Press release

Payment Gateway Market Size, Emerging Technologies, Comprehensive Research Study

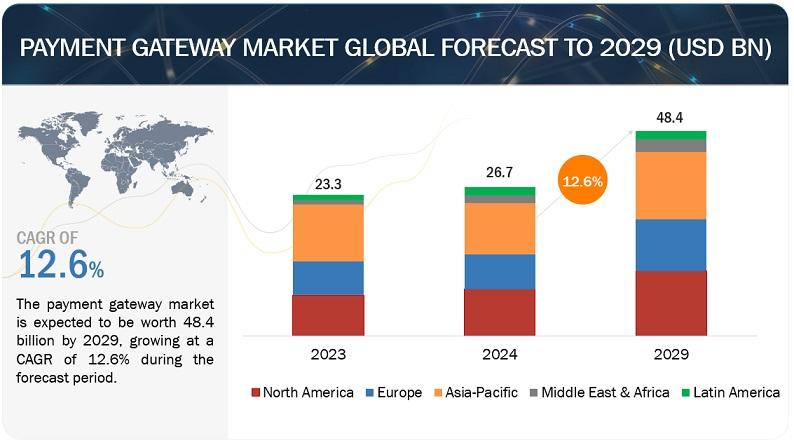

The global Payment Gateway Market Size is projected to grow from USD 26.7 billion in 2024 to USD 48.4 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 12.6% during the forecast period.Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=245750678

Today's consumers demand a frictionless and convenient checkout experience when shopping online, driving the increased adoption of payment gateways that seamlessly integrate with e-commerce platforms. These gateways offer merchants the ability to streamline the checkout process by integrating directly with their online stores, eliminating the need for customers to navigate to external payment pages. Moreover, the popularity of one-click payment options, which enable customers to complete purchases with a single click or tap, further enhances the speed and simplicity of online transactions. As a result, payment gateways that prioritize seamless integration and one-click payment capabilities are gaining traction among merchants seeking to enhance customer satisfaction and drive higher conversion rates in the competitive e-commerce landscape.

"Based on payment gateway type, the API hosted and local bank integration gateway segment to hold second largest market size during the forecast period."

API-hosted payment solutions offer businesses unparalleled flexibility in integrating with a wide range of payment methods beyond traditional credit cards, including digital wallets, alternative payment methods, and emerging technologies like cryptocurrency payments. By leveraging APIs (Application Programming Interfaces), businesses can seamlessly connect their systems with multiple payment providers, allowing customers to choose from a variety of payment options at checkout. This flexibility not only caters to diverse consumer preferences but also enables businesses to expand their reach to global markets where alternative payment methods may be more prevalent. Additionally, API-hosted solutions empower businesses to stay ahead of the curve by adopting innovative payment technologies such as cryptocurrency payments, which offer benefits like lower transaction fees, faster settlement times, and enhanced security. As the payment landscape continues to evolve, API-hosted solutions provide businesses with the agility and scalability needed to adapt to changing consumer behaviors and emerging trends, ultimately driving growth and competitiveness in today's dynamic marketplace.

"By vertical, the retail & eCommerce segment is expected to hold the largest market size during the forecast period."

Modern retail strategies increasingly embrace an omnichannel approach, blending physical storefronts with an online presence to offer customers a seamless shopping experience. Payment gateways that facilitate the integration of in-store and online transactions play a crucial role in realizing this vision of unified commerce. By enabling features such as click-and-collect or buy-online-return-in-store options, these gateways bridge the gap between offline and online channels, allowing customers to engage with brands across various touchpoints effortlessly. For instance, customers can browse products online, make purchases through a preferred payment method, and choose to pick up their orders in-store at their convenience. Similarly, customers can return items purchased online to a physical store, providing added convenience and flexibility. This integration not only enhances customer satisfaction but also enables retailers to leverage their physical infrastructure to fulfill online orders efficiently while driving foot traffic to brick-and-mortar locations. Overall, payment gateways that support seamless integration between in-store and online transactions empower retailers to deliver a cohesive and personalized shopping experience that meets the evolving expectations of today's consumers.

"Asia Pacific is expected to hold a higher growth rate during the forecast period."

Across Asia Pacific region, there is an intense surge in technology initiatives and substantial investments in bolstering digital infrastructure. The robust commitment to advancing technological landscapes has created a pressing need for comprehensive validation methodologies, and payment gateway emerges as a linchpin in this context. The systematic approach of payment gateway aligns seamlessly with the multifaceted objectives of technology-driven projects. As governments and businesses embark on initiatives ranging from smart cities to digital transformation programs, the reliability and success of these projects hinge on the efficiency and accuracy of their underlying software systems. Payment gateway, tailored to the region's diverse technological environments, not only expedites the testing process but also provides a structured means to identify and rectify potential issues in a proactive manner. This strategic alignment ensures that the investments in technology initiatives yield reliable, high-quality outcomes, contributing to the overall advancement of the Asia Pacific region's digital landscape.

Get More Info :- https://www.marketsandmarkets.com/Market-Reports/payment-gateway-market-245750678.html

Market Players

The major vendors covered in the payment gateway market are include JP Morgan (US), Paypal (US), Amazon (US), Visa (US), Mastercard (US), PhonPe (India), Razorpay (India), Alibaba (China), Stripe (Ireland), Adyen (Netherlands), Block, Inc (US), FIS (US), Global Payments (US), Apple (US), Fiserv (US), Verifone (US), Paysafe (UK), Fidelity payments (US), Easebuzz (India), Bluesnap (US), Windcave (US), Helcim (US), Instamojo (India), NOWPayments (Netherlands), CoinGate (Lithuania), Ippopay (India), PayJunction (US), Lyra Network (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the payment gateway market.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Gateway Market Size, Emerging Technologies, Comprehensive Research Study here

News-ID: 3466411 • Views: …

More Releases for Payment

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…

Payment Card Industry 2025 by Product (Contactless Payment, Card Contact Payment …

ReportsWeb.com has announced the addition of the “Global Payment Card Market Professional Survey Report 2018” ,provides a vital recent industry data which covers in general market situation along with future scenario for industry around the Globe.

Key Players -

MasterCard, Visa, American Express, Banco Itau, Bank of America Merrill Lynch, Bank of Brazil, Bank of East Asia, Chase Commercial Banking, Diner's Club, Hang Seng Bank, Hyundai, JP Morgan, SimplyCash, Sumitomo…

Payment Security Software Market 2018- Digital Transformation in Payment Methods …

Market Highlights

“The increasing number of cashless transactions is the main factor behind the rising demand for payment security software across the world,” says a FGR analyst. With the ongoing digital transformation, the payment market is witnessing a significant change in the pattern of financial transactions, which is shifting towards cashless increasingly.

The digitization across industries is leading to high investments in the development and the deployment of new technologies, encouraging…

Payment Gateway Industry Worth US$ 86.9 Billion By 2025 - Hosted Payment Gateway …

The merchants all over the globe are avidly willing to expand their businesses cross-border by adaption of a logical approach, by partnering with the payment gateways. With the help of this partnership, these merchants gain the advantage of tapping the opportunities created by the globalization of e-commerce. Majority of merchants today, are eyeing up global expansion and wish to grow at a faster pace, however, the last thing they would…

Contactless Payment Observe Huge Demand in Australia Payment Market

Pune, India, 04 December 2017: WiseGuyReports announced addition of new report, titled “Payments in Australia 2017: What Consumers Want”.

A 'payment system' is new technology that allows consumers, businesses, and many organizations to transfer money to a financial institution and vice versa. This includes Payment Instructions - Cash, Card, Check and Electronic Funds Transfer which customers use to pay - and generally unseen arrangements ensure that the funds move from one…