Press release

How to Tackle Inflation? And Protect Your Money

Inflation is when the prices of goods and services increase, and it's a problem that can have a big impact on your finances. India's inflation rate increased from September 2021, when it was 4.35%, to January 2022, when it was 6.01%.This growth is about 50%. If it explodes beyond control, inflation ruins value for everyone. Debt rates of return in an environment of rising inflation are scientifically shown to be unappealing, but there is a slanted connection between inflation and equity returns.

To Beat Inflation, Download Imperial Money App Now-

https://play.google.com/store/apps/details?id=com.iw.imperialmoney

You can take a few steps to secure your funds from inflation, Here are some tips:-

Make sure you're investing your money in the right places.

Protect your savings by using a savings account or investing in low-risk assets.

You won't have to struggle to keep up with rising costs if you live within your means.

Be prepared for price hikes by stocking up on essential items when they're available at a discount.

What Is Inflation?

Inflation is the increase in the prices of goods and services in an economy over a period of time. It's caused by a variety of factors, including a rise in the cost of goods, increased demand, and currency depreciation.

When prices rise, your money buys less and less. Inflation can have a serious impact on your quality of life, so it's important to take steps to protect your money. One way to do that is by investing in assets that are likely to hold their value or even increase in value during times of inflation.

How Does Inflation Affect Your Money?

Inflation is the enemy of your money. It's what steadily eats away at your savings and, over time, can really add up. The key to protecting your money against inflation is to invest it in things that will maintain their value over time. This could be things like mutual funds, property, gold, or stocks and shares in stable companies.

But it's not just about investing your money-you also need to be smart about how you use it. For example, if you have a credit card, try to pay off as much of the balance as possible each month. This will help you avoid paying interest, which will only increase as inflation rises.

How to Save Money During Inflation?

So, you want to save money during inflation? Here are some pointers to get you going: Invest in things that will most likely increase in value. Look for deals on essential items, such as food and clothing. Make use of price controls where available. Consider holding some of your money in hard assets such as gold or silver.

Investing During Inflation

When it comes to inflation, you need to be smart about how you invest your money?

Here are some pointers for staying up to date:-

Think about investing in assets that are going to hold their value. Precious metals like gold and silver are always a safe bet.

Try to keep your money in short-term investments so you can take advantage of rising prices.

Make sure you're diversified so if one investment falls short, you still have others that are doing well.

And finally, always consult with a financial advisor to get professional advice tailored specifically to your situation.

Real Estate and Inflation

When it comes to inflation, your best bet is to invest in real estate. Unlike stocks or bonds, real estate is a tangible asset that can't be devalued by inflation. In fact, during times of high inflation, real estate tends to go up in value. What are the steps involved in investing in real estate? It's not as difficult as you might imagine.

You can start by looking for properties that are priced below market value. These are called "fixer-uppers." You can also invest in real estate crowdfunding, which is a way to pool your money with other investors and invest in a property together. This is a great way to get started if you're not quite sure how to invest in real estate on your own.

Here are few 5 Tips to Help You Tackle Inflation:-

1. Stick to a budget.

2. Invest your money wisely.

3. Stay ahead of the curve.

4. Shop around for the best deals.

5. Use cash whenever possible.

Conclusion

Inflation is a natural occurrence in any economy, but that doesn't mean it isn't a problem when it starts to affect your finances. Luckily, there are things you can do to protect your money and even take advantage of inflation.

Contact Us: 9595889988

Email Us: wecare@imperialfin.com

Follow Us: https://www.facebook.com/imperialfin/

Follow US: https://in.linkedin.com/company/imperialmoney

Download App: https://play.google.com/store/apps/details?id=com.iw.imperialmoney

Subscribe to YouTube Channel: https://www.youtube.com/c/IMPERIALMONEY

Imperial Money Pvt. Ltd.

302, Royal Vista, Opp. Dhantoli Garden Main Gate, Dhantoli, Nagpur - 440012

Imperial Money is a dedicated company that provides personalized services for wealth creation. It is an all-around choice to go for to induce your monetary assets at ease with multiple innovative prospects that add more value to your profile. The services and ideas include innovative products, best-in-class experience, mutual funds, and equities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How to Tackle Inflation? And Protect Your Money here

News-ID: 2765055 • Views: …

More Releases from Imperial Money Pvt. Ltd.

5 Investment Strategies to With Wealth Creation

Are anybody looking for wealth creation? If so, then come to the right place! In this blog post, will discuss five proven investment strategies that can help to reach financial goals.

Nagpur, Maharashtra, India., June 16, 2023 - /PressReleasePoint/ - Want to Take Wealth Creation to the Next Level? all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it…

5 Investment Strategies to Help You With Wealth Creation

Want to Take Your Wealth Creation to the Next Level?

We all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it can be hard to know where to start. That's where this blog comes in. In this article, we will discuss five game-changing investment strategies that can help you transform your wealth creation journey.

Here are 5 Investment Strategies…

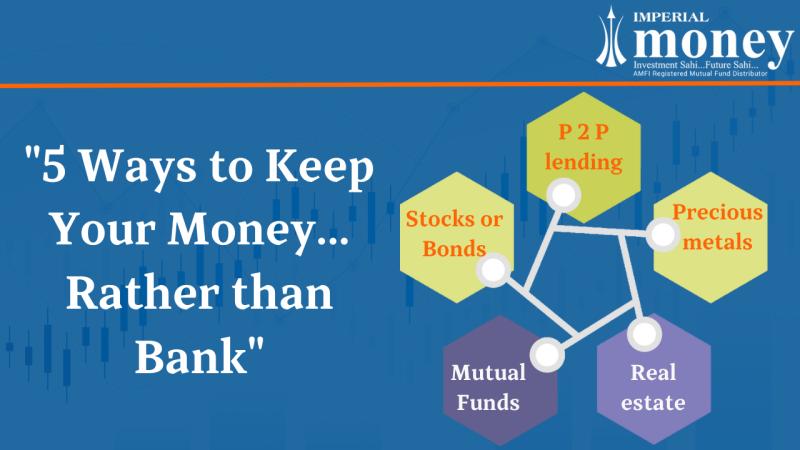

Top 5 Alternatives to Banks for Investing Your Money

Rather than a bank, here are the 5 best ways to keep your money

When it comes to storing your money, a bank account may seem like the most obvious option. However, there are many alternatives to banks to consider that may better suit your financial goals and preferences. In this blog, we'll explore some of the best alternatives to banks to keep your money besides a traditional bank.

Invest in…

More Releases for Inflation

How Does Inflation Affect Companies?

All companies are affected by inflation. Non-essential companies get crushed and essential thrive during inflation. Though the definition of an "essential company" may not be obvious. For example during a recession alcohol consumption increases. So the customers obviously see alcohol as an essential product to cope with hard times.

Will companies increase salary due to inflation?

Companies are adjusting salaries for inflation only as a last resort, which is important as you'll…

k3 mapa sees inflation staying for years

Wiesbaden, August 17th 2021. Inflation has arrived and will stay for various years. Both money supply and output demand factors favour this forecast. Money supply will stay strong as central banks need to keep interests rates low and production output suffers from long term Covid

In May 2018 we published: “k3 sees rough times ahead” arguing that global debt had risen to new record highs and there were only three possible…

Inflation Device Market, by Display Type (Analog Inflation Devices, Display Infl …

Inflation Device Market has significant potential owing to the high demand for minimally invasive treatment across the globe. These devices are majorly used in the intervention radiology, intervention cardiology and peripheral vascular surgical procedures including angioplasty, angiography, embolization, thrombosis and so on. The inflated devices are used for the implementation in mainly gastroenterology, pulmonary, and otolaryngology procedures. As these procedures require comparatively large-size balloon, resulting in a huge amount of…

United States Slide Inflation Cylinders Market Report 2017

Summary

This report studies sales (consumption) of Slide Inflation Cylinders in United States market, focuses on the top players, with sales, price, revenue and market share for each player, covering

Cobham

Luxfer Gas Cylinders

Market Segment by States, covering

California

Texas

New York

Florida

Illinois

Split by product types, with sales, revenue, price, market share and growth rate of each type, can be divided into

Type I

Type II

Split by applications, this report focuses on sales, market share and growth rate of…

'INFLATION' a solo show by FANAKAPAN

BSMT SPACE is very proud to present 'INFLATION’ - the first solo show by acclaimed Street Artist Fanakapan, opening on the 8th of April with a private viewing on April 7th. One of the most impressive artists on the scene, with a style of his own that he continually redefines, Fanakapan is set to push the boundaries of his visual masterpieces further in what will be a stellar exhibition that…

India Faces Continuing Inflation, Raises Interest Rates

India's central bank has raised interest rates for the 12th time in 18 months to try to contain inflation. The Reserve Bank of India raised the policy lending rate, called the repo rate, by 25 basis points to 8.25%. India has been struggling to contain inflation which is at a 13-month high of 9.78%. The move was widely expected by a majority of economists, though some predicted a pause after…