Press release

Cyber Insurance Market Revenue Surges: Acumen Research Projection

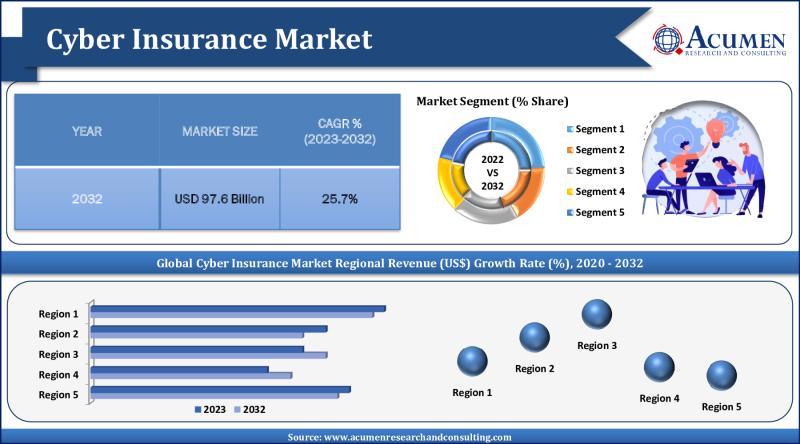

Key Points and Statistics on the Cyber Insurance Market:● The global cyber insurance market size is expected to reach USD 97.6 Billion by 2032, growing at a CAGR of 25.7% from 2023 to 2032.

● North America leads the market, holding over 36% of the market share in 2022.

● The Asia-Pacific region is expected to record a CAGR of around 26.9% from 2023 to 2032.

● The stand-alone insurance type segment accounts for over 57% of the market share in 2022.

● The BFSI segment recorded more than 26% of the revenue share in 2022.

● Key drivers include the increasing frequency of cyberattacks and evolving data protection regulations.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3365

Cyber Insurance Market Overview and Analysis:

Cyber insurance is becoming increasingly relevant as businesses and individuals rely more on digital technologies. It provides financial protection against the consequences of cyber incidents, covering costs like data recovery, legal fees, and regulatory fines. The market is witnessing robust growth, driven by the escalating threat landscape and heightened awareness of cyber risks. The demand for cyber insurance is also fueled by the need for compliance with data protection laws like GDPR and CCPA.

Latest Cyber Insurance Market Trends and Innovations

The cyber insurance market is constantly evolving, with new trends and innovations emerging all the time. Some of the latest trends include:

● Development of tailored cyber insurance products for small businesses: Small businesses are increasingly becoming targets of cyber attacks, and as a result, there is a growing demand for cyber insurance products that are specifically designed for their needs. These products typically offer a range of coverage options, including protection against data breaches, malware attacks, and denial-of-service attacks.

● Integration of technology and analytics for better risk assessment: Insurers are increasingly using technology and analytics to better assess the cyber risk of their customers. This information can then be used to price policies more accurately and to develop more tailored coverage options.

● Increased use of cyber insurance by large corporations: Large corporations have traditionally been the primary buyers of cyber insurance, but there is a growing trend of smaller businesses purchasing cyber insurance as well. This is due to the increasing awareness of cyber risks and the availability of more affordable cyber insurance products.

Major Growth Drivers of the Cyber Insurance Market

The growth of the cyber insurance market is being driven by a number of factors, including:

● Increasing reliance on digital technologies: Businesses are increasingly reliant on digital technologies, which makes them more vulnerable to cyber attacks.

● Expanding cyber risk landscape: The cyber risk landscape is constantly evolving, with new threats emerging all the time.

● Rise of remote work and cloud adoption: The rise of remote work and cloud adoption has increased the cyber risk exposure of businesses.

● Greater awareness of cyber risks: Businesses are becoming more aware of the cyber risks they face, and are taking steps to mitigate these risks.

Key Challenges Facing the Cyber Insurance Industry

The cyber insurance industry faces a number of challenges, including:

● Lack of standardization in cyber risk assessment: There is no standardized approach to cyber risk assessment, which makes it difficult for insurers to accurately price policies.

● Uncertainty in quantifying cyber risks: The uncertainty in quantifying cyber risks makes it difficult for insurers to accurately price policies.

● High cost of cyber insurance: Cyber insurance can be expensive, which can make it difficult for some businesses to afford.

● Limited availability of cyber insurance: Some insurers are reluctant to offer cyber insurance, due to the high risk of claims.

Despite these challenges, the cyber insurance market is expected to continue to grow in the coming years. As businesses become more aware of the cyber risks they face, and as the cyber risk landscape continues to evolve, the demand for cyber insurance is likely to increase.

Market Segmentation Insights:

● By Component:

○ Services

○ Solutions

● By Insurance Type:

○ Stand-alone

○ Packaged

● By Organization Size:

○ Large Enterprises

○ Small and Medium Enterprises

● By End Use Industry:

○ BFSI

○ Retail

○ IT and Telecom

○ Healthcare

○ Others

Overview by Region of the Cyber Insurance Market:

North America dominates the market, thanks to its advanced digital infrastructure and stringent regulatory environment. However, significant growth is also expected in the Asia-Pacific region due to increasing digitalization and awareness of cyber risks.

Cyber Insurance Market Table of Content:

CHAPTER 1. Industry Overview of Cyber Insurance Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Cyber Insurance Market By Component

CHAPTER 6. Cyber Insurance Market By Insurance Type

CHAPTER 7. Cyber Insurance Market By Organization Size

CHAPTER 8. Cyber Insurance Market By End Use Industry

CHAPTER 9. North America Cyber Insurance Market By Country

CHAPTER 10. Europe Cyber Insurance Market By Country

CHAPTER 11. Asia Pacific Cyber Insurance Market By Country

CHAPTER 12. Latin America Cyber Insurance Market By Country

CHAPTER 13. Middle East & Africa Cyber Insurance Market By Country

CHAPTER 14. Player Analysis Of Cyber Insurance Market

CHAPTER 15. Company Profile

List of Key Players in the Global Market:

Notable companies in the market include AIG, Chubb, Zurich Insurance Group, Allianz, AXA, Travelers Insurance, Beazley, Hiscox, Liberty Mutual, CNA Financial, Berkshire Hathaway Specialty Insurance, and Marsh & McLennan.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3365

Browse for more Related Reports

https://reserchindustries.blogspot.com/2024/03/anti-plagiarism-software-market-share.html

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Revenue Surges: Acumen Research Projection here

News-ID: 3444638 • Views: …

More Releases from Acumen Research and Consulting

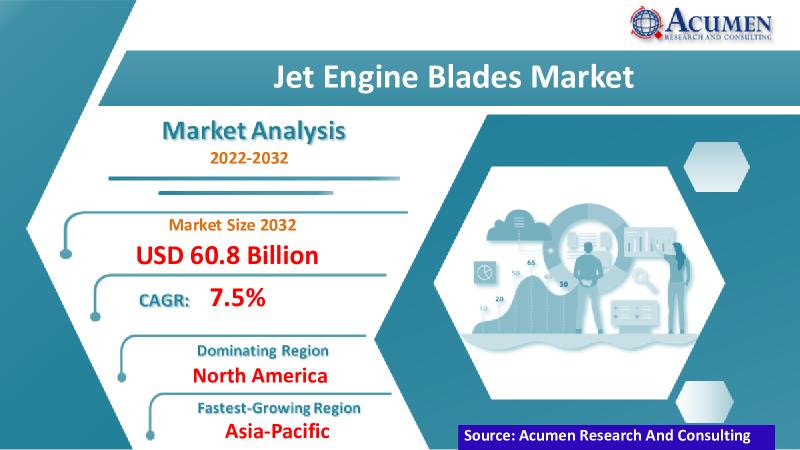

Jet Engine Blades Market Size, Share, Growth Trends and Forecast 2023 - 2032

The global Jet Engine Blades Market has been experiencing remarkable growth, fueled by advancements in aviation technology, increasing air passenger traffic, and the burgeoning demand for fuel-efficient aircraft. With a market size of USD 30.1 Billion in 2022, the sector is poised for exponential expansion, projected to reach USD 60.8 Billion by 2032, at a notable CAGR of 7.5% from 2023 to 2032. This article delves into the intricacies of…

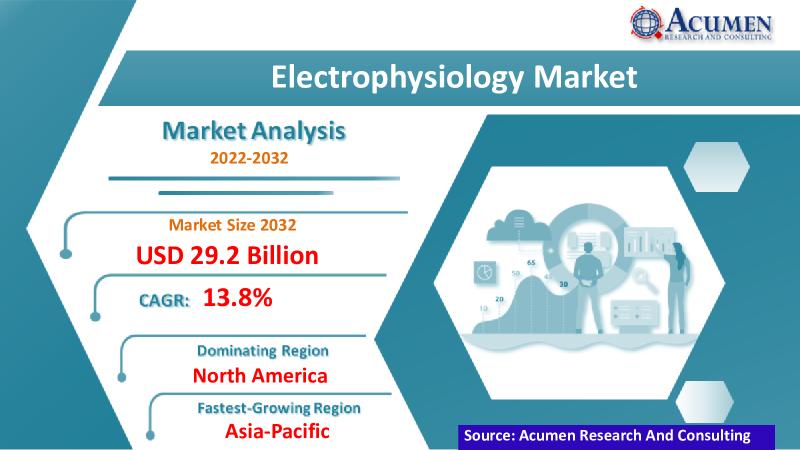

Electrophysiology Market Sales and Revenue Report 2023-2032

The Electrophysiology (EP) Market has witnessed remarkable growth in recent years, fueled by technological advancements, rising prevalence of cardiac arrhythmias, and an aging population. With a market size of USD 8.2 billion in 2022 and a projected growth to USD 29.2 billion by 2032, representing a robust CAGR of 13.8% from 2023 to 2032, the EP market presents a compelling landscape of opportunities and challenges. In this article, we delve…

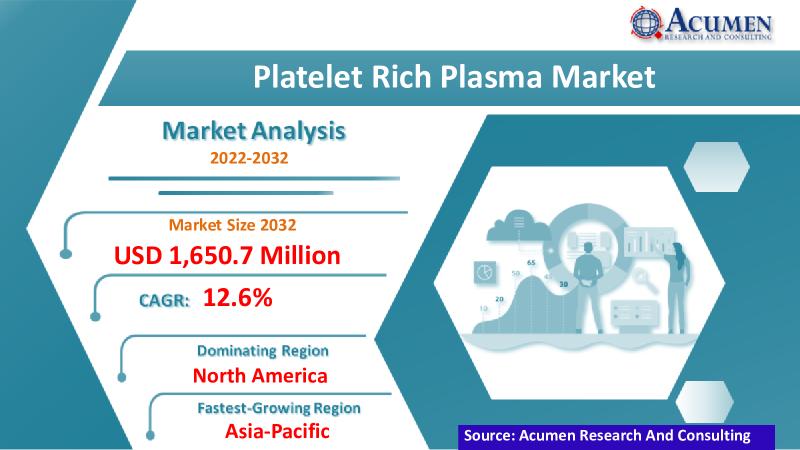

Platelet Rich Plasma Market Size, Share, Growth, and Forecast 2023-2032

The Platelet Rich Plasma (PRP) market has emerged as a dynamic sector within the healthcare industry, offering innovative solutions in regenerative medicine and orthopedics. With a promising growth trajectory, driven by technological advancements and increasing applications, the PRP market is poised for significant expansion in the coming years.

Download Free Platelet Rich Plasma Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart) https://www.acumenresearchandconsulting.com/request-sample/2508

Market Overview:

In 2023, the Platelet…

Pharmaceutical Intermediates Market Size, Share, Growth Forecast 2023-2032

The pharmaceutical intermediates market is witnessing robust growth, with an estimated market size of USD 30.9 billion in 2022, poised to reach USD 55.8 billion by 2032. This remarkable growth, at a CAGR of 6.2% from 2023 to 2032, underscores the industry's resilience and potential. In this article, we delve into the dynamics shaping this market, exploring key drivers, constraints, opportunities, and the competitive landscape.

Download Free Pharmaceutical Intermediates Market Sample…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…