Press release

China's GDP Surprises on Buoyant Demand

Economists are becoming more positive on this year's economic prospects.Image: https://www.getnews.info/uploads/00fca63e211ffb8a1956472d8f5965db.jpg

In its April World Economic Outlook (WEO), the IMF now forecasts aggregate GDP growth to reach 3.2 percent this year, up 0.3 percentage points from its October projection. The Fund describes the global economy as "surprisingly resilient [https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook-april-2024?cid=ca-com-homepage-SM2024]" for the way in which it has continued to grow despite the higher interest rates needed to rein in inflation.

In this vein, China's National Bureau of Statistics (NBS) provided better-than-expected economic news when it released its National Accounts [https://www.stats.gov.cn/english/PressRelease/202404/t20240416_1954583.html] for the first quarter. China's GDP grew by 5.3 percent year-over-year beating the 5.0 percent forecast of the Chief Economists surveyed [https://www.cbnri.org/news/5446560.html] by the Yicai Research Institute.

While growth in Q1 was similar to last year's outturn (5.2 percent), its composition was quite different (Figure 1). Most importantly, net exports were a drag on growth in 2023, but they contributed positively in Q1. On the other hand, investment's contribution dropped significantly while consumption's was slightly smaller.

Figure 1

Image: https://www.getnews.info/uploads/d49baf566bd64f305ffb6aba2759fe0c.png

GDP growth in Q1 was even more impressive when looked at on a quarter-over-quarter basis (Figure 2). The 1.6 percent growth recorded in Q1 was well above the average of last year's quarterly rates. Quarterly growth of 1.6 percent translates into 6.6 percent at annual rates. With most estimates of China's potential growth in the 4.5 to 5.5 percent range, Q1's strong performance likely narrowed China's excess supply gap [https://www.yicaiglobal.com/opinion/mark.kruger/the-macroeconomic-takeaways-from-chinas-two-sessions].

Figure 2

Image: https://www.getnews.info/uploads/48751ebfeec458a77ce1483443433e6d.png

In dollar terms, China's exports were up 1.5 percent in the first quarter, compared to a 1.9 percent fall in the same period a year ago. China's exports to the US continued to fall but the decline this year (-4 percent) was significantly smaller than last year (-17 percent). It appears that robust demand in the US is, to some extent, offsetting the effects of the tariffs on its imports from China.

On a 12-month average basis, China's exports are down 6 percent from their September 2022 peak (Figure 3). Nevertheless, they are up by more than a third from their pre-pandemic level. China's ability to maintain competitive export levels even as its GDP growth has decelerated has led to the narrative that it is "exporting its over-capacity". However, looking at the structure of China's economy, it is difficult to find a factual basis for this story.

Figure 3

Image: https://www.getnews.info/uploads/4b4e83b55a93a5d131a744c35597255b.png

China does not export a particularly high share of its output. In recent years, China's merchandise exports have been below a fifth of its GDP. This is about half as much as Germany and Korea and pretty close to Japan's share.

But merchandise exports are only part of the trade story. Imports are often a crucial component of a country's ability to export. Moreover, trade in services has become increasingly important. Economists like to look at the ratio of the current account balance to GDP as the most comprehensive measure of a country's external position.

Looking at the data this way, there is nothing unusual about China's economy. In recent years, its current account surplus has been around 2 percent of GDP - a smaller ratio than in Germany, Korea and Japan (Figure 4).

Figure 4

Image: https://www.getnews.info/uploads/4d5c2a51be81328b48c07444c2620a68.png

China has rapidly become competitive in high-value-added markets like autos. But its emergence as an auto-exporting power is not unique, rather it is reminiscent of Japan's experience in the 1980s and Korea's in the 2010s.

What makes China stand out is not the structure of its economy but its size. Because China is so large, the evolution of its economy can have disruptive effects on its trading partners. The fear of China flooding the world with its products is an old story too. Indeed, in acceding to the WTO, China had to accept unique rules [https://www.nber.org/system/files/working_papers/w13349/w13349.pdf] that allowed its trading partners to protect their markets by restricting the amount China could export.

The Chinese economy is driven by domestic demand. As Figure 1 shows, domestic demand accounted for 85 percent of GDP growth in Q1, with consumption making the largest contribution.

In Q1, consumption was supported by both strong income growth and a decline in the savings rate. Although it has fallen well below its 2020 peak, the household savings rate remains more elevated than pre-pandemic levels (Figure 5). This means that there is still scope for household confidence to reduce precautionary savings and fuel consumption as the year progresses.

Figure 5

Image: https://www.getnews.info/uploads/1548b2fd2cfb6778988a414b1ed7d2ab.png

Adjusting for CPI inflation, retail sales in the first quarter grew more rapidly than in the same period a year ago. However, their growth was still much slower than in 2019Q1 (Figure 6). The weakness seems confined to the goods category, as lodging and catering sales this year grew more rapidly than pre-pandemic rates.

Figure 6

Image: https://www.getnews.info/uploads/547e2cacf242d462ae215d4bb84b6f7a.png

The Chinese consumer's willingness to spend on travel continued in the second quarter. The Ministry of Tourism and Culture reported that travel and spending for the Qing Ming (Tomb Sweeping) Festival exceeded pre-pandemic levels by significant amounts (Figure 7).

Figure 7

Image: https://www.getnews.info/uploads/7e18dc5c55371c19af15ca217fa7fc4c.png

The strong consumption of these services - which appear to be discretionary rather than necessary - suggests that household confidence is intact. I believe that much of the sluggishness in goods consumption stems from the weakness in the property market.

Within the goods category, autos remain a bright spot (Figure 8). Year-to-date, sales are 11 percent higher than in January-March 2023. Almost all of the growth came from purchases of New Energy Vehicles (NEVs), which were up 28 percent year-over-year in Q1. Sales of passenger cars with internal combustion engines were only up 2 percent. In March, NEVs accounted for 40 percent of the passenger cars sold, up from a third in March 2023.

Figure 8

Image: https://www.getnews.info/uploads/e28a5af76abdcad9f74e389280436ef6.png

While the economy, in general, looks pretty good, conditions in the property market continue to deteriorate. New home sales fell to 189 million square meters in the first quarter, down 28 percent from last year (Figure 9). Starts of new homes fell by a similar percentage to a level not seen since the first quarter of 2005.

Figure 9

Image: https://www.getnews.info/uploads/802066ed4031988fff25b48ea4b70bcb.png

Housing inventories have continued to rise. At close to 5.5 months of sales, they have exceeded the peak of the 2015-16 cycle (Figure 10).

Figure 10

Image: https://www.getnews.info/uploads/cd9e393edad064fd6469c779ba4a3a68.png

Sheng Laiyun, the NBS's Deputy Director, explained that the three major projects - building affordable housing, constructing public infrastructure and transforming urban villages - have been effective in boosting real estate development. Moreover, various regions have implemented supportive policies including easing purchase restrictions and lowering provident fund interest rates.

Looking ahead, Sheng noted that the rapid expansion of real estate experienced over the past 20 years may not be sustainable. Nevertheless, continued urbanization and upgrading of living conditions, as incomes continue to rise, will underpin the property market's healthy development.

Fixed asset investment (FAI) increased by 4.5 percent in the first quarter, somewhat more slowly than the 5.1 percent recorded in January-March 2023 (Figure 11). Last year, FAI growth slowed steadily and dropped to 3 percent for the year as a whole. This year, there has been an encouraging rebound in investment in the manufacturing sector, which is up close to 10 percent year-over-year.

Figure 11

Image: https://www.getnews.info/uploads/815daebaed8a54f4b8bf99a8899da347.png

As a result of the weakness in the property market, real estate's share of overall FAI fell from close to 29 percent in 2020-21 to 22 percent last year - the same share as in 2010 (Figure 12).

Figure 12

Image: https://www.getnews.info/uploads/2a1e8481af231ffb02576021cc899fc4.png

Less economic activity devoted to real estate could be good for China's long-run development. And, while the prices of homes have fallen, housing in China remains expensive by international standards. The first quarter's data suggests that the transition to less real estate in GDP can be achieved without sacrificing growth. The challenge will be to maintain this pattern of development over the next several quarters.

In its April WEO, the IMF predicts that the Chinese economy will only grow by 4.6 percent this year. I wonder if the strong start in Q1 will encourage the Fund to revise up its projection. The IMF has been quite bearish on China's prospects. Last April, the Fund predicted that China's growth would only reach 4.5 percent in 2023. In the event, the economy grew by 5.2 percent (Figure 13).

While economic forecasting is difficult, I wonder if the IMF's errors are telling us something.

Figure 13

Image: https://www.getnews.info/uploads/969290193fc0c2fd33cec57754a28296.png

Media Contact

Company Name: Yicai Media Group

Contact Person: Zhu Liming

Email: Send Email [http://www.universalpressrelease.com/?pr=chinas-gdp-surprises-on-buoyant-demand]

Country: China

Website: https://www.yicaiglobal.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release China's GDP Surprises on Buoyant Demand here

News-ID: 3487898 • Views: …

More Releases from Getnews

Porcelain and Fiberglass Maintenance, Inc. Celebrates 69 Years of Excellence in …

Image: https://www.getnews.info/wp-content/uploads/2024/05/1716964844.jpeg

Porcelain and Fiberglass Maintenance, Inc., Southern California's premier bathtub refinishing company, proudly celebrates 69 years of unparalleled service in bathtub reglazing, countertop refinishing, and more.

Los Angeles, CA - May 29, 2024 - Established in 1955, Porcelain and Fiberglass Maintenance, Inc. is the oldest refinishing company in the nation. This family-owned business continues to lead the industry with its unwavering commitment to quality and customer satisfaction, excelling in the restoration…

Atlantbh Implements AI To Streamline Client's Customer Service

Image: https://www.getnews.info/uploads/1d7d5a4adacbd43f1d131b91f25c2196.jpg

In today's dynamic market, businesses strive to stay ahead. Utilizing the power of Artificial Intelligence (AI) is no longer an option but a strategic necessity. For the past seven years, Atlantbh, a software development company, has assisted international clients in enhancing efficiency and refining operations through cutting-edge AI technologies.

"A few years back, we used AI to analyze text and extract common business attributes, such as business category, address, and…

Wirestork.com Tackles UAE Debt Surge with Travel Ban Checks and comprehensive Le …

Image: https://www.getnews.info/wp-content/uploads/2024/05/1716947078.png

Wirestork.com - Rising Consumer Debts in UAE

Wirestork.com, a leading travel ban check company in the GCC, is addressing the rising concerns of consumer credit and debt in the UAE. Recent data shows a significant increase in consumer credit, which has climbed to AED 415,649 million in Q3 2023 from AED 402,640 million in the previous quarter. This sharp rise highlights an urgent issue requiring effective solutions.

Dubai, UAE…

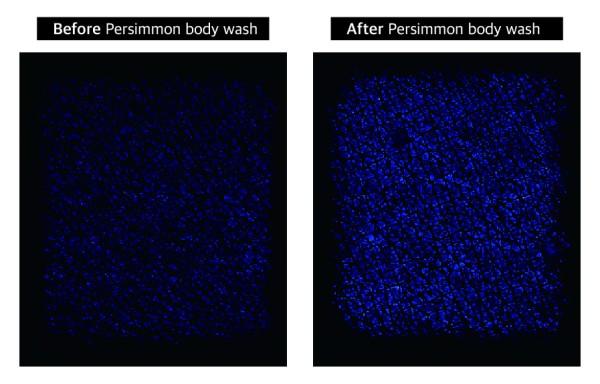

Meditold Research Institute "Persimmon Body Soap treats Elderly Odor in a Short …

Image: https://www.getnews.info/uploads/c3fbbf035c1cbbea81821a3aafd01747.jpg

Meditold Research Institute has announced the results of a human body application test of persimmon body soap with body odor care technology.

On the test, conducted by the Korea Institute of Dermatology, was conducted in men and women aged 41 to 63 years old in relation to the effectiveness of improving skin moisture loss, cleaning sebum, relieving itching caused by drying, and relieving armpit odor.

An official from the Meditold Institute…

More Releases for Figure

Floralite - Reduce Fat & Get Attractive Figure How To Buy!

Floralite Have you been working on your eating routine without seeing the results that you are anticipating? There is indeed thing called Floralite diet pills.

Advantages of Floralite

Floralite One of various things to esteem about this thing is that it's made expressly for the Floralite diet. That is an epic notwithstanding considering the way that when you use a thing that is custom fitted to work with the movements…

THE WORLD'S MOST CONTROVERSIAL ACTION FIGURE...EVER!

FOR IMMEDIATE RELEASE

THE WORLD'S MOST CONTROVERSIAL ACTION FIGURE...EVER!

Contact: William Hirsch - Schlock Toys @ +1-949-677-9353 or DocSchlock@SchlockToys.com

Featured on Tomi with Fox News host Tomi Lahren! SCHLOCK TOYS join forces with Kickstarter to Make Toys Great Again!

The Kickstarter campaign page can be found HERE: https://www.kickstarter.com/projects/schlocktoys/collectors-edition-talking-trump-2020-man-of-action-figure/description

“What a great message to be sent, and I think Trump himself would love this and that he’d be excited about it!”

- Tomi Lahren, Fox News

“You…

Macarons Market Latest Sales Figure Signals More Opportunities Ahead

Global Macarons Sales Market(Sales,Revenue and competitors Analysis of Major Market)from 2014-2026 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Macarons Market. Some of the key players profiled in the study are La Dure�,…

Global Womens Figure Skates Market Growth 2019-2024

LP INFORMATION offers a latest published report on Womens Figure Skates Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

According to this study, over the next five years the Womens Figure Skates market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2024, from US$ xx million in 2019.…

Figure Skating Equipment Market Report 2018: Segmentation by Type (Figure Skate …

Global Figure Skating Equipment market research report provides company profile for SP-Teri, Graf Skate, Riedell Shoes, Roces, American Athletic, Rollerblade, Winnwell, Dongguan King Line, Jackson Ultima, HD Sports(MK Blades, John Wilson), Edea, Risport Skates, Paramount Skates and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY…

Long-lasting Performance Improvement with Key Figure Analysis

Vienna/Reutlingen, October 17, 2012 – Manz, a leading high-tech mechanical engineering company, is optimizing its processes in strategic sourcing in order to recognize the risks and potential associated with each supplier early on so that the sourcing department can react to them in time. POOL4TOOL’s customized eSolutions localize and analyze key figures that are relevant to the decision making process, and displays these figures in a comprehensive and transparent way.…