Press release

SME Insurance Market is Likely to Experience a Tremendous Growth in Near Future: Allianz, Chubb, Munich Re

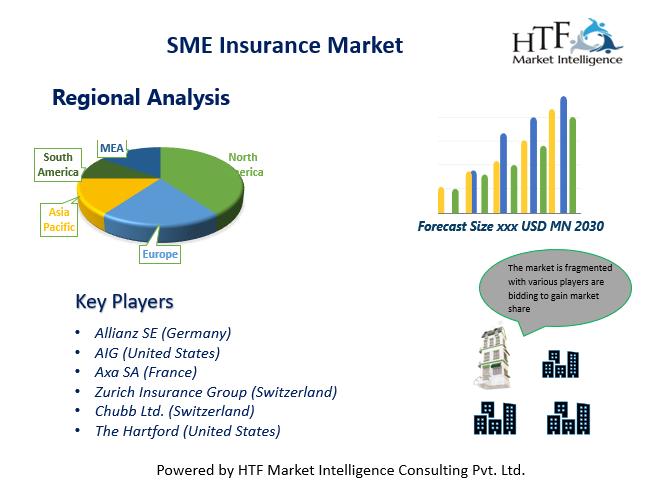

The latest survey on SME Insurance Market is conducted to provide hidden gems performance analysis of SME Insurance to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in SME Insurance market has made companies uncertain about their future outlook as the disturbance in the value chain has made a serious economic slump. Some are the key & emerging players that are part of the coverage and profiled in the study are Allianz SE (Germany), AIG (United States), Axa SA (France), Zurich Insurance Group (Switzerland), Chubb Ltd. (Switzerland), The Hartford (United States), Travelers Companies Inc. (United States), Liberty Mutual Group (United States), Berkshire Hathaway Inc. (United States), Munich Re (Germany), Generali Group (Italy), Tokio Marine Holdings Inc. (Japan)According to HTF Market Intelligence, the Global SME Insurance Market is expected to see a growth rate of 7.1% from 2023 to 2030.

Get Access to Statistical Data, Charts & Key Players Strategies

@ https://www.htfmarketintelligence.com/sample-report/global-sme-insurance-market?utm_source=Krati_OpenPR&utm_id=Krati

SME Insurance Market Overview

SME insurance helps cover the costs of liability and property damage claims. It can also replace lost income if the business has to close temporarily because of a loss. The coverage includes property damage, legal liability, and employee-related risks. The risks vary according to the environment they are working in. Apart from this business insurance coverage, it provides additional ones. Moreover, the SME insurance protects the financial assets, intellectual and physical properties of the business from events such as lawsuits, thefts, loss of income, employee injuries and others.

Market Trends

Adoption of Automation and Artificial Intelligence in Insurance Processes

Rising Number of InsurTech Firms which are Offering Specific Functionalities or Parts of Value Chain

Market Drivers

Ability to Distribute Insurance Policies in Small Businesses in a Cost-Effective way that covers Various Risks

Risks Such as Legal Liability, Employee Illness and Natural Disasters to Businesses are leading to Investment in Business Insurance

Market Opportunities:

Rising Number of Small and Medium Enterprises in Emerging Economies is Boosting the Market Growth

Market Leaders & Development Strategies:

On April 21, 2022, Zurich launched its SME insurance offering in New Zealand, providing small and medium-sized enterprises with a range of coverage options to protect their businesses. The offering included property, business interruption, liability, and cyber insurance, as well as several additional services such as legal advice and risk engineering. The new offering aimed to address the unique risks and challenges that SMEs face, such as limited resources and increased vulnerability to cyber attacks.

SME Insurance Market Segmentation

Market Analysis by Types: Property Insurance, Liability Insurance, Business Interruption Insurance, Others

Market Analysis by Applications: Manufacturing, Construction, Retail, Healthcare, Others

Target Audience:

SME Insurance Developers and Providers, Regulatory Bodies, Potential Investors, New Entrants, Analysts and Strategic Business Planners, Venture Capitalists, Research and Development Institutes, Government Bodies, Others

Know more About Customization @: https://www.htfmarketintelligence.com/enquiry-before-buy/global-sme-insurance-market?utm_source=Krati_OpenPR&utm_id=Krati

Important Features that are under offering & key highlights of the SME Insurance market report:

1. Why lots of Key players are not profiled in the Study?

--> The market study is surveyed by collecting data from various companies from SME Insurance industry, and the base for coverage is NAICS standards. However, the study is not limited to profiling only a few companies; connect with sales executives to get a customized list. The standard version of the research report is listed with players like Allianz SE (Germany), AIG (United States), Axa SA (France), Zurich Insurance Group (Switzerland), Chubb Ltd. (Switzerland), The Hartford (United States), Travelers Companies Inc. (United States), Liberty Mutual Group (United States), Berkshire Hathaway Inc. (United States), Munich Re (Germany), Generali Group (Italy), Tokio Marine Holdings Inc. (Japan)

2. Does the Scope of the Market Study allow further Segmentation?

---> Yes, for a deep dive analysis add-on segmentation is applicable in a premium customized version of the report to better derive market values. The standard version of this report covers segmentation by Application [Manufacturing, Construction, Retail, Healthcare, Others ], by Type [Property Insurance, Liability Insurance, Business Interruption Insurance, Others], and by regions [In North America, In Latin America, Europe, The Asia-pacific, Middle East and Africa (MEA), What are the main countries covered , The United States, Canada, Germany, France, UK, Italy, Russia, China, Japan, Korea, Southeast Asia, India, Australia, Brazil, Mexico, Argentina, Chile, Colombia, Egypt, Saudi Arabia, United Arab Emirates, Nigeria & South Africa]

3. What level of granularity would the Country landscape cover?

---> In the premium version of the report, two-level of regional segmentations allow user to have access to a country-level break-up of market Size by revenue and volume*

* Wherever applicable

4. Does the Study also provide insights into macroeconomic factors?

---> Yes, the study also includes market factor analysis that includes macroeconomic factors, the inflationary cycle and its impact, and Russia-Ukraine war analysis and its effect on the value/supply chain.

For More Information Read Table of Content @ https://www.htfmarketintelligence.com/report/global-sme-insurance-market

HTF MI provides customized studies specific to regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico.

• South & Central America: Argentina, Chile, and Brazil.

• Middle East & Africa: Saudi Arabia, UAE, Turkey, Egypt, and South Africa.

• Europe: the United Kingdom, France, Italy, Germany, Spain, and Russia.

• Asia-Pacific: India, China, Japan, South Korea, Indonesia, Singapore, Australia, etc.

Reasons to Buy

• Stay tuned with the latest and SME Insurance market research findings

• Identify segments with hidden growth potential for investment in SME Insurance

• Benchmark performance against key competitors

• Utilize the relationships between key data sets for superior strategizing.

• Facilitate decision-making based on historic and forecast trends of SME Insurance market

• Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

• Gain a global perspective on the development of the SME Insurance market

Check for Best Quote @ https://www.htfmarketintelligence.com/buy-now?format=1&report=3180?utm_source=Krati_OpenPR&utm_id=Krati

Thanks for reading SME Insurance research article; you can also get individual chapter-wise sections or region-wise report versions like LATAM, North America, MENA, Southeast Asia, Europe, APAC or Country Specific reports such as Japan, United Kingdom, United States or China, etc

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to enable businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SME Insurance Market is Likely to Experience a Tremendous Growth in Near Future: Allianz, Chubb, Munich Re here

News-ID: 3636716 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Online Corporate Assessment Services Market Size, Regional Demand, Trends and Fo …

Global Online Corporate Assessment Services Market, is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Online Corporate Assessment Services Market. Some of the key players profiled in the study are SHL, Mercer, Korn Ferry, Aon, IBM,…

AI in Games Market Size Is Booming Worldwide with Share, Size, Top Key Players

Global AI in Games Market, is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the AI in Games Market. Some of the key players profiled in the study are Microsoft, Ubisoft, Sony, Epic Games, EA (Electronic Arts),…

IT Spending in Energy Market: Forthcoming Trends and Share Analysis by 2032

Global IT Spending in Energy Market, is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the IT Spending in Energy Market. Some of the key players profiled in the study are IBM, Oracle, Microsoft, SAP, Siemens, ABB,…

Operation & Business Support System Market Size, Regional Demand, Trends and For …

Global Operation & Business Support System Market, is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Operation & Business Support System Market. Some of the key players profiled in the study are Amdocs, Ericsson, Huawei, Nokia,…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…