Press release

Auto Loans Services Market SWOT Analysis by Key Players Alliant Credit Union, Capital One, LendingTree Auto Loan

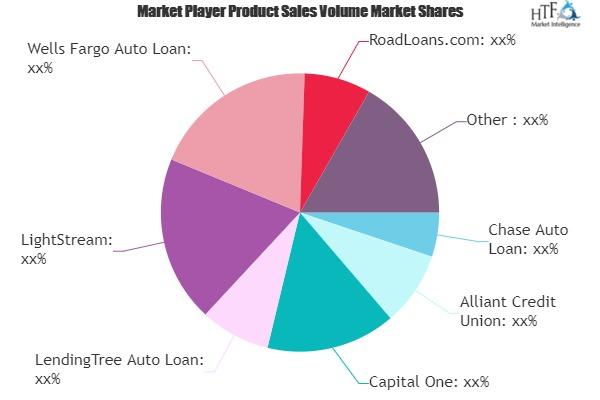

Global Auto Loans Services Market Report 2020 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Auto Loans Services Market. Some of the key players profiled in the study are Chase Auto Loan, Alliant Credit Union, Capital One, LendingTree Auto Loan, LightStream, Wells Fargo Auto Loan, RoadLoans.com, U.S. Bank, CarsDirect, Bank of America, CMBC, PingAn, Guazi & UMB Financial Corporation.You can get free access to samples from the report here: https://www.htfmarketreport.com/sample-report/2645073-global-auto-loans-services-market-2

Auto Loans Services Market Overview:

If you are involved in the Auto Loans Services industry or intend to be, then this study will provide you comprehensive outlook. It’s vital you keep your market knowledge up to date segmented by Product Type Segmentation, Online & Offline and major players. If you want to classify different company according to your targeted objective or geography we can provide customization according to your requirement.

Auto Loans Services Market: Demand Analysis & Opportunity Outlook 2025

Auto Loans Services research study is to define market sizes of various segments & countries by past years and to forecast the values by next 5 years. The report is assembled to comprise each qualitative and quantitative elements of the industry facts including: market share, market size (value and volume 2014-19, and forecast to 2025) which admire each countries concerned in the competitive examination. Further, the study additionally caters the in-depth statistics about the crucial elements which includes drivers & restraining factors that defines future growth outlook of the market.

Important years considered in the study are:

Historical year – 2014-2019 ; Base year – 2019; Forecast period** – 2020 to 2025 [** unless otherwise stated]

The segments and sub-section of Auto Loans Services market are shown below:

The Study is segmented by following Product Type: , Product Type Segmentation, Online & Offline

Major applications/end-users industry are as follows:

Some of the key players/Manufacturers involved in the Market are – Chase Auto Loan, Alliant Credit Union, Capital One, LendingTree Auto Loan, LightStream, Wells Fargo Auto Loan, RoadLoans.com, U.S. Bank, CarsDirect, Bank of America, CMBC, PingAn, Guazi & UMB Financial Corporation

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/2645073-global-auto-loans-services-market-2

If opting for the Global version of Auto Loans Services Market analysis is provided for major regions as follows:

• North America (USA, Canada and Mexico)

• Europe (Germany, France, the United Kingdom, Netherlands, Russia , Italy and Rest of Europe)

• Asia-Pacific (China, Japan, Australia, New Zealand, South Korea, India and Southeast Asia)

• South America (Brazil, Argentina, Colombia, rest of countries etc.)

• Middle East and Africa (Saudi Arabia, United Arab Emirates, Israel, Egypt, Nigeria and South Africa)

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=2645073

Key Answers Captured in Study are

Which geography would have better demand for product/services?

What strategies of big players help them acquire share in regional market?

Countries that may see the steep rise in CAGR & year-on-year (Y-O-Y) growth?

How feasible is market for long term investment?

What opportunity the country would offer for existing and new players in the Auto Loans Services market?

Risk side analysis involved with suppliers in specific geography?

What influencing factors driving the demand of Auto Loans Services near future?

What is the impact analysis of various factors in the Global Auto Loans Services market growth?

What are the recent trends in the regional market and how successful they are?

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/2645073-global-auto-loans-services-market-2

There are 15 Chapters to display the Global Auto Loans Services market.

Chapter 1, About Executive Summary to describe Definition, Specifications and Classification of Global Auto Loans Services market, Applications [], Market Segment by Types , Product Type Segmentation, Online & Offline;

Chapter 2, objective of the study.

Chapter 3, to display Research methodology and techniques.

Chapter 4 and 5, to show the Auto Loans Services Market Analysis, segmentation analysis, characteristics;

Chapter 6 and 7, to show Five forces (bargaining Power of buyers/suppliers), Threats to new entrants and market condition;

Chapter 8 and 9, to show analysis by regional segmentation[North America Country (United States, Canada), South America, Asia Country (China, Japan, India, Korea), Europe Country (Germany, UK, France, Italy) & Other Country (Middle East, Africa, GCC) ], comparison, leading countries and opportunities; Regional Marketing Type Analysis, Supply Chain Analysis

Chapter 10, to identify major decision framework accumulated through Industry experts and strategic decision makers;

Chapter 11 and 12, Global Auto Loans Services Market Trend Analysis, Drivers, Challenges by consumer behavior, Marketing Channels

Chapter 13 and 14, about vendor landscape (classification and Market Ranking)

Chapter 15, deals with Global Auto Loans Services Market sales channel, distributors, Research Findings and Conclusion, appendix and data source.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia or Oceania [Australia and New Zealand].

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Auto Loans Services Market SWOT Analysis by Key Players Alliant Credit Union, Capital One, LendingTree Auto Loan here

News-ID: 2208105 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Photovoltaic Solar Charge Controller Sales Market May See Big Move |Morningstar …

According to HTF Market Intelligence, the Global Photovoltaic Solar Charge Controller Sales market to witness a CAGR of 15.5% during the forecast period (2024-2030). The Latest Released Photovoltaic Solar Charge Controller Sales Market Research assesses the future growth potential of the Photovoltaic Solar Charge Controller Sales market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers…

Fast Fashion Market is Set To Fly High in Years to Come|Authentic Brands Group , …

According to HTF Market Intelligence, the Global Fast Fashion market to witness a CAGR of 14.56% during the forecast period (2024-2030). The Latest Released Fast Fashion Market Research assesses the future growth potential of the Fast Fashion market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify potential gaps and…

Zinc Flake Market to See Huge Growth by 2030:Shishengst, Aalberts NV

According to HTF Market Intelligence, the Global Zinc Flake market to witness a CAGR of 4.37% during the forecast period (2024-2030). The Latest Released Zinc Flake Market Research assesses the future growth potential of the Zinc Flake market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify potential gaps and…

Caffeine-based Drinks Market Is Booming Worldwide |Red Bull,Keurig Dr Pepper

According to HTF Market Intelligence, the Global Caffeine-based Drinks market to witness a CAGR of 7.00% during the forecast period (2024-2030). The Latest Released Caffeine-based Drinks Market Research assesses the future growth potential of the Caffeine-based Drinks market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify potential gaps and…

More Releases for Loan

Loan Servicing Software Market Growing Popularity and Emerging Trends: FICS, Loa …

The Global Loan Servicing Software Market has witnessed continuous growth in the past few years and may grow further during the forecast period (2020-2026). The assessment provides a 360° view and insights, outlining the key outcomes of the industry, current scenario witnesses a slowdown and study aims to unique strategies followed by key players. These insights also help the business decision-makers to formulate better business plans and make informed decisions…

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? - Ke …

The banking industry in UAE is a highly fragmented space with a presence of ~60 national & international banks in the country. Post-2016 oil crisis, suffering from high NPAs banks in UAE tended to be more cautious when lending particularly to corporate & individuals thereby increasing rejection rates. Even now, banks generally avoid lending to ex-pats (sometimes putting additional eligibility conditions) & prefer to provide loans to Nationals working in…

Global Lending Software Market By Type (Loan Origination Software (LOS), Loan Ma …

This report studies the Lending Software Market status and outlook of Global and major regions, from angles of players, countries, product types and end industries; this report analyzes the top players in global market, and splits the Lending Software Market by product type and applications/end industries. These details further contain a basic summary of the company, merchant profile, and the product range of the company in question. The report analyzes…

Personal Loan at loanbaba.com

If you give out a lot of repayments from monthly income, getting loans can be burdensome. This is why some cannot obtain one. However, for meeting main expenses, a personal loan is a smart tool. There is an application process that you have to follow to get the loan approved, especially if you do not possess a hard proof about your ability to pay.

Importance of a Good Credit Score

If you…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…

Loan Against Property-Apply Loan Against Property with Lowest EMI

A loan against property is ideal for those looking to invest in business, set-up new business, purchase a new property or satisfy any monetary need of personal nature such as vacation, wedding or any major purchase. Loan against property, as the name suggests, is a secured loan and uses a commercial and a residential property as collateral. The eligibility for this loan is determined based on the value of the…