Press release

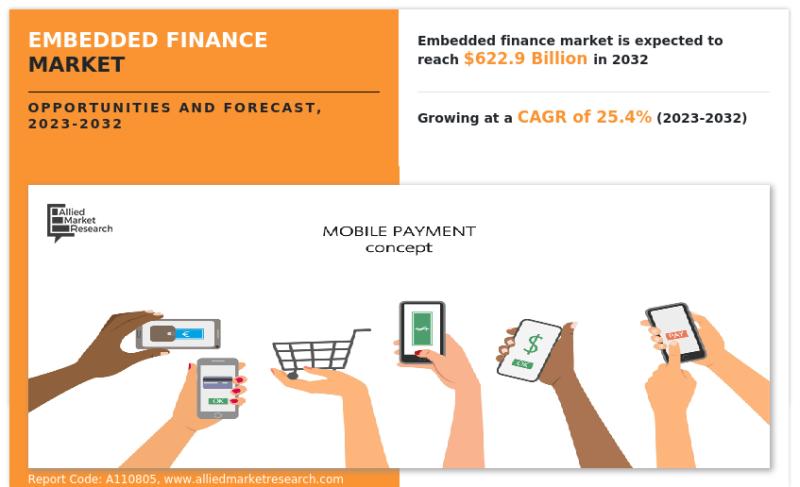

Embedded Finance Market To Cross USD 622.9 billion By Value at Exponential CAGR of 25.4% Through 2032 | FinBox, Lendflow, PAYRIX, PayPal Holdings, Inc

Embedded finance means incorporating financial capabilities directly into the customer experience of various businesses or platforms, such as e-commerce websites, social media platforms, or mobile apps. Embedded finance allows any individual to access and use financial services, such as payments, loans, or insurance, without leaving the platform or app, which is already using it. It brings financial services closer to the customers, making them more convenient and accessible in everyday activities.Allied Market Research published a report, titled, "Embedded Finance Market by Type (Embedded Payment, Embedded Lending, Embedded Investment, and Embedded Insurance), and Industry Vertical (Retail and E-Commerce, Transportation & Logistics, Healthcare, Media & Entertainment, and Others): Global Opportunity Analysis and Industry Forecast, 2023-2032." According to the report, the global embedded finance market was valued at $66.8 billion in 2022, and is projected to reach $622.9 billion by 2032, growing at a CAGR of 25.4% from 2023 to 2032.

🔸𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐚𝐛𝐥𝐞 𝐨𝐟 𝐂𝐨𝐧𝐭𝐞𝐧𝐭𝐬 𝐇𝐞𝐫𝐞: https://www.alliedmarketresearch.com/request-sample/111289

Prime Determinants of Growth

The embedded finances market is driven by the rising trend of digital transformation in several sectors and the evolving demands of customers in the digital world to embrace embedded finance as a means to enhance their products and services. However, regulatory challenges indeed act as a significant restraint for the embedded finance market. On the contrary, with the integration of financial services into non-financial platforms, such as e-commerce websites, ride-sharing apps, and social media platforms, embedded finance has the potential to reach a much larger audience than traditional financial institutions alone.

COVID-19 Scenario

The COVID-19 pandemic had a positive impact on the embedded finance market. With the widespread adoption of remote work, online shopping, and digital services, the need for seamless financial transactions became more pronounced.

The pandemic accelerated the shift towards digital channels, and embedded finance emerged as a key solution to meet the growing demand for convenient financial services. The integration of financial services into non-financial platforms became even more crucial as businesses sought to offer comprehensive solutions to their customers.

From contactless payments to digital lending and insurance, embedded finance provided a way for businesses to adapt to the changing landscape and enhance customer experience. As a result, the embedded finance market experienced rapid growth during the pandemic, and its importance and potential for further expansion became increasingly evident.

🔸𝐆𝐫𝐚𝐛 𝐭𝐡𝐞 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 !!! 𝐋𝐈𝐌𝐈𝐓𝐄𝐃-𝐓𝐈𝐌𝐄 𝐎𝐅𝐅𝐄𝐑 - 𝐁𝐮𝐲 𝐍𝐨𝐰 & 𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐨𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 :- https://bit.ly/44uTgic

The embedded payment segment to maintain its leadership status throughout the forecast period

Based on type, the embedded payment segment held the highest market share in 2022, accounting for around two-fifths of the global embedded finance market revenue. This can be attributed to the widespread adoption of payment service across various demographics and regions. However, the embedded lending segment is projected to manifest the highest CAGR of 28.7% from 2023 to 2032, this is attribute to the fact that it enables businesses to provide rapid and personalized lending options right within their platforms, satisfying the increased demand for quick access to finance and improving the overall customer experience.

The retail and e-commerce segment to maintain its leadership status throughout the forecast period

Based on industry vertical, the retail and e-commerce segment held the highest market share in 2022, accounting for nearly two-fifths of the global embedded finance market revenue. This is attributed to the increasing demand for integrated payment solutions, personalized financing options, and streamlined customer experiences within these sectors. However, the media and entertainment segment is projected to manifest the highest CAGR of 29.7% from 2023 to 2032. This is owing to the integration of microtransactions and digital currencies into media platforms has the potential to revolutionize content monetization models.

North America to maintain its dominance in 2022

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for more than one-third of the global embedded finance market revenue. This is because regulatory bodies in North America are actively considering policies and regulations to foster innovation and competition in the embedded finance space. However, the Asia-Pacific region is expected to witness the fastest CAGR of 28.7% from 2023 to 2032, and is likely to dominate the market during the forecast period, owing to the fact that Asia-Pacific region witnessing significant digital transformation across various sectors, including finance.

Leading Market Players: -

Block, Inc.

Cybrid Technology Inc

Fortis Payment Systems, LLC ("Fortis")

Finastra International Limited

FinBox

Lendflow

PAYRIX

PayPal Holdings, Inc

Stripe

The report provides a detailed analysis of these key players of the global embedded finance market. These players have adopted different strategies such as expansion and product launch to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

🔸𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A110805

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the embedded finance market forecast from 2023 to 2032 to identify the prevailing embedded finance market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the embedded finance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global embedded finance market trends, key players, market segments, application areas, and market growth strategies.

🔸𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Group Life Insurance Market https://www.alliedmarketresearch.com/group-life-insurance-market-A14963

Check Cashing Services Market https://www.alliedmarketresearch.com/check-cashing-services-market-A10531

Extended Warranty Market https://www.alliedmarketresearch.com/extended-warranty-market

Accounting Services Market https://www.alliedmarketresearch.com/accounting-services-market-A12933

Cybersecurity in Banking Market https://www.alliedmarketresearch.com/cybersecurity-in-banking-market-A12738

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Embedded Finance Market To Cross USD 622.9 billion By Value at Exponential CAGR of 25.4% Through 2032 | FinBox, Lendflow, PAYRIX, PayPal Holdings, Inc here

News-ID: 3480430 • Views: …

More Releases from Allied Market Research

Flexible Battery Market Analysis, Trends, Top Manufacturers, Share, Growth, Stat …

Allied Market Research published an exclusive report, titled, "Flexible Battery Market Size, Share, Competitive Landscape and Trend Analysis Report by Type, by Voltage, by Rechargeability, by Application : Global Opportunity Analysis and Industry Forecast, 2023-2032".

Global Flexible Battery Market was valued at $0.17 billion in 2022 and is projected to reach $1.5 billion by 2032, growing at a CAGR of 24.9% from 2023 to 2032.

Download Research Report Sample & TOC :…

Industry 5.0 Market Size is Expected to Reach $637.4 Billion by 2032

Allied Market Research published an exclusive report, titled, "Industry 5.0 Market Size, Share, Competitive Landscape and Trend Analysis Report by Technology, by End-Use Vertical : Global Opportunity Analysis and Industry Forecast, 2023-2032".

The Global Industry 5.0 Market was valued at $129.1 billion in 2022, and is projected to reach $637.4 billion by 2032, growing at a CAGR of 17.3% from 2023 to 2032.

Download Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A313229

Industry 5.0…

Leak Detection Market Growth, Latest Trends, Competitive Scenario, and Regional …

Allied Market Research published an exclusive report, titled, "Leak Detection Market by Technology (Acoustic/Ultrasound, Fiber Optic, Pressure-flow Deviation Methods, Mass/Volume Balance, Thermal Imaging, and Others) and End User (Oil and Gas, Chemical Plants, Water Treatment Plants, Thermal Power Plants, Mining and Slurry, and Others): Global Opportunity Analysis and Industry Forecast, 2023-2032".

The Global Leak Detection Market was valued at $4.7 billion in 2022, and is projected to reach $8.2 billion by…

Exploring the Zinc Ion Batteries Market: Latest Trends, Industry Analysis, and F …

As per the report published by Allied Market Research Titled "Zinc Ion Batteries Market Size, Share, Competitive Landscape and Trend Analysis Report by Type, by Application : Global Opportunity Analysis and Industry Forecast, 2023-2032"

The Global Zinc Ion Batteries Market size was valued at $314.6 million in 2022, and is projected to reach $467.1 million by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Download Research Report Sample &…

More Releases for Embedded

PayNXT360 Expects the Belgium Embedded Finance Market to Reach US$1,039.7 millio …

According to PayNXT360's Q4 2021 Embedded Finance Survey, Embedded Finance industry in the country is expected to grow by 44.9% on annual basis to reach US$1,039.7 million in 2022.

The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 25.6% during 2022-2029. The embedded finance revenues in the country will increase from US$1,039.7 million in 2022 to reach US$3,530.7 million by 2029.

This report provides…

According to PayNXT360's Q4 2021 Embedded Finance Survey, the Embedded Finance I …

According to PayNXT360's Q4 2021 Embedded Finance Survey, Embedded Finance industry in the country is expected to grow by 42.5% on annual basis to reach US$4,700.8 million in 2022.

The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 25.2% during 2022-2029. The embedded finance revenues in the country will increase from US$4,700.8 million in 2022 to reach US$15,878.2 million by 2029.

This report provides…

The Denmark Embedded Finance Market is Expected to Record a Growth of 29.5% in 2 …

According to PayNXT360's Q4 2021 Embedded Finance Survey, Embedded Finance industry in the country is expected to grow by 29.5% on annual basis to reach US$659.3 million in 2022.

The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 18.0% during 2022-2029. The embedded finance revenues in the country will increase from US$659.3 million in 2022 to reach US$1,617.8 million by 2029.

This report provides…

Embedded Processor Market

The recent report published by Reports and Data comprises of an in-depth assessment of the Global Embedded Processor Market. It assesses the ever-changing market dynamics and overall development of the industry. The report is fabricated with thorough primary and secondary research and is updated with the latest and emerging market trends to offer the readers opportunities to capitalize on the current market environment. For a thorough analysis, the market has…

The Merchant Embedded Computing Market: Advantech, Kontron, Abaco, Artesyn Embed …

MarketResearchReports.Biz adds “Global The Merchant Embedded Computing Market Share, Size, Trends and Forecast Market Research Report” reports to its database. This report provides a strategic analysis of the The Merchant Embedded Computing market and the growth estimates for the forecasted period.

This report studies the global The Merchant Embedded Computing market status and forecast, categorizes the global The Merchant Embedded Computing market size (value & volume) by manufacturers, type, application, and…

Embedded System Market (Standalone Embedded Systems, Real Time Embedded Systems, …

Embedded systems is a field derived through a combined study of software and hardware. Both aspects come together to create a functional targeting device that possesses the advantages of adaptability, speed, accuracy, reliability, power, and smaller size. Embedded systems possess a wide array of utility in the fields of mobile communication, electronic payment solutions, railways, aeronautics, and automobiles. They can be designed for specific applications in each field and can…