Press release

Private Student Loans Market Seeking Excellent Growth | Sallie Mae, LendKey, CommonBond

The Latest research study released by HTF MI "Private Student Loans Market" with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status. Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered in this Research are Sallie Mae (United States), LendKey (United States), CommonBond (United States), Discover Financial Services (United States), SoFi Technologies, Inc. (United States), MPOWER Financing (United States), Earnest (United States), Citizens Financial Group (United States), Nelnet, Inc. (United States), Ascent Funding (United States), College Ave Student Loan Servicing, LLC (United States), Purefy (United States), Wells Fargo (United States), Climb Credit, Inc. (Canada), Credible Labs Inc. (United States), EDvestinU (United States), Navient (United States), Eduvanz (India).Click here for free sample + related graphs of the report @: https://www.htfmarketreport.com/sample-report/4151446-global-private-student-loans-market-1?utm_source=Vishwanath_OpenPR&utm_id=Vishwanath

Global Private Student Loans Market by Type (Bar Exam Loans, Bootcamp Loans, Credit Union Loans, International Student Loans, Medical School Loans, Institutional Loans, Others), End Users (Students, Parents), Interest Rate (Fixed-Rate, Variable Rate), Distribution Channel (Direct to Consumer, School Certified), Program Type (Undergraduate, Graduate, Postgraduate)

for more information or any query mail at sales@htfmarketreport.com

Private student loans are issued by banks, financial institutions, or online lenders to the students for paying their educational and living expenses. The increasing number of student population and the emerging trend of studying abroad for quality education will accelerate the growth of the private student loans market as international students are not eligible for federal loans. However, declination in the interest rate of private student loans will boost the market. From the interest rate segment, fixed-rate loans are highly selected by the borrowers as it has relatively low interest and rates don't change over time.

"In April 2022, Nelnet Bank, a leading provider of education lending for students and families launched private student loan to broaden its offering and provide a new flexible option to fulfill students college funding needs. The company offers private student loan with fixed & variable interest rates and a range of packages for undergraduates, graduates, MBA students, law students, and medical students."

If you have any Enquiry please click here @: https://www.htfmarketreport.com/enquiry-before-buy/4151446-global-private-student-loans-market-1?utm_source=Vishwanath_OpenPR&utm_id=Vishwanath

Market Drivers

• Growing Number of Student Population Globally and Requirement for Quality Education

• Borrowing of Private Student Loans for Higher Educations like Post Graduation Courses, Medical Schools, Etc.

• Dominance of Direct to Consumer Distribution Channel and Application of Private Student Loans for Tuition Fees and Living Expenses

Market Trend

• Increased Adoption of Innovative Technological Solutions like AI by Lenders to Directly Offer Loans to Students

Opportunities

• Growing Popularity of Private Student Loans Among the International Students as Most of Them Cannot Qualify for Federal Loan

Challenges

• Requirement of Co-Signers and Lack of Income-Driven Repayment Plans May Can Create Hurdles for the Market

• Availability of a Large Number of Private Student Loan Providers in the Market

Geographically, this report is segmented into some key Regions, with manufacture, depletion, revenue (million USD), and market share and growth rate of Private Student Loans in these regions, from 2018 to 2028 (forecast), covering China, USA, Europe, Japan, Korea, India, Southeast Asia & South America and its Share (%) and CAGR for the forecasted period 2023 to 2029

Informational Takeaways from the Market Study: The report Private Student Loans matches the completely examined and evaluated data of the noticeable companies and their situation in the market considering impact of Coronavirus. The measured tools including SWOT analysis, Porter's five powers analysis, and assumption return debt were utilized while separating the improvement of the key players performing in the market.

Key Development's in the Market: This segment of the Private Student Loans report fuses the major developments of the market that contains confirmations, composed endeavours, R&D, new thing dispatch, joint endeavours, and relationship of driving members working in the market.

To get this report buy full copy @: https://www.htfmarketreport.com/buy-now?format=1&report=4151446?utm_source=Vishwanath_OpenPR&utm_id=Vishwanath

Some of the important question for stakeholders and business professional for expanding their position in the Private Student Loans Market:

Q 1. Which Region offers the most rewarding open doors for the market Ahead of 2022?

Q 2. What are the business threats and Impact of latest scenario over the market Growth and Estimation?

Q 3. What are probably the most encouraging, high-development scenarios for Private Student Loans movement showcase by applications, types and regions?

Q 4.What segments grab most noteworthy attention in Private Student Loans Market in 2021 and beyond?

Q 5. Who are the significant players confronting and developing in Private Student Loans Market?

For More Information Read Table of Content @: https://www.htfmarketreport.com/reports/4151446-global-private-student-loans-market-1?utm_source=Vishwanath_OpenPR&utm_id=Vishwanath

Key poles of the TOC:

Chapter 1 Private Student Loans Market Business Overview

Chapter 2 Major Breakdown by Type

Chapter 3 Major Application Wise Breakdown (Revenue & Volume)

Chapter 4 Manufacture Market Breakdown

Chapter 5 Sales & Estimates Market Study

Chapter 6 Key Manufacturers Production and Sales Market Comparison Breakdown

…………………..

Chapter 8 Manufacturers, Deals and Closings Market Evaluation & Aggressiveness

Chapter 9 Key Companies Breakdown by Overall Market Size & Revenue by Type

………………..

Chapter 11 Business / Industry Chain (Value & Supply Chain Analysis)

Chapter 12 Conclusions & Appendix

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, LATAM, Europe or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 (434) 322-0091

sales@htfmarketreport.com

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Student Loans Market Seeking Excellent Growth | Sallie Mae, LendKey, CommonBond here

News-ID: 3302319 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

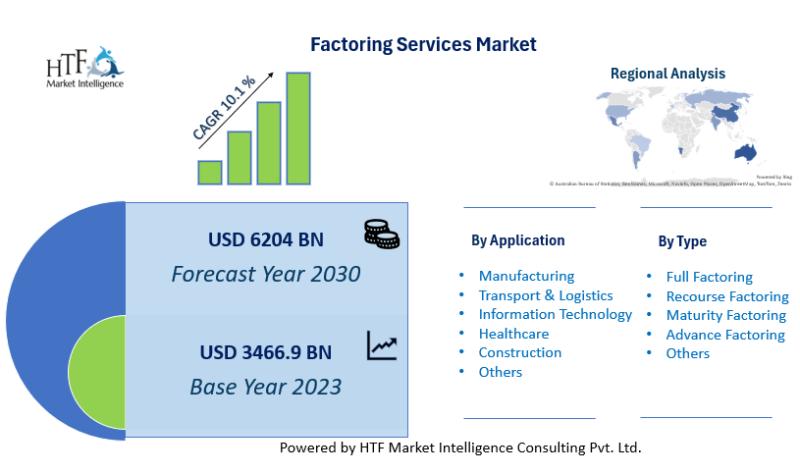

Factoring Services Market Touching New Development Level: OTR Capital, RTS Finan …

The latest survey on Factoring Services Market is conducted to provide hidden gems performance analysis of Factoring Services to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

Rare Metals Market looks to expand its size in Overseas Marketplace

The latest survey on Rare Metals Market is conducted to provide hidden gems performance analysis of Rare Metals to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

IT consulting Services Market to Witness Huge Growth by 2030: Gartner, Syntel, A …

The latest survey on IT consulting Services Market is conducted to provide hidden gems performance analysis of IT consulting Services to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest…

Pharmacy Automation Market Is Booming Worldwide: RxSafe, Asteres, InterLink AI

The latest survey on Pharmacy Automation Market is conducted to provide hidden gems performance analysis of Pharmacy Automation to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

More Releases for Loan

Loan Servicing Software Market Growing Popularity and Emerging Trends: FICS, Loa …

The Global Loan Servicing Software Market has witnessed continuous growth in the past few years and may grow further during the forecast period (2020-2026). The assessment provides a 360° view and insights, outlining the key outcomes of the industry, current scenario witnesses a slowdown and study aims to unique strategies followed by key players. These insights also help the business decision-makers to formulate better business plans and make informed decisions…

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? - Ke …

The banking industry in UAE is a highly fragmented space with a presence of ~60 national & international banks in the country. Post-2016 oil crisis, suffering from high NPAs banks in UAE tended to be more cautious when lending particularly to corporate & individuals thereby increasing rejection rates. Even now, banks generally avoid lending to ex-pats (sometimes putting additional eligibility conditions) & prefer to provide loans to Nationals working in…

Global Lending Software Market By Type (Loan Origination Software (LOS), Loan Ma …

This report studies the Lending Software Market status and outlook of Global and major regions, from angles of players, countries, product types and end industries; this report analyzes the top players in global market, and splits the Lending Software Market by product type and applications/end industries. These details further contain a basic summary of the company, merchant profile, and the product range of the company in question. The report analyzes…

Personal Loan at loanbaba.com

If you give out a lot of repayments from monthly income, getting loans can be burdensome. This is why some cannot obtain one. However, for meeting main expenses, a personal loan is a smart tool. There is an application process that you have to follow to get the loan approved, especially if you do not possess a hard proof about your ability to pay.

Importance of a Good Credit Score

If you…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…

Loan Against Property-Apply Loan Against Property with Lowest EMI

A loan against property is ideal for those looking to invest in business, set-up new business, purchase a new property or satisfy any monetary need of personal nature such as vacation, wedding or any major purchase. Loan against property, as the name suggests, is a secured loan and uses a commercial and a residential property as collateral. The eligibility for this loan is determined based on the value of the…