Press release

Online Trading Platform Market 2031 | Achieves Record-breaking Growth to Generate $18.4 Mn

According to a new report published by Allied Market Research, titled, "Online Trading Platform Market," The online trading platform market was valued at $8.9 billion in 2021, and is estimated to reach $18.4 billion by 2031, growing at a CAGR of 7.8% from 2022 to 2031.An online trading platform is a digital tool or software that allows investors and traders to buy and sell financial instruments such as stocks, bonds, options, commodities, and currencies through the internet. These platforms are provided by brokerage firms and financial institutions, and they enable users to execute trades, access market data, perform analysis, and manage their investment portfolios from anywhere with an internet connection.

Request Sample Report at: https://www.alliedmarketresearch.com/request-sample/A16544

The online trading platform market is influenced by factors such as increase in use of smartphones and internet access throughout the globe. In addition, increase in demand for customized Electronic Trading Platform from end users, such as government and non-profitable banks, is anticipated to drive demand for these solutions. Technological advancements and integration of trading platforms on smartphones are few major factors expected to create various market opportunities for key players. In addition, companies in the market are focused on expanding their business units globally. In addition, rise in demand for cloud-based solutions is anticipated to be opportunistic for the Online Trading Platform Industrygrowth during the forecast period. They have countless number of advantages over previous used trading strategies.

Based on type, the commissions segment dominated the online trading platform market in 2021, and is expected to maintain the dominance in the upcoming years. It is because commissions could be assessed on a per-order basis. Orders placed over more than one day is handled as distinct order for commission purposes. However, the transaction fees is expected to witness the highest growth rate during the forecast period, as because buyers and sellers pay transaction fees, which are payments made to banks and brokers for their services. Investors care about transaction fees as they are one of the most important predictors of net returns.

For Report Customization: https://www.alliedmarketresearch.com/request-for-customization/A16544

Based on application, the institutional investors segment dominated the online trading platform market in 2021, and is expected to maintain its dominance in the upcoming years. This is because move large blocks of shares and can have a tremendous influence on movements of the stock market. It is defined as sophisticated investors who are well-informed and thus less inclined to make rash decisions and investments. However, the retail investors segment is expected to witness the highest growth rate during the Online Trading Platform Market Forecast period, as have access to a wealth of information but has less access to information that are reserved for institutional investors. Also, retail investment is more user friendly and is mostly done by new clients.

North America is a rapidly growing region in the global Online Trading Platform Industry, owing to rise in technological advancements and adoption. It possesses well-equipped infrastructure and the ability to afford online trading platform solutions. Furthermore, it is projected to show strong growth, owing to favorable urban and modern environments. Top global companies in North America are focused on the U.S., which contributes significantly in the market. The industry is developing as a result of increased investments in trading technologies (such as blockchain), as well as increase in number of online trading suppliers and government supports for global trading. According to select USA, the financial markets in the U.S. are the world's largest and most liquid. For instance, in February 2021, Plus500, an online trading platform provider based in the UK, announced its venture in North America as an expansion strategy. The company aims to expand its business units in new regions.

Buy Now & Get Exclusive Discount on this Report: https://www.alliedmarketresearch.com/online-trading-platform-market/purchase-options

The Asia-Pacific region is poised to experience the most rapid growth during the projected period, boasting the highest Compound Annual Growth Rate (CAGR). This surge is driven by increased investments in online trading platform solutions across countries like China, Japan, India, Australia, South Korea, and the rest of the Asia-Pacific region. Major industry players are directing their focus towards Asia-Pacific, capitalizing on the region's anticipated rise in the adoption of trading services, particularly within the cloud sector. Although some banks in the area have yet to develop and introduce online trading platforms, those that have swiftly adapted are now positioned to seize opportunities for market expansion. This adaptation not only allows for an increase in market share but also facilitates comprehensive enhancements to their operational framework, all while offering customers added convenience through a new channel.

Some of the key industry players profiled in the report Td Ameritrade Holding Corporation, Interactive brokers, E-Trade, Profile Software, Chetu, Inc., Empirica, Pragmatic Coder, EffectiveSoft Ltd., Charles Schwab, and Devexperts llc. This study includes online trading platform market share, trends, online trading platform market analysis, and future estimations to determine the imminent investment pockets.

COVID-19 scenario:

• The outbreak of the COVID-19 pandemic had less negative impact on the growth of the online trading platform industry as the adoption of online trading solutions increased significantly.

• Increase in adoption of online trading platforms during the pandemic was due to surge in artificial intelligence in form of robo-advisory, increase in sales of smartphones and work-from-home policies.

Access the full summary at: https://www.alliedmarketresearch.com/online-trading-platform-market-A16544

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

If you have special requirements, please tell us, and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

Contact:

David Correa

5933 NE Wi

Toll-Free: 1-800-792-5285

UK: +44-845-528-1300n Sivers Drive

#205, Portland, OR 97220

United States

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies. This helps us dig out market data that helps us generate accurate research data tables and confirm utmost accuracy in our market forecasting. Every data company in the domain is concerned. Our secondary data procurement methodology includes deep presented in the reports published by us is extracted through primary interviews with top officials from leading online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Trading Platform Market 2031 | Achieves Record-breaking Growth to Generate $18.4 Mn here

News-ID: 3467641 • Views: …

More Releases from Allied Market Research

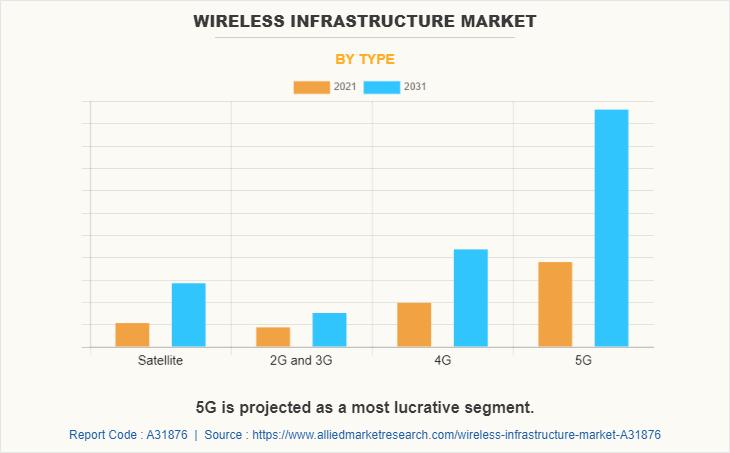

Wireless Infrastructure Market : $152.3 Billion in 2021 to $386.5 Billion by 203 …

According to a new report published by Allied Market Research, titled, "Wireless Infrastructure Market," The wireless infrastructure market was valued at $152.3 billion in 2021, and is estimated to reach $386.5 billion by 2031, growing at a CAGR of 10% from 2022 to 2031.

Asia-Pacific dominates the market in terms of growth, followed by Europe, LAMEA, and North America. China dominated the global wireless infrastructure market share in 2021, whereas China…

Blue Hydrogen Market is estimated to reach $3.5 billion by 2031, with a CAGR of …

The blue hydrogen market size was valued at $0.9 billion in 2021, and blue hydrogen industry is estimated to reach $3.5 billion by 2031, growing at a CAGR of 14.1% from 2022 to 2031.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.alliedmarketresearch.com/request-sample/A16007

Blue hydrogen is an industry term for hydrogen produced from natural gas and supported by carbon capture and storage. The CO2 generated during the manufacturing process is captured and stored permanently…

Wireless Backhaul Equipment Market Trends, Active Key Players, and Growth Projec …

Allied Market Research, titled, "Wireless Backhaul Equipment Market," The wireless backhaul equipment market was valued at $31.9 billion in 2021, and is estimated to reach $104.8 billion by 2031, growing at a CAGR of 12.9% from 2022 to 2031.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅: https://www.alliedmarketresearch.com/request-sample/5871

Wireless backhaul equipment is the backbone of wireless communication networks, connecting the core network to remote sites such as cell towers and small cells. The core network refers…

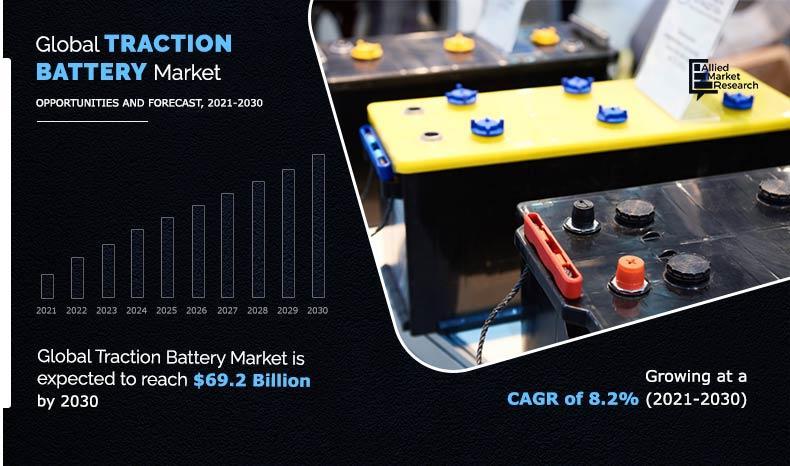

Traction Equipment Market is projected to reach $390.7 million by 2031, growing …

The traction equipment market size was valued at $300.1 million in 2021, and is estimated to reach $390.7 million by 2031, growing at a CAGR of 2.8% from 2022 to 2031.

Traction is the adhesive friction of a body on a surface on which it moves or it is the drawing of a vehicle by motive power. In addition, traction is used on electrification systems around the world. However, equipment used…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Algorithmic Trading Market Witness Highest Growth in Near Future | Virtu Financi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Scope of the Report:

Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc. And investment banks were the most widely…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…