Press release

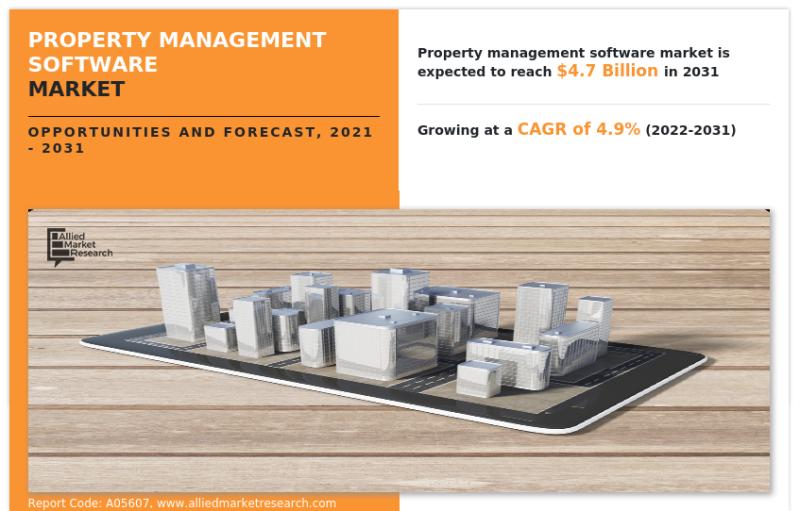

Property Management Software Market to Witness a Pronounce Growth Rate ~ 4.9% of CAGR by 2031

Property management software serves as a centralized computer system for planning, coordinating, and overseeing the daily operations of an accommodation operation. Depending on the software provider, it can manage every aspect of the reservation process as well as front and back-office operations, channel management, guest communication, housekeeping, and maintenance management.According to a new report published by Allied Market Research, The property management software market was valued at $3 billion in 2021, and is estimated to reach $4.7 billion by 2031, growing at a CAGR of 4.9% from 2022 to 2031.

Request Sample Report at: https://www.alliedmarketresearch.com/request-sample/5972

Increase in adoption of cloud computing solutions and software-as-a-service (SaaS) platforms, machine learning tools, and the internet of things (IoT), rise in the development of smart real estate infrastructure, and growing dependency upon one platform approach drive the growth of the global property management software market.

Covid-19 Scenario:

• The COVID-19 pandemic outbreak has a significant impact on the growth of property management software market, due to increased internet penetration, growing adoption of connected devices, and rise in the number of customer satisfaction tools.

• The pandemic compelled organizations across the globe to adopt remote work policies, leading to a rapid increase in demand for tools to support remote teams and workflows.

For Report Customization: https://www.alliedmarketresearch.com/request-for-customization/5972

Region-wise, North America held a significant global property management software market share, due to the country's expanding hotel capacity, the U.S. currently dominates the regional market for North America. The main drivers of the growth of the property management software industry in North America are the rapid advancements in software as a service (SaaS) technology and rise in awareness for personalized property managing software.

Moreover, rapid urbanization and increase in spending construction of smart real estate infrastructure to enhance the standard of living and streamline technological property care take solutions are the primary factors that drive growth of the property management software industry in Asia-Pacific and Europe.

Based on the deployment model, the cloud based segment held the largest share in 2021, capturing three-fourths of the global property management software market, and would lead the trail through 2031. The same segment is estimated to witness the fastest CAGR of 5.4% during the forecast period. The report also discusses the on premises segment.

Access the full summary at: https://www.alliedmarketresearch.com/property-management-software-market

In terms of property type, the commercial segment captured the largest market share of one-third in 2021 and is likely to maintain its leadership in terms of revenue during the forecast period. The residential segment, on the other hand, is likely to achieve the fastest CAGR of 5.6% through 2031. The report also studies the industrial and special purpose segments.

Based on solution, the marketing and advertising segment held the largest share in 2021, accounting for more than one-fourth of the global property management software market, and would dominate through 2031. The accounting and cash flow management software segment, on the other hand is estimated to witness the fastest CAGR of 7.3% during the forecast period. The report also discusses the rental and tenant management, property sale and purchase solution, legal and insurance consultancy, and others segments.

Leading players of the global property management software market analyzed in the research include Alibaba Cloud, Console Australia Pty. Ltd., Entrata, Inc., IQware Inc., Microsoft Corporation, Oracle Corporation, PropertyMe Pty. Ltd., REI Master Pty. Ltd., Rockend Pty. Ltd., and TAP Co., Ltd.

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/5972

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

Contact:

David Correa

5933 NE Wi

Toll-Free: 1-800-792-5285

UK: +44-845-528-1300n Sivers Drive

#205, Portland, OR 97220

United States

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies. This helps us dig out market data that helps us generate accurate research data tables and confirm utmost accuracy in our market forecasting. Every data company in the domain is concerned. Our secondary data procurement methodology includes deep presented in the reports published by us is extracted through primary interviews with top officials from leading online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Property Management Software Market to Witness a Pronounce Growth Rate ~ 4.9% of CAGR by 2031 here

News-ID: 3251742 • Views: …

More Releases from Allied Market Research

Tethered Drone Market Poised for Strong Growth Through 2031: Key Trends and Fore …

The 𝐓𝐞𝐭𝐡𝐞𝐫𝐞𝐝 𝐃𝐫𝐨𝐧𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 report provides an in-depth examination of evolving market patterns, primary sectors, significant investment opportunities, the value chain, regional overview, and the competitive environment. 𝐓𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐭𝐞𝐭𝐡𝐞𝐫𝐞𝐝 𝐝𝐫𝐨𝐧𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐬𝐢𝐳𝐞 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 $𝟐𝟓𝟕.𝟑 𝐦𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟏, 𝐚𝐧𝐝 𝐢𝐬 𝐩𝐫𝐨𝐣𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 $𝟒𝟎𝟒.𝟗 𝐦𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟏, 𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐚𝐭 𝐚 𝐂𝐀𝐆𝐑 𝐨𝐟 𝟒.𝟗% 𝐟𝐫𝐨𝐦 𝟐𝟎𝟐𝟐 𝐭𝐨 𝟐𝟎𝟑𝟏.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐍𝐨𝐰: https://www.alliedmarketresearch.com/request-sample/A31560

Tethered drones are a form of unmanned aerial…

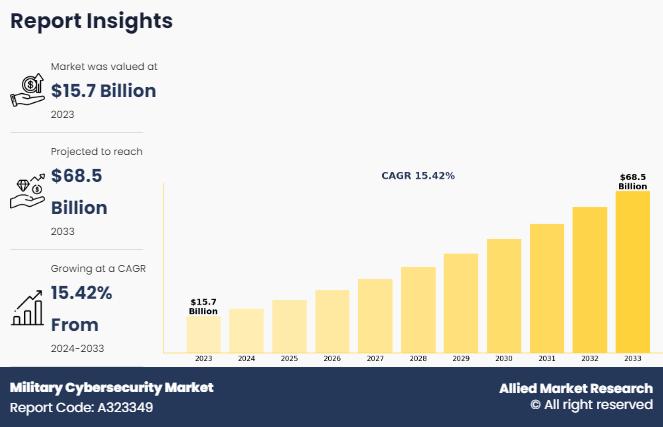

Military Cybersecurity Market : Fortifying Defense Against Emerging Digital Thre …

According to a new report published by Allied Market Research, titled, "Military Cybersecurity Market," The military cybersecurity market size was valued at $15.7 billion in 2023, and is estimated to reach $68.5 billion by 2033, growing at a CAGR of 15.4% from 2024 to 2033.

Military cybersecurity refers to the measures, strategies, and technologies employed by military organizations to protect their digital assets, including networks, systems, and data, from cyber threats…

Automotive Gateway Market : Revolutionizing Vehicle Communication Networks for t …

According to a new report published by Allied Market Research, titled, "Automotive Gateway Market," The Automotive Gateway Market Size was valued at $4.6 billion in 2022, and is estimated to reach $8.4 billion by 2032, growing at a CAGR of 6% from 2023 to 2032.

The automotive gateway facilitates efficient management of vehicle networks, handling tasks such as message routing, protocol translation, and network diagnostics. It ensures the secure and reliable…

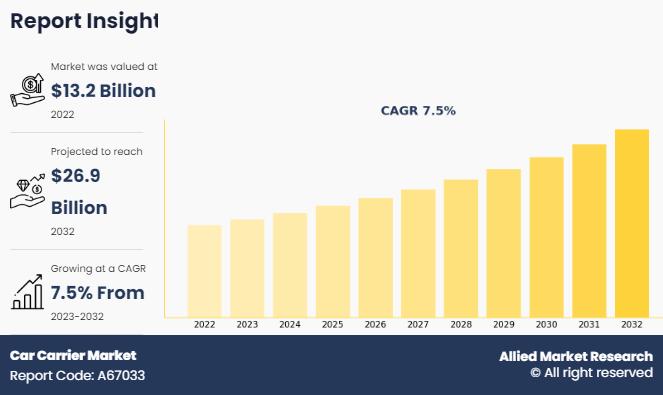

Car Carrier Market : Expanding Horizons in Automotive Logistics and Transportati …

According to a new report published by Allied Market Research, titled, "Car Carrier Market," The car carrier market size was valued at $13.2 billion in 2022, and is the car carrier market share is estimated to reach $26.9 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032.

Car carrier market analysis states that car carrier are the trucks used to transport passenger cars and construction machinery to…

More Releases for Property

Property abroad. French property price increase

French property prices showed a steady increase in 2005 with more property sales passing through the books of local French estate agents.

According to investment property experts, apartment prices rose by 10.6 per cent in 2005, while the price of a house or Villa rose by 9.9 per cent. Although both figures are lower than those for 2004, the FNAIM was very happy with the fact that there was…

Property abroad: Costa Blanca property sales increase

Over 50,000 Costa Blanca property sales will take place over next decade

The thirst for Spanish property on the Costa Blanca in Spain has grown enormously over the past two years. British investors looking for the ideal property abroad have moved here in droves buying holiday,retirement or investment property. Costa Blanca is the most popular location for buying property in Spain at the moment . Its warm climate…

Property abroad. Bulgarian property. Bansko or the beach for Investment property …

As authorities in Bulgaria prepare to debate legislation on the Black Sea building regulations. Bansko gains momentum.

Bulgarian property is still gaining momentum. The number of Britons buying Bulgarian property in 2005 rose by 77 per cent on the previous year. With the promise of E.U. entry in 2007 or 2008 and flight increases to regional airports, and analysts' expecting a 15-20 per cent rise over the next year, demand…

Property abroad: Spanish property price rise slow down

According to figures released this week by the housing ministry in Madrid. The rise in Spanish property values on a national level slowed down in 2005.

A price slow down is great news for potential buyers in 2006 looking to buy their property abroad along the southern coast of Spain but not so good news for those Spanish property owners looking to sell.

There are some fantastic new development projects available along…

Off Plan Property - Property Investment Made Simple?

Over the past 5 years several property investment companies have sprung up offering naive property investors the chance to share in the growth in the UK property investment industry. some companies offer excellent advice and resources but the majority of them have jumped on the property investment bandwagon and offer nothing more than slick marketing without any substance or very little experience.

Damian Qualter, MD of www.BuyProperty4Less.com, states " The Property…

Property Investment UK - Buying Off Plan Property Advice

"Property Investment - How can we do that?"

"Many of our clients are first time investors who want to jump on the Property investment bandwagon. Most have ailing pension funds and need someone who can just guide them in the off plan property maize to make an informed decision based on facts and potential of the investment NOT based on how much commission the sales person can make "rail-roading" unsuspecting…