Press release

Tax Management Market Size, Share, Trends, Growth and Regional Analysis 2027

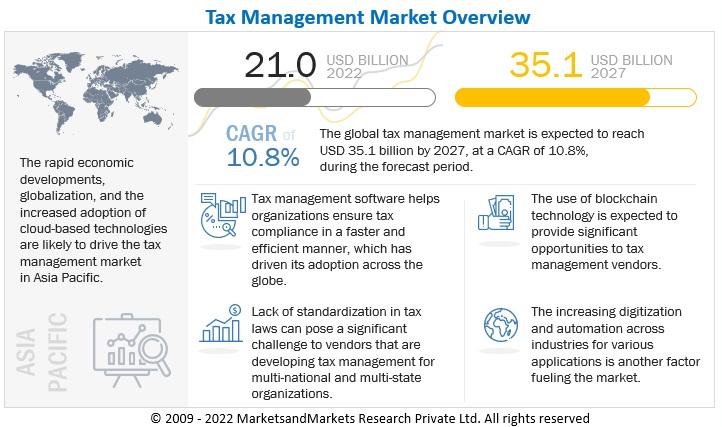

the global Tax Management Market is projected to grow to USD 35.1 billion by 2027 from USD 21.0 billion in 2022 at a Compound Annual Growth Rate (CAGR) of 10.8% during the forecast period. Standardization of tax compliance processes to scale operations globally, minimize risks, and fulfill tax obligations with lesser effort, increase in transparency for tax audits, and automation compliance tasks with AI, ML, and provision of automated compliance updates along with rules and regulations in countries are some of the key factors driving the market growth.Get Sample of Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=230446693

Software segment to continue with the larger market size during the forecast period

Tax management software facilitates the completion of tax returns for companies operating across verticals. It provides automated tax compliance with local accounting legislation and standards. Organizations across the globe have started adopting tax management software to keep up with the rapidly changing regulations and shifts in product taxability. Tax management software is experiencing an increasing demand pertaining to the ever-evolving tax and accounting laws across countries. There has to be enhanced software that can consider all of the regulatory needs and compliances put forward by the authorities of various regions. This is of utmost importance and provides alert(s) while establishing tax obligations across regions, and countries based on their nexus laws.

SMEs to record a higher CAGR during the forecast period

The increasing complexity of tax compliance has forced SMEs to adopt advanced tax management software. Cost-effectiveness is an important need for SMEs, as limited budgets always constrain them. This, in turn, leads to restricted ways adopted by SMEs to market themselves and gain visibility. SMEs have come a long way in enhancing strategic approaches including, but not limited to, service offerings, filing and reporting compliance requirements, levels of tax understanding, tax obligations complexity, and rapid changes in business ecosystems/environments. For instance, IRS (Internal Revenue Service) estimates that businesses with less than USD 1 million in revenue are to incur almost two-thirds of business compliance costs. Such costs are larger, related to revenues or assets, for SMEs than for large enterprises. Additionally, due to the complex tax codes, SMEs can understate their revenues and overstate their expenses, thus underpaying their taxes.

Manufacturing vertical to hold the second-highest market size during the forecast period

Manufacturing firms are an integral part of the supply/value chain. Hence, manufacturing firms must run smoothly so that the value chain will be stable. Globalization, eCommerce, and product shipment have reduced the gap between manufacturers and consumers. Nowadays, manufacturers have extended their market reach, resulting in more revenue and increased taxable products and services. The challenges faced while calculating tax for a manufacturer include selling to retailers or resellers, product-wise taxability, shipping or delivery, installation, and repairs. Hence, the process of tax calculation is complex and needs continuous observation. Manufacturers need to pay fines for any missing or invalid certificate. Tax management solutions can greatly help manufacturers better handle exempt or taxable transactions. Avalara and ClearTax are some of the companies providing tax management solutions to manufacturing companies.

Asia Pacific to record the highest CAGR during the forecast period

Asia Pacific is expected to have the most rapid growth rate in the tax management market during the forecast period due to its growing technology adoption and implementation at a growing scale across large enterprises and SMEs. The rise in indirect taxation is gathering pace as governments across the Asia Pacific region broaden the net of goods and services tax (GST) and value-added tax (VAT). Most of the automation, increased integration, and collaboration across international operations are essential. The outcome would ease the strains, reducing the risks and providing the agility needed to future-proof capabilities. Companies in the Asia Pacific are benefitting from the flexible economic conditions, healthy industrialization, and globalization-motivated policies of the governments practiced across different countries in the region. To match the rapid pace of technological advancement, companies are expected to use, improvise, enhance, constantly update and upgrade tax management solutions. There is a huge untapped market for tax management in India, China, Japan, and several other countries of Asia Pacific; this has proven to be a driver for the market in the region.

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/tax-management-market-230446693.html

The tax management market comprises major providers, such as Thomson Reuters (Canada), Intuit (US), H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), Sovos Compliance (US), SAP SE (Germany), Blucora (US), Vertex (US), DAVO Technologies (US), Sailotech (US), Defmacro Software (India), Xero (New Zealand), TaxSlayer (US), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), Taxback International (Ireland), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), SAXTAX (US,) and Shoeboxes (US)

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Size, Share, Trends, Growth and Regional Analysis 2027 here

News-ID: 2922639 • Views: …

More Releases for Tax

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…

Industry Leading Tax Software Market For High-Volume Tax Businesses with Online …

Market Highlights

Tax software is software that ensures tax compliance for income tax, corporate tax, VAT, service tax, customs, sales tax, use tax, or other taxes its users may be required to pay. The software automatically calculates a user's tax liabilities to the government, keeps track of all transactions, keeps track of eligible tax credits, etc. The software can also generate forms or filings needed for tax. The software will have…

Kreston Reeves Tax Director achieves leading international tax qualification

Kreston Reeves, one of the leading accountancy and financial services firms located across London, Kent and Sussex, is proud to announce that Matthew Creevy, Corporation Tax Technical Director, has achieved the Advanced Diploma in International Taxation (ADIT), placing him in the highest echelons of international tax professionals.

ADIT is an advanced level designation in international cross-border tax. The credential is designed by a board of world-leading experts and has been created…

SMP Accounting & Tax appoints Rachael Hooper as Tax Manager

Russell Bedford member SMP Accounting & Tax Limited, one of the Isle of Man’s largest accounting and tax firms, has appointed Rachael Hooper as a manager in its Tax Department.

Rachael will be working in all areas of UK, Isle of Man and International taxation, with a particular focus on UK resident non-UK domiciled individuals, Trusts and Inheritance Tax.

After qualifying as a Chartered Accountant with a Big Four accountancy firm, Rachael…

United Tax Group Announces Effective Tax Negotiators

United States (June 2011) – United Tax Group announces effective tax negotiators for clients. Tax negotiators work directly with the IRS so tax payers do not. The expertise of tax negotiators helps save clients thousands.

Tax negotiators from United Tax Group are assigned individual clients. This means tax negotiators are working on particular cases assigned. Therefore, clients receive individualized attention for their case.

This individualized attention by United Tax Group gets results.…