Press release

Whole Life Insurance Market is Booming Worldwide : Allianz, AXA, Nippon Life Insurance

HTF MI introduces new research on Whole Life Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Whole Life Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing.Some of the major key players profiled in the study are Allianz (Germany), AXA (France), Nippon Life Insurance (Japan), American Intl. Group (United States), Aviva (United Kingdom), Assicurazioni Generali (Italy), State Farm Insurance (United States), Dai-ichi Mutual Life Insurance (Japan), Munich Re Group (Germany), Zurich Financial Services (Switzerland), Prudential (United States), Asahi Mutual Life Insurance (Japan), Sumitomo Life Insurance (Japan), Aegon (Netherlands), MetLife (United States), Swiss Reinsurance (Switzerland), CNP Assurances ( France), Meiji Yasuda Life Insurance Company (Japan), Standard Life Assurance (United Kingdom).

The global Whole Life Insurance market size is expanding at robust growth of 2%, sizing up market trajectory from USD 158081.5 Million in 2023 to USD 178412 Million by 2029.

Get Free Sample Report + All Related Graphs & Charts 👉 https://www.htfmarketintelligence.com/sample-report/global-whole-life-insurance-market

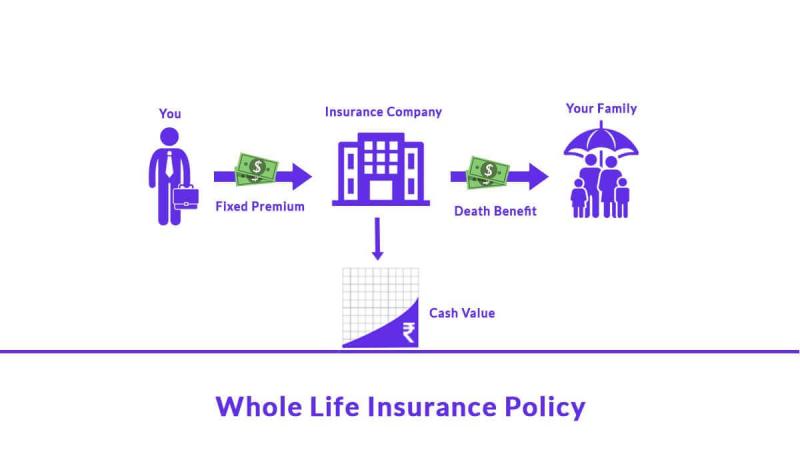

Definition:

Whole life insurance is a type of permanent life insurance policy that provides coverage for the entire life of the policyholder, as long as premiums are paid. It is a contract between the policyholder and the insurance company, in which the policyholder pays regular premiums in exchange for a death benefit that is paid out to their beneficiaries upon their death.

On the off chance that you are engaged with the industry or expect to be, at that point this investigation will give you a complete perspective. It's crucial you stay up with the latest sectioned by Applications [Personal/Family, Business], Product Types [Non-participating Whole Life, Participating Whole Life] and some significant parts of the business.

Market Trends:

The Rising Popularity of Online Distribution Channel

Market Drivers:

The Rising Incidences of Natural Disasters such as Flood, Tornado, & Earthquake and Upusurging Adoption of Personal Lines Insurance to Secure Financial Losses

Market Opportunities:

Proliferation Due to Long Term Value Creation And Productivity Improvements Leads to Grow the Market. and Increase Lifestyles and Health Concerns

Market Restraints:

Proliferation Due to Long Term Value Creation And Productivity Improvements Leads to Grow the Market. and Increase Lifestyles and Health Concerns

Market Challenges:

Proliferation Due to Long Term Value Creation And Productivity Improvements Leads to Grow the Market. and Increase Lifestyles and Health Concerns

Buy the Full Research report of Whole Life Insurance Market 👉 https://www.htfmarketintelligence.com/buy-now?format=1&report=424

Whole Life Insurance Market by Key Players: Allianz (Germany), AXA (France), Nippon Life Insurance (Japan), American Intl. Group (United States), Aviva (United Kingdom), Assicurazioni Generali (Italy), State Farm Insurance (United States), Dai-ichi Mutual Life Insurance (Japan), Munich Re Group (Germany), Zurich Financial Services (Switzerland), Prudential (United States), Asahi Mutual Life Insurance (Japan), Sumitomo Life Insurance (Japan), Aegon (Netherlands), MetLife (United States), Swiss Reinsurance (Switzerland), CNP Assurances ( France), Meiji Yasuda Life Insurance Company (Japan), Standard Life Assurance (United Kingdom)

Whole Life Insurance Market by Geographical Analysis:

• APAC (Japan, China, South Korea, Australia, India, and the Rest of APAC; the Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

Get Exclusive Offer on Account of New Year & Christmas, Request Now

@ https://www.htfmarketintelligence.com/request-discount/global-whole-life-insurance-market

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Browse for Full Report at @ https://www.htfmarketintelligence.com/report/global-whole-life-insurance-market

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, Australia or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 434 322 0091

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, resea rch, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Whole Life Insurance Market is Booming Worldwide : Allianz, AXA, Nippon Life Insurance here

News-ID: 3315119 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Education ERP Market to Get an Explosive Growth in Near Future | Ellucian , Jenz …

HTF Market Intelligence recently released a survey document on Education ERP market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the…

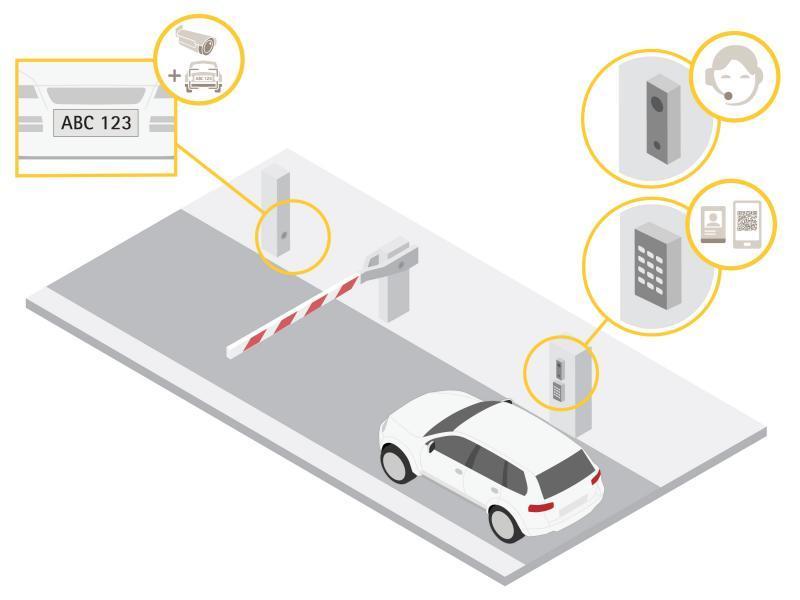

Vehicle Entrance Control Systems Market Rapidly Gaining Traction in Key Business …

HTF MI introduces new research on Global Vehicle Entrance Control Systems covering the micro level of analysis by competitors and key business segments. The Global Vehicle Entrance Control Systems explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of…

Hospital Asset Management Market Likely to Boost Future Growth by 2030 | GE Heal …

HTF Market Intelligence published a new research document of 150+pages on Hospital Asset Management Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Hospital Asset Management market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic…

Modular Hospital Market Boosting the Growth Worldwide :Polyclinic 2.0 ,KEF Infra

The latest study released on the Global Modular Hospital Market by HTF MI evaluates market size, trend, and forecast to 2030. The Modular Hospital market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

More Releases for Life

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…

Global Life Jackets & Life Vests Market Research

Global Life Jackets & Life Vests Market Research Suffocating remains an essential reason for lethal passings everywhere throughout the world. In the course of recent decades, there has been little change in the yearly suffocating rate with huge recreational sailing suffocating passings. For example, around 459 individuals suffocated in the U.S. amid recreational drifting events in 2012 and relatively 85% of these individuals were not wearing an actual existence coat.…