Press release

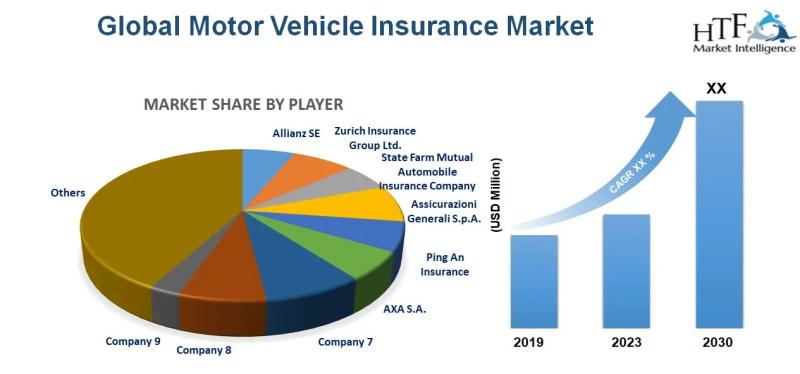

Motor Vehicle Insurance Market revenue is expected to grow by 4.5% from 2023 to 2030, reaching nearly USD992.4 Million| Prudential plc, GEICO, AXA S.A

HTF Market Intelligence recently released a survey document on Motor Vehicle Insurance market and provides information and useful stats on market structure and size.The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities.

Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the Motor Vehicle Insurance market.

Some of the companies listed in the study from the complete survey list are Allianz SE (Germany), Zurich Insurance Group Ltd. (Switzerland), State Farm Mutual Automobile Insurance Company (United States), Assicurazioni Generali S.p.A. (Italy), Ping An Insurance (China), AXA S.A. (France), Prudential plc (United Kingdom), China Life Insurance Group Company Limited (China), People's Insurance Company (Group) of China Limited (China), Bharti AXA General Insurance Company Limited (India), Tokio Marine Holdings, Inc. (Japan), Sompo Holdings, Inc. (Japan), Liberty Mutual Holding Company, Inc. (United States), Progressive Corporation (United States), GEICO Corporation (United States), Others..

According to HTF Market Intelligence, the Global Motor Vehicle Insurance market is expected to see a growth rate of 4.5% and may see market size of USD992.4 Million by 2030, currently pegged at USD731.6 Million

Gain More Insights into the Market Size, Request a Sample Report @ https://www.htfmarketintelligence.com/sample-report/global-motor-vehicle-insurance-market?utm_source=Neeti_OpenPR&utm_id=Neeti

Definition:

Motor vehicle insurance, commonly known as auto insurance or car insurance, is a type of insurance policy designed to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

In exchange for paying a premium, the insurance company agrees to cover the insured party's losses as outlined in the insurance policy.

Market Trends:

Many insurance companies were increasingly offering UBI programs where premiums are based on the actual usage patterns of the insured vehicle. This involves the use of telematics devices or mobile apps to track driving behavior such as mileage, speed, braking, and acceleration.

UBI allows for more personalized pricing and has the potential to encourage safer driving habits.

Market Drivers:

One of the most influential factors is the driver's history, including past accidents, traffic violations, and claims. Drivers with clean records typically receive lower premiums, while those with a history of accidents or violations may face higher rates due to increased perceived risk.

Market Opportunities:

Embracing digital transformation initiatives can improve efficiency, reduce costs, and enhance the overall customer experience. This includes implementing digital platforms for policy management, claims processing, and customer service, as well as offering online self-service options and mobile apps for policyholders. Providing a seamless digital experience can attract and retain customers in an increasingly competitive market.

Key Players in This Report Include: Allianz SE (Germany), Zurich Insurance Group Ltd. (Switzerland), State Farm Mutual Automobile Insurance Company (United States), Assicurazioni Generali S.p.A. (Italy), Ping An Insurance (China), AXA S.A. (France), Prudential plc (United Kingdom), China Life Insurance Group Company Limited (China), People's Insurance Company (Group) of China Limited (China), Bharti AXA General Insurance Company Limited (India), Tokio Marine Holdings, Inc. (Japan), Sompo Holdings, Inc. (Japan), Liberty Mutual Holding Company, Inc. (United States), Progressive Corporation (United States), GEICO Corporation (United States), Others.

Check Available Discount Now @ https://www.htfmarketintelligence.com/request-discount/global-motor-vehicle-insurance-market?utm_source=Neeti_OpenPR&utm_id=Neeti

The Global Motor Vehicle Insurance Market segments and Market Data Break Down are illuminated below:

Motor Vehicle Insurance Market is Segmented by Global Motor Vehicle Insurance Market Breakdown by Application (Personal, Commercial) by Type of Coverage (Comprehensive, Third-party liability) by Distribution Channel (Brokers, Direct, Banks, Others) and by Geography (North America, South America, Europe, Asia Pacific, MEA)

Global Motor Vehicle Insurance market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to helps the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• -To carefully analyze and forecast the size of the Motor Vehicle Insurance market by value and volume.

• -To estimate the market shares of major segments of the Motor Vehicle Insurance

• -To showcase the development of the Motor Vehicle Insurance market in different parts of the world.

• -To analyze and study micro-markets in terms of their contributions to the Motor Vehicle Insurance market, their prospects, and individual growth trends.

• -To offer precise and useful details about factors affecting the growth of the Motor Vehicle Insurance

• -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Motor Vehicle Insurance market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Get Complete Scope of Work @ https://www.htfmarketintelligence.com/report/global-motor-vehicle-insurance-market?utm_source=Neeti_OpenPR&utm_id=Neeti

Major highlights from Table of Contents:

Motor Vehicle Insurance Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Motor Vehicle Insurance market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Motor Vehicle Insurance Market Executive Summary:

It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Motor Vehicle Insurance Market Production by Region Motor Vehicle Insurance Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

Key Points Covered in Motor Vehicle Insurance Market Report:

• Motor Vehicle Insurance Overview, Definition and Classification Market drivers and barriers

• Motor Vehicle Insurance Market Competition by Manufacturers

• Impact Analysis of COVID-19 on Motor Vehicle Insurance Market

• Motor Vehicle Insurance Capacity, Production, Revenue (Value) by Region (2023-2030)

• Motor Vehicle Insurance Supply (Production), Consumption, Export, Import by Region (2023-2030)

• Motor Vehicle Insurance Production, Revenue (Value), Price Trend by Type {Comprehensive, Third-party liability}

• Motor Vehicle Insurance Manufacturers Profiles/Analysis Motor Vehicle Insurance Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Purchase Latest Edition Now @ https://www.htfmarketintelligence.com/buy-now?format=1&report=7833?utm_source=Neeti_OpenPR&utm_id=Neeti

Key questions answered

• How feasible is Motor Vehicle Insurance market for long-term investment?

• What are influencing factors driving the demand for Motor Vehicle Insurance near future?

• What is the impact analysis of various factors in the Global Motor Vehicle Insurance market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: + 15075562445

sales@htfmarketintelligence.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to enable businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Motor Vehicle Insurance Market revenue is expected to grow by 4.5% from 2023 to 2030, reaching nearly USD992.4 Million| Prudential plc, GEICO, AXA S.A here

News-ID: 3469268 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Aviation Engineering Service Market Demand Analysis and Opportunity Outlook 2030 …

The Latest published market study on Global Aviation Engineering Service Market provides an overview of the current market dynamics in the Aviation Engineering Service space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some…

API Security Protection System Market Demonstrates A Spectacular Growth By 2024- …

The Latest published market study on Global API Security Protection System Market provides an overview of the current market dynamics in the API Security Protection System space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

ESG Platform Market Growth Potential is Booming Now: OneTrust, CSRHub, MSCI ESG

The Latest published market study on Global ESG Platform Market provides an overview of the current market dynamics in the ESG Platform space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the…

Stadium Seat Market Present Scenario and Growth Analysis till 2030: RECARO, Avan …

The Latest published market study on Global Stadium Seat Market provides an overview of the current market dynamics in the Stadium Seat space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…