Press release

Insurtech for Health Insurance Market is Booming Worldwide : GoHealth Policygeniu Next Insurance Lemonade Bright Health OutSystems

HTF MI introduces new research on Insurtech for Health Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Insurtech for Health Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled in the study are GoHealth Policygeniu Next Insurance Lemonade Bright Health OutSystems DXC Technology Company Zipari Majesco Clearcover MetroMile Shift Technology Oscar Insurance.Get Free Sample Report + All Related Graphs & Charts 👉 https://www.htfmarketintelligence.com/sample-report/united-states-insurtech-for-health-insurance-market

The global Insurtech for Health Insurance market size is expanding at robust growth of 15.16%, sizing up market trajectory from USD 936.21 Million in 2023 to USD 2183.3 Million by 2029.

Definition:

The term "insurtech" refers to the use of cutting-edge technology to problems or possibilities in the insurance value chain. It involves making use of data, analytics, process automation for goods, and process advancements to provide more organised interactions between insurers and their holders. As a result, it is seen as a technical advancement that has increased the efficiency of the insurance sector. Multiple reasons primarily drive the US health insurance insurtech sector. The need for insurtech in the United States is being driven by growth in the health insurance industry's income, expanding health insurance demand across several locations, and a rise in the desire of insurance firms for tech-driven solutions. The market is becoming more competitive as a result of regulatory and cost-cutting constraints on enterprises.

On the off chance that you are engaged with the industry or expect to be, at that point this investigation will give you a complete perspective. It's crucial you stay up with the latest sectioned by Applications [product development & underwriting, sales & marketing, policy administration collection & disbursement, claims management], Product Types [Critical Illness Insurance, Maternity Insurance, Individual Insurance, Senior Citizens Insurance, Other] and some significant parts of the business.

Market Trends:

The health insurance business is starting to change due to digitization. Payers in the United States are gradually moving towards digital, but they lag behind other businesses in terms of consumer satisfaction, automation, and the application of artificial intelligence. As a result, spending on digital programmes is rising. Companies that provide health insurance are adopting a digital approach. Cost reductions, efficiency, and customer happiness are all significantly impacted. 61 percent of consumers in the USA prefer to monitor the progress of their claims online, according to a research. Companies are likely to implement digital products given the vast and potential customer digital options.

Market Drivers:

One of the most notable and lucrative industries for generating new income is the health insurance industry in the US. In the USA, there is an increasing demand for private health insurance plans, which fuels lucrative new income streams for the companies that supply these plans. Health insurance-related coverage is becoming more popular as a result of increased health risks and rising healthcare expenses. Insurance customers also want to use services that are more technologically advanced. As a result, they are stimulating the market for insurtech products. The consumer is increasingly at the centre of everything insurers do.

Market Opportunities:

The US insurance sector has undergone a technological revolution in the previous ten years. As insurers have grown their dependence on technology for cost and process optimisation, particularly for health insurance, emerging capabilities like telematics, artificial intelligence, big data, aerial photography, and claims automation have become increasingly prevalent.

Market Restraints:

The US insurance sector has undergone a technological revolution in the previous ten years. As insurers have grown their dependence on technology for cost and process optimisation, particularly for health insurance, emerging capabilities like telematics, artificial intelligence, big data, aerial photography, and claims automation have become increasingly prevalent.

Market Challenges:

The US insurance sector has undergone a technological revolution in the previous ten years. As insurers have grown their dependence on technology for cost and process optimisation, particularly for health insurance, emerging capabilities like telematics, artificial intelligence, big data, aerial photography, and claims automation have become increasingly prevalent.

Buy the Full Research report of Insurtech for Health Insurance Market 👉 https://www.htfmarketintelligence.com/buy-now?format=1&report=3427

Insurtech for Health Insurance Market by Key Players: GoHealth Policygeniu Next Insurance Lemonade Bright Health OutSystems DXC Technology Company Zipari Majesco Clearcover MetroMile Shift Technology Oscar Insurance

Which market aspects are illuminated in the report?

Executive Summary: It covers a summary of the most vital studies, the Insurtech for Health Insurance market increasing rate, modest circumstances, market trends, drivers and problems as well as macroscopic pointers.

Study Analysis: Covers major companies, vital market segments, and the scope of the products offered in the Insurtech for Health Insurance market, the years measured, and the study points.

Company Profile: Each Firm well-defined in this segment is screened based on a product's, value, SWOT analysis, ability, and other significant features.

Manufacture by region: This Insurtech for Health Insurance report offers data on imports and exports, sales, production, and key companies in all studied regional markets

Avail Limited Period Offer /Discount on Immediate purchase @ https://www.htfmarketintelligence.com/request-discount/united-states-insurtech-for-health-insurance-market

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Browse for Full Report at @ https://www.htfmarketintelligence.com/report/united-states-insurtech-for-health-insurance-market

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, Australia or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 434 322 0091

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, resea rch, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech for Health Insurance Market is Booming Worldwide : GoHealth Policygeniu Next Insurance Lemonade Bright Health OutSystems here

News-ID: 3290644 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Education ERP Market to Get an Explosive Growth in Near Future | Ellucian , Jenz …

HTF Market Intelligence recently released a survey document on Education ERP market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the…

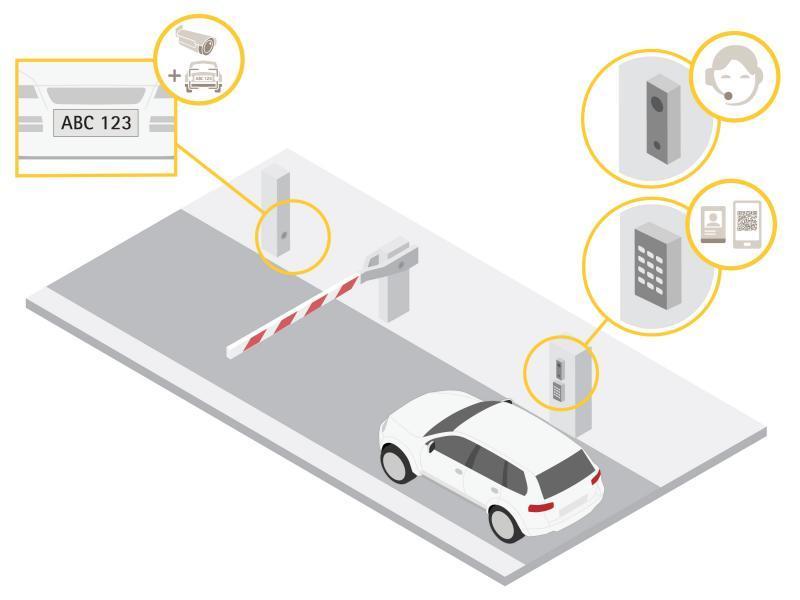

Vehicle Entrance Control Systems Market Rapidly Gaining Traction in Key Business …

HTF MI introduces new research on Global Vehicle Entrance Control Systems covering the micro level of analysis by competitors and key business segments. The Global Vehicle Entrance Control Systems explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of…

Hospital Asset Management Market Likely to Boost Future Growth by 2030 | GE Heal …

HTF Market Intelligence published a new research document of 150+pages on Hospital Asset Management Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Hospital Asset Management market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic…

Modular Hospital Market Boosting the Growth Worldwide :Polyclinic 2.0 ,KEF Infra

The latest study released on the Global Modular Hospital Market by HTF MI evaluates market size, trend, and forecast to 2030. The Modular Hospital market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…