Press release

Australia’s Market segments by fuel type: diverse results, new directions and the missing type

For Part 3 of our Australian report series we wanted to add a further dimension to the fuel type trends: Market Segments. Again, we saw some interesting evolution and a pretty diverse set of results across the different channels from 2014 to 2018.Market Segments/Sales Channel

What about the market segments/sales channels? Well, we have some fluctuation for this before we even delve into the fuel type splits. As we mentioned in Part 1, we have seen a distinct growth in the True Fleet channel since 2014 which has grown 10.2% comparing 2014 to 2018. (2.1 percentage points in terms of share). We have also seen upward pressure in the Dealer/Manufacturer channel moving from a 12.6% share in 2014 to 16.4% in 2018.

Now this is possibly the result of aggressive sales targets from OEMs trying to wrestle a larger share, but it brings with it the prevalence of high demo/cyber cars, as dealers capitalise on manufacturer bonuses for the sake of margin, before moving the inventory from their used yards as very low kilometre demos.

For comparison in Europe it is Germany where we see the highest number of dealer registrations, with an average 19.9% of all registrations since 2014 being made in this channel. However, while VW, Audi, Mercedes have certainly increased in volume for the Australian market place it is Hyundai and Kia in terms of growth which have taken the lead in this channel.

The share of RAC/Short-Term Rental has also grown by around 1.8 percentage points since 2014 meaning that the Private Market place has had to suffer a loss. Now, given we are talking about new vehicles here and the already mentioned prevalence of demo cars, it is not hard to imagine that more consumers are then just opting for a lower price vehicle even without as much warranty as a new car.

These vehicles have already taken the first depreciation hit when it drives off the lots or is registered. And for the warranty conscious it is perhaps then not too surprising to see Hyundai and Kia as the growers, given they offer the longest warranties (5 years & 7 years respectively).

Fuel type by Market Segment/Sales Channel

We certainly see some interesting trends emerging in the fuel types for each of the market segments:

Privates: The most stable of these has been the Private Market where Petrol has held between 73% – 75% of the channel since 2014, while Diesel has taken a drop of 1.5 percentage points to stand at 24.0% at the end of 2018. The winner of the Diesel drop is Hybrid, which has picked up around 0.4 percentage points since 2014 taking it to 1% of the share in 2018. This is certainly a move in the right direction but for a country of Australian standing only a little over 5,000 Hybrids for private customers in 2018 again highlights the Governments poor support of Alternative fuels.

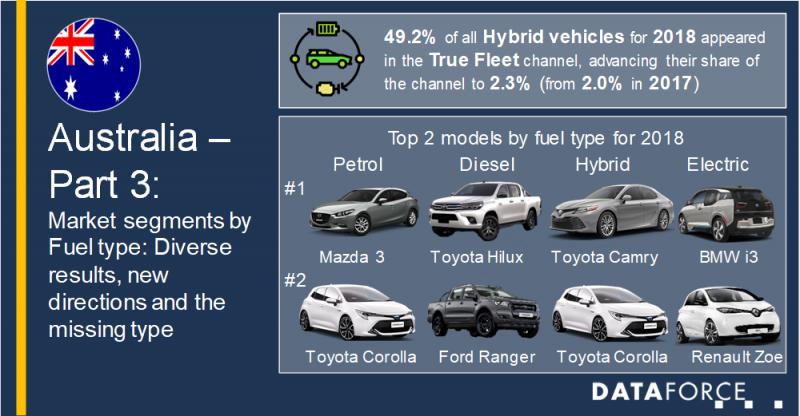

True Fleets: This channel has shown a divergence between 2014 and 2018 with Petrol being the fuel type of choice until 2017 where Diesel took the crown and since then the gap has continued to grow. In 2018, Diesel accounted for a 52.7% share, or a little under 180,000 vehicles up from 138,000 in 2014. Comparing the market segments, Hybrids were strongest in True Fleets, taking a 2.3% share of the channel for 2018 which equates to 49.2% of all Hybrid vehicles for 2018.

RAC/Short term rentals: The channel has also seen some changes happening in the fuel type mix. Petrol has and continues to be the preferred choice at present and as the channel keeps growing so does Petrol finishing with around 64,000 vehicles in 2018, but it does seem that Diesel is certainly in the ascension. It has moved from 7.2% in 2014 to 15.8% in 2018. Surprisingly, Hybrids have been on a rollercoaster ride in this channel: in 2014 they accounted for around 1.0% share, moving to 1.6% in 2016 before sliding back to 0.6% for 2017 and up again to 1.0% for 2018. Is it that the renters are fickle on Hybrid cars during the lows or that as a tactical channel the consumer appetite (from the retail channels) were not quite there, thus generating some of the highs?

Dealer/Manufacturer: As you can possibly guess the fuel type split here is pretty much a mixture of Private & True Fleets, but even though this is the first choice tactical channel, helping to cushion a shortfall or deliver a number #1 result for marketing, it is still interesting and home to some 182,000 new vehicles in 2018. Both Diesel and Petrol have grown in absolute volume from 2014 to 2018 but while Petrol has continued to climb, Diesel engines peaked in 2016 at around 60,000 and fell back to 55,000 by 2018.

(802 words; 4,560 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia’s Market segments by fuel type: diverse results, new directions and the missing type here

News-ID: 1743943 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Diesel

Demand For Diesel And Clean Quality Diesel To Bolster Growth Of Diesel Fuel Wate …

Diesel Fuel Water Separator Market: Introduction

The use of diesel is widespread in industries like automotive, healthcare, marine, construction, and manufacturing. Thus, the demand for diesel and clean quality diesel is on a surge as good quality diesel does not add up to unnecessary maintenance. Although, diesel sufficiently works well external factors damage the quality of the fuel.

This, in turn, adds up to frequent maintenance of vehicles so that the performance…

Nigeria Diesel Genset Market

Nigeria Diesel Genset market is expected to witness modest growth owing to the expansion of telecom infrastructure, the establishment of new industries, and poor grid infrastructure of the country. Growing investment in the non-oil sector of the country is anticipated to support the economic growth in the region over the coming years which would foster the demand for diesel gensets during 2018-24. Additionally, the growing number of manufacturing units in…

Diesel Engines for Non-Automotive Applications Market Global Outlook 2018: Wrtsi …

Qyresearchreports include new market research report “2018-2025 Diesel Engines for Non-Automotive Applications Report on Global and United States Market, Status and Forecast, by Players, Types and Applications” to its huge collection of research reports.

In the past few years, the global market for Diesel Engines for Non-Automotive Applications has witness a number of changes. This study is an attempt to understand the impact of these changes on the Diesel Engines for…

Diesel Engine Market

This report studies the Diesel Engine market size (value and volume) by players, regions, product types and end industries, history data 2013-2017 and forecast data 2018-2025; This report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The diesel engine is an internal combustion engine in which air is compressed inside the cylinder to…

Marine Diesel Engines Market

MaketStudyReport.com adds a New Marine Diesel Engines Market Research Report for the period of 2017-2024 that shows the growth of the market is rising at a 5% CAGR to 2024.

Marine Diesel Engines Market size is set to exceed USD 7 billion by 2024, according to a new research report. Growing demand for economic viable engines coupled with rise in seaborne trade will drive marine diesel engines market. According to United…

Global Diesel Fuel Injection Systems Market 2017 - Denso, Delphi, Woodward, DUAP …

The report focuses on global major leading industry players with information such as company profiles, product picture and specifications, sales, market share and contact information. What’s more, the Diesel Fuel Injection Systems industry development trends and marketing channels are analyzed.

The report Global Diesel Fuel Injection Systems Industry 2017 is a professional, in-depth study that includes insights extracted from complex information, which clients can use for their business advantage. A large…