Press release

High Purity Alumina Market Size, Share, Trends, Growth And Forecast To 2032

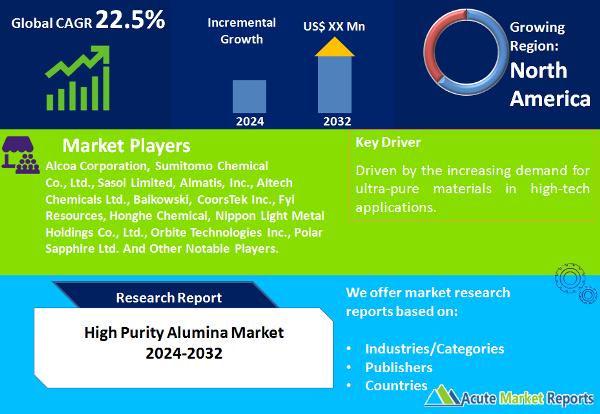

High Purity Alumina Market By Product (4N, 5N, 6N), By Application (LED, Semiconductor, Phosphor, Sapphire, Lithium-ion Batteries, Others) - Growth, Share, Opportunities & Competitive Analysis, 2024 - 2032Demand for ultra-pure materials in high-tech applications is anticipated to propel the high purity alumina market [https://www.acutemarketreports.com/report/high-purity-alumina-market] to expand at a CAGR of 22.5% during the forecast period of 2024-2032. The three catalysts-increasing adoption in LED manufacturing, expanding use in lithium-ion batteries, and rising demand for 6N HPA-establish the adaptable nature and pivotal function of HPA in propelling diverse sectors forward. Nevertheless, the market encounters obstacles stemming from the restricted accessibility of premium raw materials, thereby underscoring the imperative for sustainable supply chain methodologies and inventive resolutions. The comprehensive market segmentation analysis offers a nuanced comprehension of product inclinations and patterns of usage, whereas the geographic segmentation underscores the impact of regional factors on market expansion. Key industry participants who are influencing competitive trends do so with an emphasis on strategic initiatives to preserve their market dominance. It is anticipated that technological advancements, expanded production capacities, and strategic alliances will sustain market growth for high-purity alumina between 2024 and 2032. The dynamic character of the market, in conjunction with regional variations, presents industry participants with a global environment in which to operate and take advantage of emerging prospects.

Key Market Drivers

The market for high purity alumina is expanding significantly, driven primarily by the rising demand for 6N HPA. 6N HPA, which has an exceptionally high purity level of 99.9999%, is an indispensable constituent in a multitude of high-tech applications. Sumitomo Chemical Co., Ltd. and Altech Chemicals Limited, among others, are indispensable in satisfying this demand. In 2023, 6N HPA exhibited the highest Compound Annual Growth Rate (CAGR) and emerged as the dominant product category in terms of revenue for the period spanning 2024 to 2032, as projected. The increase in demand for 6N HPA in sectors such as LED manufacturing, semiconductor fabrication, and lithium-ion batteries-where purity is critical for optimal operation-is responsible for this expansion.

An additional noteworthy catalyst for the growth of the HPA market is the increasing utilization of HPA in the manufacturing of light-emitting diodes (LEDs). As demonstrated by the fact that it provides the substrate required for the production of LEDs, HPA has evolved into an indispensable substance. Prominent corporations such as Nippon Light Metal Holdings Company, Ltd. and Alcoa Corporation contribute actively to this trend. The LED application segment exhibited the highest anticipated CAGR throughout the forecast period and ranked first in terms of revenue in 2023. This underscores the growing prevalence of light-emitting diodes (LEDs) across a range of illumination applications and confirms HPA's critical function in guaranteeing the excellence and effectiveness of LED components.

The rising demand for HPA on the market is a result of its expanding application in lithium-ion batteries. As demonstrated by its application as a coating material on lithium-ion battery separator sheets, HPA improves battery performance and safety. Sasol Limited and Orbite Technologies Inc. are among the organizations actively engaged in addressing this expanding market need. The significant revenue generated by the Lithium-ion Batteries application segment in 2023 highlights HPA's critical contribution to the advancement of battery technologies. In addition, the segment is anticipated to experience the highest CAGR throughout the forecast, indicating substantial expansion. This driver underscores the critical significance of HPA in responding to the worldwide transition towards electric vehicles and renewable energy storage.

Browse for the report at : https://www.acutemarketreports.com/report/high-purity-alumina-market

Key Market Restraint

Notwithstanding the favorable factors propelling growth, a significant impediment to the high purity alumina industry is the restricted accessibility of premium raw materials. The constraints imposed by the difficulties in obtaining and refining bauxite or aluminum oxide to attain elevated purity levels serve as tangible indications of the difficulties that market participants encounter in this regard. Organizations engaged in this sector, such as Baikowski SAS and Rusal, encounter the challenge of maintaining a steady provision of raw materials that satisfy the rigorous standards of purity. Sector participants are allocating resources toward research and development endeavors aimed at investigating alternative sources and extraction methods as a reaction to this limitation. To ensure the high purity alumina market's sustained stability and expansion, the significance of establishing sustainable supply chains is heightened by the scarcity of premium raw materials.

Segmentation Analysis of the Market

Product-by-Product: 6N HPA Is the Market Leader

Market segmentation is achieved through the differentiation of product categories, which includes 4N, 5N, and 6N high purity alumina. 6N HPA maintained its revenue and CAGR leadership position throughout the forecast period in 2023. This highlights its preeminence as the material of choice for applications that demand absolute purity, including the fabrication of LEDs, semiconductors, and lithium-ion batteries. Concurrently, the 4N and 5N classifications accommodate particular industrial purposes by offering a variety of purity alternatives to satisfy varied market demands.

Market Segmentation by Application: The LED Application Sector Controls the Market

The demand for HPA in various industries, including LED, semiconductor, phosphor, sapphire, lithium-ion batteries, and others, is delineated through application-based segmentation. Revenue-wise, the LED application segment dominated in 2023, a result of the expanding use of HPA in LED manufacturing to improve performance and durability. Concurrently, the highest CAGR was observed in the Lithium-ion Batteries segment, which signifies the increasing significance of HPA in the progression of battery technologies. This intricate segmentation accommodates the wide range of implementations of HPA in numerous high-tech sectors, thereby offering valuable insights into particular market trends.

Get Free Sample Copy From https://www.acutemarketreports.com/request-free-sample/140219

The North America Continues to Be the Global Leader

By identifying regions with the highest CAGR and revenue percentage in the high purity alumina market, the geographic segment conducts trend analysis. Asia-Pacific is anticipated to experience the maximum compound annual growth rate (CAGR) during the period from 2024 to 2032. This is primarily due to the region's burgeoning industrialization, technological progress, and rising need for high-purity materials. It is anticipated that North America will continue to generate the highest revenue percentage due to the significant presence of key market participants and their strategic research and development investments. The aforementioned geographic patterns highlight the worldwide scope of the HPA market, wherein fluctuations in regional factors exert an impact on market expansion.

Increasing Production Capacity Continues to Be the Principal Strategy of Leading Companies

The competitive trends observed in the high purity alumina market shed light on the strategies of significant participants and offer a comprehensive assessment of the industry's terrain. Leading actors in the industry in 2023 included Alcoa Corporation, Sumitomo Chemical Co., Ltd., Sasol Limited, Almatis, Inc., Altech Chemicals Ltd., Baikowski, CoorsTek Inc., Fyi Resources, Honghe Chemical, Nippon Light Metal Holdings Co., Ltd., Orbite Technologies Inc., and Polar Sapphire Ltd., all of which capitalized on their specialized knowledge in aluminum refining, chemical processing, and strategic alliances. These actors have implemented several crucial strategies, which encompass augmenting production capacities, ensuring a sustainable supply chain, and investigating novel applications for HPA. Enhanced investments in research and development, technological advancements, and collaborative ventures are anticipated to proliferate in the competitive environment between 2024 and 2032, as organizations strive to capitalize on emergent market trends and maintain a competitive advantage.

Most Popular Reports From Materials Category: https://www.acutemarketreports.com/category/advanced-materials-market

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=high-purity-alumina-market-size-share-trends-growth-and-forecast-to-2032]

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: http://www.acutemarketreports.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release High Purity Alumina Market Size, Share, Trends, Growth And Forecast To 2032 here

News-ID: 3474076 • Views: …

More Releases from ABNewswire

Schneider Electric outperforms 2023 sustainability targets and maintains its lea …

Schneider Electric, the leader in the digital transformation of energy management and automation, announced today its 2023 sustainability impact performance as part of its full-year financial results. The Schneider Sustainability Impact score for the year exceeded expectations, reaching 6.13 out of 10, and surpassing the year-end target of 6 out of 10. Schneider Electric was also recognized as a top performer by independent environmental, social, and governance (ESG) ratings throughout…

Sustainability Business Division of Schneider Electric Responds to Cybersecurity …

- Incident limited to Sustainability Business division

- No impact on any other Schneider Electric entity

- Access to business platforms reopened on January 31, 2024

- Certain data from Sustainability Business was obtained by threat actor

Note: the following statement was published on January 29, 2024, and updated on Feb. 1st and Feb. 19th, 2024. Latest update was issued to inform that certain data from Sustainability Business was obtained by the threat actor.

On…

Schneider Group-owned Lauritz Knudsen to invest Rs 850 crore in 3 years

L&T Switchgear, the electrical and automation arm of L&T, which Schneider Electric acquired in 2020, is rebranded as Lauritz Knudsen

Lauritz Knudsen, owned by Schneider Electric Group, aims to strategically invest approximately Rs 850 crore over the next three years to establish itself as a significant player in India's rapid growth trajectory in the electrical sector.

In 2020, Schneider Electric acquired L&T Switchgear, Larsen & Toubro's electrical and automation business, for Rs…

Schneider Electric launches EcoStruxure Trademark Plant Lean Management boosting …

- New, ready-to-use solution speeds up industrial digitalization.

- Plant data empowers shop floor workers and improves site performance.

- Hardware agnostic software runs on AVEVA Trademark Data Hub platform.

Schneider Electric, the leader in the digital transformation of energy management and automation, today launched EcoStruxure Plant Lean Management, a digital solution that collects and aggregates data across industrial operations to develop key performance indicators (KPIs) for short interval management (SIM) meetings, where…

More Releases for HPA

Global High Purity Alumina (HPA) Market - Forecast to 2026

Based on the GME prediction the Global High Purity Alumina (HPA) Market will expand with a CAGR value of 18.05% from 2021 to 2026. The factors like rising government interventions in increasing the demand for LEDs within countries, encouraging cost-effective and efficient utilization of resources, changing preferences of the user base, more demand for user-friendly and economical options, increasing awareness about the usefulness of LEDs are supporting the market growth…

HPA Coated Battery Separator Market Size, Share, Development by 2024

Global Info Research offers a latest published report on HPA Coated Battery Separator Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global HPA Coated Battery Separator players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the HPA Coated Battery…

Global High Purity Alumina (HPA) Market Outlook 2019-2024 by Valuates Reports

Latest Updates on High Purity Alumina Market

Aluminium (also spelled aluminum) is a chemical element with the symbol Al and atomic number 13. It is a silvery-white, soft, non-magnetic and ductile metal in the boron group.

The 'Global High Purity Alumina (HPA) Market Outlook 2019-2024' offers detailed coverage of high purity alumina industry and presents main market trends. The market research gives historical and forecast market size, demand, end-use details, price trends,…

Global MilSatCom and HPA Collaborate on Hosted Payload Workshop

The Hosted Payload Alliance (HPA) and SMi Group, the producer of Global MilSatCom, are working together to offer HPA’s Global Government Payload Exploration workshop again at Global MilSatCom 2017, after officials from more than a dozen countries and organizations attended the workshop at Global MilSatCom 2015. The pre-conference workshop will take place November 6, 8:30 a.m. – Noon, at the Park Plaza Riverbank Hotel in London.

“HPA would like to…

High Purity Alumina (HPA) Market to Expand with Significant CAGR | 2021

Persistence Market Research (PMR), delivers key insights on the High Purity Alumina (HPA) Market in its latest report titled “Global Market Study on High Purity Alumina (HPA): High Demand for LED's and Displays to Drive Growth During 2015-2021.” According to the report, the global HPA market was valued at US$ 1.2 Bn in 2014 and is projected to expand at a CAGR of 6.9% during the forecast period to reach…

High Purity Alumina (HPA) Market to Record an Exponential CAGR by 2021

Persistence Market Research (PMR), delivers key insights on the High Purity Alumina (HPA) Market in its latest report titled “Global Market Study on High Purity Alumina (HPA): High Demand for LED's and Displays to Drive Growth During 2015-2021.” According to the report, the global HPA market was valued at US$ 1.2 Bn in 2014 and is projected to expand at a CAGR of 6.9% during the forecast period to reach…