Press release

Takaful Insurance Market - growing at CAGR of +15% by 2031 - by Application, Type, Distribution Channel, and Key Players: Syarikat Takaful Brunei Darussalam, Qatar Islamic Insurance, Abu Dhabi National Takaful Co, Zurich Malaysia, ISLAMIC INSURANCE

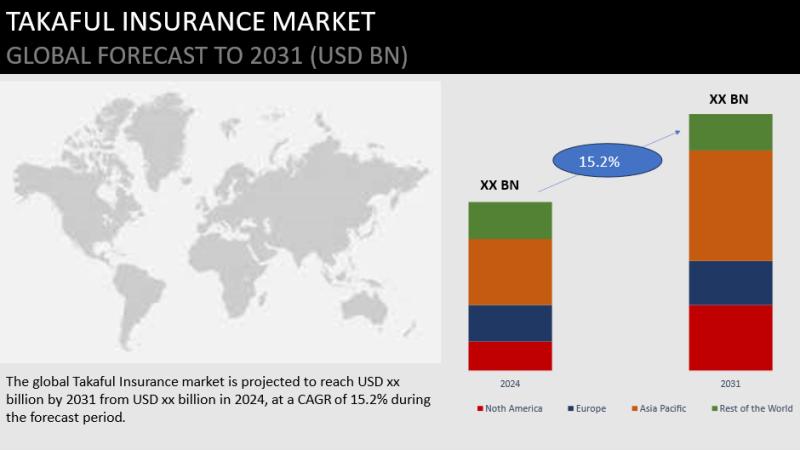

Takaful insurance is a cooperative Islamic insurance concept based on mutual assistance and shared responsibility. It operates on the principles of solidarity, mutual protection, and risk-sharing among participants. In Takaful, individuals and corporations combine their contributions into a fund to protect themselves against defined losses or damages. Unlike traditional insurance, which entails shifting risk to the insurer, Takaful stresses shared guarantee and collaboration. In accordance with Islamic values of justice and social welfare, any surplus money from the Takaful fund is given to participants as dividends or contributions to charity organisations.The Global Takaful Insurance Market in terms of revenue was estimated to be worth USD XX billion in 2023 and is poised to grow at a CAGR of 15.2% from 2024 to 2031.

Ask for Free Sample Copy of this Report:

https://www.theresearchinsights.com/request_sample.php?id=559162

Top Key Players Profiled in This Report:

Syarikat Takaful Brunei Darussalam, Qatar Islamic Insurance, Abu Dhabi National Takaful Co, Zurich Malaysia, ISLAMIC INSURANCE, Takaful International, Prudential BSN Takaful Berhad, AMAN INSURANCE, SALAMA Islamic Arab Insurance Company, Allianz and Others.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Takaful Insurance market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market

- Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market

- Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Takaful Insurance market

The report presents a thorough overview of the competitive landscape of the global Takaful Insurance Market and the detailed business profiles of the market's notable players. Threats and weaknesses of leading companies are measured by the analysts in the report by using industry-standard tools such as Porter's five force analysis and SWOT analysis. The Takaful Insurance Market report covers all key parameters such as product innovation, market strategy for leading companies, Takaful Insurance market share, revenue generation, the latest research and development and market expert perspectives.

Get 30% Discount on First Purchase of This Report:

https://www.theresearchinsights.com/ask_for_discount.php?id=559162

Growth in demand for takaful insurance across Muslim-majority has significant driver for the expansion of the takaful insurance. A growing middle class and strong economic growth have been seen in several nations with a majority of Muslims. As people's financial circumstances improve, they are more interested in using insurance to protect their possessions and well-being, and Takaful offers a Sharia-compliant choice. Furthermore, distribution of investment profit among both participants are driving the takaful insurance market.

Takaful Insurance Market Segmentation by Application:

• Personal

• Commercial

Takaful Insurance Market Segmentation by Type:

• Family Takaful

• General Takaful

Takaful Insurance Market Segmentation by Distribution Channel:

• Agents and Brokers

• Banks

• Direct Response

• Others

Takaful Insurance Market by Regions:

• North America (United States, Canada and Mexico)

• Europe (Germany, France, UK, Russia and Italy)

• Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

• South America (Brazil, Argentina, Colombia etc.)

• Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Reasons for buying this report: -

• It offers an analysis of changing competitive scenario.

• For making informed decisions in the businesses, it offers analytical data with strategic planning methodologies.

• It offers seven-year assessment of Takaful Insurance Market.

• It helps in understanding the major key product segments.

• Researchers throw light on the dynamics of the market such as drivers, restraints, trends, and opportunities.

• It offers regional analysis of Takaful Insurance Market along with business profiles of several stakeholders.

• It offers massive data about trending factors that will influence the progress of the Takaful Insurance Market.

Purchase Complete Takaful Insurance Market Report at:

https://www.theresearchinsights.com/checkout?id=559162

Contact us:

Robin

Sales manager

+91-996-067-0000

sales@theresearchinsights.com

https://www.theresearchinsights.com

About us:

The Research Insights - A global leader in analytics, research and advisory that can assist you to renovate your business and modify your approach. With us, you will learn to take decisions intrepidly. We make sense of drawbacks, opportunities, circumstances, estimations and information using our experienced skills and verified methodologies. Our research reports will give you an exceptional experience of innovative solutions and outcomes. We have effectively steered businesses all over the world with our market research reports and are outstandingly positioned to lead digital transformations. Thus, we craft greater value for clients by presenting advanced opportunities in the global market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Insurance Market - growing at CAGR of +15% by 2031 - by Application, Type, Distribution Channel, and Key Players: Syarikat Takaful Brunei Darussalam, Qatar Islamic Insurance, Abu Dhabi National Takaful Co, Zurich Malaysia, ISLAMIC INSURANCE here

News-ID: 3467015 • Views: …

More Releases from The Research Insights

Beard Oil Market to Witness Promising Growth Opportunities by 2024 - 2031 | ArtN …

Beard oil is used to nourish the beard and the skin underneath it. Beard oil helps maintain a shiny, soft, and smooth beard. Various artificial and natural products are utilized to lend a scent to the oil. Beard oil can be used as a substitute for aftershave or cologne. Some of the popular beard oil ingredients include argan oil, jojoba oil, grape seed, castor oil, almond oil, vitamin E, and…

5PL Solutions Market to Witness Promising Growth Opportunities by 2024 - 2031 | …

5PL Solutions are the logistics coordination mechanism and the joint decision making both of which are integrated to achieve more sustainable configurations of the supply chain. In information technology, 5PL solutions require new technologies of management which consider the principles of self-organization and group behavior. The Global 5PL Solutions Market report provides a holistic evaluation of the market. The report offers a comprehensive analysis of key segments, trends, drivers, restraints,…

On-Demand Logistics Market expected to witness +21% CAGR by 2031| Key Players: B …

On-demand logistics is a modern logistics strategy which enables companies to fulfill customers' orders as soon as they are placed. It aids the companies to expand their customer reach by delivering the customer's order within same-day, next-day or 2-days. In addition, it can support multichannel retailing, which streamlines and automates the fulfillment process for customer's orders which are received through numerous sales channels. Moreover, on-demand logistics requires flexible fulfillment solutions,…

Hydrogen Aircraft Market estimated to grow at +21% CAGR during 2024 - 2031| HyPo …

A hydrogen aircraft is an airplane that makes use of hydrogen (liquid or gas) as a power source. Hydrogen energy can be harnessed in two ways for a hydrogen aircraft. It can either be burned in a jet engine or other sorts of internal combustion engines, or it can be used to power a fuel cell to generate electricity to power propeller of aircraft. Research on hydrogen as a potential…

More Releases for Takaful

Takaful Insurance Market Size, Growth, Sales Value and Forecast 2021-2027 By bu …

Allied Market Research published an exclusive report, titled, “Takaful Insurance Market By Distribution Channel (Agents & Brokers, Banks, Direct Response and Others), Type (Family Takaful and General Takaful), and Application (Personal and Commercial): Global Opportunity Analysis and Industry Forecast, 2021–2030”.

The takaful insurance market report offers a detailed analysis of prime factors that impact the market growth such as key market players, current market developments, and pivotal trends. The report includes…

Takaful Market 2019 Development Plan & Strategies by Islamic Insurance Company, …

Global Takaful Market 2019-2025: In 2018, the global Takaful market size was million US$ and it is expected to reach million US$ by the end of 2025, with a CAGR of during 2019-2025.

This report focuses on the global Takaful status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Takaful development in United States, Europe and China.

Get a Quick Sample Brochure report at…

Takaful Market 2019-Advance Technology |Global Industry Share, Growth, Revunes, …

Takaful Market 2019 Report analyses the industry status, size, share, trends, growth opportunity, competition landscape and forecast to 2025. This report also provides data on patterns, improvements, target business sectors, limits and advancements. Furthermore, this research report categorizes the market by companies, region, type and end-use industry.

Get Sample Copy of this Report@ https://www.researchreportsworld.com/enquiry/request-sample/13675493

Global Takaful market 2019 research provides a basic overview of the industry including definitions, classifications, applications…

Takaful Market By Key Players: JamaPunji, AMAN, Salama, Standard Chartered, Taka …

Takaful Industry Overview

Takaful is a Sharia-compliant Islamic insurance product, where members of the community contribute money or a part of their earnings to a pooling system that guarantees against any loss or damage. The underlying principle of takaful portrays the responsibility of each to cooperate and protect each other. The Takaful market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Takaful…

Future Innovations of Takaful Market Market – Top Key Vendors like Prudential …

Takaful is a Sharia-compliant Islamic insurance product, where members of the community contribute money or a part of their earnings to a pooling system that guarantees against any loss or damage. The underlying principle of takaful portrays the responsibility of each to cooperate and protect each other. The drivers of Takaful demand include high economic growth and increase in per capita GDP, a youthful demography, increasing awareness, a greater desire…

Etiqa Group and Takaful Malaysia awarded Best Motor Insurance and Best Motor Tak …

KUALA LUMPUR, 27th April 2018 - Etiqa Group and Syarikat Takaful Malaysia Bhd (Takaful Malaysia) emerged the winners at this year’s Motor Insurance Award 2018, an annual honour accorded to top conventional and takaful motor insurance companies in the country.

The conventional insurance winner is Etiqa Insurance Bhd, followed by Allianz Malaysia Bhd in second place, while Takaful Malaysia ties with Etiqa Takaful Bhd as winners in the motor takaful category.

Hosted…