Press release

Term Life Insurance Market is Becoming High Value Market with Double-Digit Growth

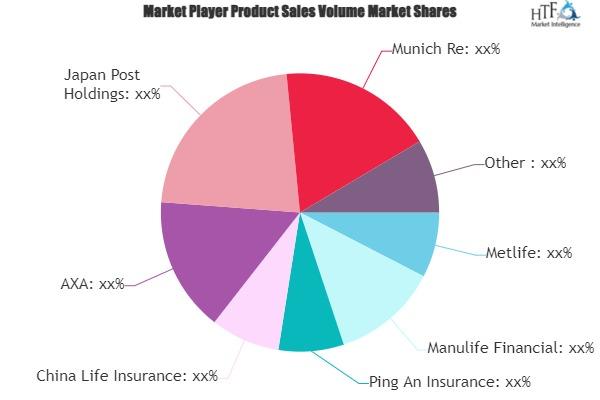

A new business intelligence report released by HTF MI with the title "Global Term Life Insurance Market Dynamics, Size and Growth Trends 2024-2032" is designed to cover the macro and micro level analysis by manufacturers and key business segments. The Global Term Life Insurance Market survey analysis offers energetic visions to conclude and study the size, share, and competitive nature of the market. The research is derived through primary and secondary statistics sources and delivers both qualitative and quantitative insights. Some of the key players profiled in the study are Metlife, Manulife Financial, Ping An Insurance, China Life Insurance, AXA, Japan Post Holdings, Munich Re, Allianz, Prudential PLC, Generali, Chubb, Prudential Financial, Legal & General, CPIC, Travelers, Swiss RE, Allstate, Aviva, Nippon Life Insurance, Berkshire Hathaway, AIA, Aflac, Zurich Insurance & AIG.What's keeping Metlife, Manulife Financial, Ping An Insurance, China Life Insurance, AXA, Japan Post Holdings, Munich Re, Allianz, Prudential PLC, Generali, Chubb, Prudential Financial, Legal & General, CPIC, Travelers, Swiss RE, Allstate, Aviva, Nippon Life Insurance, Berkshire Hathaway, AIA, Aflac, Zurich Insurance & AIG Ahead in the Market? Benchmark yourself with strategic moves and findings by HTF MI

Get Access to Sample Report + All Related Graphs & Charts @ : https://www.htfmarketreport.com/sample-report/3216519-global-term-life-insurance-market-3

Market Overview of Term Life Insurance

The study will provide you conclusive point of view that Industry experts and executives have shared. It is vital to keep the market knowledge up-to-date and segmented by Applications [Agency, Brokers, Bancassurance & Digital & Direct Channels], Product Types [, Level Term Life Insurance & Decreasing Term Life Insurance], and major players. If you are involved in the Term Life Insurance industry or aim to be or have a different set of players/manufacturers according to geography or seek to have a regional report segmented then connect with us to get a customized version.

This study mainly helps understand which market segments or regions / Countries need to be focused on in the next few years to channel efforts and investments to maximize growth and profitability. The Global Term Life Insurance report presents the market competitive landscape; in-depth analysis of the major vendor/key manufacturers, raw materials, pricing analysis, connected suppliers, and downstream buyers in the market along with the impact of economic slowdown.

Furthermore, the years considered for the study are as follows:

Historical year - 2019-2023

Base year - 2023

Forecast period** - 2024E to 2030 [** unless otherwise stated]

**Moreover, it also includes the opportunities available in micro markets for stakeholders to invest, a detailed analysis of the competitive landscape, and product services of key players.

Enquire for customized Term Life Insurance Study @: https://www.htfmarketreport.com/enquiry-before-buy/3216519-global-term-life-insurance-market-3

The titled segments and sub-section of the Term Life Insurance Market are illuminated below:

The Study Explore the Product/Types of the Market: , Level Term Life Insurance & Decreasing Term Life Insurance

Key Applications/End-users of the Market: Agency, Brokers, Bancassurance & Digital & Direct Channels

Top Players in the Market are: Metlife, Manulife Financial, Ping An Insurance, China Life Insurance, AXA, Japan Post Holdings, Munich Re, Allianz, Prudential PLC, Generali, Chubb, Prudential Financial, Legal & General, CPIC, Travelers, Swiss RE, Allstate, Aviva, Nippon Life Insurance, Berkshire Hathaway, AIA, Aflac, Zurich Insurance & AIG

Regions/Country Included are: North America (Covered in Chapter 9), United States, Canada, Mexico, Europe (Covered in Chapter 10), Germany, UK, France, Italy, Spain, Russia, Others, Asia-Pacific (Covered in Chapter 11), China, Japan, South Korea, Australia, India, South America (Covered in Chapter 12), Brazil, Argentina, Columbia, Middle East and Africa (Covered in Chapter 13), UAE, Egypt & South Africa

Important Features that are under offering & key highlights of the report:

- Detailed overview of Term Life Insurance market

- In-depth market segmentation by Type, Application, etc

- Historical, current, and projected market size in dollar terms (value) & volume

- Recent industry trends and developments

- Changing market dynamics of the industry

- Competitive landscape of Term Life Insurance market

- Strategies of key players and product offerings

- Potential and niche segments/regions exhibiting promising growth

- A neutral perspective towards Term Life Insurance market performance

- Market players' information to sustain and enhance their footprint

Read Complete Index of full Research Study at @ https://www.htfmarketreport.com/reports/3216519-global-term-life-insurance-market-3

Major Highlights from TOC:

Chapter One: Global Term Life Insurance Market Industry Overview

1.1 Overview

1.1.2 Products of Major Companies

1.2 Global Term Life Insurance Market Segment

1.2.1 Industrial Chain Analysis

1.2.2 Consumer Distribution

1.3 Price & Cost Overview

Chapter Two: Global Term Life Insurance Market Demand

2.1 By End Use Industry / Application [Agency, Brokers, Bancassurance & Digital & Direct Channels]

2.2 Term Life Insurance Market Size by Demand

2.3 Market Forecast (2024E-2030)

Chapter Three: Global Term Life Insurance Market by Type

3.1 By Type [, Level Term Life Insurance & Decreasing Term Life Insurance]

3.2 Term Life Insurance Market Size by Type

3.3 Term Life Insurance Market Forecast by Type

Chapter Four: Major Region of Term Life Insurance Market

4.1 Global Term Life Insurance Sales

4.2 Global Term Life Insurance Revenue & Market share

.........

Chapter Five: Major Companies

5.1 Market Share Analysis by Players

5.2 Regional Market Share Analysis by Players

5.3 Company Profiles (Product Offering, Financials, SWOT Analysis, etc)

............

Chapter Six: Conclusion

Get Festive Season offer on Buying Latest Version of Global Term Life Insurance Market Study @ https://www.htfmarketreport.com/buy-now?format=1&report=3216519

Key questions answered

• How Global Term Life Insurance Market growth & size is changing in next few years?

• Who are the Leading players and what are their futuristic plans in the Global Term Life Insurance market?

• What are the key concerns of the 5-forces analysis of the Global Term Life Insurance market?

• What are the strengths and weaknesses of the key vendors?

• What are the different prospects and threats faced by the dealers in the Global Term Life Insurance market?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, Southeast, LATAM, or Asia.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Term Life Insurance Market is Becoming High Value Market with Double-Digit Growth here

News-ID: 3638142 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Health Insurance Market Demand Makes Room for New Growth Story

According to HTF MI, "Global Health Insurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2030". The Global Health Insurance Market is anticipated to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030, reaching USD 18.35 Billion in 2024 and USD 32.08 Billion by 2030.

Health insurance refers to a type of coverage that pays for medical and surgical expenses incurred by the insured individual.…

Folding Ladder Market Is Likely to Experience a Tremendous Growth in Near Future

Folding Ladder Market is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Folding Ladder Market. Some of the key players profiled in the study are Werner Co. (United States), Little Giant Ladders (United States), Louisville Ladder…

Antibody Therapeutics Market Demand Makes Room for New Growth Story

Antibody Therapeutics Market is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Antibody Therapeutics Market. Some of the key players profiled in the study are F. Hoffmann-La Roche Ltd. (Switzerland), AbbVie Inc. (United States), Johnson &…

Portable WIFI Market Increasing Demand with Industry Professionals: Netgear

HTF Market Intelligence published a new research document of 150+pages on Portable WIFI Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Portable WIFI market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic slowdown have…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…