Press release

Third-Party Banking Software Market Doubtless To Enhance Future Progress with SAP, Capgemini, Fiserv

HTF Market Intelligence published a new research document of 150+pages on Third-Party Banking Software Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Third-Party Banking Software market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic slowdown have changed complete market dynamics.Some of the key players profiled in the study are Microsoft Corporation (United States), International Business Machines (IBM) Corporation (United States), Oracle Corporation (United States), SAP SE (Germany), Tata Consultancy Services (TCS) (India), Infosys Ltd. (India), Capgemini SE (France), FIS, Inc. (United States), Fiserv, Inc. (United States),

The Global Third-Party Banking Software market was valued at USD Million in 2024 and is expected to reach USD Million by 2030, growing at a CAGR of 8.2 % during 2024-2030.

Get an Inside Scoop of Study, Request now for Sample Study @ https://www.htfmarketintelligence.com/sample-report/global-third-party-banking-software-market?utm_source=Krati_OpenPR&utm_id=Krati

Definition: Third-party banking software refers to software solutions developed by independent companies or vendors that provide various services and functionalities to banks and financial institutions. These software applications are designed to enhance banking operations, improve efficiency, and offer advanced features beyond what the core banking system typically provides.

Market Trends:

●Adoption of cloud-based banking software for scalability, flexibility, and cost-effectiveness.

Market Drivers:

● Increasing demand from banks to modernize legacy systems and enhance customer experience drives the adoption of third-party banking software.

Market Opportunities:

●Offering customization and integration services to tailor third-party software solutions to individual bank needs.

Market Leaders & Development Strategies:

●On 11th June 2022, Microsoft and Technisys, creator of Core Banking software, have joined forces in a partnership. Their aim is to incorporate Microsoft Cloud for Financial Services into the Cyberbank platform, empowering financial institutions to accelerate digital transformation. This collaboration fosters innovation and shifts focus from legacy system upkeep to customer-centric value delivery.

●On 22th April 2024, As the anticipated laundering volume hits $5.05 trillion this year, banks face mounting challenges in compliance management. Oracle Financial Services launches Oracle Financial Services Compliance Agent, an AI-driven cloud solution. It facilitates affordable scenario testing, allowing banks to refine controls, detect suspicious transactions, and enhance compliance adherence efficiently.

The titled segments and sub-section of the market are illuminated below:

The Study Explore the Product Types of Third-Party Banking Software Market: On-premise, Cloud

Key Applications/end-users of Third-Party Banking Software Market: Risk Management, Information Security, Business Intelligence

Check for Best Quote @ https://www.htfmarketintelligence.com/buy-now?format=1&report=9124?utm_source=Krati_OpenPR&utm_id=Krati

With this report you will learn:

· Who the leading players are in Third-Party Banking Software Market?

· What you should look for in a Third-Party Banking Software

· What trends are driving the Market

· About the changing market behaviour over time with strategic view point to examine competition

Also included in the study are profiles of 15 Third-Party Banking Software vendors, pricing charts, financial outlook, swot analysis, products specification &comparisons matrix with recommended steps for evaluating and determining latest product/service offering.

Who should get most benefit from this report insights?

· Anyone who are directly or indirectly involved in value chain cycle of this industry and needs to be up to speed on the key players and major trends in the market for Third-Party Banking Software

· Marketers and agencies doing their due diligence in selecting a Third-Party Banking Software for large and enterprise level organizations

· Analysts and vendors looking for current intelligence about this dynamic marketplace.

· Competition who would like to benchmark and correlate themselves with market position and standings in current scenario.

Make an enquiry to understand outline of study and further possible customization in offering https://www.htfmarketintelligence.com/enquiry-before-buy/global-third-party-banking-software-market?utm_source=Krati_OpenPR&utm_id=Krati

Quick Snapshot and Extracts from TOC of Latest Edition

• Overview of Third-Party Banking Software Market

• Third-Party Banking SoftwareSize (Sales Volume) Comparison by Type (2024-2030)

• Third-Party Banking Software Size (Consumption) and Market Share Comparison by Application (2024-2030)

• Third-Party Banking Software Size (Value) Comparison by Region (2024-2030)

• Third-Party Banking Software Sales, Revenue and Growth Rate (2024-2030)

• Third-Party Banking Software Competitive Situation and Current Scenario Analysis Strategic proposal for estimating sizing of core business segments Players/Suppliers High Performance Pigments Manufacturing Base Distribution, Sales Area, Product Type Analyse competitors, including all important parameters of Third-Party Banking Software

• Third-Party Banking Software Manufacturing Cost Analysis Latest innovative headway and supply chain pattern mapping of leading and merging industry players

Get Detailed TOC and Overview of Report @ https://www.htfmarketintelligence.com/report/global-third-party-banking-software-market

Thanks for reading this article, you can also make sectional purchase or opt-in for regional report by limiting the scope to only North America, ANZ, Europe or MENA Countries, Eastern Europe or European Union.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Us:

HTF Market Intelligence is a leading market research company providing end-to-end syndicated and custom market reports, consulting services, and insightful information across the globe. HTF MI integrates History, Trends, and Forecasts to identify the highest value opportunities, cope with the most critical business challenges and transform the businesses. Analysts at HTF MI focuses on comprehending the unique needs of each client to deliver insights that are most suited to his particular requirements.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Third-Party Banking Software Market Doubtless To Enhance Future Progress with SAP, Capgemini, Fiserv here

News-ID: 3600525 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Premium Cosmetics Market is Poised to Grow a Robust CAGR of 8.5% by 2030: Coty, …

The Latest research study released by HTF MI "Global Premium Cosmetics Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are L'Oréal,…

Juvenile Life Insurance Market to Witness Stunning Growth with AIG, State Farm, …

The Latest research study released by HTF MI "Global Juvenile Life Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are…

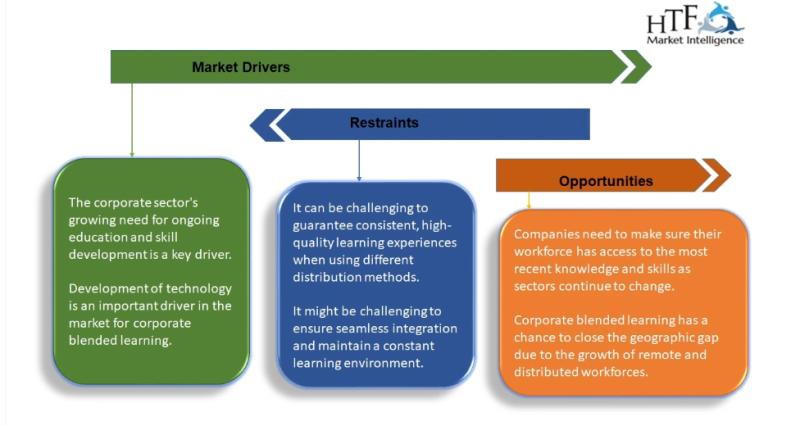

Corporate Blended Learning Market Gain Momentum with Major Giants Khan Academy, …

Latest Study on Industrial Growth of Corporate Blended Learning Market 2024-2030. A detailed study accumulated to offer the Latest insights about acute features of the Corporate Blended Learning market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future…

Suncare Products Market Size and Growth Share 2024 : Future Trends and Developme …

Latest Study on Industrial Growth of Suncare Products Market 2024-2030. A detailed study accumulated to offer the Latest insights about acute features of the Suncare Products market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and…

More Releases for Banking

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…

Digital Banking Market Research Report 2017: Internet Banking, Digital Payments, …

In this report, the global Digital Banking market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between 2016 and 2022.

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), market share and growth rate of Digital Banking in these regions, from 2012 to 2022 (forecast), covering

United…

Online banking market by Banking Type (Retail Banking, Corporate Banking, and In …

Online banking market size was valued at +$7,304 million in 2016, and is estimated to reach +$29,975 million by 2023, registering a CAGR of +22.5% from 2017 to 2023. In 2017, Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services. online retail banking dominated the overall online banking market. The report categorizes the market in…

Global Core Banking Solution Market: Branch Less Banking to Impact Core Banking …

New research report offers a comprehensive analysis of the “Core Banking Solution Market: Banks End User Segment to Lead in Terms of Value Share Throughout the Forecast Period: Global Industry Analysis 2012 - 2016 and Opportunity Assessment 2017 – 2027”.The main objective of this report is to deliver insightful information and clear-cut facts pertaining to the growth trajectories of the market.

Request for Sample Report @ https://www.mrrse.com/sample/4004

Branch Less Banking to Impact…