Press release

NexGen Capital Partners Launches Global Wealth Capital Funds, Revolutionizing Real Estate Investments for High-Net-Worth Individuals Worldwide

"We're committed to providing HNWI investors with top-tier management of quality real estate assets comparable to the offerings provided to institutional investors.�� Jickson Disla, Managing Director at Global Wealth Capital Funds

NexGen Capital Partners, LLC ("NexGen Capital"), a distinguished provider of venture and growth capital to early-stage real estate projects, proudly unveils its collaboration with M4 General Contractors LLC ("M4 General Contractors"). Together, they introduce a groundbreaking entity, Global Wealth Capital Funds ("GWCF"), a limited partnership dedicated to developing enticing real estate investment [http://nexgencaps.com/] prospects to high-net-worth [https://nexgencaps.com/] individuals ("HNWI").

The newly established Global Wealth Capital Funds ("Global Wealth") will oversee a series of private equity real estate funds, catering to accredited individual investors aiming to diversify their investment portfolios by incorporating real estate as an asset class. NexGen Capital Partners, LLC ("NexGen Capital"), seeks to raise over $380 Million over the next 5 years.

Jickson Disla, Managing Director at Global Wealth Capital Funds, expressed, "We're committed to providing HNWI investors with top-tier management of quality real estate assets comparable to the offerings provided to institutional investors."

Despite the allure of real estate as an alternative asset class, HNWIs often encounter limited access to compelling investment opportunities.

Miguel H. Pena of M4 General Contractors observed, "The traditional requirements of substantial capital and diverse professionals have made it challenging for HNWIs to engage in truly diversified portfolios with quality assets and institutional economics."

In addition to traditional emerging markets, the fund will also focus on developing Caribbean Real Estate Developments, expanding its reach, and enhancing investment opportunities for HNWIs. Global Wealth is currently raising capital for its inaugural fund, which boasts several attractive investment opportunities in its pipeline.

Federico Nunez, Managing Director at NexGen Capital, shared his enthusiasm, stating, "Our alliance with Global Wealth Capital Funds and M4 General Contractors positions us to deliver a premier product to a market that lacks comprehensive offerings."

About NexGen Capital Partners, LLC:

NexGen Capital Partners, LLC is a multifaceted holding company that integrates complementary divisions to provide full lifecycle management for its portfolio and partner companies. As the General Partner, Sponsor and financial arm of Global Wealth Capital Funds Limited Partnership, NexGen Capital Partners, LLC brings numerous financing options to its clients and portfolio companies.

About Global Wealth Capital Funds:

Global Wealth Capital Funds is newly minted fund, dedicated to providing high-quality real estate investment opportunities to accredited individual investors. With a focus on delivering superior returns and managing quality assets, Global Wealth Capital Funds offers a unique avenue for HNWIs to diversify their portfolios with real estate investments.

About M4 General Contractors LLC:

M4 General Contractors LLC [http://www.nexgencaps.com/m4-general-contractors] is a licensed General Contractor dedicated to providing top-notch construction services. With expertise in building quality real estate assets, M4 General Contractors brings valuable insights and skills to the partnership.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: NexGen Capital Partners, LLC

Contact Person: M. Pena

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=nexgen-capital-partners-launches-global-wealth-capital-funds-revolutionizing-real-estate-investments-for-highnetworth-individuals-worldwide]

Phone: 8436026135

Address:1101 Brickell Ave. South Tower 8th Floor

City: Miami

State: Florida

Country: United States

Website: http://nexgencaps.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release NexGen Capital Partners Launches Global Wealth Capital Funds, Revolutionizing Real Estate Investments for High-Net-Worth Individuals Worldwide here

News-ID: 3467930 • Views: …

More Releases from ABNewswire

Intraocular Lens Market worth $6.0 billion by 2029

Browse 222 market data Tables and 50 Figures spread through 248 Pages and in-depth TOC on "Intraocular Lens Market byType (Monofocal, Premium, Phakic), Material (Hydrophobic, Hydrophilic, Silicone) Application (Cataract, Presbyopia, Corneal Disorder), End User, Unmet Need, Buying Criteria, Reimbursement - Global Forecast to 2029

Intraocular Lens Market [https://www.marketsandmarkets.com/Market-Reports/intraocular-lens-market-263730551.html?utm_source=ABnewswire&utm_campaign=paid&utm_content=Referral] in terms of revenue was estimated to be worth $4.2 billion in 2023 and is poised to reach $6.0 billion by 2029, growing…

Clinical Alarm Management Market worth $5.4 billion by 2028

Browse 292 market data Tables and 55 Figures spread through 319 Pages and in-depth TOC on "Clinical Alarm Management Market by Product (Nurse Call Systems; Connectivity/Integration Software - EMR, Central Hubs, Notification/Alert; Ventilators, Patient Monitors, Capnography, Oximeter), Type (Centralized), End User - Global Forecast to 2028

Clinical Alarm Management Market [https://www.marketsandmarkets.com/Market-Reports/clinical-alarm-management-market-69939577.html?utm_source=ABnewswire&utm_campaign=paid&utm_content=Referral] in terms of revenue was estimated to be worth $2.7 billion in 2023 and is poised to reach $5.4 billion…

Clean Label Ingredients Market worth $69.3 billion by 2029 | Key Players are Car …

Clean Label Ingredients Market by Ingredient Type (Natural Flavors, Natural Colors, Fruit & Vegetable Ingredients, Starch & Sweeteners, Flours, Malt), Application (Food, Beverages), Form (Dry, Liquid), Certification Type - Global Forecast to 2029

The global [https://www.marketsandmarkets.com/PressReleases/clean-label-ingredients.asp], estimated to be worth USD 50.2 billion in 2024, showcases a remarkable growth projection, anticipated to escalate to USD 69.3 billion by 2029, indicating a robust compound annual growth rate (CAGR) of 6.7% during the…

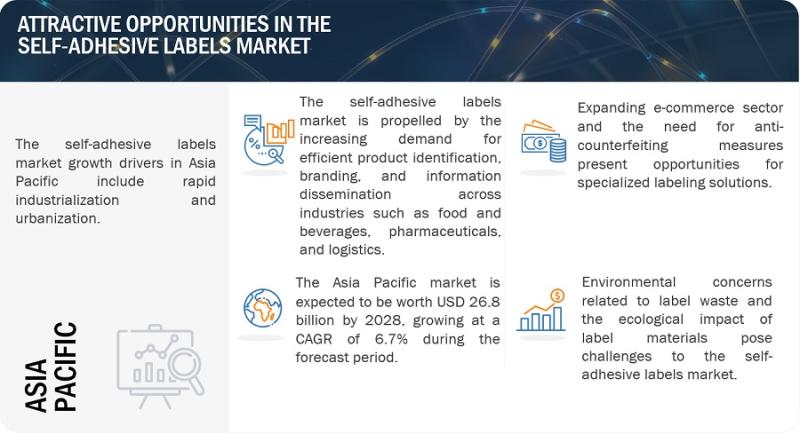

Self-Adhesive Labels MarketSize, Opportunities, Share, Top Manufacturers, Growth …

Browse 150 market data Tables and 50 Figures spread through 250 Pages and in-depth TOC on "Self-Adhesive Labels Market

The [https://www.marketsandmarkets.com/Market-Reports/self-adhesive-labels-market-96664367.html] is projected to grow from USD 53.2 billion in 2023 to USD 69.2 billion by 2028 at a CAGR of 5.4%. The self-adhesive labels market is influenced by growing demand from packaging companies. The growth of the packaging industry will have a positive impact on the self-adhesive labels market as…

More Releases for Capital

Venture Capital & Private Equity Firms Market is Going to Boom | TPG Capital, GG …

The latest independent research document on Venture Capital & Private Equity Firms examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Venture Capital & Private Equity Firms study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth,…

Venture Capital Investment Market 2021 Is Booming Worldwide | Accel, Benchmark C …

Venture Capital Investment Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Venture Capital Investment market across the globe, including valuable facts and figures. Venture Capital Investment Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…

Venture Capital Investment Market 2019 Trending Technologies, Developments, Key …

Fintech solutions provide alternative finance firms with a platform for investors to directly come across companies and individuals looking for equity financing and debt. The technology has enabled new players to take faster decisions, engage with customers more precisely, and run operations at low cost-to-income ratios compared with traditional banks

This report studies the Venture Capital Investment market status and outlook of Global and major regions, from angles of players,…

Venture Capital Investment Industry 2018-2025- Accel, Benchmark Capital, First R …

Global Venture Capital Investment Industry 2018 research report added by orianresearch.com to its vast repository provides important statistics and analytical data to give a complete understanding of the market size, share, growth, trend, demand, top player, industry overview, opportunities, value cycle, end-users, technology, types and application. The report extensively provides the market overview, gross margin, cost structure, recent trends and forecasts for the period 2018-2025. The market size estimations have…

Risk Capital Investment Market 2018: Revenue, Growth Rate & top companies like- …

The Risk Capital Investment Market report gives a detailed overview of the dynamics of the industries, which impacts on the growth of businesses. The study comprises a blend of various segments such as drivers, restraints, and opportunities. Different scenarios are examined in this report along with the top driving factors and that offers the ways for business expansion. The effective strategies are implemented by the various top-level key players to…

Venture Capital Investment Market 2018-2025 Emerging Trend - Benchmark Capital, …

ReportsWeb.com has announced the addition of the “Global Venture Capital Investment Market Size Status and Forecast 2025” report detailed insights about the aspects responsible for augmenting as well as restraining market growth and analyses the market potential for each geographical region based on the growth rate, macroeconomic parameters, consumer buying patterns, and market demand and supply scenarios.

This report studies the global Venture Capital Investment market size, industry status and forecast,…