Press release

Global Insurance Analytics Market Industry Size, Leading Players And Covid-19 Business Impact

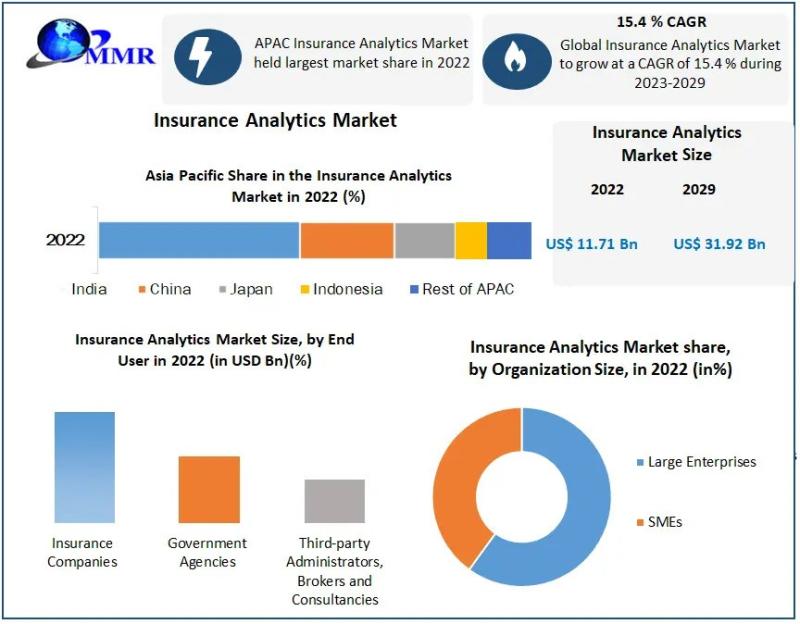

Insurance Analytics Market OverviewA popular tool in the insurance industry for risk management in pricing, rating, underwriting, marketing, claims, and reserving is insurance analytics. In addition to risk management, the analytic solution helps insurance companies to draft better insurance policies in the property, health, and life insurance markets. Increasing client satisfaction, cutting expenses, and properly applying predictive analytics to insurance models to generate more trustworthy and accurate reports for various product lines are some of the main responsibilities of the solution.

Insurance Analytics Market Report Scope and Research Methodology

The comprehensive analysis report offers valuable insights into the dynamics, trends, and future prospects of the Insurance Analytics industry during the forecast period. It covers key market drivers, challenges, and recent developments, along with demand trends, growth stimulators, spending patterns, and modernization trends across different regions.

The research is based on extensive research and analysis, incorporating inputs from industry experts, government agencies, and market participants, providing a reliable and accurate assessment of the market dynamics and future trends.

For in-depth information on this study, visit the following link: https://www.maximizemarketresearch.com/market-report/global-insurance-analytics-market/7775/

Insurance Analytics Market Dynamics

A vital part of the insurance industry is insurance analytics, which includes risk management, pricing, rating, underwriting, marketing, claims, and reserving. It makes it easier for insurance companies to draft more accurate insurance policies in sectors like property, health, and life insurance. This analytical solution's primary features include improving customer contact processes, cutting costs, and successfully utilising predictive analytics in insurance models to produce more accurate and trustworthy reports for a variety of product lines. Insurance analytics enables technology and infrastructure to process and analyse data, resulting in the ability to make well-informed decisions. Businesses are advised to update their antiquated business models, optimise operations, and improve procedures in this fiercely competitive industry.

The insurance industry's rapid digitalization and the expanding use of advanced analytics and data-driven decision-making procedures have a major impact on market dynamics. Predictive analytics and insurance claims analytics are becoming more and more popular among small and medium-sized enterprises, and the insurance analytics market is poised for significant growth as a result of the Internet of Things. However, obstacles include a lack of skilled workers, resistance to using insurance analytics, and worries about data security and privacy could hinder industry expansion. Over the last four years, the financial effect of cybercrime has almost doubled due to the ongoing evolution and expansion of cyber threats.

Insurance Analytics Market Segmentation

by Component

Tools

Services

by Application

Claims Management

Risk Management

Customer Management and Personalization

Process Optimization

Others

The worldwide insurance analytics market is divided into several segments based on the kind of application, including Claims Management, Risk Management, Customer Management and Personalisation, Process Optimisation, and Others. In 2022, the segment with the biggest market share was risk management. Institutional investors can get an automated result for improved decision-making by using insurance analytics for risk management. Additionally, it reveals a hidden trend in the data and offers perceptions into impending dangers, enabling insurers to take preventative measures against risk. The demand for the risk management market will be fueled by these factors. In order to predict possible market risks and put countermeasures in place to reduce losses, insurers must appropriately use their data to advance industry development. The growing need for data leveraging is anticipated to propel the market even further.

by Deployment Mode

Cloud

On-premises

by Organization Size

Large Enterprises

SMEs

by End-User

Insurance Companies

Government Agencies

Third-party Administrators, Brokers and Consultancies

Insurance Analytics Market Key Players

1. SAPiens International

2. Palantir

3. Lexisnexis

4. Tibco Software

5. Birst Applied Systems

6. Board International

7. Mitchell International

8. Bridgei2i

9. Qlik Prads Inc.

10. Vertafore

11. Microsoft

12. SAP

13. Oracle

14. Salesforce

15. SAS Institute

16. Opentext

17. Tableau Software

18. Verisk Analytics

19. Pegasystems

20. Guidewire

21. Hexaware

22. Microstrategy

Sample Request For Insurance Analytics Market: https://www.maximizemarketresearch.com/request-sample/7775

Table of content for the Insurance Analytics Market includes:

Part 01: Executive Summary

Part 02: Scope of the Insurance Analytics Market Report

Part 03: Global Insurance Analytics Market Landscape

Part 04: Global Insurance Analytics Market Sizing

Part 05: Global Insurance Analytics Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

To Learn More About This Study, Please Click Here: https://www.maximizemarketresearch.com/request-sample/7775

Regional Insights:

In the global Insurance Analytics market, Asia Pacific accounted for the greatest share in 2022 and is predicted to rise at the highest CAGR of 8.61% over the course of the forecast period. The rapidly developing economies in this region, the involvement of a young, tech-savvy population, the rise in discretionary income, the quick development of infrastructure, the increasing use of smartphones and cloud computing, government support for economic progress, and a growing awareness of social responsibility and the environment are the main causes of this region's rapid growth.

Our Top Trending Reports:

Baby Changing Station Market: https://www.maximizemarketresearch.com/market-report/baby-changing-station-market/146312/

Disposable Electric Toothbrushes Market: https://www.maximizemarketresearch.com/market-report/disposable-electric-toothbrushes-market/146316/

Deodorant Stick Market: https://www.maximizemarketresearch.com/market-report/deodorant-stick-market/146847/

Global Upstream Petrotechnical Training Services Market: https://www.maximizemarketresearch.com/market-report/global-upstream-petrotechnical-training-services-market/41423/

Bath Towel Market: https://www.maximizemarketresearch.com/market-report/bath-towel-market/195327/

HDPE Ball Valves Market: https://www.maximizemarketresearch.com/market-report/hdpe-ball-valves-market/199746/

Smart Robot Market: https://www.maximizemarketresearch.com/market-report/smart-robot-market/2317/

Foam Market: https://www.maximizemarketresearch.com/market-report/foam-market/122498/

Farm Tractors Market: https://www.maximizemarketresearch.com/market-report/global-farm-tractors-market/79236/

Cereal Ingredients Market: https://www.maximizemarketresearch.com/market-report/global-cereal-ingredients-market/118058/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Analytics Market Industry Size, Leading Players And Covid-19 Business Impact here

News-ID: 3519668 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

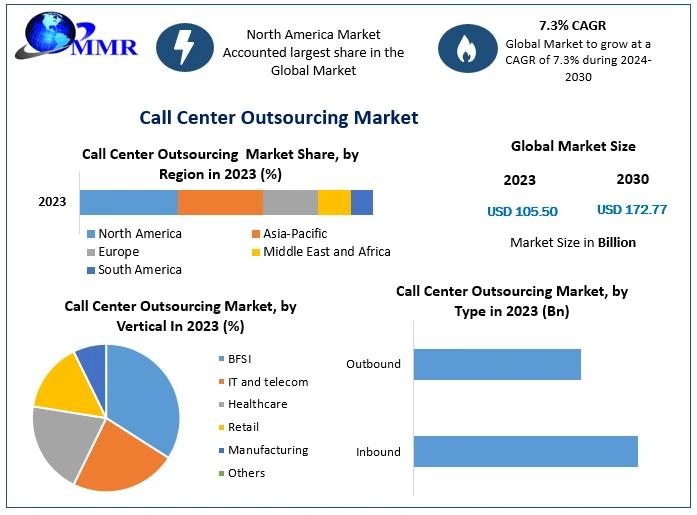

Call Center Outsourcing Market is expected to show growth from 2024 to 2030, rep …

The Call Center Outsourcing Market size is valued at USD 105.50 Billion in 2023 and is forecast to grow at a CAGR of 7.3% from 2024 to 2030, reaching nearly USD 172.77 Billion.

𝐂𝐚𝐥𝐥 𝐂𝐞𝐧𝐭𝐞𝐫 𝐎𝐮𝐭𝐬𝐨𝐮𝐫𝐜𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

The Call Center Outsourcing Market involves companies outsourcing their customer service and support functions to external service providers. This arrangement allows organizations to delegate customer interactions to specialized call centers, enabling them to focus…

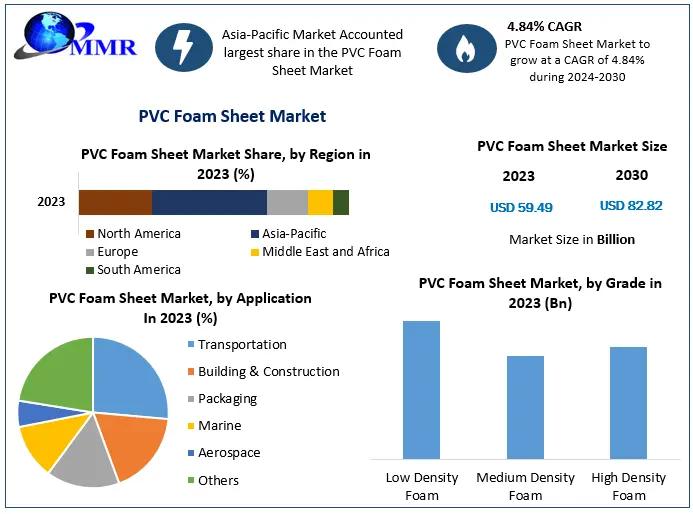

PVC Foam Sheet Market is expected to show growth from 2024 to 2030, reported by …

Global PVC Foam Sheet Market size is expected to reach 82.82 US$ Bn in year 2030, at a CAGR of 4.84 % during the forecast period.

𝐏𝐕𝐂 𝐅𝐨𝐚𝐦 𝐒𝐡𝐞𝐞𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

The manufacturing process of PVC foam sheet material is more difficult than the other materials which are used to produce foams and the materials are consequently higher priced. The PVC foam is used for several applications such as signs, displays, wall…

Tanker Shipping Market is expected to show growth from 2024 to 2030, reported by …

Tanker Shipping Market is expected to grow at a CAGR of 6% during the forecast period. Tanker Shipping Market is expected to reach US$ 5.02 Bn. by 2030.

𝐓𝐚𝐧𝐤𝐞𝐫 𝐒𝐡𝐢𝐩𝐩𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

Tanker shipping involves the transportation of bulk chemicals, crude oil, and refined products via large sea carriers, offering an economical solution for fluid transport worldwide. Growth in global commodity trading and economic expansion over the past decade are driving the…

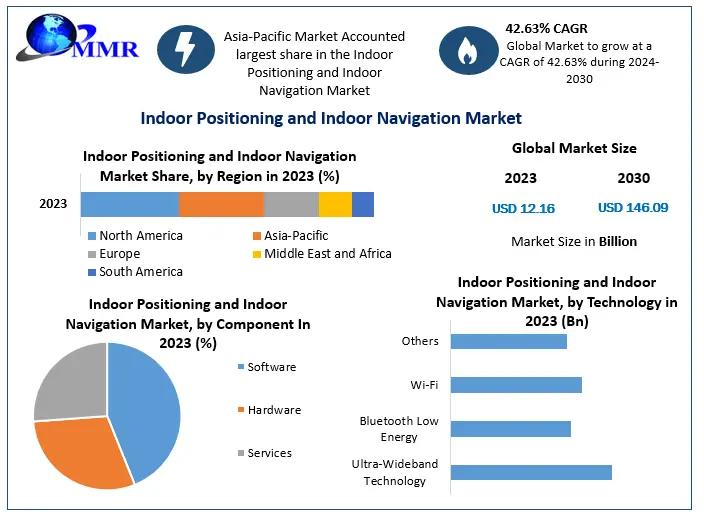

Indoor Positioning and Indoor Navigation Market is expected to show growth from …

Indoor Positioning and Indoor Navigation Market was valued at US$ 12.16 Bn in 2023 and is expected to reach US$ 146.09 Bn by 2030, at a CAGR of 42.63% during forecast period.

𝐈𝐧𝐝𝐨𝐨𝐫 𝐏𝐨𝐬𝐢𝐭𝐢𝐨𝐧𝐢𝐧𝐠 𝐚𝐧𝐝 𝐈𝐧𝐝𝐨𝐨𝐫 𝐍𝐚𝐯𝐢𝐠𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

Advanced indoor positioning and indoor navigation devices and solutions confirm better connectivity, access, and indoor navigation. Moreover, these devices and solutions will improve customer privacy and is estimated to bring in advancement…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…