Press release

GetID launches an identity verification flow builder

GetID, an estonian based online identity verification company, has released a major update of its platform. Now customers of GetID can easily set up and deploy personalised online verification procedures with GetID KYC flow builder.The usage of new GetID development streamlines the launch process and allows to reduce time and integration costs significantly with the highest level of customisation and security.

In only 3 simple steps users will be able to:

define needed checks (biometrics including liveness detection, ID document verification, AML watchlists screening) according to the KYC & Onboarding procedure

customise the visual appearance of a user journey (steps logic, data validation options and design)

choose an integration option

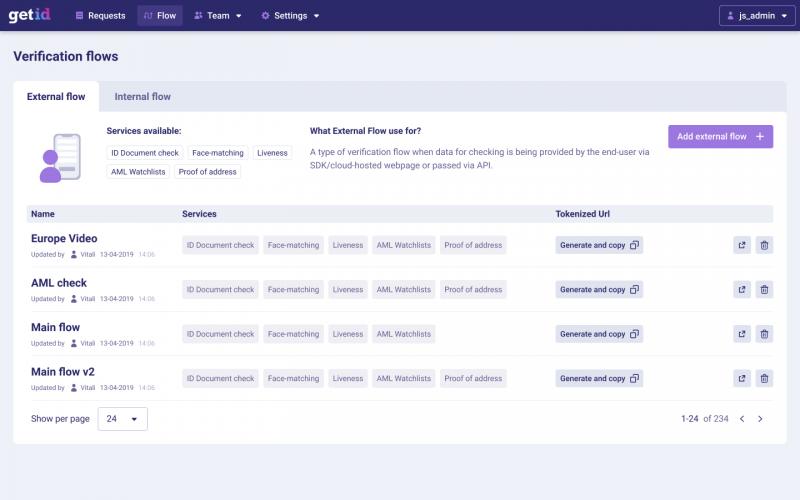

Online KYC/Identity Verification flow builder is accessible via GetID Administrative portal, which can also be used as an easy-to-get-around work environment for KYC officers and compliance teams.

GetID is a cross-platform solution and can be deployed on web, native iOS and Android based applications as well as fully in the cloud, when only a simple redirect of a user is needed.

"We are really excited about how much faster and easier the process of implementing online identity verification can be. For developers, this time is reduced to days or even hours, instead of weeks of development before. GetID online KYC flow builder is an incredibly flexible tool.

Multiple verification flows can be set up, deployed on the fly and functioning asynchronously allowing companies and compliance teams to run several verification flows for different countries, regions products.

Also, it's a perfect tool for any size company - it allows to significantly speed up and simplify the integration process while leaving a lot of room for flexibility and personalization.", says Dmitri Laush, CEO of GetID.

Maakri 19/1, 30th floor, 10145 Tallinn, Estonia

pr@getid.ee

GetID is an all-in-one identity verification service that helps other businesses to streamline their customer onboarding process, ensures full regulatory compliance and reduces fraud. The company was founded in 2019.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GetID launches an identity verification flow builder here

News-ID: 2334040 • Views: …

More Releases from GetID

GetID will be presenting innovative product updates at Money 20/20 in Amsterdam

Estonian Identity verification company GetID, now part of Checkin.com Group, is attending a notable event in the fintech industry Money 20/20, taking place in Netherlands, Amsterdam on 21-23 September 2021. GetID is coming as a part of 12 tech Estonian delegation companies led by EAS - Enterprise Estonia (Estonian government fund to support entrepreneurship).

Money 20/20 is one of the most notable events in the fintech industry. Among previous speakers of…

GetID will showcase its identity verification solution at IFX EXPO

The GetID identity verification solution team will be attending the IFX Expo taking place in Dubai on 19-20 of May. The company will showcase recent updates and useful features in its identity verification platform.

IFX expo is arguably one of the leading B2B conferences in online trading, financial services and fintech bringing together over 250 companies and thousands of financial services professionals from all over the world. GetID will be…

More Releases for KYC

Global E-KYC Market: Key Trends, Challenges and Standardization to 2030

The Global E-KYC Market size was at USD 295.15 Million in 2020, and it is predicted that it will reach a valuation of USD 1575.5 Million by the end of 2030 with an annual development rate (CAGR) of 24.5% between 2022 and 2030.

Global E-KYC Market: Overview

E-KYC is also known as electronic-know your customers. Banks and several other financial institutions widely use it. It is a type of Digital…

E-KYC Market 2022 Global - Opportunities, Challenges, Strategies & Forecasts to …

A New Study on "Global E-KYC Market Size & Share Report 2022-2028" added on intelligencemarketreport.com to its research database.

The report covers a comprehensive analysis of the E-KYC market, which has been included in the research report. The study will also cover accessible opportunities for stakeholders to invest in micro markets, as well as a thorough evaluation of the competitive environment and key rivals' product offerings. Major market aspects such as…

Video KYC Market Is Booming Worldwide with Wibmo, Ameyo, HyperVerge, Onfido

Advance Market Analytics published a new research publication on “Video KYC Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Video KYC market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

E-KYC – Market Boosting the Growth Worldwide: Acuant, Pegasystems, EverComplia …

AMA Research recently released research coverage on Global E-KYC Market that evaluates and provides market size, trend, and estimation to 2026. The E-KYC market study provides ready-to-access and self-analyzed study with significant research data proves to be a useful document for managers, industry consultants and key executives to better understand market trends, growth drivers, opportunities and upcoming challenges and competitors development activities.

Key Players in This Report Include:

Acuant (United States), Trust…

Press Release: Banco Promerica launches "Cuenta Inicia" with Mobbeel’s KYC tec …

Banco Promerica El Salvador launches Cuenta Inicia, the new 100% digital account, which can be opened easily, quickly and securely through its Mobile Banking app, thanks to the support of Veentrix, a local partner of Mobbeel, a pioneer in KYC / Digital Onboarding, digital signature and biometric authentication technology.

Cuenta Inicia can be opened in a couple of minutes with an Android or iOS smartphone. Users can start the account opening…

Fintech Companies are Benefiting by using Video KYC platform

Who are Fintech Companies?

Financial technology, also known as fintech, is a nascent economic sector consisting of companies that use technology to bring more efficiency to financial services. Normally they are startups that disrupt the status quo by providing faster and more efficient solutions than the traditional alternatives. There are around 2174 fintech startups in India. Fintech companies are at the cusp of finance and technology that helps to bring in…