Press release

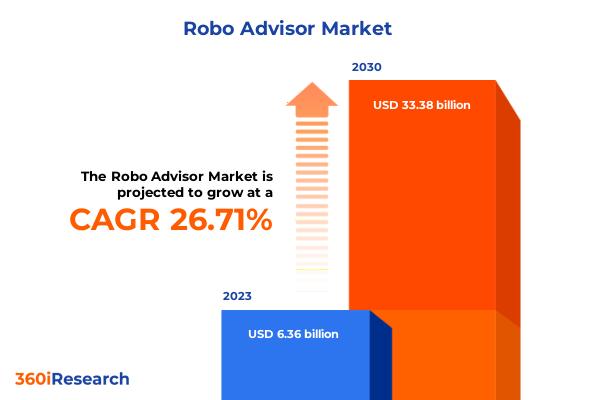

Robo Advisor Market worth $33.38 billion by 2030, growing at a CAGR of 26.71% - Exclusive Report by 360iResearch

The "Robo Advisor Market by Business Model (Hybrid Robo Advisors, Pure Robo Advisors), Provider (Banks, Fintech Robo Advisors, Traditional Wealth Managers), Service Type, End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Robo Advisor Market to grow from USD 6.36 billion in 2023 to USD 33.38 billion by 2030, at a CAGR of 26.71%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/robo-advisor?utm_source=openpr&utm_medium=referral&utm_campaign=sample

A robo advisor is a digital platform offering automated financial planning and investment management services. Robo advisors provide users with personalized investment advice, portfolio recommendations, and asset management solutions at a significantly lower cost compared to traditional human financial advisors. The expansion of financial sectors and the increasing popularity of online trading as a source of income among individuals worldwide are accelerating the use of robo-advisors. Additionally, growing digitization in financial services has increased the need for efficient wealth management solutions, further propelling the demand for robo advisors. However, limited customization options and lack of flexibility can refrain customers from adopting robo advisor services. The ongoing advancements in robo advisors to improve their performance and user experience are expected to encourage their adoption by end users worldwide.

Evolving technology, increasing demand for digital financial services, and growing millennial population have contributed to the elevated demand for robo advisors in the Americas. The APAC is witnessing rapid adoption of robo advisory platforms due to the surging internet penetration rate and central banks encouraging digital innovation in finance. Steady growth in the adoption of robo advisory solutions due to the robust regulatory frameworks that promote transparency and investor protection measures alongside investment in fintech and digital solutions by financial institutions are expanding the usage of robo advisors in the EMEA region. Furthermore, the development of fully integrated robo advisors and the introduction of hybrid models combining human expertise with digital efficiency is anticipated to encourage the adoption of robo advisors by end-users across the globe.

Market Segmentation & Coverage:

This research report categorizes the Robo Advisor Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Business Model, market is studied across Hybrid Robo Advisors and Pure Robo Advisors. The Pure Robo Advisors is projected to witness significant market share during forecast period.

Based on Provider, market is studied across Banks, Fintech Robo Advisors, and Traditional Wealth Managers. The Banks is projected to witness significant market share during forecast period.

Based on Service Type, market is studied across Comprehensive Wealth Advisory and Direct Plan-Based or Goal-Based. The Direct Plan-Based or Goal-Based is projected to witness significant market share during forecast period.

Based on End-User, market is studied across High Net Worth Individuals, Retail Investor, and Ultra High Net Worth Individuals. The Retail Investor is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 37.01% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/robo-advisor?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Robo Advisor Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Robo Advisor Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Robo Advisor Market, highlighting leading vendors and their innovative profiles. These include Acorns Grow Incorporated, Ally Financial Inc., Axos Financial, Inc., Capital One, Charles Schwab Corporation, Covestor Ltd., E*TRADE by Morgan Stanley, Fincite GmbH, FMR LLC, Ginmon Vermogensverwaltung GmbH, M1 Holdings Inc., Merrill Guided Investing by Bank of America Corporation, MFM Investment Ltd., Mphasis, Profile Software S.A., Qraft Technologies Inc., QuietGrowth Pty. Ltd., Scalable Capital GmbH, SigFig Wealth Management, LLC, Social Finance, Inc., The Vanguard Group Inc., Wealthfront Inc., Wells Fargo Clearing Services, LLC, and Zacks Advantage.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Robo Advisor Market, by Business Model

7. Robo Advisor Market, by Provider

8. Robo Advisor Market, by Service Type

9. Robo Advisor Market, by End-User

10. Americas Robo Advisor Market

11. Asia-Pacific Robo Advisor Market

12. Europe, Middle East & Africa Robo Advisor Market

13. Competitive Landscape

14. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Robo Advisor Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Robo Advisor Market?

3. What is the competitive strategic window for opportunities in the Robo Advisor Market?

4. What are the technology trends and regulatory frameworks in the Robo Advisor Market?

5. What is the market share of the leading vendors in the Robo Advisor Market?

6. What modes and strategic moves are considered suitable for entering the Robo Advisor Market?

Read More @ https://www.360iresearch.com/library/intelligence/robo-advisor?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robo Advisor Market worth $33.38 billion by 2030, growing at a CAGR of 26.71% - Exclusive Report by 360iResearch here

News-ID: 3398987 • Views: …

More Releases from 360iResearch

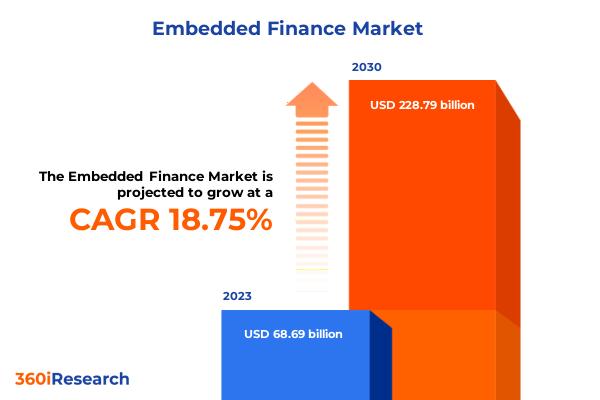

Embedded Finance Market worth $228.79 billion by 2030, growing at a CAGR of 18.7 …

The "Embedded Finance Market by Services (Embedded Banking Services, Embedded Insurance, Embedded Lending), Integration Type (Application Programming Interfaces, Software Development Kits), Business Model, End-Use - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/embedded-finance

Embedded Finance refers to the integration of financial services, such as lending, insurance, payments, or banking, directly within the products or services of non-financial companies using Application Programming Interfaces (APIs).…

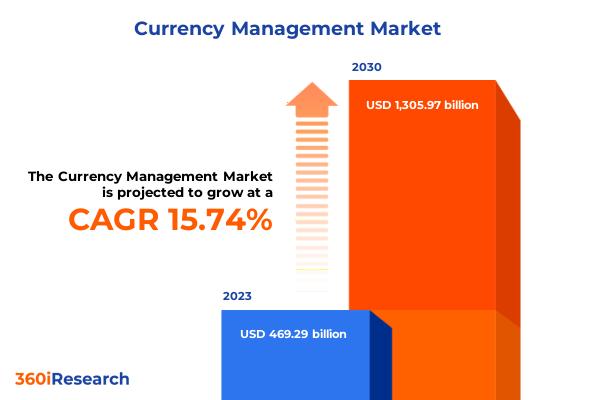

Currency Management Market worth $1,305.97 billion by 2030, growing at a CAGR of …

The "Currency Management Market by Offering (Services, Software), Type (Fixed Currency Exchange, Floating Currency Exchange), End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/currency-management

Currency management encompasses strategies, methodologies, and tools employed by firms and financial institutions to address risks and potential benefits associated with currency fluctuations, involving activities such as hedging, arbitrage, and strategic investment planning to mitigate negative financial impacts…

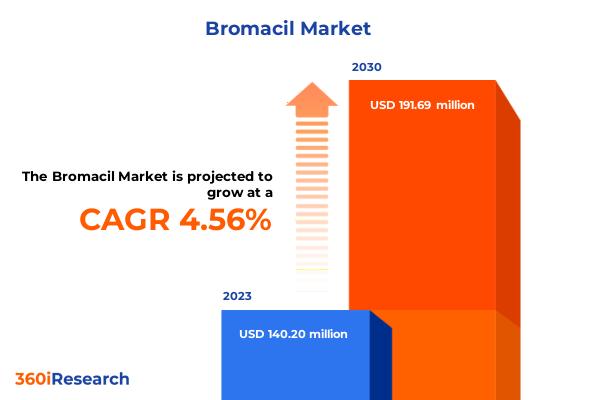

Bromacil Market worth $191.69 million by 2030, growing at a CAGR of 4.56% - Excl …

The "Bromacil Market by Formulation (Granular Formulation, Liquid Formulation), Distribution Channel (Offline, Online) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/bromacil

Bromacil, a herbicide used to control broadleaf weeds and grasses, is vital for vegetation management in agricultural and non-cropland areas due to its soil-residual activity and efficacy in preventing weed growth, ultimately enhancing agricultural productivity and land utility. Applications span agricultural…

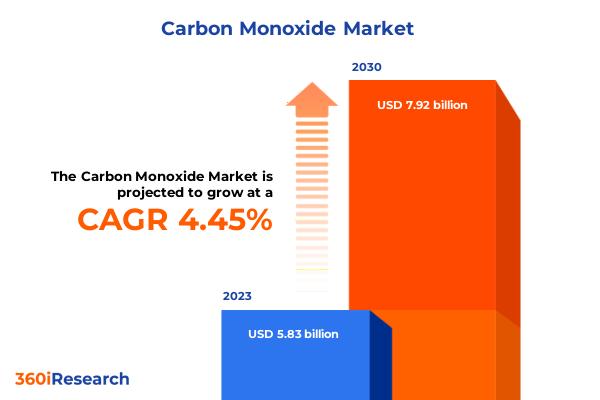

Carbon Monoxide Market worth $7.92 billion by 2030, growing at a CAGR of 4.45% - …

The "Carbon Monoxide Market by Purity Level (98% - 99%, Over 99%), Application (Chemical Synthesis, Food & Beverage, Fuel) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/carbon-monoxide

The scope of carbon monoxide (CO) market research encompasses comprehensive evaluations of production, distribution, application, and end-use industries, providing insights into current market size, projected growth, and future demand across key regions such as North…

More Releases for Robo

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo Advisors Market - Several banks increasingly partnering with robo advisor v …

Robo advisors refer to digital platforms that provide financial planning advice with the least intervention of human resources. The financial planning advice provided is algorithm-based and automatic. Owing to a vast variety of services provided, at much lesser costs as compared to renowned financial planning advisors, and the rapid improvement in results, the global robo advice market is expanding at a promising pace.

Request a sample copy of the Report @…

Robo-Advisors Market is Primarily Driven By The Low Fee Robo Advisory

Robo advisors are financial adviser class that offers portfolio management or financial advice online with least intervention of human. They offers digital financial advice depending on mathematical algorithms or rules. The algorithms are executed by software and hence financial advice essentially do not require any human advisors. Moreover, the software uses the algorithms to automatically manage, allocate and optimize client’s assets. In 2008, the robo advisors emerged with higher acceleration…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…