offers detailed insights into the Digital Banking market's size, volume, and forecasts across various product types, applications, and end-users. With its expert insights, the report serves as a crucial guide for enterprises seeking a strategic comprehension of the constantly evolving technology sector.Who are the Largest Manufacturers of Digital Banking Market Globally?

ACI Worldwide Inc. (US)

Appway AG (Switzerland)

Backbase (Netherlands)

BNY Mellon (US)

Cachet Financial Solutions Inc. (US)

Capital Banking Solutions (US)

CR2 (Ireland)

EdgeVerve Systems Limited (India)

Fidelity National Information Services, Inc. (US)

Fiserv, Inc. (US)

Infosys Limited (India)

Kony, Inc. (US)

NETinfo Plc (Cyprus)

Oracle Corporation (US)

SAB Group (France)

SAP SE (Germany)

Sopra Banking Software (France)

Tata Consultancy Services Limited (India)

Temenos AG (Switzerland)

The Bank of New York Mellon Corporation (US)

Worldline (France)

Wipro Limited (India)

Digital Banking Market's Drivers and Restraints:

The report delves into crucial aspects of the Digital Banking market, including production costs, supply chain dynamics, and raw material dependencies. It offers an analysis of how the COVID-19 pandemic has affected the industry and provides actionable recommendations for businesses to navigate evolving market conditions effectively. Key market restraints, such as economic challenges in emerging nations and obstacles within the business landscape, are identified and explored in detail. Understanding these risks enables businesses to devise strategies aimed at mitigating challenges and ensuring sustained success in this dynamic industry.

Get Sample Report Copy of Digital Banking Market Report

https://www.skyquestt.com/sample-request/digital-banking-market

Digital Banking Market Size And Scope

The Digital Banking market has experienced notable growth in recent years, propelled by the rising demand for power electronics across various sectors, including automotive, telecommunications, and renewable energy. This market is poised for further expansion as the global adoption of electric vehicles and renewable energy sources accelerates. Digital Banking s are highly valued for their exceptional thermal conductivity, electrical insulation, and mechanical strength, making them indispensable in power modules and electronic components. With ongoing advancements in technology and manufacturing, the applications of Digital Banking s are expected to broaden, extending their reach into an even wider array of uses in the near future.

Regional Segmentation:

North America: U.S., Canada and Mexico

Europe: Germany, France, U.K., Italy, Spain, and Rest of Europe

Asia Pacific: China, India, Japan, South Korea, Southeast Asia, and Rest of Asia Pacific

South America: Brazil, Argentina, and Rest of Latin America

Middle East & Africa: GCC Countries, South Africa, and Rest of Middle East & Africa

Why You Should Purchase This Report:

Discovering Valuable Connections: Uncover potential suppliers and partnership opportunities highlighted in the report.

Market Dynamics and Trends: Grasp a complete understanding of the global Digital Banking market's dynamics and trends.

In-Depth Market Analysis: Explore the latest market trends and thorough competitive analysis, along with other key insights about the global market.

Spotting Potential Collaborators: Learn about potential future partners, suppliers, or affiliates outlined in the report.

Strategic Mergers and Acquisitions: Strategically plan mergers and acquisitions by identifying top manufacturers in the industry.

Identifying Emerging Competitors: Recognize emerging players who have strong product offerings, allowing you to devise effective strategies to stay competitive.

Targeting New Clients or Partners: Identify potential new clients or partners within your desired audience.

Strategizing Based on Industry Leaders: Develop tactical plans by understanding the key areas of focus for leading companies.

Address:

1 Apache Way, Westford, Massachusetts 01886

Phone:

USA (+1) 351-333-4748

Email: sales@skyquestt.com

About Us:

SkyQuest Technology is leading growth consulting firm providing market intelligence, commercialization and technology services. It has 450+ happy clients globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Insights to 2031: Key Players & Analysis here

News-ID: 3652076 • Views: …

More Releases from SkyQuest Technology Group

3D IC Market to hit USD 53.7B by 2031.

3D IC Market Market Scope:

3D IC Market size was valued at USD 13.5 Billion in 2022 and is poised to grow from USD 14.05 Billion in 2023 to USD 53.7 Billion by 2031, at a CAGR of 18.66% during the forecast period (2024-2031).

Access the full 2024 Market report for a comprehensive understanding @https://www.skyquestt.com/report/3d-ic-market

The study of the global 3D IC Market is presented in the report, which is a thoroughly researched…

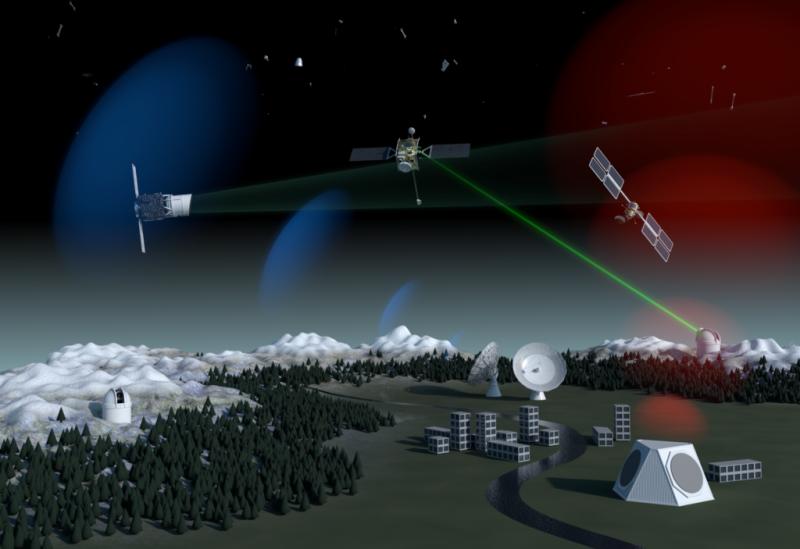

Space Situational Awareness Market to grow to USD 2.35B by 2031 at 4.6% CAGR.

Space Situational Awareness Market Scope:

Space Situational Awareness Market size was valued at USD 1.57 billion in 2022 and is poised to grow from USD 1.64 billion in 2022 to USD 2.35 billion by 2031, growing at a CAGR of 4.6% in the forecast period (2024-2031).

Access the full 2024 Market report for a comprehensive understanding @https://www.skyquestt.com/report/space-situational-awareness-market

The study of the global Space Situational Awareness is presented in the report, which is…

Sonar System Market to hit USD 2.26B by 2031, with 8% CAGR.

Sonar System Market Scope:

Sonar System Market size was valued at USD 1.13 Billion in 2022 and is poised to grow from USD 1.22 Billion in 2023 to USD 2.26 Billion by 2031, at a CAGR of 8% during the forecast period (2024-2031).

Access the full 2024 Market report for a comprehensive understanding @https://www.skyquestt.com/report/sonar-system-market

The study of the global Sonar System is presented in the report, which is a thoroughly researched…

Security Robots Market to reach USD 119.24B by 2030, growing at 15.65% CAGR.

Security Robots Market Scope:

Security Robots Market size was valued at USD 32.22 billion in 2021 and is poised to grow from USD 37.26 billion in 2022 to USD 119.24 billion by 2030, growing at a CAGR of 15.65% in the forecast period (2023-2030).

Access the full 2024 Market report for a comprehensive understanding @https://www.skyquestt.com/report/security-robots-market

The study of the global Security Robots is presented in the report, which is a thoroughly researched…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

What's driving the Neo and Challenger Bank Market trends? Key Players are Hello …

This Global Neo and Challenger Bank market report studies the industry based on one or more segments covering key players, types, applications, products, technology, end-users, and regions for historical data as well as provides forecasts for next few years.

The global Neo and Challenger Bank market is highly competitive and fragmented due to the presence of numerous small vendors in the market. Atom Bank, WeBank (Tencent Holdings Limited), N26, Starling Bank…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…