Press release

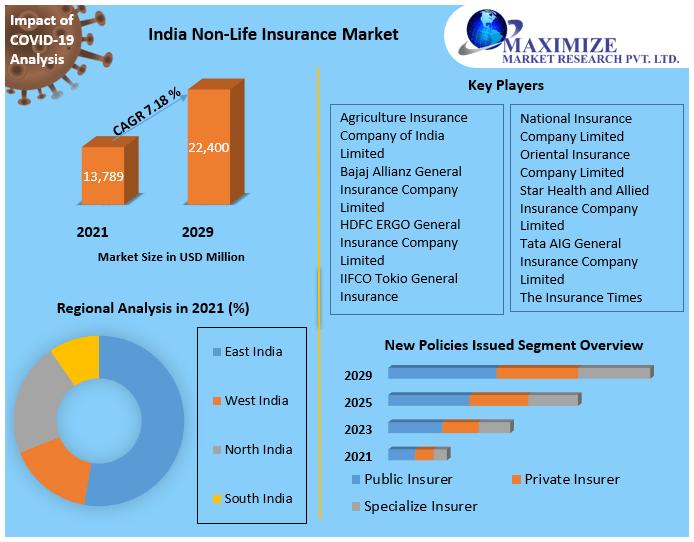

India Non-Life Insurance Market (2021-2029): Navigating Opportunities and Challenges in a Dynamic Landscape

India Non-Life Insurance Market Report Scope:Delving into the intricacies of non-life insurance, this report defines the landscape encompassing general insurance, property insurance, and casualty insurance. The coverage spans a variety of policies, addressing medical emergencies, property protection, and financial loss compensation. Non-life insurance policies, often with a one-year duration, are explored in detail, with a focus on the diverse segments that constitute this dynamic market.

India Non-Life Insurance Market was valued at US$ 13, 7889 Mn. in 2021 and is expected to grow at US$ 22,400 Mn. in 2029. India Non-Life Insurance Market size is expected to grow at a CAGR of 7.18 % through the forecast period.

Explore additional details by clicking the link provided: https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

India Non-Life Insurance Market Research Methodology:

This report is the result of a meticulous research methodology, leveraging a combination of extensive primary and secondary research, data triangulation, and expert analysis. Stakeholders can rely on the precision and reliability of the findings, providing a comprehensive understanding of the India Non-Life Insurance Market and aiding strategic decision-making.

What are India Non-Life Insurance Market Drivers:

The India Non-Life Insurance Market is driven by a multitude of factors. The surge in demand from associated sectors like the automobile and healthcare industries propels market growth. The expanding purchasing power of the middle-class population, coupled with a growing young working demographic, further contributes to the market's upward trajectory. Compulsory motor insurance in India, driven by the growth in the automobile sector, particularly boosts the motor insurance segment of non-life insurance.

For a deeper understanding, click on the link below: https://www.maximizemarketresearch.com/request-sample/42091

India Non-Life Insurance Market Regional Insights:

Regional dynamics play a crucial role in shaping the India Non-Life Insurance Market. The market's growth is attributed to increased demand for insurance across various sectors, such as automobile and healthcare. A robust middle-class population and a growing young workforce contribute to market expansion. However, challenges like data privacy concerns and cyber risks need strategic attention.

This press release encapsulates the essence of the comprehensive report, providing stakeholders with valuable insights into the India Non-Life Insurance Market. With a focus on market values, scope, methodology, drivers, restraints, and regional insights, this report serves as a vital resource for decision-makers navigating the dynamic landscape of the India Non-Life Insurance Market.

What is India Non-Life Insurance Market Segmentation:

by Product

• Motor insurance

• Health insurance

• Fire insurance

• Marine insurance

• Others

According to the Product, In 2021, auto insurance had the biggest market share. A notable increase in the need for cars and the requirement for auto insurance throughout India. The study offers a thorough segment analysis of the non-life insurance industry in India, offering insightful information at both the macro and micro levels. The coverage includes damage and destruction to the vehicle caused by typhoons, earthquakes, floods, and other natural disasters. It also includes coverage for harm and destruction to the car brought on by riots, strikes, burglaries, and theft. When travelling, the cover provides security for both co-passengers and the vehicle's owner/driver. In addition, damage and destruction sustained when mounting or removing from the car are covered.

by New Policies Issued

• Public insurer

• Private insurer

• Specialize insurer

by Distribution Channel

• Individual agents

• Corporate agents - banks

• Corporate agents - others

• Brokers

• Direct business

• Others

For a deeper understanding, click on the link below: https://www.maximizemarketresearch.com/request-sample/42091

Who are India Non-Life Insurance Market Key Players:

• Agriculture Insurance Company of India Limited

• Bajaj Allianz General Insurance Company Limited

• HDFC ERGO General Insurance Company Limited

• ICICI Lombard General Insurance Company Limited

• IIFCO Tokio General Insurance

• National Insurance Company Limited

• Oriental Insurance Company Limited

• Star Health and Allied Insurance Company Limited

• Tata AIG General Insurance Company Limited

• The New India Assurance Company Limited

• The Insurance Times

• ICICI Bank

• Mahindra Insurance Brokers Limited

• Royal Sundaram General Insurance Co. Limited

• Universal Sompo General Insurance Co. Ltd.

Table of content for the India Non-Life Insurance Market includes:

Part 01: Executive Summary

Part 02: Scope of the India Non-Life Insurance Market Report

Part 03: Global India Non-Life Insurance Market Landscape

Part 04: Global India Non-Life Insurance Market Sizing

Part 05: Global India Non-Life Insurance Market Segmentation

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

For a deeper understanding, click on the link below: https://www.maximizemarketresearch.com/request-sample/42091

Key Offerings:

Past Market Size and Competitive Landscape (2022 to 2029)

Past Pricing and price curve by region (2022 to 2029)

Market Size, Share, Size and Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by growth and trend

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Related Reports:

Global 5G Core Market https://www.maximizemarketresearch.com/market-report/global-5g-core-market/91567/

Global Terrestrial Trunked Radio (TETRA) Market https://www.maximizemarketresearch.com/market-report/global-terrestrial-trunked-radio-tetra-market/7062/

Asia Pacific Diagnostic Imaging Market https://www.maximizemarketresearch.com/market-report/asia-pacific-diagnostic-imaging-market/10362/

Global Acute Sinusitis Market https://www.maximizemarketresearch.com/market-report/global-acute-sinusitis-market/34868/

Global Smartphone3D Camera Market https://www.maximizemarketresearch.com/market-report/global-smartphone3d-camera-market/23465/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT and telecom, chemical, food and beverage, aerospace and defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Non-Life Insurance Market (2021-2029): Navigating Opportunities and Challenges in a Dynamic Landscape here

News-ID: 3305819 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Organ-On-Chip Market Size Forecast: 31.7% CAGR Through 2024 to 2030

𝐎𝐫𝐠𝐚𝐧-𝐎𝐧-𝐂𝐡𝐢𝐩 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐨𝐫 𝐃𝐞𝐦𝐚𝐧𝐝 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐨𝐫 𝐃𝐞𝐜𝐫𝐞𝐚𝐬𝐞 𝐟𝐨𝐫 𝐰𝐡𝐚𝐭 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐬:

The organ-on-chip market is experiencing significant growth driven by increasing demand for advanced drug testing, personalized medicine, and more accurate disease modeling. These microfluidic devices, which simulate human organ systems on a chip, offer substantial advantages over traditional in vitro and animal testing methods by providing more precise and relevant biological responses. The rising focus on reducing drug development costs…

Portable Solar Charger Market Trend: USD 16.72 Billion by 2030 with 21% CAGR Gro …

𝐏𝐨𝐫𝐭𝐚𝐛𝐥𝐞 𝐒𝐨𝐥𝐚𝐫 𝐂𝐡𝐚𝐫𝐠𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐨𝐫 𝐃𝐞𝐦𝐚𝐧𝐝 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐨𝐫 𝐃𝐞𝐜𝐫𝐞𝐚𝐬𝐞 𝐟𝐨𝐫 𝐰𝐡𝐚𝐭 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐬:

The portable solar charger market has seen a notable increase in demand driven by the growing need for sustainable and off-grid energy solutions. This growth is primarily fueled by the rising adoption of portable solar chargers among outdoor enthusiasts, travelers, and individuals in areas with unreliable electricity access. Innovations in solar technology, such as higher efficiency photovoltaic cells…

Tunnel Boring Machine Market Forecast: 7.06% CAGR to Achieve USD 11.28 Billion b …

𝐓𝐮𝐧𝐧𝐞𝐥 𝐁𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐜𝐡𝐢𝐧𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐨𝐫 𝐃𝐞𝐦𝐚𝐧𝐝 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐨𝐫 𝐃𝐞𝐜𝐫𝐞𝐚𝐬𝐞 𝐟𝐨𝐫 𝐰𝐡𝐚𝐭 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐬:

The tunnel boring machine (TBM) market is experiencing an increase in demand, driven by the expanding infrastructure projects globally. This growth is largely attributed to the rising need for efficient tunneling solutions in urban transit systems, highway expansions, and underground utilities. The adoption of TBMs is facilitated by their ability to handle complex and challenging geological conditions while…

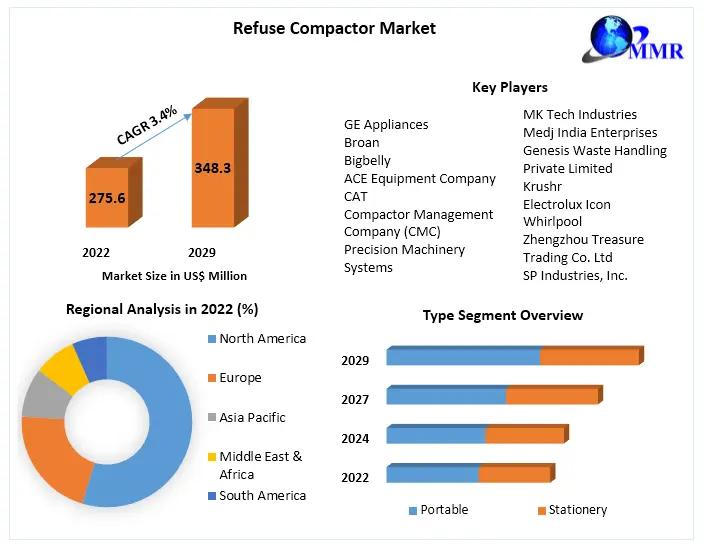

Refuse Compactor Market to Reach USD 348.35 Million by 2029, Growing at 3.4% CAG …

𝐑𝐞𝐟𝐮𝐬𝐞 𝐂𝐨𝐦𝐩𝐚𝐜𝐭𝐨𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐨𝐫 𝐃𝐞𝐦𝐚𝐧𝐝 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐨𝐫 𝐃𝐞𝐜𝐫𝐞𝐚𝐬𝐞 𝐟𝐨𝐫 𝐰𝐡𝐚𝐭 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐬:

The refuse compactor market is experiencing steady growth due to increasing urbanization, industrialization, and the need for efficient waste management solutions. The rise in environmental concerns and stringent government regulations for waste disposal and recycling are driving the demand for refuse compactors across various sectors. Municipalities, commercial establishments, and industrial facilities are adopting compactors to manage waste more effectively,…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…