Press release

Personal Lines Insurance Market is set to Fly High in Years to Come |Allianz, AXA , Zurich Insurance Group

According to HTF Market Intelligence, the Global Personal Lines Insurance market to witness a CAGR of 48.03% during the forecast period (2024-2030). The Latest Released Personal Lines Insurance Market Research assesses the future growth potential of the Personal Lines Insurance market and provides information and useful statistics on market structure and size.This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report identifies and analyses the changing dynamics and emerging trends along with the key drivers, challenges, opportunities and constraints in the Personal Lines Insurance market. The Personal Lines Insurance market size is estimated to increase by USD at a CAGR of 48.03% by 2030. The report includes historic market data from 2024 to 2030. The Current market value is pegged at USD .

Get Access to Statistical Data, Charts & Key Players' Strategies @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-personal-lines-insurance-market?utm_source=Tarusha_OpenPR&utm_id=Tarusha

The Major Players Covered in this Report: Allianz (Germany), AXA (France), Zurich Insurance Group (Switzerland), Generali Group (Italy), Aviva plc (United Kingdom), Prudential plc (United Kingdom), Ping An Insurance (China), AIA Group (Hong Kong), MetLife (United States), Chubb Limited (Switzerla

Definition:

Personal Lines Insurance refers to insurance products designed to protect individuals against loss. These products include policies for automobiles, homeowners, renters, health, life, and personal liability. Personal lines insurance aims to provide financial protection for personal risks, covering the insured's personal property and health.

Market Trends:

• Digital Transformation: Increased use of digital platforms and insurtech solutions for buying, managing, and claiming insurance policies.

Market Drivers:

• Economic Growth: Rising disposable incomes and increasing asset ownership drive demand for personal lines insurance.

Market Opportunities:

• Emerging Markets: Expanding into developing markets where insurance penetration is still low.

• Product Innovation: Developing new products to meet evolving consumer needs, such as insurance for smart homes and shared economy assets.

Market Challenges:

• Competitive Market: High competition among insurers leads to pressure on pricing and profitability.

Market Restraints:

• Economic Uncertainty: Economic downturns can reduce disposable income and spending on insurance.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.htfmarketintelligence.com/sample-report/global-personal-lines-insurance-market?utm_source=Tarusha_OpenPR&utm_id=Tarusha

The titled segments and sub-sections of the market are illuminated below:

In-depth analysis of Personal Lines Insurance market segments by Types: by Type (Auto insurance, Homeowners Insurance, Renters Insurance, Personal liability insurance)

Detailed analysis of Personal Lines Insurance market segments by Applications: by Application (Individual, Family)

Major Key Players of the Market: Allianz (Germany), AXA (France), Zurich Insurance Group (Switzerland), Generali Group (Italy), Aviva plc (United Kingdom), Prudential plc (United Kingdom), Ping An Insurance (China), AIA Group (Hong Kong), MetLife (United States), Chubb Limited (Switzerla

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

- The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

- North America (United States, Mexico & Canada)

- South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

- Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

- Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report:

- -To carefully analyse and forecast the size of the Personal Lines Insurance market by value and volume.

- -To estimate the market shares of major segments of the Personal Lines Insurance market.

- -To showcase the development of the Personal Lines Insurance market in different parts of the world.

- -To analyse and study micro-markets in terms of their contributions to the Personal Lines Insurance market, their prospects, and individual growth trends.

- -To offer precise and useful details about factors affecting the growth of the Personal Lines Insurance market.

- -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Personal Lines Insurance market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Global Personal Lines Insurance Market Breakdown by Application (Individual, Family) by Type (Auto insurance, Homeowners Insurance, Renters Insurance, Personal liability insurance) by Distribution Channel (Agency, Broker, Bank assurance, Direct Writing) and by Geography (North America, South America, Europe, Asia Pacific, MEA)

Check for discount (10-30%) on Immediate Purchase @ https://www.htfmarketintelligence.com/request-discount/global-personal-lines-insurance-market?utm_source=Tarusha_OpenPR&utm_id=Tarusha

Key takeaways from the Personal Lines Insurance market report:

- Detailed consideration of Personal Lines Insurance market-particular drivers, Trends, constraints, Restraints, Opportunities, and major micro markets.

- Comprehensive valuation of all prospects and threats in the

- In-depth study of industry strategies for growth of the Personal Lines Insurance market-leading players.

- Personal Lines Insurance market latest innovations and major procedures.

- Favourable dip inside Vigorous high-tech and market latest trends remarkable the Market.

- Conclusive study about the growth conspiracy of Personal Lines Insurance market for forthcoming years.

Major questions answered:

- What are influencing factors driving the demand for Personal Lines Insurance near future?

- What is the impact analysis of various factors in the Global Personal Lines Insurance market growth?

- What are the recent trends in the regional market and how successful they are?

- How feasible is Personal Lines Insurance market for long-term investment?

Buy Latest Edition of Market Study Now @ https://www.htfmarketintelligence.com/buy-now?format=1&report=10792?utm_source=Tarusha_OpenPR&utm_id=Tarusha

Major highlights from Table of Contents:

Personal Lines Insurance Market Study Coverage:

- It includes major manufacturers, emerging player's growth story, and major business segments of Global Personal Lines Insurance Market Opportunities & Growth Trend to 2030 market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

- Global Personal Lines Insurance Market Opportunities & Growth Trend to 2030 Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

- Personal Lines Insurance Market Production by Region Personal Lines Insurance Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

Key Points Covered in Personal Lines Insurance Market Report:

- Personal Lines Insurance Overview, Definition and Classification Market drivers and barriers

- Personal Lines Insurance Market Competition by Manufacturers

- Personal Lines Insurance Capacity, Production, Revenue (Value) by Region (2024-2030)

- Personal Lines Insurance Supply (Production), Consumption, Export, Import by Region (2024-2030)

- Personal Lines Insurance Production, Revenue (Value), Price Trend by Type {by Type (Auto insurance, Homeowners Insurance, Renters Insurance, Personal liability insurance)}

- Personal Lines Insurance Market Analysis by Application {by Application (Individual, Family)}

- Personal Lines Insurance Manufacturers Profiles/Analysis Personal Lines Insurance Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

- Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, MINT, BRICS, G7, Western / Eastern Europe, or Southeast Asia. Also, we can serve you with customized research services as HTF MI holds a database repository that includes public organizations and Millions of Privately held companies with expertise across various Industry domains.

Contact Us:

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

Connect with us on LinkedIn | Facebook | Twitter

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Personal Lines Insurance Market is set to Fly High in Years to Come |Allianz, AXA , Zurich Insurance Group here

News-ID: 3643798 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

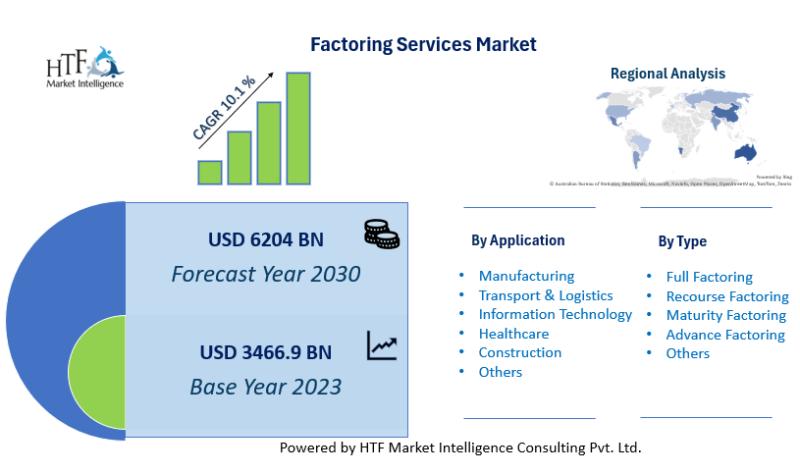

Factoring Services Market Touching New Development Level: OTR Capital, RTS Finan …

The latest survey on Factoring Services Market is conducted to provide hidden gems performance analysis of Factoring Services to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

Rare Metals Market looks to expand its size in Overseas Marketplace

The latest survey on Rare Metals Market is conducted to provide hidden gems performance analysis of Rare Metals to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

IT consulting Services Market to Witness Huge Growth by 2030: Gartner, Syntel, A …

The latest survey on IT consulting Services Market is conducted to provide hidden gems performance analysis of IT consulting Services to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest…

Pharmacy Automation Market Is Booming Worldwide: RxSafe, Asteres, InterLink AI

The latest survey on Pharmacy Automation Market is conducted to provide hidden gems performance analysis of Pharmacy Automation to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…