Press release

SME Insurance Market Massive Growth Opportunity Ahead | Chubb Corporation , Progressive commercial

The Latest released Global SME Insurance Market Research Report provides a detailed assessment of Key and emerging players showcasing company profiles, product/service offerings, market price, and sales revenue to better derive market size estimation. With this assessment of SME Insurance Industry, the aim is to provide a viewpoint on upcoming trends, growth drivers, opinions, and facts derived from industry executives with statistically supported and market-validated data. Furthermore, a detailed commentary on How or Why this market may see a growth momentum during the forecast period is analyzed and correlated with dominating and emerging players' strengths and weaknesses.Berkshire Hathaway (United States), Liberty Mutual (United States), Allstate Corp (United States), Farmers Insurance Group (United States), Allianz global corporate and specialty (Germany), CNA (Singapore), Zurich (Switzerland), AXA (France), CGI Insurance (England) and State farm (United States). The Players having a strong hold in the market are Berkshire Hathaway, Liberty Mutual, Allstate Corp, and Farmers Insurance Group. Additionally, following companies can also be profiled that are part of our coverage like The Travelers Companies (United States), American International Group, Inc. (United States), Nationwide (United Kingdom), AIA Group Limited (China), Chubb Corporation (United States), Progressive commercial (United States), Hartford insurance company (United States), Hanover insurance group (United States) and ICICI Lombard (India).

Whats keeping SME Insurance Market gain a competitive edge in Global SME Insurance Market and stay up-to-date with available business opportunities in various segments and emerging territories.

Get Quick Access to Sample Pages of Global SME Insurance Market @ https://www.htfmarketreport.com/sample-report/2832182-global-sme-insurance-market-6?utm_source=Sweety_OpenPR&utm_id=Sweety

Market Drivers

Ability to Distribute Insurance Policies in Small Businesses in a Cost-Effective way that covers Various Risks

Risks Such as Legal Liability, Employee Illness and Natural Disasters to Businesses are leading to Investment in Business Insurance

Market Trend :

Adoption of Automation and Artificial Intelligence in Insurance Processes

Rising Number of InsurTech Firms which are Offering Specific Functionalities or Parts of Value Chain

Restraints:

Rise in Inflation Rates are Causing in Cancellation of Policies

Opportunities :

Rising Number of Small and Medium Enterprises in Emerging Economies is Boosting the Market Growth

Challenges:

Lack of Awareness about the Insurance for Small Businesses

(The sample of this report is readily available on request)

What this report sample includes:

• A Brief Introduction about SME Insurance Market Research Scope and Methodology.

• Leading and Emerging Players Revenue Analysis.

• Major Highlights from Growth Drivers and Market Trends.

• Key Snapshot from the Final Study.

• Graphical Illustration of the Regional Analysis.

Get Access to Statistical Data, Charts & Key Players' Strategies @ https://www.htfmarketreport.com/enquiry-before-buy/2832182-global-sme-insurance-market-6?utm_source=Sweety_OpenPR&utm_id=Sweety

Maintaining the status quo will not drive growth, henceforth a lot of SME Insurance Manufacturers of seen entering new markets, then looking for top and bottom-line growth from overseas investments. HTF MI has covered 19+ Country-level analyses in Global SME Insurance Market Regional Coverage.

Geographically, the global version of SME Insurance Market report covers the following regions and countries

North America (the USA, Canada, and Mexico)

Europe (Germany, France, the United Kingdom, Netherlands, Belgium, Nordic, Spain, Russia, Italy, and the Rest of Europe)

Asia-Pacific (China, Japan, Australia, New Zealand, South Korea, India, Southeast Asia, and Others)

South America (Brazil, Argentina, Colombia, Others)

MEA (Saudi Arabia, Turkey, United Arab Emirates (UAE), Israel, Egypt, South Africa, Morocco & Rest of MEA)

Data Source & Research Methodology:

Our analysts drafted the report by gathering information through primary (through surveys and interviews) and secondary (including industry body databases, reputable paid sources, and trade journals) methods of data collection. The report encompasses an exhaustive qualitative and quantitative evaluation. The study includes growth trends, micro- and macro-economic indicators, and regulations and governmental policies.

Against challenges Faced by Industry, SME Insurance Market Study discuss and Shed Light on

- The resulting overview to understand why and how the Global SME Insurance industry is expected to change.

- Where the SME Insurance industry is heading and what are the top priorities? To elaborate, HTF MI turned to the manufacturers to draw insights like financial analysis, the survey of SME Insurance companies, and interviews with upstream suppliers downstream buyers, and industry experts.

- How SME Insurance company in this diverse set of players can best navigate the emerging new industry landscape and develop a strategy to gain market position.

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=2832182?utm_source=Sweety_OpenPR&utm_id=Sweety

Extract from Table of Content of Global SME Insurance Market:

1. Introduction

a. Study Assumptions

b. Scope of the Study

2. Research Methodology

3. Executive Summary

4. Market Dynamics

a. Market Drivers

b. Market Restraints

c. Industry Attractiveness - Porter's Five Forces Analysis

5. Market Segmentation (2019-2030)

6. Competitive Landscape

a. Vendor Market Share (2021-2023)

b. Company Profiles

7. Market Opportunities and Future Trends

8. Industrial Chain, Downstream Buyers, and Sourcing Strategy

9. Marketing Strategy Analysis

12. ........Continued…!

Browse Summary and Detailed Table of Content @ https://www.htfmarketreport.com/reports/2832182-global-sme-insurance-market-6?utm_source=Sweety_OpenPR&utm_id=Sweety

Overall, the SME Insurance Market report is a reliable source for managers, analysts,s, and executives from the industry to better analyze market scenarios from a third-party research perspective. HTF MI aims to bridge the gap between businesses and end customers to better elaborate manufacturers with benefits, limits, trends, and market growth rates. SWOT analysis is also incorporated in the SME Insurance market report in line with speculation attainability investigation and venture return investigation.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SME Insurance Market Massive Growth Opportunity Ahead | Chubb Corporation , Progressive commercial here

News-ID: 3604243 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Education ERP Market to Get an Explosive Growth in Near Future | Ellucian , Jenz …

HTF Market Intelligence recently released a survey document on Education ERP market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the…

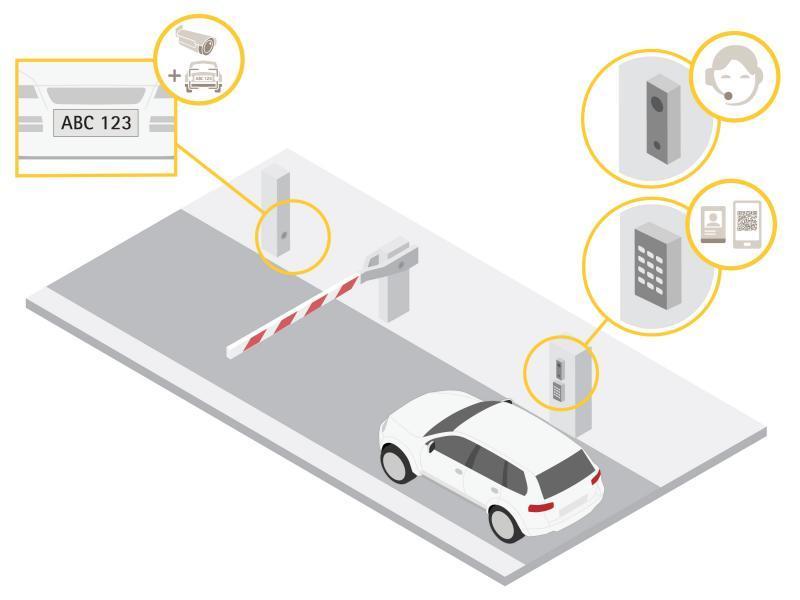

Vehicle Entrance Control Systems Market Rapidly Gaining Traction in Key Business …

HTF MI introduces new research on Global Vehicle Entrance Control Systems covering the micro level of analysis by competitors and key business segments. The Global Vehicle Entrance Control Systems explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of…

Hospital Asset Management Market Likely to Boost Future Growth by 2030 | GE Heal …

HTF Market Intelligence published a new research document of 150+pages on Hospital Asset Management Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Hospital Asset Management market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic…

Modular Hospital Market Boosting the Growth Worldwide :Polyclinic 2.0 ,KEF Infra

The latest study released on the Global Modular Hospital Market by HTF MI evaluates market size, trend, and forecast to 2030. The Modular Hospital market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…