Press release

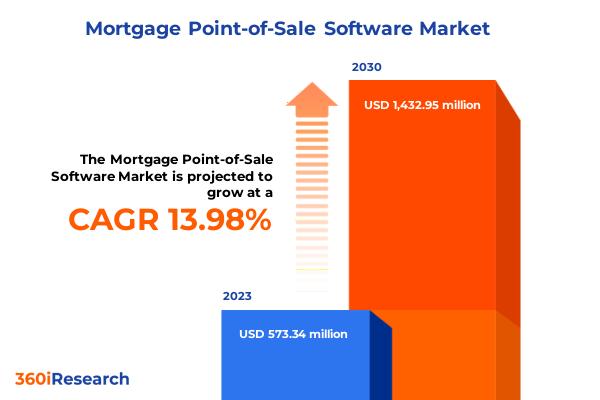

Mortgage Point-of-Sale Software Market worth $1,432.95 million by 2030, growing at a CAGR of 13.98% - Exclusive Report by 360iResearch

The "Mortgage Point-of-Sale Software Market by Product (Fixed Mortgage POS, Mobile Mortgage POS), Function (Automate Mortgage Application Processing, Borrower Pipeline Dashboard, Borrower-Facing Portal), Deployment, End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Mortgage Point-of-Sale (POS) software serves as a specialized digital platform streamlining the mortgage application process for lenders and borrowers, incorporating functionalities such as document collection, application submission, credit scoring, and borrower communication. It's crucial to address consumer demands for fast, transparent, and user-friendly mortgage services. Mortgage POS software applications span various stages of the mortgage lifecycle, enhancing efficiency through automation and real-time updates, reducing operational costs, and significantly improving borrower experience and lender productivity. Key end-users include banks and financial institutions, mortgage brokers, and credit unions, which benefit from faster processing times, reduced overhead, and higher customer satisfaction. Market growth is driven by digital transformation, evolving consumer preferences for quicker mortgage processing, and stringent regulatory compliance requiring accurate documentation. Potential opportunities in the market include the integration of AI and machine learning to expedite loan approval, expanding mobile applications to attract tech-savvy users, and enhancing data security to meet regulatory requirements and build consumer trust. However, challenges include high implementation costs, resistance to change from traditional processing methods, and rising data security concerns. Research and innovation should focus on blockchain technology for improved transparency and fraud reduction, continuous improvements in user experience (UX) design to enhance satisfaction and adoption, and advanced API integrations for seamless integration with existing financial systems. The market is characterized by dynamic technological advancements and a strong emphasis on innovation and digital transformation, presenting significant opportunities for businesses to grow by adopting advanced technologies and improving data security and user experience.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Mortgage Point-of-Sale Software Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Fixed Mortgage POS and Mobile Mortgage POS.

Based on Function, market is studied across Automate Mortgage Application Processing, Borrower Pipeline Dashboard, Borrower-Facing Portal, and Integration of Loan Origination System (LOS) Tools.

Based on Deployment, market is studied across Cloud and On-Premise.

Based on End-User, market is studied across Banking, Financial Services & Insurance, Consultants, Fin-Tech, and University & Education Institutions.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Profiles:

The report delves into recent significant developments in the Mortgage Point-of-Sale Software Market, highlighting leading vendors and their innovative profiles. These include BeSmartee Inc., Black Knight, Inc., Blend Labs, Inc., BNTouch, Inc., Calyx Technology, Inc., CLOUDVIRGA, Inc. by Stewart Information Services Corporation, Finastra, Floify LLC, Lender Price by Cre8tech Labs Inc., LenderHomePage.com, LendingPad Corp., Maxwell Financial Labs, Inc., MortgageHippo, Inc., Roostify, Inc., Shape Software Inc., and SimpleNexus LLC by nCino, Inc..

Introducing ThinkMi Query: Revolutionizing Market Intelligence with AI-Powered Insights for the Mortgage Point-of-Sale Software Market

We proudly unveil ThinkMi Query, a cutting-edge AI product designed to transform how businesses interact with the Mortgage Point-of-Sale Software Market. ThinkMi Query stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi Query is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it's a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Mortgage Point-of-Sale Software Market. Embrace the future of market analysis with ThinkMi Query, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi Query @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=query

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Mortgage Point-of-Sale Software Market, by Product

7. Mortgage Point-of-Sale Software Market, by Function

8. Mortgage Point-of-Sale Software Market, by Deployment

9. Mortgage Point-of-Sale Software Market, by End-User

10. Americas Mortgage Point-of-Sale Software Market

11. Asia-Pacific Mortgage Point-of-Sale Software Market

12. Europe, Middle East & Africa Mortgage Point-of-Sale Software Market

13. Competitive Landscape

14. Competitive Portfolio

Read More @ https://www.360iresearch.com/library/intelligence/mortgage-point-of-sale-software?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Point-of-Sale Software Market worth $1,432.95 million by 2030, growing at a CAGR of 13.98% - Exclusive Report by 360iResearch here

News-ID: 3570478 • Views: …

More Releases from 360iResearch

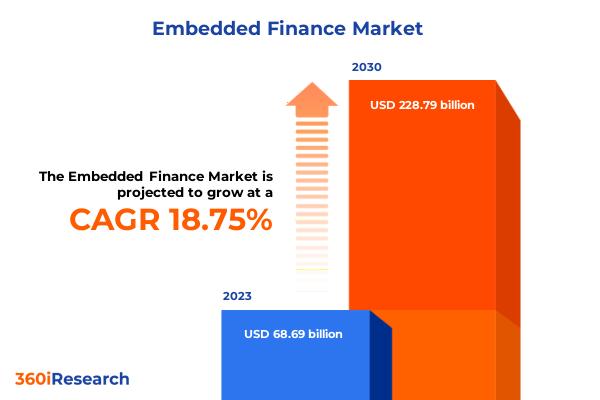

Embedded Finance Market worth $228.79 billion by 2030, growing at a CAGR of 18.7 …

The "Embedded Finance Market by Services (Embedded Banking Services, Embedded Insurance, Embedded Lending), Integration Type (Application Programming Interfaces, Software Development Kits), Business Model, End-Use - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/embedded-finance

Embedded Finance refers to the integration of financial services, such as lending, insurance, payments, or banking, directly within the products or services of non-financial companies using Application Programming Interfaces (APIs).…

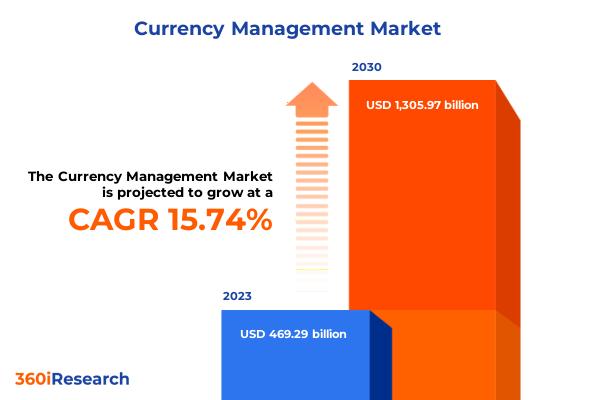

Currency Management Market worth $1,305.97 billion by 2030, growing at a CAGR of …

The "Currency Management Market by Offering (Services, Software), Type (Fixed Currency Exchange, Floating Currency Exchange), End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/currency-management

Currency management encompasses strategies, methodologies, and tools employed by firms and financial institutions to address risks and potential benefits associated with currency fluctuations, involving activities such as hedging, arbitrage, and strategic investment planning to mitigate negative financial impacts…

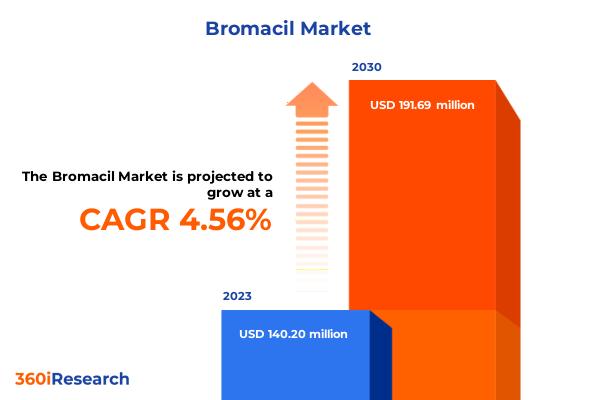

Bromacil Market worth $191.69 million by 2030, growing at a CAGR of 4.56% - Excl …

The "Bromacil Market by Formulation (Granular Formulation, Liquid Formulation), Distribution Channel (Offline, Online) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/bromacil

Bromacil, a herbicide used to control broadleaf weeds and grasses, is vital for vegetation management in agricultural and non-cropland areas due to its soil-residual activity and efficacy in preventing weed growth, ultimately enhancing agricultural productivity and land utility. Applications span agricultural…

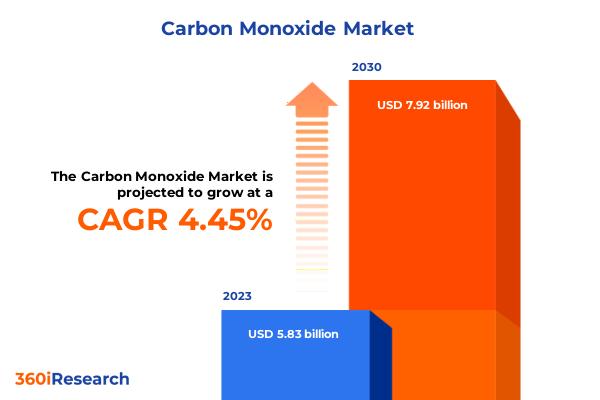

Carbon Monoxide Market worth $7.92 billion by 2030, growing at a CAGR of 4.45% - …

The "Carbon Monoxide Market by Purity Level (98% - 99%, Over 99%), Application (Chemical Synthesis, Food & Beverage, Fuel) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/carbon-monoxide

The scope of carbon monoxide (CO) market research encompasses comprehensive evaluations of production, distribution, application, and end-use industries, providing insights into current market size, projected growth, and future demand across key regions such as North…

More Releases for Mortgage

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…

Boca Raton Welcomes A New Mortgage Lender: DreamLink Mortgage

DreamLink Mortgage will masterfully serve the mortgage needs in the South Florida area and beyond. Using cutting-edge financial technology with a simplified virtual closing process, DreamLink offers the lowest rates with reduced turn-around time.

Three-decades long mortgage lender Eric Wagner launches DreamLink Mortgage, a new leading mortgage provider, bringing the same trusted knowledge and expertise with improved products, systems and processes. Wagner has worked in the mortgage business since 1991, his…

Global Residential Mortgage Service Market, Top key players are Accenture ,Resid …

Global Residential Mortgage Service Market Size, Status and Forecast 2019-2025

In 2018, the global Residential Mortgage Service market size was million US$ and it is expected to reach million US$ by the end of 2025, with a CAGR of during 2019-2025.

This report focuses on the global Residential Mortgage Service status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Residential Mortgage Service development in…

Global Residential Mortgage Service Market Outlook to 2023 – Accenture, Reside …

A mortgage servicer is a company to which some borrowers pay their mortgage loan payments and which performs other services in connection with mortgages and mortgage-backed securities. The global market size of Residential Mortgage Service is $XX million in 2017 with XX CAGR from 2013 to 2017, and it is expected to reach $XX million by the end of 2023 with a CAGR of XX% from 2018 to 2023.

Request for…

Booming Trend of Global Residential Mortgage Service Market Forecast to 2025: Ke …

UpMarketResearch offers a latest published report on “Global Residential Mortgage Service Market Analysis and Forecast 2019-2025” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 108 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Get Exclusive FREE Sample Copy Of this Report @ https://www.upmarketresearch.com/home/requested_sample/35907

Residential Mortgage Service Market research report delivers a…

Residential Mortgage Service Market Outlook To 2023 – Accenture, Residential M …

Dec 2018, New York USA (News) - A mortgage servicer is a company to which some borrowers pay their mortgage loan payments and which performs other services in connection with mortgages and mortgage-backed securities. The mortgage servicer may be the entity that originated the mortgage, or it may have purchased the mortgage servicing rights from the original mortgage lender. The duties of a mortgage servicer vary, but typically include the…