Press release

Global Digital Lending Market Share Worth USD 44.84 Billion in 2032 | Tavant, FIS, Fiserv, Inc., Newgen Software Technologies Limited

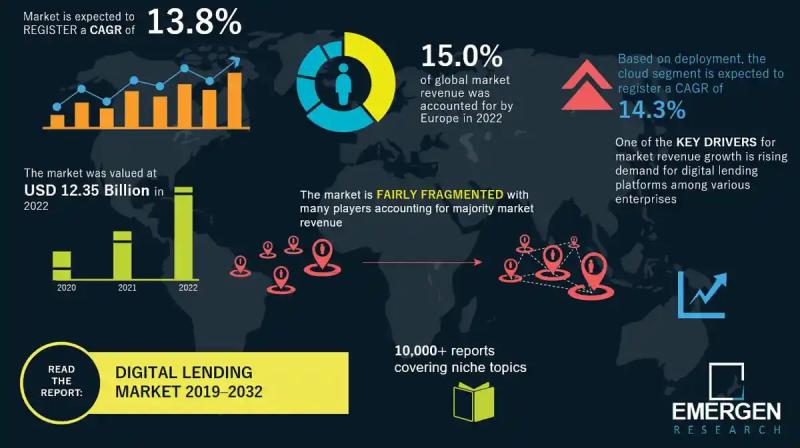

The global digital lending market size was USD 12.35 Billion in 2022 and is expected to register a steady revenue CAGR of 13.8% during the forecast period, according to latest analysis by Emergen Research. Rising Internet and smartphone usage and government protection policies and actions and increasing better customer experiences and use of ML, AI, and blockchain technologies for digital lending are key factors driving market revenue growth.Digital lending offers advantages such as easy information collection of customers, improved load disbursement process, efficiency enhancement, guaranteed faster decision making, and greater consistency of lending process. The recent development of Unified Payment Interface (UPI) is increasing use of digital lending due to cashless transaction procedures through peer-to-peer, interbank, and merchant channels, instant payments and money transfer, protection of personal information of customers, cashback and rewards facility, and monetary transactions through multiple accounts at any point of time.

We Have Recent Updates of Digital Lending Market in Sample Copy: https://www.emergenresearch.com/request-sample/2225

Pre-approved credit limits via UPI are expected to connect the traditional banking industry and create new digital lending choices for banks and non-bank financial institutions. As a result, the governments are taking various initiatives to include UPI in various economic processes and expanding the facilities provided by UPI in other unreached areas of action. For instance, on 6 April 2023, the government of India announced pre-approved credit lines to banks via UPI. The project stimulates innovation and increases the impact of UPI by providing borrowers with access to digital credit lines from banks via UPI. Furthermore, this immediately reduces the number of cards, time, and effort required by clients, making UPI transactions simple, which is expected to drive revenue growth of the market.

Complex and staggered loan origination processes and lack of personalization and market regulations are major factors, which could restrain market revenue growth. In addition, concerns regarding risk and compliance is another factor, which could restrain market revenue growth. The increase in digital lending applications sponsored by non-financial services businesses or unregulated entities resulting in increasing concerns about mis-selling, unprofessional business practices, data protection, and cybersecurity. Moreover, inconsistency in the continuous synchronized approach of merging digital lending with technological advancements is a major problem among the users due to high investment cost of resources.

Some Key Highlights From the Report

• The solutions segment accounted for largest revenue share in the global digital lending market in 2022. This is because digital lending solutions offer increased profits, improved efficiency, flexibility, security, and consistency, easy information sharing across banking working systems for analysis, and smooth monitoring of lending and other critical banking processes.

• In addition, increasing number of medium and small enterprises in the market globally is rising demand for the development of digital lending solutions. Moreover, rising technological advancements such as Artificial Intelligence (AI) and Machine Learning (ML), is also expected to drive revenue growth of this segment. For instance, on 14 December 2021, Temenos, a banking software vendor, announced a partnership with KAF, a well-diversified financial services conglomerate in Malaysia, to establish a digital lending company utilizing Temenos Banking Cloud.

• The cloud segment is expected to register steadily fast revenue growth rate in the global digital lending market during the forecast period. This is due to improved information management and client experience, enhanced scalability, lower expenditures, and better ecosystem integration. The data integrity component of cloud storage platforms enables the prevention of unauthorized data breaches. Some of these platforms also facilitate the user with notification of mismatch between current state of data and last states of protected state of data by the comparison and analysis of major differences arising in these platforms.

• The banks segment is expected to account for significantly large revenue share in the global digital lending market during the forecast period. This is because banks offer personalized features similar to physical banking services and facilities, greater convenience, control, security, and financial literacy awareness.

• The latest trend of integrating digital lending services with neo banking is transforming the traditional banking scenario due to increased financial inclusion of unbanked and underserved population, low maintenance costs, simpler account creation, and faster service delivery. As a result, prominent corporations are following suit and establishing neo-banking platforms and solutions. For instance, on 17 November 2021, Freecharge, an Axis Bank-owned payments provider announced the launch of its neo-banking platform.

• The North America market accounted for largest revenue share in the global digital lending market in 2022. This is attributed to rapid technological advancements and their adoption in various major lending organizations and enhanced digital security upgrades due to rise in businesses and cybercrime events.

• Moreover, different portfolio and platform launches in different regions is also expected to drive market revenue growth during the forecast period. For instance, on 21 November 2022, Propel Holdings, a FinTech company that provides people with access to credit in the U.S. announced the launch of an online credit service Fora Credit for underserved Canadian consumers in Alberta and Ontario and would be extended to more provinces in Canada in the upcoming months.

• Some major companies in the global market report include Tavant, FIS, Fiserv, Inc., Newgen Software Technologies Limited, Pegasystems Inc., Nucleus Software Exports Ltd., Roostify, Inc., Sigma Infosolutions, Temenos, and Intellect Design Arena Ltd.

• On 29 June 2021, Nucleus Software, the leading software product provider that offers lending and transaction banking products to global financial leaders announced that the consumer finance division of Tien Phong Commercial Joint Stock Bank (TPBank), one of the top banks in Vietnam, will be powered by FinnOne Neo. TPFico provided rapid digital loans whenever and wherever needed, driven by the cutting-edge digital lending platform FinnOne Neo.

To get leading market solutions, visit the link below: https://www.emergenresearch.com/industry-report/digital-lending-market

Emergen Research has segmented the global digital lending market on the basis of component, deployment, application, and region:

• Component Outlook (Revenue, USD Billion; 2019-2032)

o Solutions

o Services

• Deployment Outlook (Revenue, USD Billion; 2019-2032)

o On- Premises

o Cloud

• Application Outlook (Revenue, USD Billion; 2019-2032)

o Banks

o Insurance Companies

o Savings and Loan Associations

o Credit Unions

o Peer-to-Peer Lending

o Others

• Regional Outlook (Revenue, USD Billion; 2019-2032)

o North America

1. U.S.

2. Canada

3. Mexico

o Europe

1. Germany

2. France

3. UK

4. Italy

5. Spain

6. Benelux

7. Rest of Europe

o Asia Pacific

1. China

2. India

3. Japan

4. South Korea

5. Rest of APAC

o Latin America

1. Brazil

2. Rest of LATAM

o Middle East & Africa

1. Saudi Arabia

2. UAE

3. South Africa

4. Turkey

5. Rest of Middle East & Africa

Free Sample Report: https://www.emergenresearch.com/request-sample/2225

Contact Us:

Eric Lee

Corporate Sales Specialist

Emergen Research

Direct Line: +1 (604) 757-9756

E-mail: sales@emergenresearch.com

Visit for More Insights: https://www.emergenresearch.com/insights

About Us:

Emergen Research is a market research and consulting company that provides syndicated research reports, customized research reports, and consulting services. Our solutions purely focus on your purpose to locate, target, and analyse consumer behavior shifts across demographics, across industries, and help clients make smarter business decisions. We offer market intelligence studies ensuring relevant and fact-based research across multiple industries, including Healthcare, Touch Points, Chemicals, Types, and Energy. We consistently update our research offerings to ensure our clients are aware of the latest trends existent in the market. Emergen Research has a strong base of experienced analysts from varied areas of expertise. Our industry experience and ability to develop a concrete solution to any research problems provides our clients with the ability to secure an edge over their respective competitors.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digital Lending Market Share Worth USD 44.84 Billion in 2032 | Tavant, FIS, Fiserv, Inc., Newgen Software Technologies Limited here

News-ID: 3491054 • Views: …

More Releases from Emergen Research

Bacteriophage Market Size to Boost USD 65.67 Million By 2032 | CAGR 4.2% - Publi …

The global Bacteriophage Market size was USD 43.52 Million in 2022 and is expected to register a steady revenue CAGR of 4.2% during the forecast period, according to latest analysis by Emergen Research. Increasing prevalence of antibiotic-resistant bacteria and rising demand for personalized medicine and investments and research activities for the production of bacteriophage based treatments and medications are key factors driving market revenue growth.

Bacteriophages have been shown to be…

Internet of Behaviors (IoB) Market Size to Boost USD 3,087.86 Billion By 2032 | …

The global Internet of Behaviors (IoB) market size is expected to reach USD 3.087.86 Billion in 2032 and register a steady revenue CAGR of 23.6% over the forecast period, according to the latest analysis by Emergen Research. Stringent regulations on the use of Internet of Behaviors (IoB) in various industries and technological advancements of big data analytics and IoB technology are key factors driving market revenue growth. The use and…

Consumer Internet of Things (IoT) Market Size to Boost USD 334.78 Billion By 203 …

The global Consumer Internet of Things (IoT) Market size is expected to reach USD 334.78 Billion in 2032 and register a revenue CAGR of 13.9% during the forecast period, according to the latest analysis by Emergen Research. Increasing adoption of smart devices and growing number of internet users is a major factor driving the market revenue growth. When using the Internet of Things for customer care, organizations can use the…

Industrial Safety Market Size to Boost USD 12.33 Billion By 2032 | CAGR 6.8% - P …

The Industrial Safety Market is experiencing robust growth, driven by the imperative need for workplace safety across various industries worldwide. Industrial safety encompasses a range of products, solutions, and services designed to protect workers, assets, and the environment from occupational hazards and accidents. With an increasing focus on compliance with stringent safety regulations, risk mitigation, and employee well-being, industries are investing in advanced safety technologies and practices. The market's expansion…

More Releases for UPI

Here's How Unified Payments Interface (UPI) Market Keep Key Segments Growth Roll …

AMA introduce new research on Global Unified Payments Interface (UPI) covering micro level of analysis by competitors and key business segments (2022-2028). The Global Unified Payments Interface (UPI) explores comprehensive study on various segments like opportunities, size, development, innovation, sales and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists both qualitative and quantitative detailing.

Ask Free Sample Report PDF @…

Unified Payments Interface (UPI) Market Recent Trends, Future Growth, High Deman …

Market Research, Inc. published a report titled "Unified Payments Interface (UPI) Market" research report which covers inclusive data on established trends, drivers, growth opportunities and restraints that can change the market dynamics of the global industry. This report provides an in-depth analysis of the market segmentation that includes products, applications and geographical analysis. It also includes market drivers and restraints of the market, which are derived from SWOT analysis. …

Splendid News! Now You Can Buy OSMF Mouth Opening Kit Through Cash On Delivery, …

You can also use Google Pay, Phone Pay, Bharat Pay, Paytm, Amazon Pay, PayPal, Credit Card and debit card to buy while availing all over India free shipping.

AHMEDABAD, GUJARAT, INDIA, FEBRUARY 4, 2022 - Smile In Hour®, India's leading dental clinic startup https://www.smileinhour.com lead by top dentopreneur Dr. Bharat Agravat, is now offering its innovative product — the OSMF Mouth Opening Kit — on cash on delivery. This service,…

M-commerce Payment Market 2021 Global Analysis by Key Players – PayTM, PayUMon …

Intelligencemarketreport.com Publish a New Market Research Report on “M-commerce Payment Market - Global Research Report 2021-2027”.

The research includes detailed information on developing trends, market drivers, development opportunities, and market restraints that may affect the M-commerce Payment market dynamics. It includes a product, application, and competition analysis, as well as an in-depth examination of the market segments. With strategic analysis, micro and macro market trend and scenarios, pricing analysis, and a…

Ludo King offers 60% discounts with Google UPI Transactions

Ludo King, the best casual board game on Google Play, is now offering a Flat 60% Discount on most coin packs. These discounts are available on purchases that are done with Unified Payment Interface (UPI) transactions through the Google Play Store.

Google has recently added the option of UPI transactions to its store, which allows users to directly transfer money between two bank accounts through their registered UPI ID. Ludo…

Global Croscarmallose Sodium Market 2019 - JRS PHARMA, DFE Pharma, UNIVERSAL PRE …

This new report by Eon Market Research, titled “Global Croscarmallose Sodium Market 2019 Research Report, 2015 – 2025” offers a comprehensive analysis of Croscarmallose Sodium industry at a global as well as regional and country level. Key facts analyzed in this report include the Croscarmallose Sodium market size by players, regions, product types and end industries, history data 2014-2018 and forecast data 2019-2025. This report primarily focuses on the study…