Press release

Payvision Founder Rudolf Booker Attacks Investors Protection Organisation EFRI

Victims of binary options and forex broker schemes started to bring legal claims against ING subsidiary Payvision before the courts in different jurisdictions. They made their now lost deposits via the Dutch fintech, founded by Rudolf Booker. The victims, members of the European Fund Recovery Initiative (EFRI), claim that Payvision knowingly and intentionally facilitated these fraudulent broker schemes.However, instead of dealing with these claims, Payvision and its founder and former CEO Rudolf Booker started a tsunami of legal intimidation and defamatory campaigns to silence EFRI and its founder and principal, Elfriede Sixt. In the latest development, the Payvision founder and former CEO Rudolf Booker learned that Sixt was a speaker at Brussels's upcoming Financial Economic Crime 2022 event. Consequently, he retained a Belgian lawyer to send intimidating and defamatory threats to the event organizer and other event speakers to prevent Sixt from speaking.

According to the criminal files, Payvision transferred millions of Euros to the offshore entities of their clients Uwe Lenhoff and Gal Barak until their arrest in early 2019. Mr. Lenhoff died in prison for unknown reasons in the summer of 2020, and Mr. Barak was sentenced in September 2020 to several years in prison and more than €4 million in restitution payments for investment fraud and money laundering. The court documents show that a significant part of the money was laundered via Payvision.

In a statement to FinTelegram News, Elfriede Sixt said that Booker acts with threats and intimidation like his former partner Lenhoff. He would have made a lot of money at the expense of the many victims and would use it to silence EFRI. But she would continue to point to payment processors who act as facilitators of cybercrime. She would bring charges against Booker and Payvision.

Read the story on FinTelegram: https://fintelegram.com/payvision-founder-rudolf-booker-and-his-desperate-legal-intimidation-and-defamation-to-silence-efri/

132-134 Great Ancoats Street

Advantage Business Center

Manchester, M4 6DE

Ben Givon

reporter@fintelegram.com

Active since 2018, FinTelegram (www.fintelegram.com) is a cyber financial intelligence and whistleblower platform with the mission of protecting and educating investors. FinTelegram regularly produces reports on financial service providers and issues warnings about schemes and fraudulent activities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payvision Founder Rudolf Booker Attacks Investors Protection Organisation EFRI here

News-ID: 2612064 • Views: …

More Releases from FinTelegram News

Financial Cybercrime facilitated by Cryptocurrencies and Social Media Gold Mine …

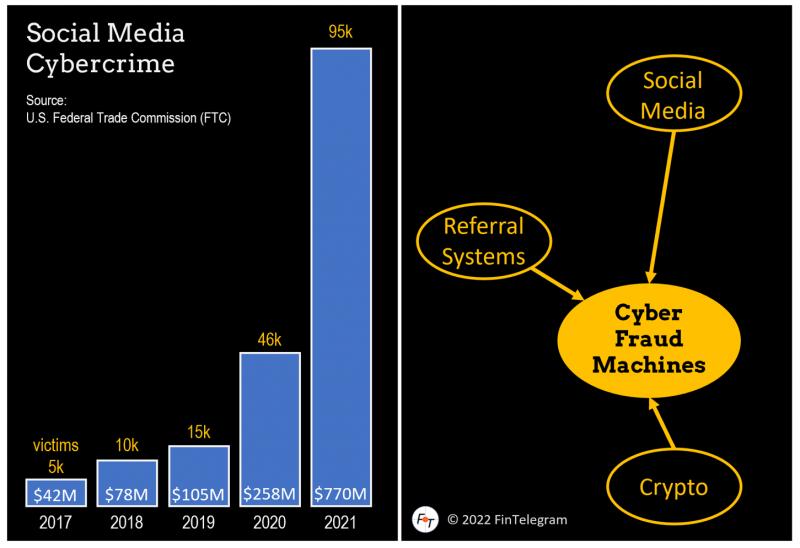

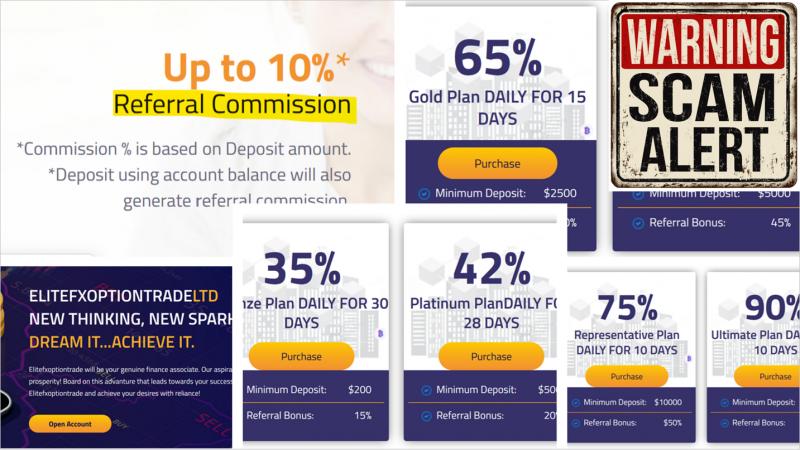

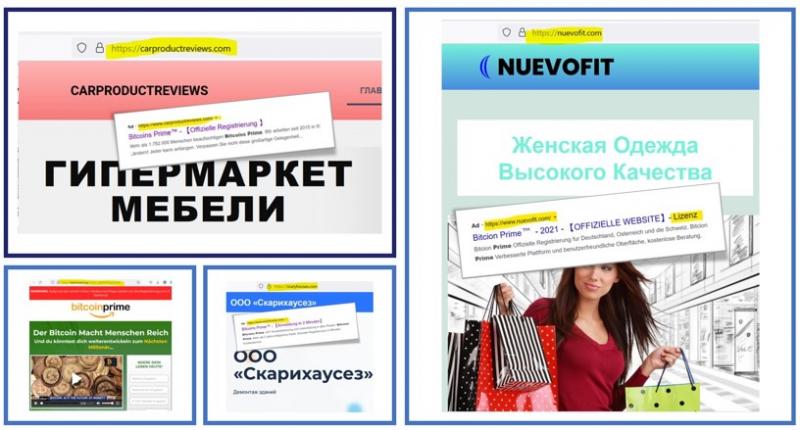

FinTelegram has warned many times against fraud marketing campaigns chasing victims for their investment schemes on Google and social media platforms. Our research findings show that online attackers find victims for their investment schemes primarily through fraudulent crypto campaigns on Google and social media platforms. Cybercrime organizations combine the power of social media with the new capabilities of cryptocurrencies to build super-efficient cyber fraud machines.

Fraudulent crypto campaigns such as Bitcoin…

FinTelegram Exposed Vast Crypto Investment Scheme Attacking European Consumers

CyberFinance - Financial market regulators, most notably the UK FCA as well as the Spanish CNMV, have placed a strategic focus on the crypto segment in recent months. In the first weeks of 2022, dozens of warnings have already been issued against crypto trading and crypto investment schemes attacking European consumers. It is no exaggeration to say that we are in the middle of a global crypto fraud tsunami.

In its…

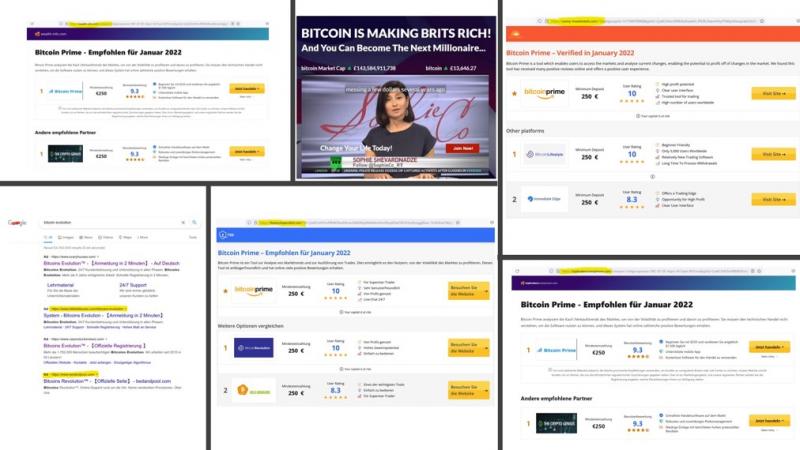

FinTelegram Warns Against Fake Crypto Review Platforms Chasing Consumers for Bro …

As a cyber financial intelligence and whistleblower platform, FinTelegram targets online fraud schemes and their facilitator. Digital marketing agencies are among essential fraud-facilitators. Scheme operators task them with chasing after victims deploying fraudulent marketing campaigns on Google and social media. Over the last couple of months, the number of warnings from financial market regulators such as the UK FCA or the Spanish CNMV against illegal crypto platforms has literally been…

FinTelegram Urges German Regulator to Take Action Against Fraudulent Google Ads

CyberFinance Regulation - Google, like Meta, has been massively criticized for making a lot of money from ads placed by fraudulent scheme operators. The UK Financial Conduct Authority (FCA) issued 1,200 warnings in 2020 about fraud schemes operating on Google and social media platforms. Consequently, in August 2021, Google UK & Ireland re-regulated the advertising of financial offers, allowing only FCA-regulated firms to advertise financial services, including crypto ads. However,…

More Releases for Payvision

Payment Processing Solutions Market Analysis With Key Players, Applications, Tre …

Global Payment Processing Solutions Market By Payment Method (E-Wallet, Credit Card, Debit Card), Vertical (Retail, Hospitality, IT & Telecommunication, Utilities, BFSI, Media & Entertainment, Transportation, Others), Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa) – Industry Trends and Forecast to 2026

Wide-ranging market information of the Global Payment Processing Solutions Market report will surely grow business and improve return on investment (ROI). The report has been prepared by…

Payment Processing Solutions Market Analysis With Key Players, Applications, Tre …

Payment processing solutions is the combined technological offerings that work in collaboration with the merchant and customer to process the financial transactions with the generation of a payment gateway which operates on a set of parameters pre-defined by the merchant. These solutions act as a middle man between the merchant and consumer account providing efficient flow of financial transactions. These solutions are a combination of all the processes that work…

Payment Processing Solutions Market Analysis With Key Players, Applications, Tre …

Payment processing solutions is the combined technological offerings that work in collaboration with the merchant and customer to process the financial transactions with the generation of a payment gateway which operates on a set of parameters pre-defined by the merchant. These solutions act as a middle man between the merchant and consumer account providing efficient flow of financial transactions. These solutions are a combination of all the processes that work…

Payment Processing Solutions Market Analysis With Key Players, Applications, Tre …

Global payment processing solutions market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of payment processing solutions market for global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Wide-ranging market information of the Global Payment Processing Solutions Market report will…

Payment Processing Solutions Market Analysis With Key Players, Applications, Tre …

Data collection and base year analysis is done using data collection modules with large sample sizes. The market data is analysed and forecasted using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more please request an analyst call or can drop down your enquiry.

Wide-ranging market information of the Global Payment Processing Solutions Market report…

Payment Processing Solutions Market Analysis With Key Players, Applications, Tre …

Global payment processing solutions market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of payment processing solutions market for global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Wide-ranging market information of the Global Payment Processing Solutions Market report will…