Press release

Top 5 Alternatives to Banks for Investing Your Money

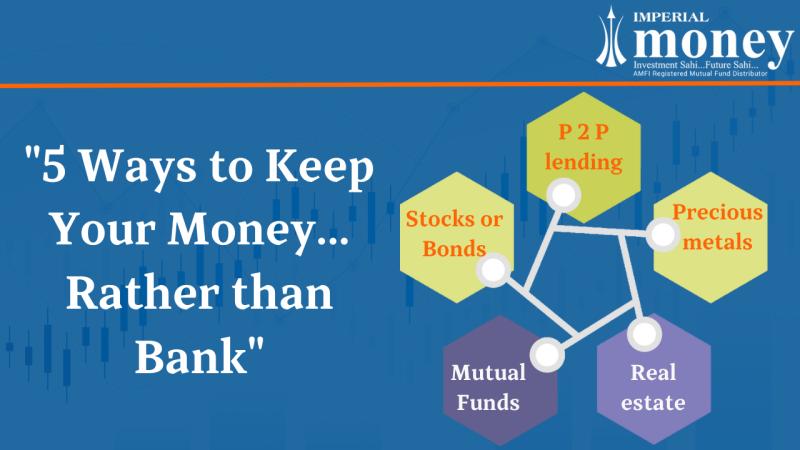

Rather than a bank, here are the 5 best ways to keep your moneyWhen it comes to storing your money, a bank account may seem like the most obvious option. However, there are many alternatives to banks to consider that may better suit your financial goals and preferences. In this blog, we'll explore some of the best alternatives to banks to keep your money besides a traditional bank.

Invest in Stocks or Bonds

Peer-to-Peer Lending

Precious Metals

Real estate

Debt Mutual Funds

Invest in Stocks or Bonds

Investing in stocks is one alternative to bank. While investing comes with risk, it can also provide higher returns than a savings account. Stocks represent ownership in a company, and their value can increase or decrease based on factors such as company performance and economic trends. On the other hand, bonds represent a loan to a company or government entity and provide a fixed rate of return over a period of time.

When considering investing, it's important to do your research and consult with a financial advisor to determine which investments are right for you. It's also important to understand that investing carries risk and that there is always the possibility of losing money.

Peer-to-Peer Lending

Another option for keeping money is to participate in peer-to-peer lending. This involves lending money directly to individuals or small businesses through online platforms, with the goal of earning a higher return than you would with a traditional bank account. Peer-to-peer lending platforms typically use algorithms to match lenders with borrowers based on factors such as credit score and loan amount.

Lenders can choose which loans to invest in and earn interest on their investment over time. However, peer-to-peer lending also carries risk, as there is always the possibility that borrowers may default on their loans. Before participating in peer-to-peer lending, it's important to research the platforms you're considering and understand the risks involved. It may also be helpful to consult with a financial advisor.

Precious Metals

Investing in precious metals like gold or silver is another option for storing your money. Precious metals have historically retained value even in times of economic instability, and they can potentially provide a hedge against inflation and currency fluctuations.

However, investing in precious metals can be volatile, and prices can fluctuate based on factors such as supply and demand, geopolitical events, and global economic conditions. It's important to do your research and consult with a financial advisor before investing in precious metals.

Real estate

Investing in real estate can also be a way to store your money and potentially earn a return over time. This can involve purchasing rental properties, flipping houses for a profit, or investing in real estate investment trusts (REITs).

Real estate investing can be a significant financial commitment, and it requires careful consideration and research. It's important to understand the local real estate market and to have a solid understanding of the risks and potential rewards involved.

Debt Mutual Funds

Mutual funds can be an excellent alternative investment. Mutual funds are a type of investment vehicle that pools money from multiple investors to purchase securities like stocks, bonds, and other assets. The funds are managed by professionals who use their expertise to invest in a diverse range of securities, reducing the risk of loss for the investors. Mutual funds offer various benefits like diversification, professional management, liquidity, and flexibility.

Investing in mutual funds can be an excellent way to grow your wealth while reducing risk. However, it is crucial to do your research and choose the right mutual fund that aligns with your investment goals, risk tolerance, and financial situation. Mutual funds come with management fees and other expenses, which can impact your overall returns, so it's essential to keep an eye on the fees and choose a fund with a low expense ratio.

Conclusion -

In conclusion, there are several options available to individuals looking for alternative investment From precious metals to mutual funds, each option offers unique benefits and drawbacks that should be considered before making a decision. Whether you are looking to diversify your investments, protect your wealth from inflation, or simply explore new opportunities, it's essential to do your research and seek professional advice before making any financial decisions. Ultimately, by taking the time to understand your options and develop a comprehensive financial plan, you can find the best ways to store your money and achieve your long-term financial goals.

302, Royal Vista Apartment, Opp. Main Gate Dhantoli Garde, Dhantoli Nagpur.

Imperial Money Pvt. Ltd. makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Unless otherwise specified, all returns, expense ratio, NAV, etc are historical and for illustrative purposes only. Future will vary greatly and depends on personal and market circumstances. The information provided by our blog is educational only and is not investment or tax advice.

Mutual fund investments are subject to market risks. Please read all scheme related documents carefully before investing. Past performance of the schemes is neither an indicator nor a guarantee of future performance. Terms and conditions of the website/app are applicable. Privacy policy of the website is applicable.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 5 Alternatives to Banks for Investing Your Money here

News-ID: 3047819 • Views: …

More Releases from Imperial Money Pvt. Ltd.

5 Investment Strategies to With Wealth Creation

Are anybody looking for wealth creation? If so, then come to the right place! In this blog post, will discuss five proven investment strategies that can help to reach financial goals.

Nagpur, Maharashtra, India., June 16, 2023 - /PressReleasePoint/ - Want to Take Wealth Creation to the Next Level? all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it…

5 Investment Strategies to Help You With Wealth Creation

Want to Take Your Wealth Creation to the Next Level?

We all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it can be hard to know where to start. That's where this blog comes in. In this article, we will discuss five game-changing investment strategies that can help you transform your wealth creation journey.

Here are 5 Investment Strategies…

More Releases for Mutual

Homeowners Insurance Market is Booming Growth by Top Key Players - American Fami …

Global Homeowners Insurance Market Research Report 2022"This research report provides COVID-19 Outbreak study accumulated to offer Latest insights about acute features of the Homeowners Insurance Market. This intelligence report includes investigations based on Current scenarios, Historical records, and Future predictions. The report contains different market predictions related to market size, revenue, production, CAGR, Consumption, gross margin, diagrams, graphs, pie charts, price, and other substantial factors. While emphasizing the key driving and…

Mutual Insurance Market To Witness Astonishing Growth With Liberty Mutual, Amica …

LOS ANGELES, UNITED STATES - The report on the global Lighting Distribution Box market is comprehensively prepared with main focus on the competitive landscape, geographical growth, segmentation, and market dynamics, including drivers, restraints, and opportunities. It sheds light on key production, revenue, and consumption trends so that players could improve their sales and growth in the Global Lighting Distribution Box Market. It offers a detailed analysis of the competition and…

Mutual Fund Apps for Direct Investment Market Growing Enormously with Top Key Pl …

A wide-ranging analysis of Mutual Fund Apps for Direct Investment Market has recently published by Report Consultant. It has been compiled by using primary and secondary research methodologies. Different dynamic aspects of the businesses have been listed to get a clear idea of business strategies. It includes a blend of several market segments and sub-segments.

Analyzed in a descriptive manner, the global Mutual Fund Apps for Direct Investment market report presents…

Homeowners Insurance Market Share 2019- Farmers Insurance Group, USAA Insurance, …

Homeowners insurance is a form of property insurance designed to protect a home—or possessions in the home—by providing financial reimbursement to the owner in the event of damages or theft. Homeowners insurance may also provide liability coverage against accidents in the home or on the property.

Request a Sample of this Report@ https://www.orbisresearch.com/contacts/request-sample/2572396

In 2018, the global Homeowners Insurance market size was xx million US$ and it is expected to reach xx…

Sri Lanka Mutual Fund Sector Sri Lanka Mutual Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

What are Unit Trusts (Mutual Fund)?

Types of Unit Trusts (Mutual Funds) in Sri Lanka

2.1 Types of Funds

2.1.1 Open Ended Funds

2.1.2 Closed Ended Funds

2.2 Types of Trust Units

2.2.1 Gilt Edged Funds

2.2.2 Indexed Funds

2.2.3 Income Funds or High Yield Funds

…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…