Press release

Cryptocurrency vs Mutual Funds: Where Should You Invest?

Cryptocurrency vs Mutual Funds: What is better to Invest?Everything in the world, whether man-made or natural, has its value and keeps fluctuating constantly. The concept of money was first used thousands of years ago as something to trade for. Only in 600 B.C, the concept of currency in the form of coins and paper was invested. The concept of money or currency has evolved into a much complex system since then. This interests people to invest in things whose value tends to go up over time to grow their money. Over time, different ways of investments have been developed and are still constantly on their way to invention.

For mutual funds details & investments download our app -

https://play.google.com/store/apps/details?id=com.iw.imperialmoney

This blog specifically revolves around two types of investments, namely – Mutual funds and cryptocurrency which is the most talked-about investment vehicle.

What is a mutual fund? And how does it work?

Most of us know about mutual funds or have at least heard of them. Well, a mutual fund is a financial vehicle that consists of a pool of money from various investors which goes in securities like stocks, bonds, money market & nowadays in real estate as well.

Mutual funds are managed by professional fund managers whose aim is to make capital out of investments made by people. Any gain or loss is proportionally shared by each shareholder of the mutual fund.

What is cryptocurrency? And how does it work?

“Crypto has a chance of becoming Digital Gold,” says Former US Treasury Secretary. Cryptocurrency or crypto is a digital currency used in peer-to-peer electronic cash systems over the internet. Cryptocurrencies are decentralized i.e. there is no centralized authority to govern them, and they work based on a blockchain system.

Bitcoin is one of the most famous types of crypto. Bitcoin along with many others is limited in number unlike other types of currencies which can be increased if needed. Cryptocurrency is discovered or mined by solving complex mathematical problems. Some other famous cryptocurrencies are – Ethereum, Litecoin, Bitcoin Cash, etc.

The question arises – which of them is better for investment?

Parameters

Mutual funds

Cryptocurrency

Source The existing assets and their values. Most cryptocurrencies are finite in number and are yet to be mined completely.

Risk Comparatively low risk High risk due to uncertainty and volatility.

Returns 5% – 15 % annually Fluctuates annually from 1318% in 2017 to -72.6% in 2018 to 87.2% in 2019 to 302% in 2020

Additional costs Very Low Transactional Fees Very low transactional fees

Medium of investment Through financial advisors or online platforms. Online through any crypto trading application or crypto exchanges,

Quantity The potential is not finite and is measured by the value of assets. Most cryptocurrencies are finite in number and are yet to be mined completely.

Legalities It is legal and regulated by SEBI in India. Using crypto is legal but it is not recognized by any Central government across the globe.

So then, who wins?

Well…the answer is no one. Both of them are not always compatible as an investment option. Where should one invest depends on various factors but the most important one is “Risk appetite”. As mentioned in the above table, both of them have differing returns and thus way different risks associated with them.

Apart from its uncertainty, crypto faces one major issue that is – since it’s decentralized it is very difficult for it to become a form of currency. On the other hand, big corporates like Apple and Amazon are in favor of crypto as a currency, and that is why it has now become a tricky issue and constantly appears in financial news.

Now few more data for your understanding. Only 100 people across the globe are holding 13% of BITCOIN with their individual capacity. 40% holding of all BITCOIN globally holding by 2500 unknown accounts. That is how single trade by 1 account holder influence and generate very high of volatility.

We believe looking into the all parameters we have to choose sensible and realistic products and services which suit our risk profile.

No matter where and how you choose to invest, it is quite understood that planning is the key. It is highly recommended that you consult a financial distributor for your hard-earned money to safely grow for your future needs.

Imperial Money Private Limited is one such firm that provides personalized financial services and wealth creation activities. This organization is an expert in mutual fund distribution and systematic investment products. Imperial money aims at sensible investment and customer satisfaction.

In conclusion with this analysis, there are always different ways to invest and grow your money. People need to choose the right option for them keeping in mind their capacity and ability to cope up with the outcome.

HAPPY INVESTING!!!

Contact Us : 9595889988, 8446686863

Email Us: wecare@imperialfin.com

Follow Us: https://www.facebook.com/imperialfin/

Follow US: https://in.linkedin.com/company/imperialmoney

Subscribe to YouTube Channel: https://www.youtube.com/c/IMPERIALMONEY

Imperial Money Pvt. Ltd.

302, Royal Vista, Opp. Dhantoli Garden Main Gate, Dhantoli, Nagpur - 440012

Imperial Money is a dedicated company that provides personalized services for wealth creation. It is an all-around choice to go for to induce your monetary assets at ease with multiple innovative prospects that add more value to your profile. The services and ideas include innovative products, best-in-class experience, mutual funds, and equities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cryptocurrency vs Mutual Funds: Where Should You Invest? here

News-ID: 2301103 • Views: …

More Releases from Imperial Money Pvt. Ltd.

5 Investment Strategies to With Wealth Creation

Are anybody looking for wealth creation? If so, then come to the right place! In this blog post, will discuss five proven investment strategies that can help to reach financial goals.

Nagpur, Maharashtra, India., June 16, 2023 - /PressReleasePoint/ - Want to Take Wealth Creation to the Next Level? all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it…

5 Investment Strategies to Help You With Wealth Creation

Want to Take Your Wealth Creation to the Next Level?

We all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it can be hard to know where to start. That's where this blog comes in. In this article, we will discuss five game-changing investment strategies that can help you transform your wealth creation journey.

Here are 5 Investment Strategies…

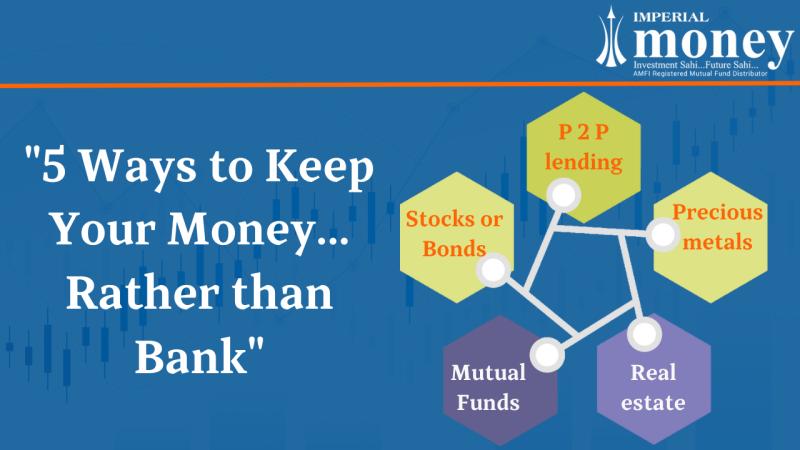

Top 5 Alternatives to Banks for Investing Your Money

Rather than a bank, here are the 5 best ways to keep your money

When it comes to storing your money, a bank account may seem like the most obvious option. However, there are many alternatives to banks to consider that may better suit your financial goals and preferences. In this blog, we'll explore some of the best alternatives to banks to keep your money besides a traditional bank.

Invest in…

More Releases for Crypto

Crypto Asset Management Market Is Booming So Rapidly | Coinbase, Gemini, Crypto …

Advance Market Analytics published a new research publication on "Crypto Asset Management Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The Crypto Asset Management market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts…

Crypto Consulting Services Market 2022 Demand Statistics, In-depth Analysis and …

The "Crypto Consulting Services Market" report's competitor analysis summary includes business information, income shares, product innovations, regional product presence, growth approaches, pricing policy, marketing efforts, and near-term objectives of leading companies. This study examines historical market growth statistics for Crypto Consulting Services and analyzes them to present market conditions. Customers will receive data from this report that is both historical and statistically significant. It allows readers to get a more…

Crypto Consulting Services Market Explore Worth Observing Growth and Demand: 202 …

Worldwide Market Reports published new research on the Global Crypto Consulting Services Market report covering the micro-level of analysis by competitors and key business segments (2022-2028). The Global Crypto Consulting Services explores comprehensive studies on various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing.

Various factors…

Will you accept crypto becomes when will you accept crypto?

Crypto has achieved many things in its short life. It has been lauded as the next big thing while simultaneously being pilloried as an accident waiting to happen (or being an accident in the middle of happening). Regulators have spoken out against it at the same time as small investors have flocked to it. Pages and pages of content have been written explaining why this time, crypto is going to…

Crypto for non-cryptonians

The breathless press releases, the excitement, the hype, the highs of the bull markets, the lows of bear markets, the tweets and the regulators’ concerns; the crypto sector has provided plenty of debate over the last few years. Unless you are directly involved in it, asking a question can feel like a multitude of superhero comic fans are giving you a half an hour, panel-by-panel account of what happened in…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…