Press release

ESG Reporting Software Market Size, Opportunities, Industry Overlook During Forecast Period 2027

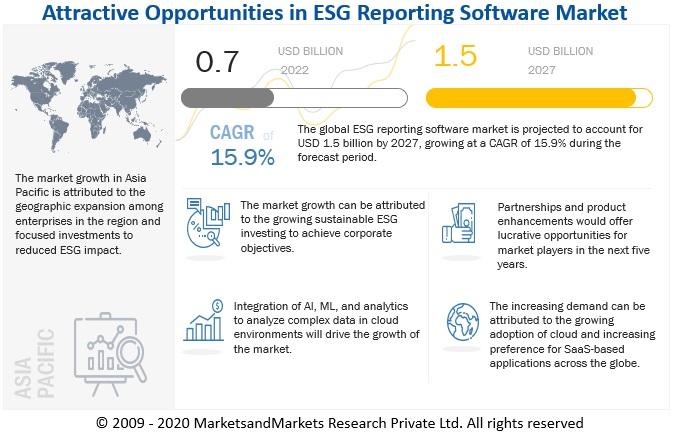

the global ESG Reporting software market to grow from USD 0.7 billion in 2022 to USD 1.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period. The major factors driving the growth of the ESG Reporting software market include surge in adoption of cloud-based solutions and services across verticals, higher investment by government as well in this market across regions, spike in corporate data volume, and credible corporate disclosures.Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=173110129

Large Enterprises segment forecasted to have multiplied growth in market size during the forecast period

Organizations with more than 1,000 employees are categorized as large enterprises. With large enterprises, under ESG, "Environmental" refers to how a company is exposed to and manages risks and opportunities to solve problems associated with climate, natural resource scarcity, pollution, waste, and other environmental factors, as well as its own environmental impact. The term "social" refers to the examination of a companys values and business relationships through issues such as supply chain, product quality and safety, employee health and safety, diversity and inclusion policies, worker welfare, and labor concerns. "Governance" considers a companys corporate structure, board diversity, executive compensation, corporate resilience and event responsiveness, and policies and practices on lobbying, political contributions, bribery, and corruption. The worlds largest shareholder, the American multinational investment management corporation Blackrock, has informed the market that it believes sustainability risk, particularly climate risk, is an investment risk. As a result, where corporate disclosures are insufficient to make a thorough assessment, or a company has not provided a credible plan to transition its business model to a low-carbon economy, including short, medium and long-term targets, sustainability is a key component of the investment approach.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=173110129

Government and public sector to record significant growth during the forecast period

Governments can help with the management and transition costs of ESG risks and exert significant influence over outcomes through their policy and regulatory functions, but initial measurement and attribution of ESG risks appears to be best captured by assigning them to each sector. SASB, TCFD, or GRI uniform ESG standards and regulatory frameworks for the public sector, as for the private sector. Because the objectives of the public sector are linked to public interest and benefit, public bodies have strong incentives to be more transparent about their impact. Climate change has sparked unprecedented public interest, and sustainability reports enable governments to demonstrate their progress in reducing emissions. The public sector is the largest economic sector in most countries, which means it has a significant impact on the environment. It serves two functions: it provides essential services such as the armed forces, healthcare, public transportation, and waste collection, all of which contribute to climate change.

Asia Pacific is projected to record the highest market size during the forecast period

Asia Pacific is one of the fast-growing markets for ESG Reporting software, and its growth is driven by the presence of many SMEs in different countries. Major factors for technological advancements in the region are the rising levels of urbanization, technological innovation, and government support for the digital economy. The region is expected to experience fast growth during the forecast period. Additionally, the Asia Pacific region is expected to experience extensive growth opportunities during the forecast period majorly due to the presence of manufacturing units in this region. South Korea, Japan, Singapore, India, Australia, and China emerged as undisputed leaders in Asia Pacific with regards to cloud adoption. Australia with its trade-friendly policy environment is another potential market in Asia Pacific for ESG Reporting software. The increasing adoption of ESG Reporting software solutions in this region is due to the improving economic outlook of Asia which seems to be positive for enterprises. Moreover, ESG Reporting software enables enterprises to improve the operational issues, increase customer satisfaction, and assign jobs instantly. Furthermore, the increasing trend toward SaaS would give rise to the growth of ESG Reporting software market in this region.

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/esg-reporting-software-market-173110129.html

Market Players

Some prominent players across all service types profiled in the ESG Reporting software market study include Wolters Kluwer (Netherlands), Nasdaq (US), PwC (UK), Workiva (US), Refinitiv (UK), Diligent (US), Sphera (US), Cority (Canada), Intelex (Canada), Greenstone (UK), Novisto (Canada), Emex (Ireland), Enhelix (US), Anthesis (UK), Diginex (Hong Kong), Bain & Co. (US), Keramida (US), Isometrix (US), Accuvio (acquired by Diligent) (US).

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG Reporting Software Market Size, Opportunities, Industry Overlook During Forecast Period 2027 here

News-ID: 2878119 • Views: …

More Releases from Markets and Markets

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

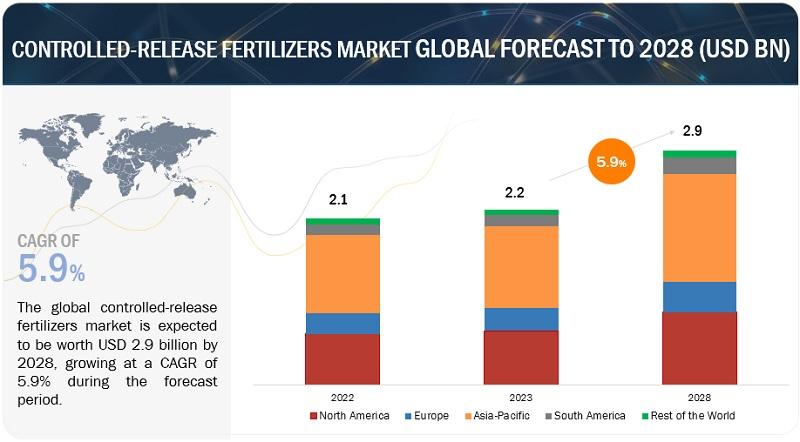

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

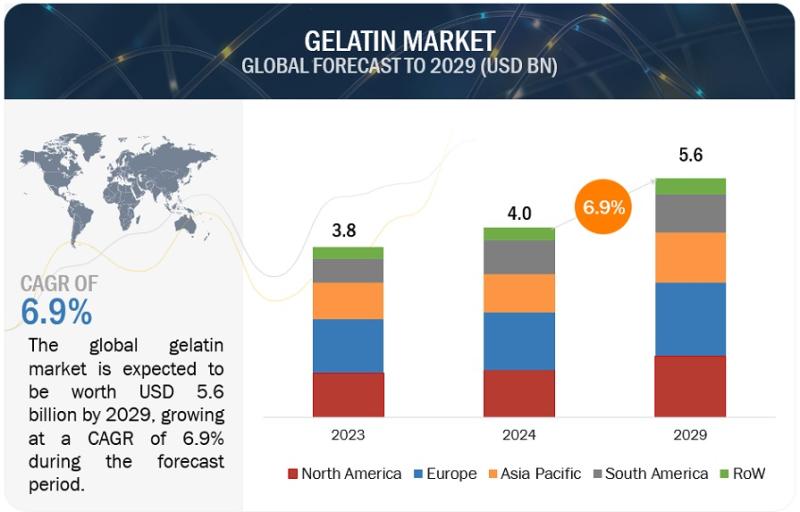

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

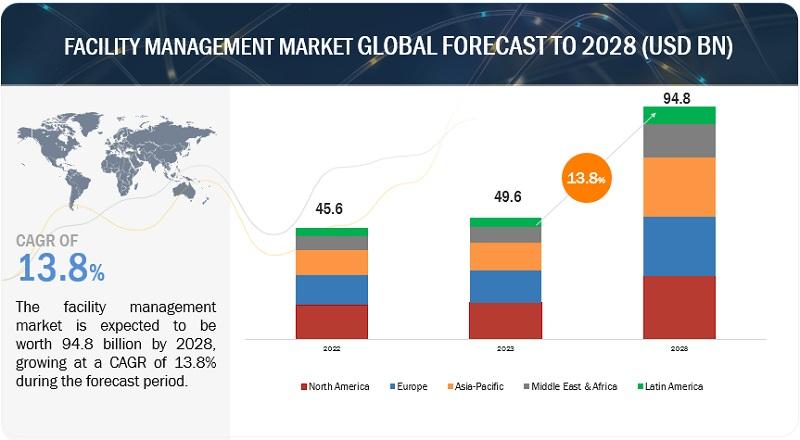

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for ESG

KEXXEL GROUP: Learn invaluable insights from more than 30 leading ESG experts se …

Kuala Lumpur, 22 September 2022: Is your business sustainable for the Future?

ESG is rapidly transforming the business climate today and is constantly evolving. As ESG will drive a catalytic movement for businesses, it is imperative to understand how it works and seize the opportunities it presents to be resilient and stay ahead of the competition.

With that in mind, we are proud to bring our first ever 2-day…

Investor ESG Software Market : Industry Development Scenario and Forecast to 203 …

In the aftermath of the COVID-19 pandemic, investors are anticipated to consider ESG (Environmental, Social, and Governance) factors in an attempt to plug the gaps created by the pandemic. Such findings are expected to translate into future revenue opportunities for companies in the investor ESG software market during the forecast period. Small, medium, and large enterprises are taking into consideration the social element of ESG, while the green bond market…

Hire Talent for ESG, CSR Roles & Social Impact Jobs with our AI

Discover talent for Global Good with the help of our AI on the Socious App. Ensure lasting positive impact by AI matching your roles with the right candidates, reducing mismatch risk and improving retention rate, employee happiness, and performance.

Tokyo, Japan (Socious.io) - Born out of the need to accelerate social change, Socious connects organisations with the right talent. Our AI reduces the risk of mismatches and ensures your ESG & CSR…

ESG (Environmental, Social, and Governance) - Top Trends by Sector Report

Sustainability used to be just about saving the planet. Today it has morphed into an umbrella term for environmental, social, and governance (ESG) issues. Citizens, governments, regulators, and the media are turning the spotlight on corporations and demanding action. Social inequality, corruption, tax avoidance, and a lack of action on climate change are all issues that companies must now address head-on, in full public view.

Get FREE PDF Sample of the…

ESG Bonds Market Revenue, Major Players, Consumer Trends, Analysis & Forecast Ti …

(United States, OR Portland): The report presents an in-depth assessment of the ESG Bonds Market including enabling technologies, key trends, market drivers, challenges, standardization, regulatory landscape, deployment models, operator case studies, opportunities, future roadmap, value chain, ecosystem player profiles and strategies.

The report also presents forecasts for ESG Bonds from 2021 till 2026. The report covers the pre COVID-19 historic data, impact of COVID-19 and post-COVID-19 (Corona Virus) impact on various…

MEDICI Launches ‘ESG Meets FinTech – A Strategic Analysis’

MEDICI released its new report ‘ESG Meets FinTech – A Strategic Analysis,’ which covers the impact of financial technology on Environmental, Social, and Governance (ESG) criteria. The report analyzes the various dimensions of ESG and sustainability in the context of FinTech, including impact investing, financial inclusion, FinTech products & services dealing with sustainability, and ESG Data & Rating platforms.

Key Highlights

FinTech products and services that are oriented towards ESG. These…