Press release

Germany: True Fleets recovering slightly and Diesel still has a heartbeat

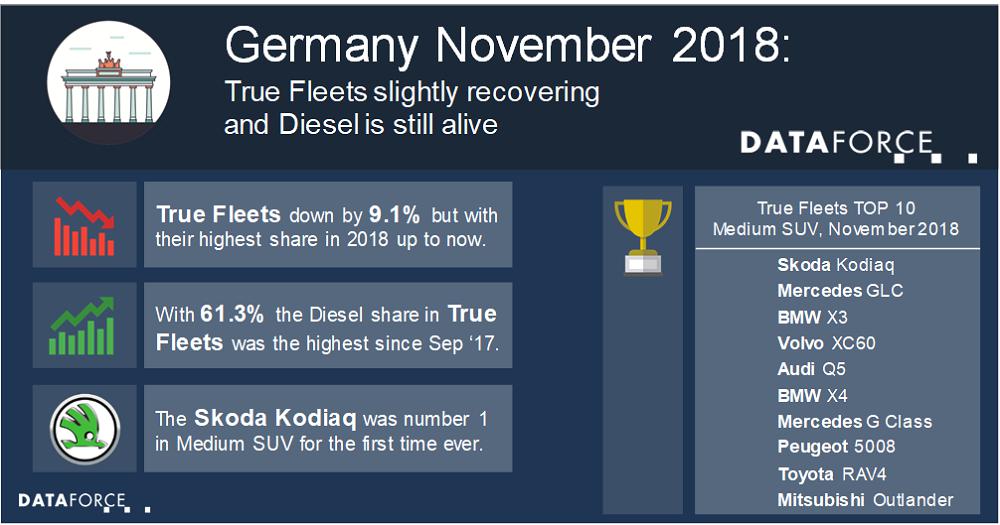

Less than 273,000 new passenger car registrations or a drop of 9.9%; November was certainly a tough month for Germany. The hardest hit, channel wise, were the Private buyers with 16.1%, but you must keep in mind that November 2017 was extraordinarily strong. Registrations of Dealerships, Manufacturers and Short -Term Rentals were down by 4.3%. However, if you look at the year-to-date figures for the first eleven months of 2018 the registrations on these so-called Special Channels are almost spot on with a fractional increase of only 0.03%. Calling this a stable result would be an understatement. No reason to get ecstatic but with - 9.1% True Fleets are at least in better shape than in September and October and due to the relatively weak performance of the Private Market the share of company cars climbed to 26.3% which is the highest for the current year, up to now.Brand performance

In the top ten ranking there was an equal share of wins and losses. Five brands were able to increase their volume and five were lagging behind. Market leader Volkswagen returned to growth (+ 1.3%) followed by BMW and Mercedes. Thanks to a solid + 5.1% Škoda jumped from rank number six into fourth position. Opel on rank number six (behind Ford) had a very strong November with + 18.6% and its highest November volume since 2007. The very positive result for the brand from Rüsselsheim – for this month there was no other brand with a higher growth by absolute figures – was mainly driven by the models Astra, Grandland X, Adam and Insignia.

Audi dropped back to seventh position followed by SEAT, Renault and Volvo. The Swedish Manufacturer achieved a remarkable + 46.2% which led to a market share of 2.83% which is just marginally behind Volvo’s all-time record share of 2,84% back in January 2005! The biggest support came from two SUV models; the XC60 (delivering a truly impressive + 65.1%) and the all-new XC40.

Segment performance

The general trend continues: while SUV keeps on growing, all six Passenger Car subsegments are down, especially the PC Medium segment. Currently in decline having lost 21.5% over November 2017 leaving its share at the lowest ever for this group of cars of 15.5%. Medium-sized SUVs however increased their slice of the market and November brought us a new segment leader: the Škoda Kodiaq was number one for the first time and scored both its best monthly volume (a 4-digit number for the very first time) and market share, outperforming very established competitors like Mercedes GLC, BMW X3 or Audi Q5.

Fuel type performance

Diesel is still alive! Despite the unfavourable press its registrations were once again increasing as 61.3% of all new company cars registered in November were equipped with a Diesel powertrain. That’s the highest percentage seen in more than a year (September 2017 to be precise). And it seems the larger the fleet is, the higher its appetite for Diesel goes. While the share is slightly under 50 percent in companies with up to nine passenger cars in their car parc, it is 59.4% in the fleet size 10 to 49 and even 68.7% in larger fleets with at least 50 cars (all figures 2018 YTD November). Eight out of the top 10 models in November had a Diesel share above 70%; only the Volkswagen models Golf (due to a significant amount of Electric E-Golf) and Polo were below this level. Deal’s being done or the realisation that Diesel is not in fact as bad as some would have you believe?

(604 words; 3,517 characters)

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Michael Gergen

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-231

Fax: +49 69 95930-333

Email: michael.gergen@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Germany: True Fleets recovering slightly and Diesel still has a heartbeat here

News-ID: 1447353 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for November

Atrad.io Announces November results at 8.37%

Against a backdrop of an almost generalized increase of cryptocurrencies, the automated arbitrage trading platform achieved a performance of 8.37% in November, confirming the net annual target of 116%.

Bitcoin has gained more than 70 % in recent weeks, beating its previous records one by one.

In general enthusiasm, everyone is rushing to buy it, both regular investors and newcomers.

Beyond the announcement of PayPal entering the Bitcoin sphere and several other…

Scaring Now Through November 1, 2012

The shrieks and shrills are underway at Fear Overload Haunted Houses, now in its 3rd consecutive year at Bayfair Center in San Leandro. Voted the scariest haunted houses in California by HauntWorld – the largest online haunted house association – Fear Overload raises their own bar in 2012 with two new bone-chilling haunts: Asylum and Insomnia.

Asylum portrays an abandoned Insane Asylum from the 1960s. “You will journey through this…

Six China Sourcing Fairs to be Held Concurrently in Mumbai from November 23 to N …

* The largest Greater China products exhibition in India. * Co-located events comprise of Electronics & Components, Security Products, Home Products, Gifts & Premiums, Hardware & Building Materials, and Bathroom Products.

Mumbai, India, Monday - November 14th, 2011 -- Six China Sourcing Fairs are to be concurrently held in Mumbai on November 23-25, 2011 at Bombay Exhibition Centre, Goregaon featuring a host of latest products from Greater China and other Asian…

MIE Solutions will be Exhibiting and Presenting at FABTECH in Chicago November 1 …

MIE Solutions will be exhibiting and presenting at FABTECH International in Chicago showcasing its range of software products for the manufacturing industry including its ERP, Quoting, Maintenance and Collaboration Software solutions.

Garden Grove, CA, September 03, 2011 -- David Ferguson the President of MIE Solutions will be presenting two educational seminars at FABTECH November 14th, 2011.

10:30 am -12:30 pm– Benefits of Incorporating Data Collection within the Shop Floor and Going Paperless

Shop…

Business901 announces November Training Programs

Value Stream Marketing, Marketing your Black Belt and more.

Mississippi, USA - October 22, 2010 -- Business901 announces their November Training Programs. The schedule includes three 28 day programs and their 90 day - Achieving Expert Status. The 28 day programs are:

1. Marketing your Black Belt

2. Get Clients NOW!

3. Value Stream Marketing

Marketing your Black Belt(http://business901.com/expert-status/marketing-your-black-belt/)is a 28-day program starting November 5th. Marketing your Black Belt is based specifically on…

November is the month of performance!

Melbourne, Australia, 4 October 2010 – eab group announces the launch of a new series of open training courses dedicated to the improvement of organizational performance. The courses will be held in Melbourne, during November, under the slogan: “November is the month of performance!”

10-11 November 2010, ANU House, Melbourne

Measuring and learning with Key Performance Indicators

18 November 2010, ANU House, Melbourne

Solutions for improving the operational performance of Small and…