Press release

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Takaful) & Growth of 8.9%

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth driven by the rising awareness and acceptance of Islamic finance principles, which emphasize ethical and interest-free transactions. Along with this, the expanding Muslim population, coupled with increasing disposable incomes, is contributing to the accelerating demand for Sharia-compliant financial products. Additionally, the growing perception of Takaful as a viable and competitive alternative to conventional insurance is bolstering market growth.

Government regulations favoring Islamic financial products and the establishment of supportive frameworks for Takaful operations further enhance market expansion. Moreover, the increasing penetration of Takaful services in non-Muslim majority countries, driven by the global diversification strategies of Takaful operators, is also fostering growth. The integration of advanced technologies and digital platforms in Takaful services, aimed at enhancing customer experience and operational efficiency, is another significant factor contributing to the positive outlook of the global Takaful market.

Leading Players Profiled in this Report:

• Islamic Insurance Company

• JamaPunji

• AMAN

• Salama

• Standard Chartered

• Takaful Brunei Darussalam Sdn Bhd

• Allianz

• Prudential BSN Takaful Berhad

• Zurich Malaysia

• Takaful Malaysia

• Qatar Islamic Insurance Company

Global Takaful Market Growth Analysis:

The scope of the global market encompasses various sectors, including life, health, motor, and property insurance, catering to both individual and corporate clients. The market is witnessing a substantial increase in demand for family Takaful products, which provide comprehensive coverage and investment opportunities while adhering to Islamic principles. Additionally, the expansion of micro-Takaful services aimed at providing affordable and accessible insurance solutions to low-income populations is broadening the market reach. The market is also benefiting from the growing trend of integrating Takaful with Islamic banking services, offering bundled financial solutions to customers. Technological advancements, such as the use of blockchain for transparent and efficient claims processing and the development of mobile applications for seamless policy management, are further propelling market growth.

Moreover, the global Takaful market is poised for sustained expansion, supported by the increasing preference for ethical financial products, continuous innovation, and the robust regulatory environment fostering the growth of Islamic finance.

Do you know more information, Contact to our analyst at- https://www.imarcgroup.com/takaful-market

Key Market Segmentation:

Breakup by Product Type:

• Life/Family Takaful

• General Takaful

General takaful accounts for the majority of the market share due to the rising popularity in both Islamic and non-Islamic nations.

Regional Insights:

• Gulf Cooperation Council (GCC)

• Southeast Asia

• Africa

• Others

Gulf Cooperation Council (GCC) leads the market due to high economic growth and a substantial Muslim population.

TOC for the Takaful Market Research Report:

• Preface

• Scope and Methodology

• Executive Summary

• Introduction

• Global Takaful Market

• SWOT Analysis

• Value Chain Analysis

• Price Analysis

• Competitive Landscape

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Takaful) & Growth of 8.9% here

News-ID: 3570428 • Views: …

More Releases from IMARC Group

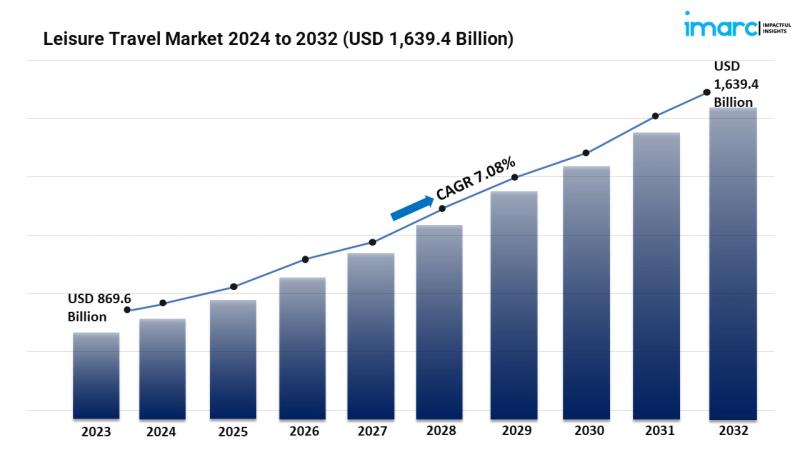

Leisure Travel Market Size to Surpass USD 1639.4 Billion by 2032, Rising At A CA …

𝐆𝐥𝐨𝐛𝐚𝐥 𝐋𝐞𝐢𝐬𝐮𝐫𝐞 𝐓𝐫𝐚𝐯𝐞𝐥 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲: 𝐊𝐞𝐲 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐢𝐧 𝟐𝟎𝟐𝟒-𝟐𝟎𝟑𝟐

𝐒𝐮𝐦𝐦𝐚𝐫𝐲:

● The global leisure travel market size reached USD 869.6 Billion in 2023.

● The market is expected to reach USD 1,639.4 Billion by 2032, exhibiting a growth rate (CAGR) of 7.08% during 2024-2032.

● Asia Pacific leads the market, accounting for the largest leisure travel market share.

● Group accounts for the majority of the market share in the traveler type segment due to…

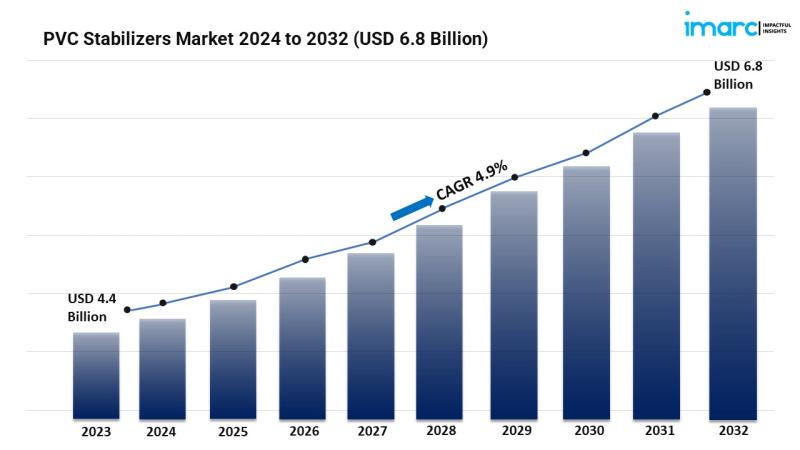

PVC Stabilizers Market Predicted to Exceed USD 6.8 Billion by 2032, Rising At A …

𝐆𝐥𝐨𝐛𝐚𝐥 𝐏𝐕𝐂 𝐒𝐭𝐚𝐛𝐢𝐥𝐢𝐳𝐞𝐫𝐬 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲: 𝐊𝐞𝐲 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐢𝐧 𝟐𝟎𝟐𝟒-𝟐𝟎𝟑𝟐

𝐒𝐮𝐦𝐦𝐚𝐫𝐲:

● The global PVC stabilizers market size reached USD 4.4 Billion in 2023.

● The market is expected to reach USD 6.8 Billion by 2032, exhibiting a growth rate (CAGR) of 4.9% during 2024-2032.

● Asia Pacific leads the market, accounting for the largest PVC stabilizers market share.

● Lead-based accounts for the majority of the market share in the type segment, as it…

Blueberries Prices, Demand, Historical and Forecast Data

𝐁𝐥𝐮𝐞𝐛𝐞𝐫𝐫𝐢𝐞𝐬 𝐏𝐫𝐢𝐜𝐞 𝐈𝐧 𝐔𝐒𝐀

𝐔𝐒𝐀:2763 USD/MT

In 2023, the price of blueberries in the United States reached 2763 USD/MT by December. Similarly, in China, the blueberries prices hit 2135 USD/MT in December 2023.

The latest report by IMARC Group, titled "𝐁𝐥𝐮𝐞𝐛𝐞𝐫𝐫𝐢𝐞𝐬 𝐏𝐫𝐢𝐜𝐞 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭 𝟐𝟎𝟐𝟒: 𝐏𝐫𝐢𝐜𝐞 𝐓𝐫𝐞𝐧𝐝, 𝐂𝐡𝐚𝐫𝐭, 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐍𝐞𝐰𝐬, 𝐃𝐞𝐦𝐚𝐧𝐝, 𝐇𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐚𝐧𝐝 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐃𝐚𝐭𝐚," provides a thorough examination of Blueberries Prices. This report delves into globally, presenting a detailed analysis, along with…

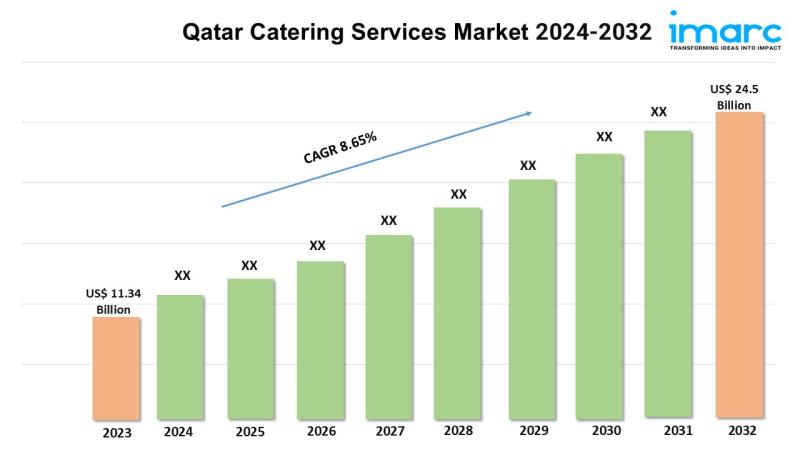

Qatar Catering Services Market Size to Surpass USD 24.5 Billion by 2032, exhibit …

According to the latest report by IMARC Group, titled "𝐐𝐚𝐭𝐚𝐫 𝐂𝐚𝐭𝐞𝐫𝐢𝐧𝐠 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐛𝐲 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐓𝐲𝐩𝐞 (𝐂𝐨𝐧𝐭𝐫𝐚𝐜𝐭𝐮𝐚𝐥 𝐂𝐚𝐭𝐞𝐫𝐢𝐧𝐠 𝐒𝐞𝐫𝐯𝐢𝐜𝐞, 𝐍𝐨𝐧-𝐜𝐨𝐧𝐭𝐫𝐚𝐜𝐭𝐮𝐚𝐥 𝐂𝐚𝐭𝐞𝐫𝐢𝐧𝐠 𝐒𝐞𝐫𝐯𝐢𝐜𝐞), 𝐄𝐧𝐝 𝐔𝐬𝐞𝐫 (𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐚𝐥, 𝐇𝐨𝐬𝐩𝐢𝐭𝐚𝐥𝐢𝐭𝐲, 𝐄𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧𝐚𝐥, 𝐇𝐞𝐚𝐥𝐭𝐡𝐜𝐚𝐫𝐞, 𝐈𝐧-𝐅𝐥𝐢𝐠𝐡𝐭, 𝐚𝐧𝐝 𝐎𝐭𝐡𝐞𝐫𝐬), 𝐚𝐧𝐝 𝐑𝐞𝐠𝐢𝐨𝐧 𝟐𝟎𝟐𝟒-𝟐𝟎𝟑𝟐," the report presents a thorough review featuring the Qatar catering services market growth, share, trends, and research of the industry.

The Qatar catering services market size reached 𝐔𝐒𝐃 𝟏𝟏.𝟑𝟒 𝐁𝐢𝐥𝐥𝐢𝐨𝐧 in 2023. Looking forward, IMARC Group…

More Releases for Takaful

Takaful Insurance Market Size, Growth, Sales Value and Forecast 2021-2027 By bu …

Allied Market Research published an exclusive report, titled, “Takaful Insurance Market By Distribution Channel (Agents & Brokers, Banks, Direct Response and Others), Type (Family Takaful and General Takaful), and Application (Personal and Commercial): Global Opportunity Analysis and Industry Forecast, 2021–2030”.

The takaful insurance market report offers a detailed analysis of prime factors that impact the market growth such as key market players, current market developments, and pivotal trends. The report includes…

Takaful Market 2019 Development Plan & Strategies by Islamic Insurance Company, …

Global Takaful Market 2019-2025: In 2018, the global Takaful market size was million US$ and it is expected to reach million US$ by the end of 2025, with a CAGR of during 2019-2025.

This report focuses on the global Takaful status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Takaful development in United States, Europe and China.

Get a Quick Sample Brochure report at…

Takaful Market 2019-Advance Technology |Global Industry Share, Growth, Revunes, …

Takaful Market 2019 Report analyses the industry status, size, share, trends, growth opportunity, competition landscape and forecast to 2025. This report also provides data on patterns, improvements, target business sectors, limits and advancements. Furthermore, this research report categorizes the market by companies, region, type and end-use industry.

Get Sample Copy of this Report@ https://www.researchreportsworld.com/enquiry/request-sample/13675493

Global Takaful market 2019 research provides a basic overview of the industry including definitions, classifications, applications…

Takaful Market By Key Players: JamaPunji, AMAN, Salama, Standard Chartered, Taka …

Takaful Industry Overview

Takaful is a Sharia-compliant Islamic insurance product, where members of the community contribute money or a part of their earnings to a pooling system that guarantees against any loss or damage. The underlying principle of takaful portrays the responsibility of each to cooperate and protect each other. The Takaful market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Takaful…

Future Innovations of Takaful Market Market – Top Key Vendors like Prudential …

Takaful is a Sharia-compliant Islamic insurance product, where members of the community contribute money or a part of their earnings to a pooling system that guarantees against any loss or damage. The underlying principle of takaful portrays the responsibility of each to cooperate and protect each other. The drivers of Takaful demand include high economic growth and increase in per capita GDP, a youthful demography, increasing awareness, a greater desire…

Etiqa Group and Takaful Malaysia awarded Best Motor Insurance and Best Motor Tak …

KUALA LUMPUR, 27th April 2018 - Etiqa Group and Syarikat Takaful Malaysia Bhd (Takaful Malaysia) emerged the winners at this year’s Motor Insurance Award 2018, an annual honour accorded to top conventional and takaful motor insurance companies in the country.

The conventional insurance winner is Etiqa Insurance Bhd, followed by Allianz Malaysia Bhd in second place, while Takaful Malaysia ties with Etiqa Takaful Bhd as winners in the motor takaful category.

Hosted…