Press release

Global Buy Now Pay Later (BNPL) Market Size (2022-2030) Share, Industry Trends, Growth, Challenges, and Forecast: Custom Market Insights

The Global Buy Now Pay Later BNPL Market was estimated at USD 16 billion in 2021 and is anticipated to reach around USD 90 billion by 2030, growing at a CAGR of roughly 22% between 2022 and 2030. The global Buy Now Pay Later BNPL market research report offers an in-depth analysis of the global market size, further segmented into regional and country-level market size and segmentation market growth.Also, it provides the market share, sales analysis, competitive landscape, the impact of domestic and global market participants, trade regulations, value chain optimization, recent key developments, strategic market growth analysis, opportunities analysis, product launches, and technological innovations.

Get a sample of the report: https://www.custommarketinsights.com/request-for-free-sample/?reportid=19989

The Buy Now Pay Later BNPL Market: Overview

The point-of-sale financing option known as "Buy Now, Pay Later" has grown in popularity recently, particularly among younger groups. The COVID-19 epidemic exacerbated several financial stress-related issues, including late payments and lowering credit limits. Due in part to this, the widespread use of credit cards has declined over the past few years globally, making room for the emergence of alternative payment methods.

As an alternative to credit cards as well as some other forms of financing, these solutions were developed to allow clients the choice to purchase their products and pay in a pre-agreed number of payments over time. In addition, the client incurs no cost because these solutions are typically offered at low or no interest rates and with no additional fees.

The Buy Now Pay Later BNPL Market: Growth Factors

The industry is expanding as a result of factors like digitization, rising merchant adoption, rising repeat usage among younger consumers, and the entry of new firms offering BNPL services for lending. In addition, younger customers favor using BNPL services since they may purchase expensive laptops and cellphones and make payments for stationery products, among other advantages.

Financial service providers may now offer customers cutting-edge digital services due to technological improvements and the substantial increase in internet usage worldwide. For example, demand for internet banking is being driven by the growing use of mobile apps for payment transfers. Additionally, the e-commerce industry's rapid expansion has aided fintech firms in expanding their global footprints for BNPL solutions.

Directly Purchase a Copy of the Report @ https://www.custommarketinsights.com/report/buy-now-pay-later-market/

More people owning smartphones and the need for better internet connectivity have driven businesses to accept payments online from clients. The BNPL platform also supports the QR-code feature, which enables users to scan the code and make the appropriate payments. However, during the projected year, it is anticipated that hefty late fees levied by BNPL service providers will impede market growth. Credit providers and banks providing BNPL services charge the business and the client.

The Buy Now Pay Later BNPL Market: Key Players Insights

The BNPL market is moderately fragmented. Customers and retailers both benefit from BNPL. Leading suppliers are moving into the e-commerce ecosystem by increasing their footprints and attracting new clients. By 2025, the market for these BNPL payment apps is anticipated to grow 10-15 times, according to Bank of America Corp., owing to the increasing use of BNPL by customers to make in-person and online purchases. Many merchants are emphasizing the acceptance of these online installment loans and point-of-sale loans as payment options, opening up the new business potential for BNPL solution providers. Over the forecast period, the market is also anticipated to be driven by the expanding e-commerce sector.

• 2022: The Central Bank of Kuwait (CBK) has allowed a new Buy Now Pay Later product to start testing by launching it in the regional market within the Regulatory Sandbox with a group of willing customers and merchants to thoroughly assess and evaluate the product. The CBK is keen to facilitate advanced financial technologies and strengthen its role in adopting and driving innovation.

• 2022: Customers are encouraged to use the Klarna app to purchase now and pay later at B&M, one of the UK's fastest-growing variety retailers. It implies that customers can buy using the BNPL app at the register and pay for it over three interest-free payments.

Press Release For Buy Now Pay Later BNPL Market: https://www.custommarketinsights.com/press-releases/bnpl-market-size/

The Buy Now Pay Later BNPL Market: Report Scope

The study focuses on (BNPL) Buy Now Pay Later market analysis on a global scale, and market sizing includes the income generated by these solutions provided by different market players. To support the market projections and growth rates over the anticipated 2022-2030.

The study monitors essential market factors, underlying growth influencers, and significant vendors active in the sector. The study also examines how COVID-19 has affected the ecology generally. The scope of the study includes market sizing and forecast for segmentation by channel, organization size, end-use, application, and geography.

The Buy Now Pay Later BNPL Market: Prominent Players

Sezzle

Klarna Bank AB

Afterpay

Laybuy Group Holdings Limited

Splitit

Quadpay

Affirm Holdings Inc.

PayPal Holdings Inc.

Perpay

Payl8r (Social Money Ltd.)

Enquire for Customization in Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=19989

The Buy Now Pay Later BNPL Market: Segments

By Channel

POS

Online

By Organization Size

SMEs

Large Enterprises

By End-use

Retail

Consumer Electronics

Healthcare

Fashion & Garment

Leisure & Entertainment

Others

The Buy Now Pay Later BNPL Market: Regions

North America

The U.S.

Canada

Mexico

Europe

France

The UK

Spain

Germany

Italy

Rest of Europe

Asia Pacific

China

Japan

India

Australia

South Korea

Rest of Asia Pacific

The Middle East & Africa

Saudi Arabia

UAE

Egypt

Kuwait

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Check Out Some of Our Other Reports:

Global Facility Management Market: https://www.custommarketinsights.com/report/facility-management-market/

Global Multi-Access Edge Computing Market: https://www.custommarketinsights.com/report/multi-access-edge-computing-market/

Global IoT Telecom Services Market: https://www.custommarketinsights.com/report/iot-telecom-services-market/

Global Infrastructure as a Service Market: https://www.custommarketinsights.com/report/infrastructure-as-a-service-market/

Global IT Asset Disposition Market: https://www.custommarketinsights.com/report/it-asset-disposition-market/

CMI Consulting LLC

1333, 701 Tillery Street Unit 12, Austin, TX, Travis, US, 78702

Sales & Support +1 801 639 9061

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

Custom Market Insights provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Buy Now Pay Later (BNPL) Market Size (2022-2030) Share, Industry Trends, Growth, Challenges, and Forecast: Custom Market Insights here

News-ID: 2982755 • Views: …

More Releases from Custom Market Insights

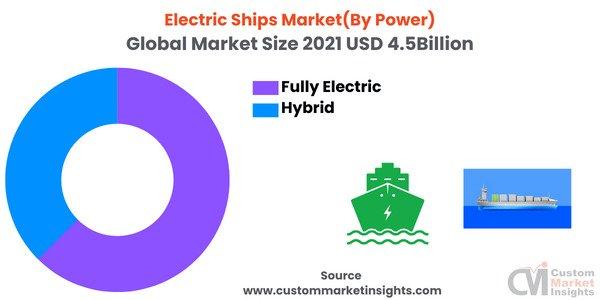

Global Electric Ships Market Size (2022-2030) Share, Industry Trends, Growth, Ch …

The Global Electric Ships Market size was estimated at USD 4.5 Billion in 2021 and is expected to hit around USD 16 Billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 15% from 2022 to 2030.

The report examines the Electric Ships market's drivers and restraints, as well as their impact analysis. Also, the report mentions global opportunities prevailing in the Electric Ships market.

Get a sample…

![[Latest] U.S. Education Market Size, Forecast, Analysis & Share Surpass US$ 3.1 Trillion By 2030, At 4.2% CAGR](https://cdn.open-pr.com/W/4/W410609714_g.jpg)

[Latest] U.S. Education Market Size, Forecast, Analysis & Share Surpass US$ 3.1 …

The U.S. Education Market was estimated at USD 1.4 Trillion in 2021 and is expected to reach USD 1.8 Trillion in 2022 and is anticipated to reach around USD 3.1 Trillion by 2030, growing at a CAGR of roughly 4.2% between 2022 and 2030.

The U.S. Education Market research report offers an in-depth analysis of the U.S. market size, which is further segmented into the regional and country-level market size, and…

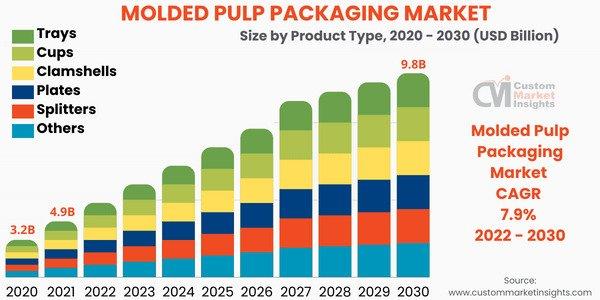

Global Molded Pulp Packaging Market Size (2022-2030) Share, Industry Trends, Gro …

Our recently published report, Molded Pulp Packaging Market, offers a comprehensive and deep evaluation of the market's stature. Also, the market report estimates the market size, revenue, price, market share, market forecast, growth rate, and competitive analysis.

As per research, the molded pulp market size was estimated at around US$ 4.9 billion in 2022, growing at a CAGR of nearly 7.9% during 2022-2030. The market is projected to reach approximately…

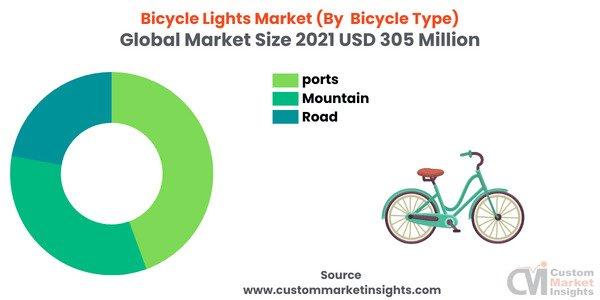

Global Bicycle Lights Market Size (2022-2030) Share, Industry Trends, Growth, Ch …

The Global Bicycle Lights Market was estimated at USD 305 million in 2021 and is expected to reach USD 334 million in 2022 and is anticipated to reach around USD 570 million by 2030, growing at a CAGR of roughly 8.5% between 2022 and 2030.

Our research report offers a 360-degree view of the Bicycle Lights market's drivers and restraints, coupled with the impact they have on demand during the projection…

More Releases for BNPL

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Philippines BNPL Industry to Grow at a CAGR of 50.9% Durin …

The coronavirus pandemic has accelerated the shift towards online shopping among consumers in the Philippines. Notably, this boom in the Filipino e-commerce industry has also resulted in the widespread adoption of digital payment methods such as buy now, pay later (BNPL) payment solutions in the country. In the Philippines, consumers are increasingly looking for flexible and convenient payment solutions which allow them to manage their finances effectively.

According to PayNXT360’s Q4…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

PayNXT360 Expects the Saudi Arabian BNPL Industry to Grow at a CAGR of 42.4% Dur …

With the awareness regarding BNPL products on the uptick in Saudi Arabia, more than 80% of the consumers said that they are keen to make use of the BNPL services in the country, according to PayNXT360’s Q4 2021 Global BNPL Market Survey.

This change in attitude towards BNPL products is shaping the future of the payments industry in Saudi Arabia. PayNXT360 expects the trend to continue from the short to medium-term…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…